- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Miami Real Estate Market Report 2022/2023 (Part 2)

Part 2 of our Miami Real Estate Market Report 2022 / 2023 | The Miami Rental Market and its Sustainability

Introduction to our Rental Market section of the Miami Real Estate Market Report 2022 / 2023.

Why should you care about the rental market if you are a primary buyer or seller? So often we focus real estate reports on the movement of sales price, price per sqft, number of sales or other consumer related data. However the relationship between rental data and sales data is also VERY relevant. In Miami we have a large ‘investor class’ market. In part 1 we revealed the importance of understanding the difference between the secondary ‘investor’ class and the primary class and we looked at the different behaviors that exist between the two groups. In part two we reveal not how they differ from each other, but how they actually affect each other. Notably how the investor class rental prices will directly affect property values.

How does this happen?

The ROI for investors is based off rental income against carry cost, so of course what an investor is willing to pay for a property is often largely determined by its income, thus if income goes up, so does value. It’s also important to understand the rental market sustainability, because if those rates DO drop over time you are going to see a flurry of sellers who lack the returns they hoped for. If owners will sell on mass, prices will drop. So, in neighborhoods like Brickell (and more specifically within certain condo buildings) that are dominated by rentals the current value of properties in the area (whether being used as a primary or not) are going to be systematically affected by changing rental rates.

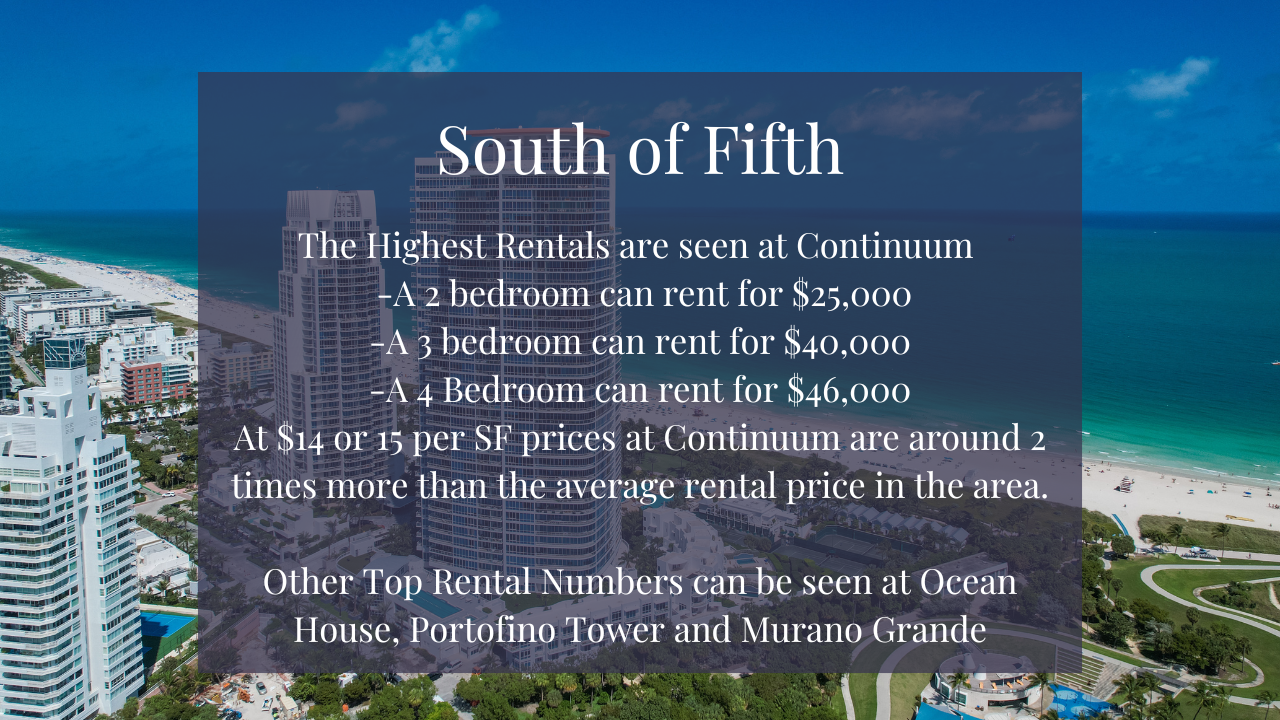

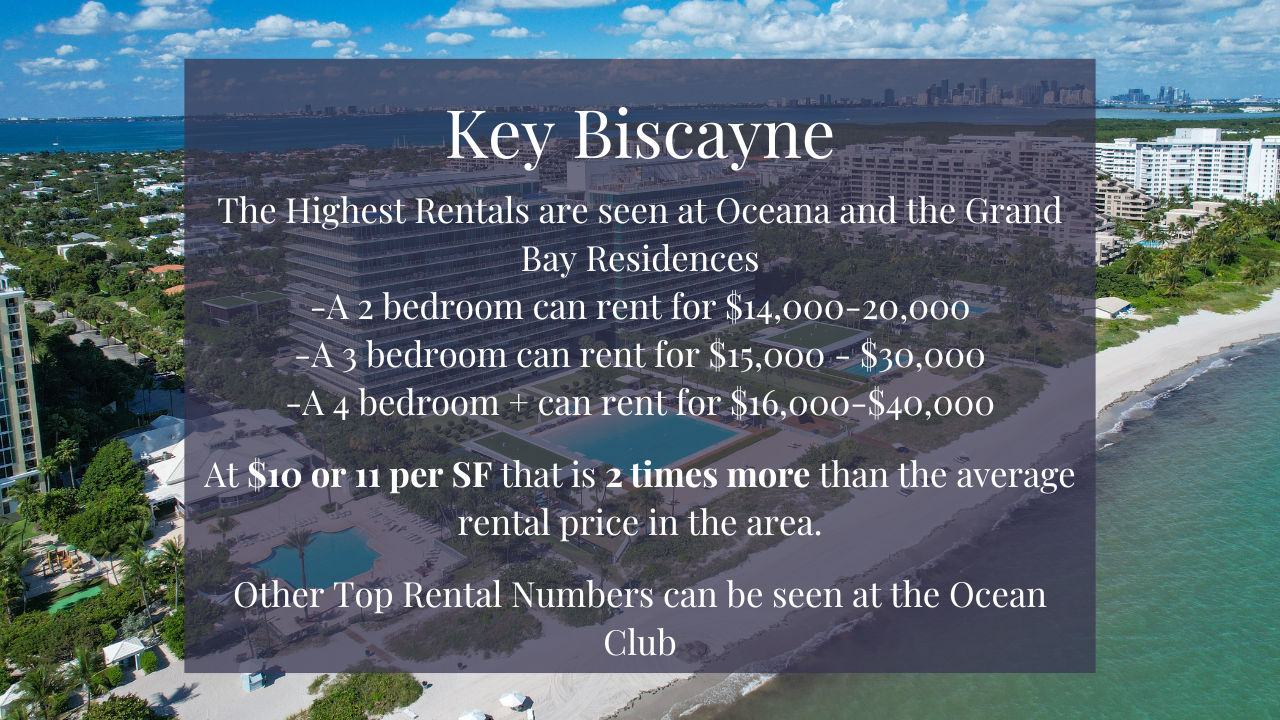

Where are the most expensive rents in Miami to be found?

As one might imagine there are a number of very high-end rentals that we have seen in Miami. For example the seasonal Venetian Island homes that have rented for $300,000 a month over the spring, but in truth these are outliers which also don’t provide much analytical benefit. Better to focus on the concentration of different condo units across key neighborhoods.

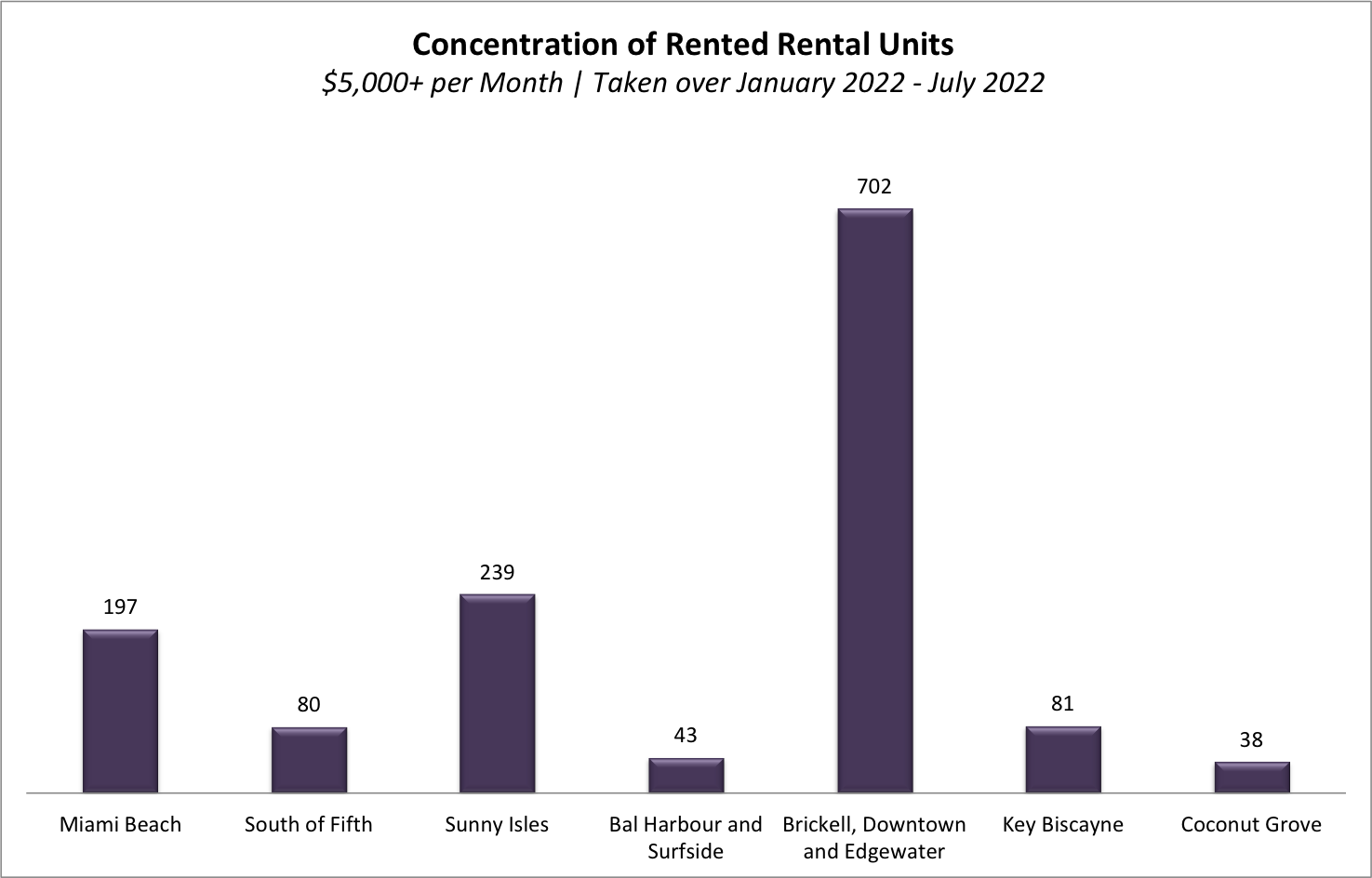

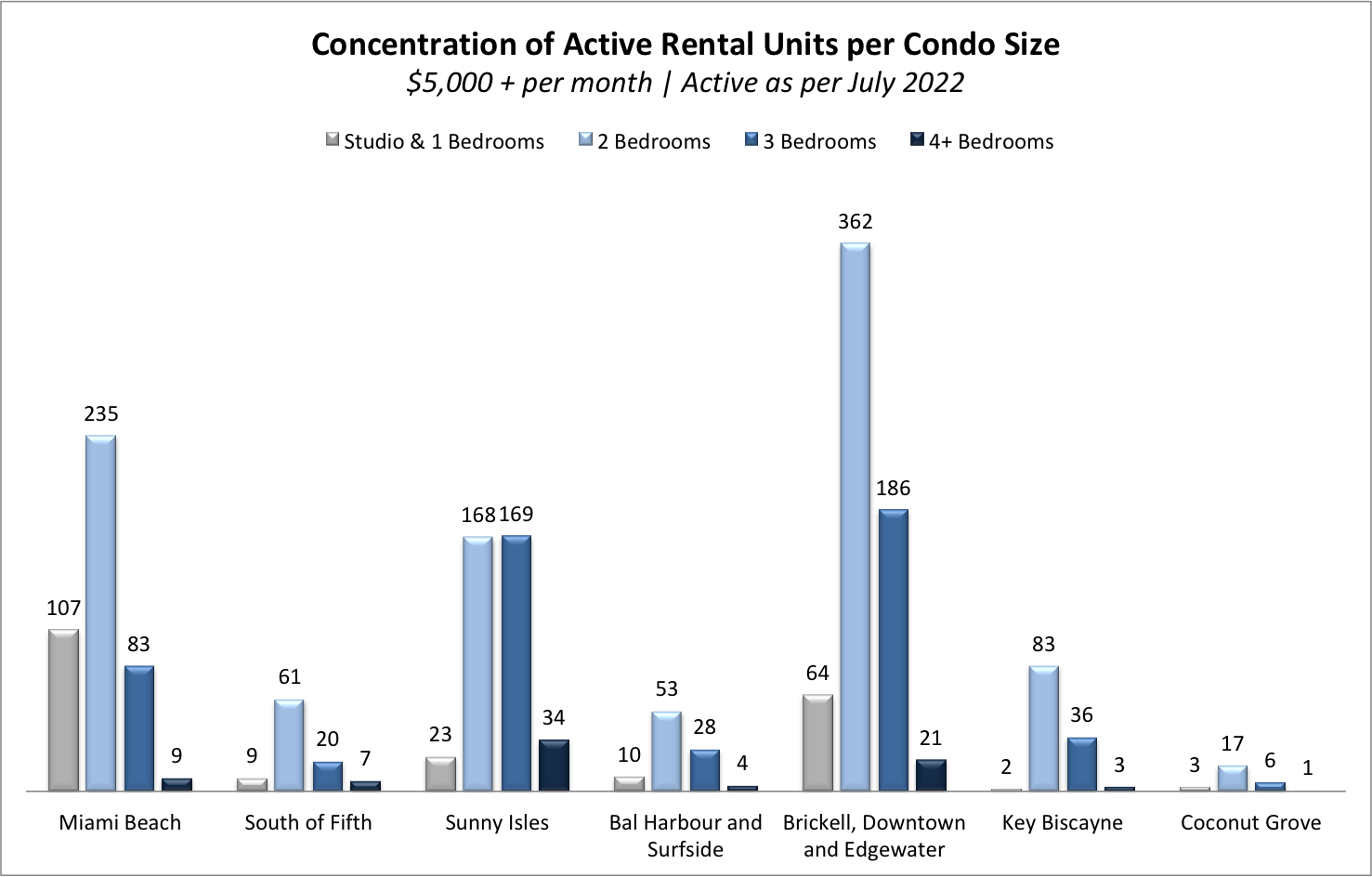

Where is the highest Concentration of rentals?

The Condo markets unsurprisingly dominate Miami rental product with 3.5 times as many rentals than the single family market and out of the 1,380 condo rentals (in the selected areas we looked at rentals of condos of $5,000 per month+) that occurred in the last 6 months its Brickell, downtown and Edgewater with 702 Rentals that takes the number 1 spot. Second is Sunny Isles with 239 rentals and 3rd is Miami Beach. Brickell is statistically 79% rentals and 21% primary home owners. Within these each neighborhood however there are some buildings that are more dominated by rentals. For those statistics click here.

Where have we seen the highest increases of rent over last 2 years?

Rent have increased drastically at at average rate of 30% to 50%, in some cases even more. With the enormous influx of relocation buyers the demand for rentals saw an increase. Not only did we see rental prices skyrocket we also saw a surge in luxury and ultra -luxury properties renting for amounts of $50K per month or more.

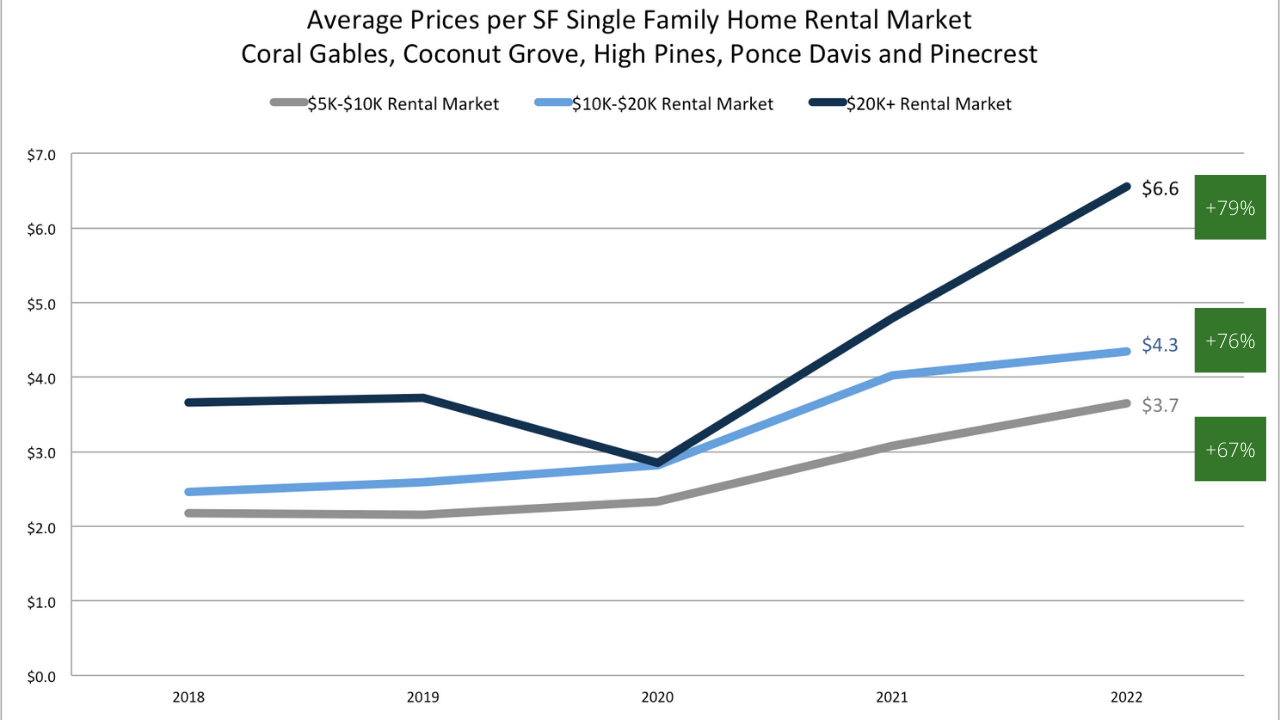

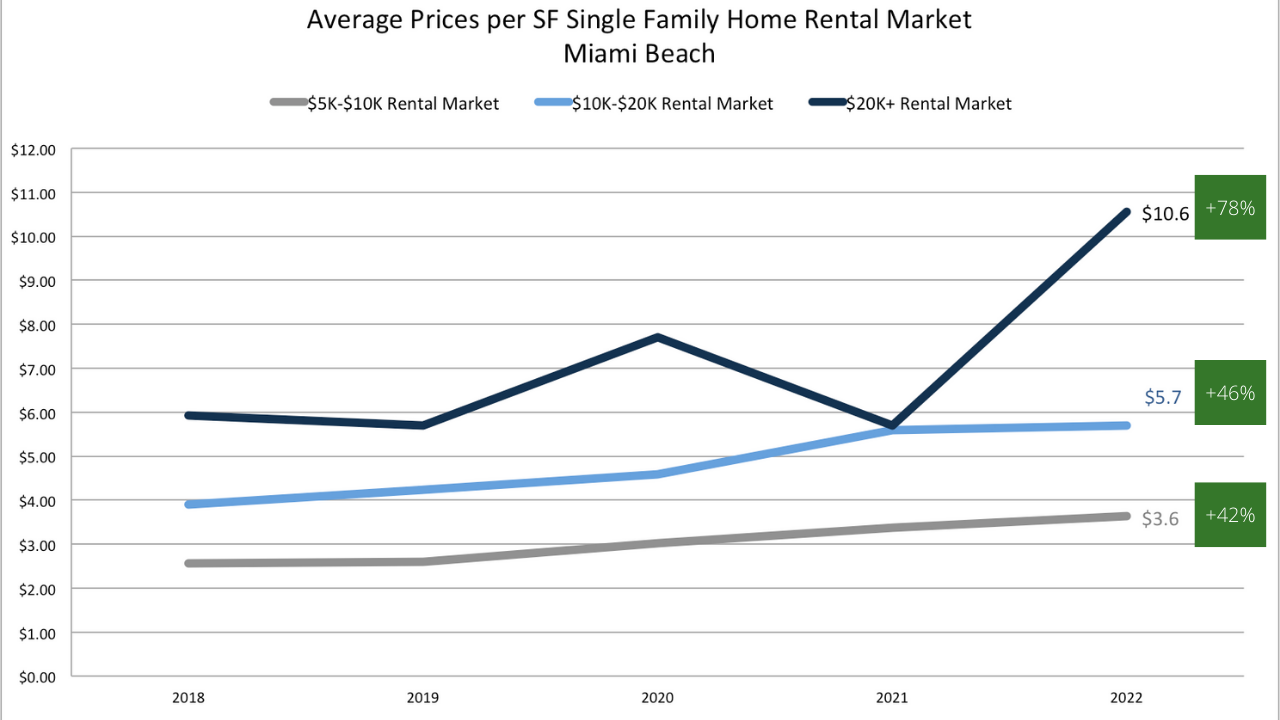

Although most markets have seen impressive increases it is the single-family market that has seen the biggest growth. The lack of inventory in the housing market plays an important role. As there are dozens of condos for rent the housing rental market is seeing limited supply which drives the prices up. Furthermore, families are moving into Miami and they simply prefer single-family homes over condo life.

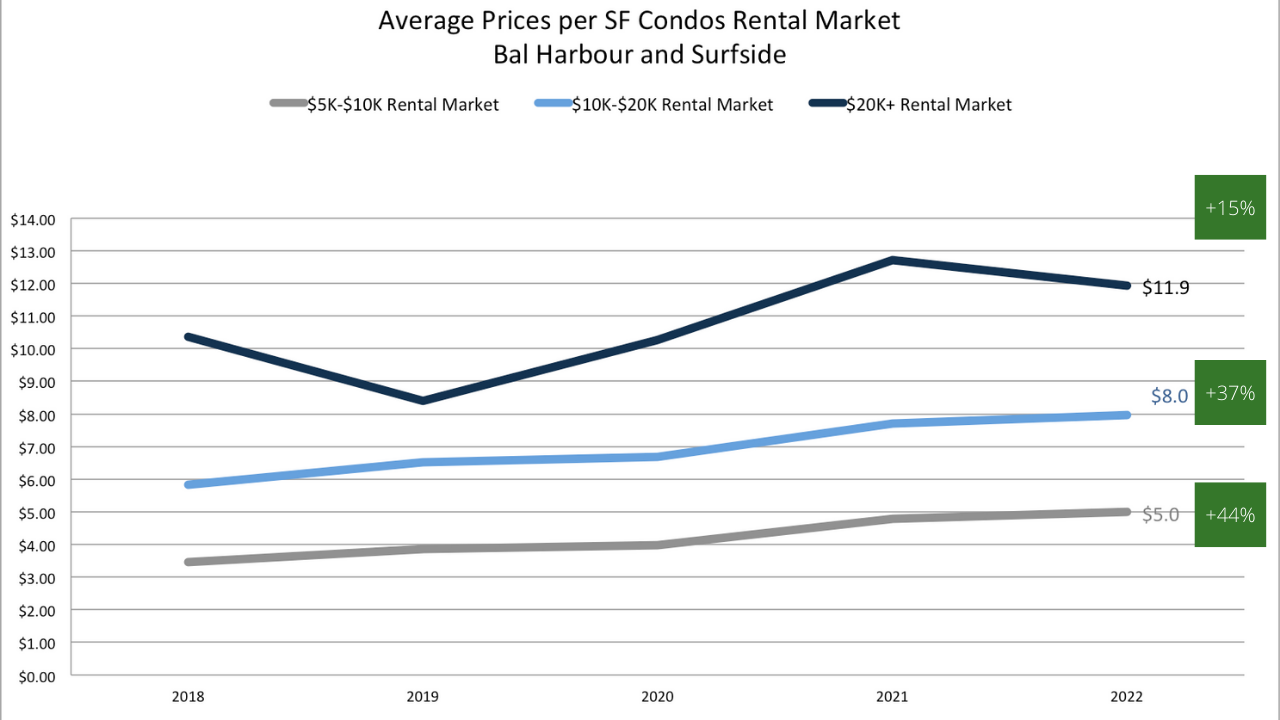

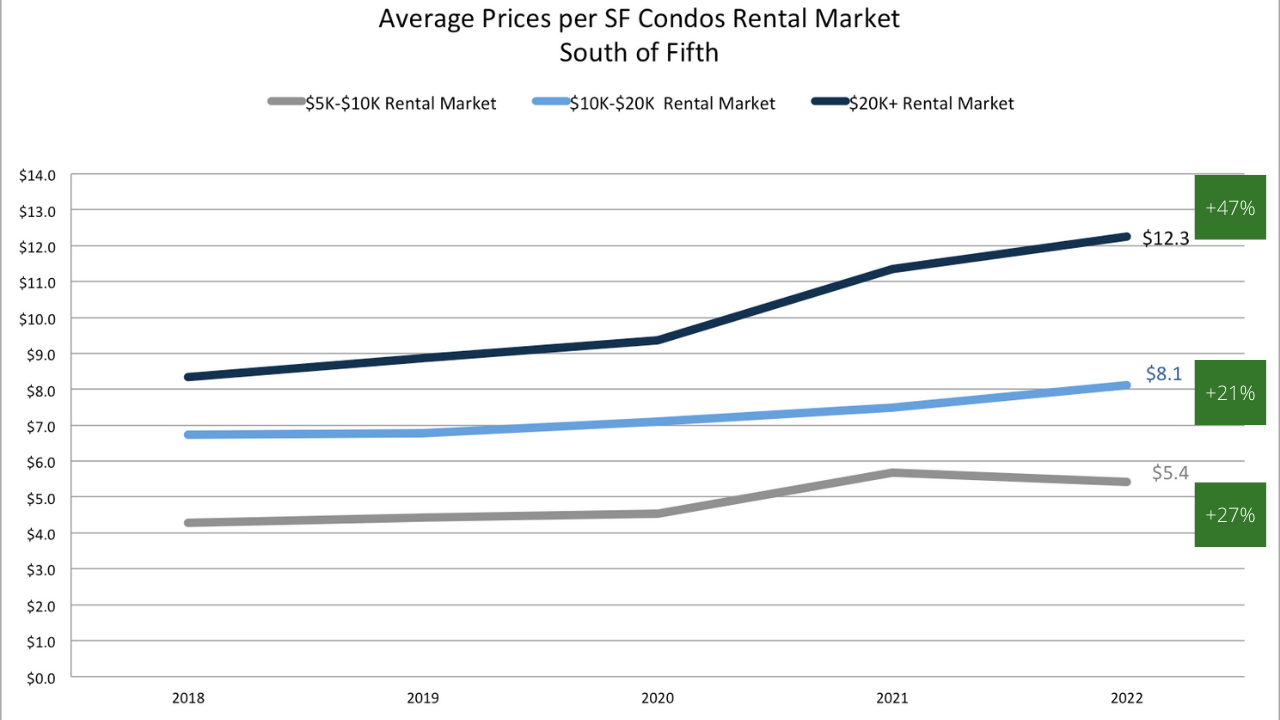

In the single family home markets we see the ultra-luxury segments increase the most while in the condo markets the highest increases are seen in the lower ends of the market.

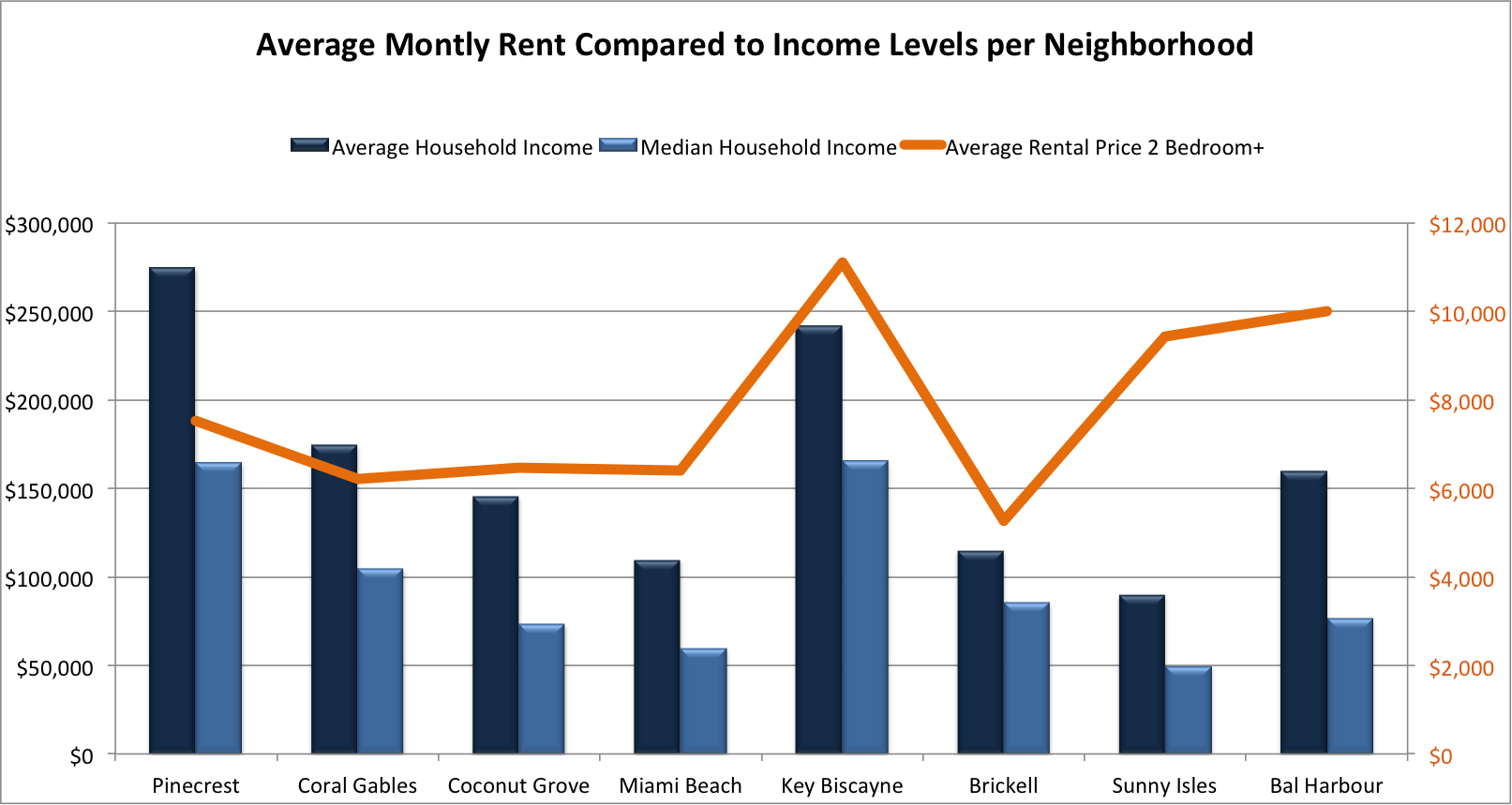

Where do we find the highest rental prices in relation to Salaries?

When we get into where we find the highest rental prices we should also talk about the income levels in those neighborhoods. This is becoming ever more a topic of conversation as its begs the question ‘How can we sustain high rental prices if they get so out of whack with inhabitants salaries?’

As discussed in our podcast between David Siddons and Shakira Sanchez (Brickell Territory Manager) rents in places like Brickell have gone up 100%. Salaries were around $85-$120k on average, but with 40 new businesses establishing residency in Miami and most around Brickell these figures do not account for the salaries of these new commercial inhabitants. The question is whether these new inhabitants will stay in Brickell, move out to the suburbs or buy after renting for a short while, especially once they get acclimated and recognize that it’s better to buy than waste money on rent.

Sustaining a Hot Rental Market

Just sustaining the extremely strong rental market as a whole in Miami is an ongoing debate and many people share different opinions. Trees do not grow to the sky and rental prices cannot keep increasing forever. They can only be sustained in conjunction with the market’s ability to keep affording the rent. We are noticing now and have reported several months ago as well that some locals can no longer afford renting a Brickell condo. On the other hand, Miami is growing sustainably and new businesses and talent is coming to our city. These new residents can afford the rent and actually think it is affordable.

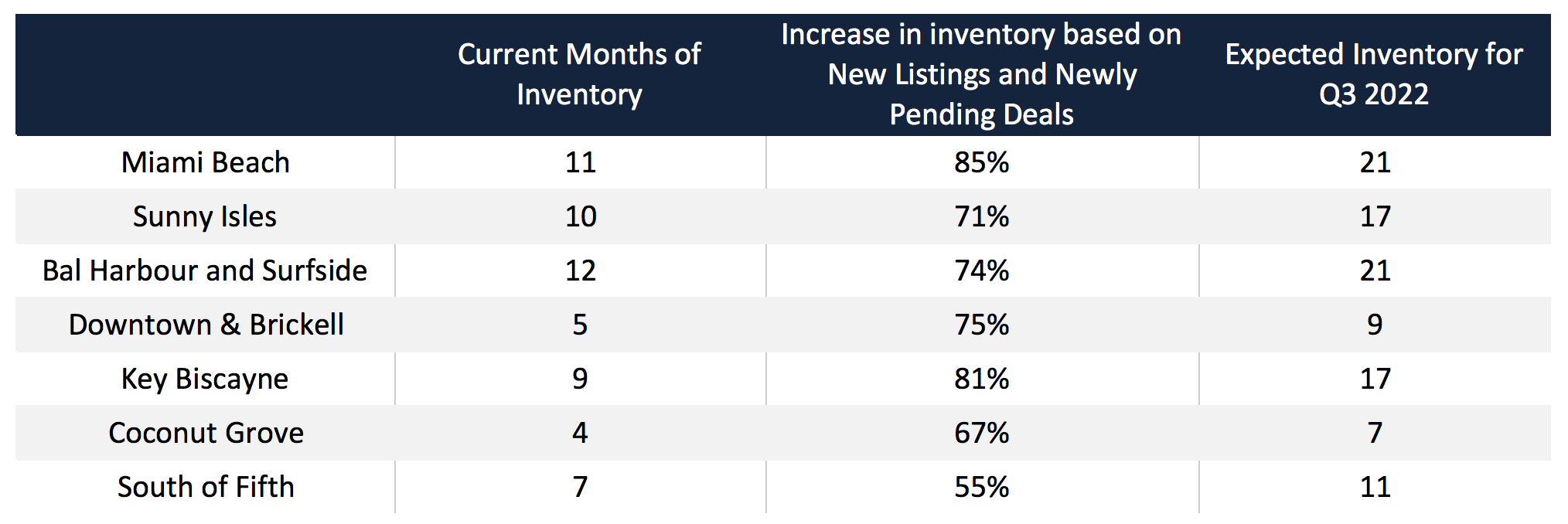

What is very telling is the supply of rentals. Back in 2015/2016, I predicted a strong correction in the urban core because the market was introducing around 8-10 new condos buildings and almost all of them were purchased as investments. We intuitively knew that the market could no way absorb such a huge number of properties and the population was not growing fast enough… and so sure enough it corrected. The markets with the least amount of new potential inventory like the primary single family home markets of Coral Gables and Coconut Grove show the best immunity from potential oversupply.

What about Airbnb. What are the Pros and Cons?

We conclude our rental section of the Miami Real Estate Market Report 2022 with the Airbnb phenomenon. The Airbnb market can make amazing money but it can also burn just as easily. Condos that allow Airbnb are hugely hindered on appreciation. The transient rotating door policies lead to primary owners wanting to sell and leave, leaving 100% investors, of which many are speculators. A very fragile model. When it is up it is up, when its down it is really down.

It is long term often better to focus on single or multifamily Airbnb. These are more stable and provide better resale retention. With that said this is a complex subject and there are many cases of Airbnb providing truly staggering returns and some that can rent well, but then have soft periods when they do not. As with all investments be aware of the ultimate resale value as appreciation of asset is the big driver for long term wealth growth.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS