- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Miami Real Estate Market Report 2022/2023 (Part 3)

Part 3 of our Miami Real Estate Market Forecast 2022/2023 | Miami Real Estate Market Economics

Introduction to our Miami Real Estate Market Forecast 2022/2023.

In this part of the report we get into ‘why’ changes are happening within our market. All too often reports just talk about what is happening but don’t say why it is happening. It’s the ‘why’ that makes forecasting and predictions possibly accurate, because it helps us recognize triggers to change before they occur. Economics basis of the ‘study of human behavior’ is an all important piece of the report equation and will help us forecast the Miami real estate market into the last quarters of 2022 and into 2023.

Miami Real Estate Market Forecast 2022/2023 | The Effect of Interest Rates

Once we got to May 2022 rates were hiked by 0.5. On the 24th of May, Bloomberg Business week reported: ‘Pandemic Fueled US housing boom has hit a wall as buyers get priced out’. On Wed 25th May CNN reported: “Fed signals several half-percentage point hikes to come”

Economic confidence is a fragile phenomenon, and opinions that voice the certainty of a continued ‘status quo’ bull market are foolish at best – change is always a certainty. Raised interest rates have brought about a change in psychology, but THIS DOES NOT NECESSARILY HAVE TO SPELL DISASTER. Consider the historical interest rates.

Primary home buyers. Historically interest rates have been much higher. The 2020 mid 2022 interest rates were extremely low! This of course helped fuel an already hot Miami real estate market and possibly worked into the psychology of buyers who while making over-asking offers may have thought: ‘“If I have to pay 5-10% over the ask, it’s ok because my interest rates are so low that my monthly payment is still manageable”. With that said, this does not mean the overall market is going to fold up, a return to the norm is more expected, potentially because it means a return to more normal interest rates. So consider the answer here: No Crash, not at all, but a correction.

Cash buyers not reliant on mortgages. During and post pandemic we, as a real estate group, noticed that most of the sales were cash contracts and there was little reliance on mortgages. I should be clear though that most of our clients are mid-range and high level buyers (paying $3m or more). There is still plenty of cash in the system and Miami being the city that has many neighborhoods that cater to a more affluent class means less impact with interest rates.

Investors are typically the most affected by rising interest rates as they carefully way up the carry cost to ROI. With that said and referencing back to Part 2 -the rental market. we have seen such excellent ROI with rentals that even with a bump on interest rates it has been hard to dent the 50%++ increase in rents that we have seen across many parts of Miami over the last 18 months!

Interest rates into 2023. What is likely to come in the coming 6 months? While in our podcast Drew expects the rates to be near the 5% or even 6% by the end of this year, he does recognize that given the sharp increases in recent months it should taper off and level out in 2023.

In a recent article of Forbes, the 30-year, fixed-mortgage rate forecasts of several experts are shared. Most of them predicting a rate between 4.8% and 5.5% by the end of 2022. According to Longforecast.com the rates will fluctuate between 5% and 7%, reaching the 7% by the end of 2023.

Miami Real Estate Market Forecast 2022/2023 | The Effect of Inflation

Inflation in the US as of July 1st was running at 8.6% according to Forbes. Annual rates of inflation are calculated using 12-month selections of the Consumer Price Index which is published monthly by the Labor Department’s Bureau of Labor Statistics (BLS). This is clearly going to make anyone jittery.

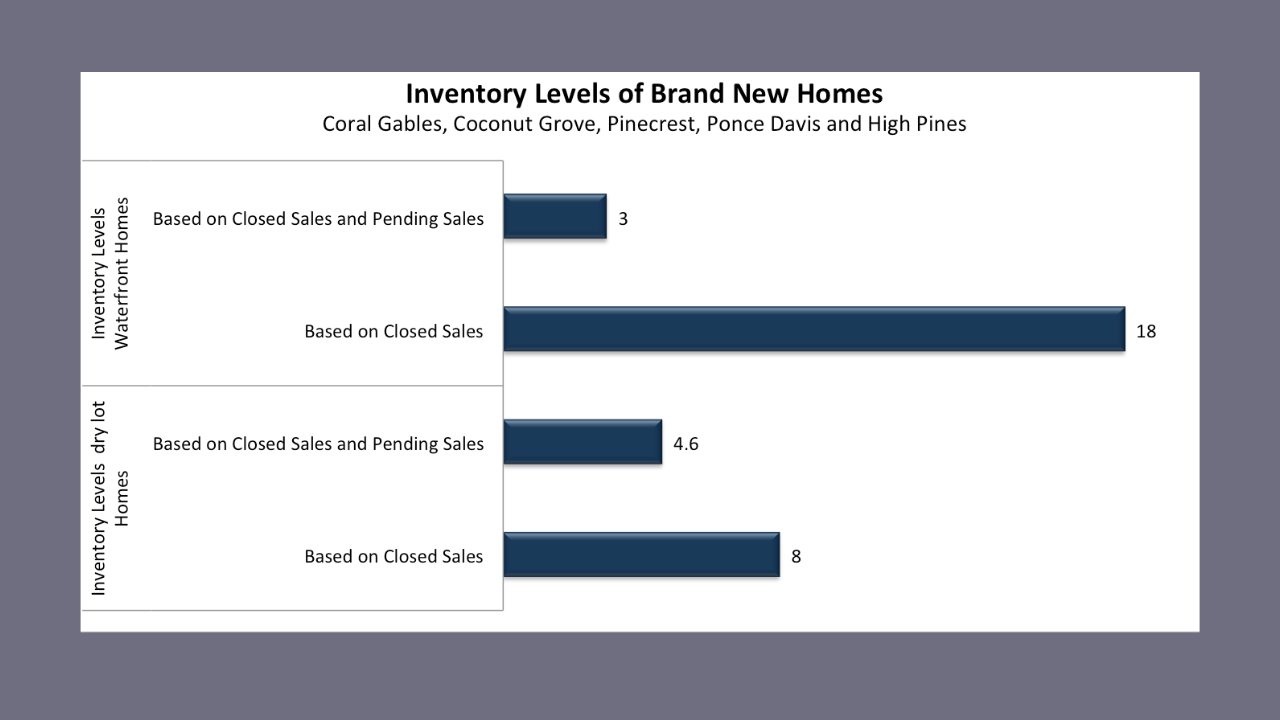

New Homes Real Estate is a direct hedge against inflation. The cost of new homes is particularly affected. Inflation has meant the cost of building new homes has gone up, as the costs of materials skyrocketed. The price of materials has been further exasperated by supply chain issues and labor shortages in Miami. When we look at the cost of new homes we see some examples. Below we show 3 different primary neighborhoods with examples of how much new home prices have gone up since 2020.

Miami Real Estate Market Forecast 2022/2023 | The Effect of the Stock Market

At the same time that the interest rates have been increasing, the stock market has taken a hit. Some believe if the stock market takes a hit people will look towards real estate as a safer investment. This is generally true, but there is much more to consider. There are both positive and negative psychological side effects of a correcting stock market.

Negatives: This is particularly relevant at the very top-end of the market. Many who made sizable amounts of money on the stock market may now be looking at their portfolio’s and feel undecidedly less affluent! So are less willing to pay top dollar.

Others will be in need of liquidity or wish to hold on to their cash as they believe the stock market will go lower and see future opportunity. Others might now be spooked in an unpredictable bearish market and prefer to sit tight for a few months and avoid taking risky positions.

Positives: We may see some very wealthy property owners be motivated to sell their trophy properties. This could free up some much needed inventory in a market that has very very little.

Real Estate as mentioned above is a good hedge against inflation and if the stock market is not the place to put your money, and neither is Crypto or bonds, and you don’t see upside on the stock market anytime soon, your only play becomes leaving it in the bank (see inflation above!) or putting it in real estate.

Some of the Record breaking sales in 2021 and 2022 and months of inventory in the luxury segment ($5M+).

Miami Real Estate Market Forecast 2022/2023 | The Effect of Supply Chain Issues

Negatives – For those looking to sell land it can be off putting for buyers to be faced with the prospect of home construction without knowledge of what it’s going to cost. Check out the podcast below.

Looking to sell a new construction home, or if you own a newer home (built in the last 7 years) then if you want to sell you are going to do really well in the current market! Please do give us a call. We constantly have buyers. If you are a builder, definitely please call us!

For those looking for a new home we are bringing out to our audience a book of new homes being built and finished over the next 6 month to 36 months! This is a compiled list of new homes not currently listed on the MLS.

New homes sold in the last 12 months

Miami Real Estate Market Forecast 2022/2023 | The Effect of Mass Migration and Corporate Relocations.

Miami had and still is the recipient of considerable migration. Migration over the last two years has been driving home prices up and saturating our private school system. Once recent observation is that sales will slow around schools simply because there is no more space. As one realtor was quoted: ‘its easier to find a home than find a space in school’. With this in mind our operations director ‘Cris Buzolin’ works tirelessly with families to help with this problem.

Read our blog on where to live to be near Miami’s top private schools

Corporate relocation as discussed in our podcast with Shakira Sanchez in part two I still very real and is not only driving up the sales market but the rental market as wealthier higher earners move into Miami.

The 40 companies moving into Miami.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS