- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Cyclical Challenges of the Miami Condo Market | Is it Time to Sell your Miami Condo?

Miami Condo Market Update | The Challenges of The Miami Condo Market in 2022

This article best explains the volatility of the Miami condo market. It covers what happened in Miami historically and what happens now in the Miami Condo Market. It is essential to recognize the historical behavior of the condo market. We are the only realtors in Miami with 15 years of data. We explain the changing patterns of the different neighborhoods’ condo markets with our unique software analytics. With easy-to-understand screens, you can process in seconds, what it takes many realtors years to understand.

Our Miami condo update will help our readers to make sound Miami condo investments and to act ahead of the market. If you want to sell or buy Miami luxury condos for sale, contact me at 305.508.0899.

The Vulnerability of the Miami Condo Market in 2022

The condo market is more cyclical and investor-driven than the single-family home market. That is why we are always more cautious with the condo market and like to discuss it separately from the single-family home market. Miami condo prices are nearing their peak level, seen in the 2015 Miami condo market. In early 2022 we saw low inventory levels and record sales prices, and properties did not stay long on the market.

Many are comparing this market to the 2008 market, but several factors make today’s market very different than the 2008 market. History doesn’t repeat itself, but it rhymes. Some of the most important differences are that inventory is much lower, fewer condos are constructed, banks are stricter with their requirements, and a 20% down payment is needed. All signs of a better-controlled market, but something concerns us.

As mentioned above, the Miami condo market is more investor-driven, and with the current buying trends, more and more investors want in. The problem is that Miami is becoming more and more expensive. Rent has increased by 30-50% because of the high demand from relocating tenants. What used to rent for $3/$4K is now renting for $5K. Miami has become a world-class city, but its price levels have also climbed to the top. Miami has just become, just behind NYC, the second most expensive city in the US. Ask anyone in Miami, and the answer will be that life has become much more costly, yet Miami salaries have not increased exponentially. We have welcomed many CEOs and high-end execs, but they made their money elsewhere, and they are not the ones renting these units. Cities like LA, San Francisco, and NY have more skilled entry-level and mid-level professionals, which creates the engine to make their industries more successful. Their labor force is highly educated and often comes from Ivy League universities. Those 20-something-year-olds often enter the labor force at $150K, which isn’t the case in Miami.

Are Brickell (and other) Residents Living Beyond Their Means, and Could this Result in a Correction?

Brickell’s median yearly income is $80, and the highest percentage of people (31%) falls in the $75K-$150K household income bracket. Only 25% of Brickell’s population earns more than $150K. A household that received around $100K/$125K per year will have $83K/$100K left after taxes. Take the 30% rule for renting, and this household’s monthly rent should not exceed $3,000. They would have to rent a one-bedroom because of the 275 Brickell rented units in this price range in the last 90 days, 23 were two bedrooms. Imagine this couple or person would like to live in a newer, amenity-rich condo and rent for $5K. The yearly costs would be 50% or more of the household’s total income. In other words, people are renting units and living a lifestyle they cannot afford.

The problem is that these rental returns will anchor the future appreciation of a condo. Currently, these units rent for $5K, making it go up in value. It’s an income-producing mechanism that was making $3K per month and now makes $5K, so now that property appreciated by 40%. At one moment this market is no longer sustainable, and the local market can no longer afford these high rents. The demand for rental units will decrease, values will have to come down, and residences will depreciate. A residence that goes from $5K back to $3K per month is suddenly not such a successful investment anymore. Insult to injury is that a new product coming into the market sells for approximately $1,000 per SF. These highly-priced units will need a much higher rental return. Miami does not have the workforce to sustain this. The most generic units are the riskiest ones, and we see a sizeable threat for the $1M-$4M units in the more generic buildings.

The Peak of the Miami Condo Market is nearing!

The Miami luxury condo market is nearing the peak prices as seen in 2015. As of September 2022, we are seeing a lower amount of sales, fewer pending sales, and an increase in listings.

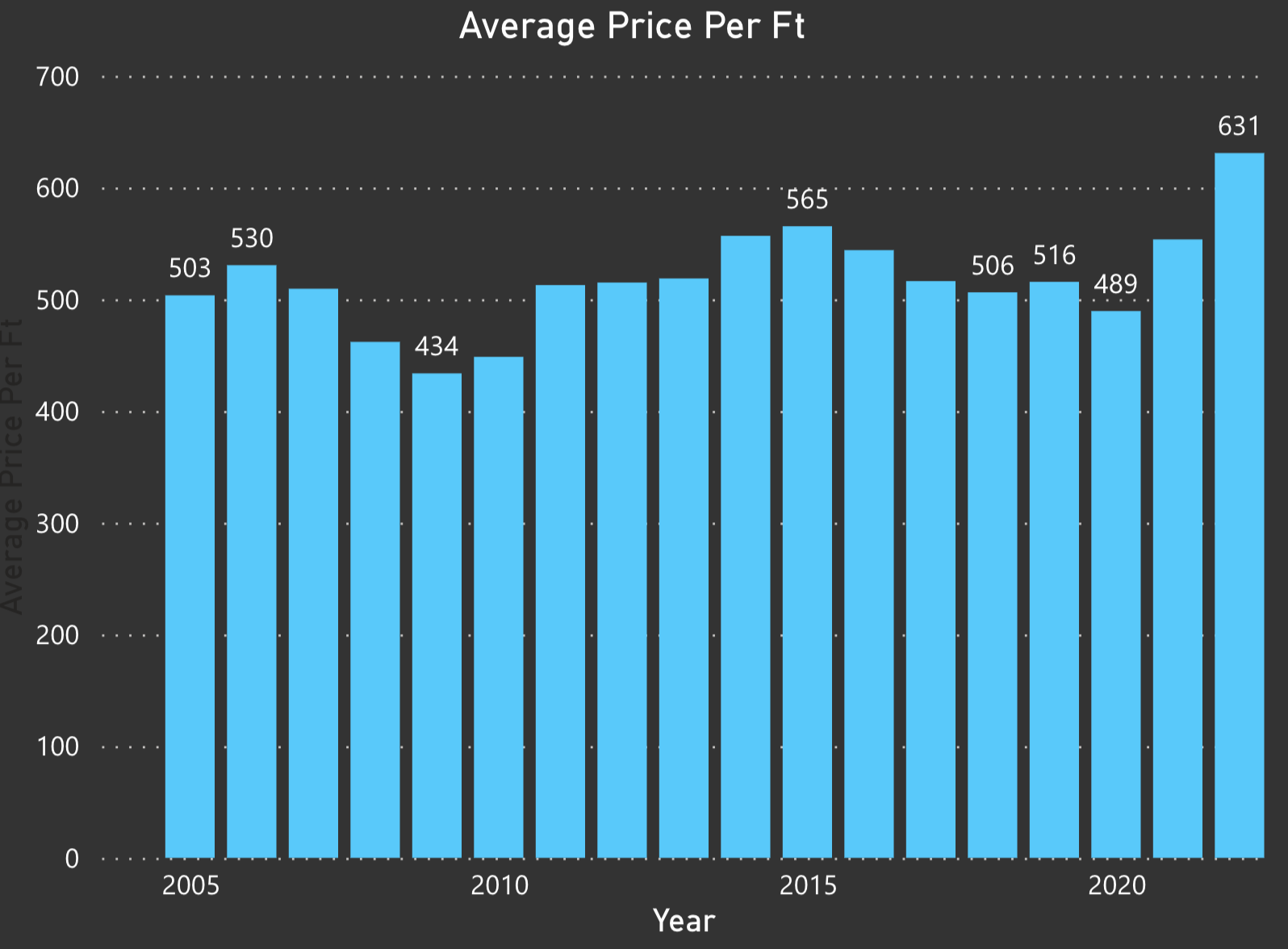

The Condo Life Cycle of Condos in the $500K – $1M Range

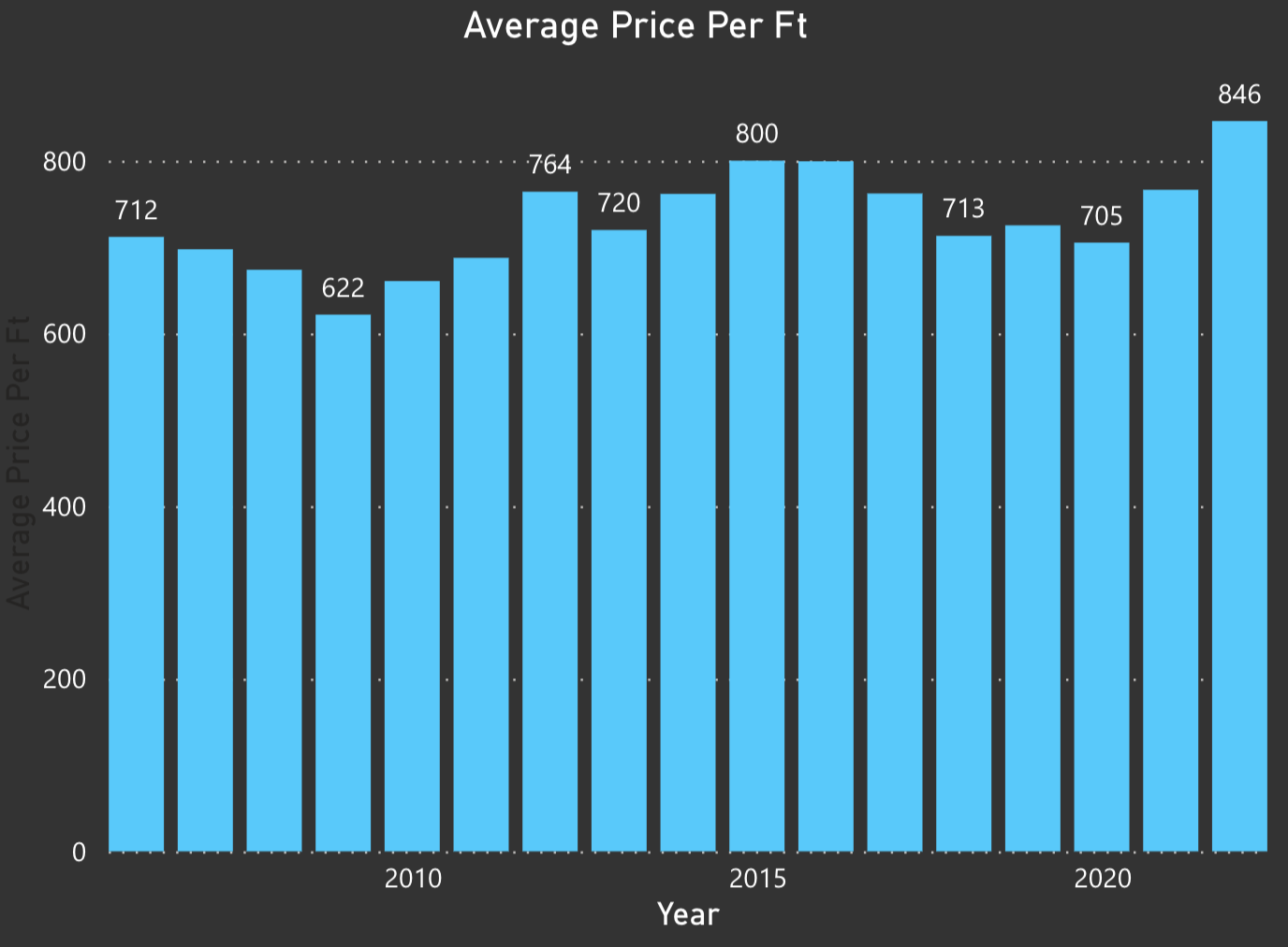

The Condo Life Cycle of Condos in the $1M-$2M Range

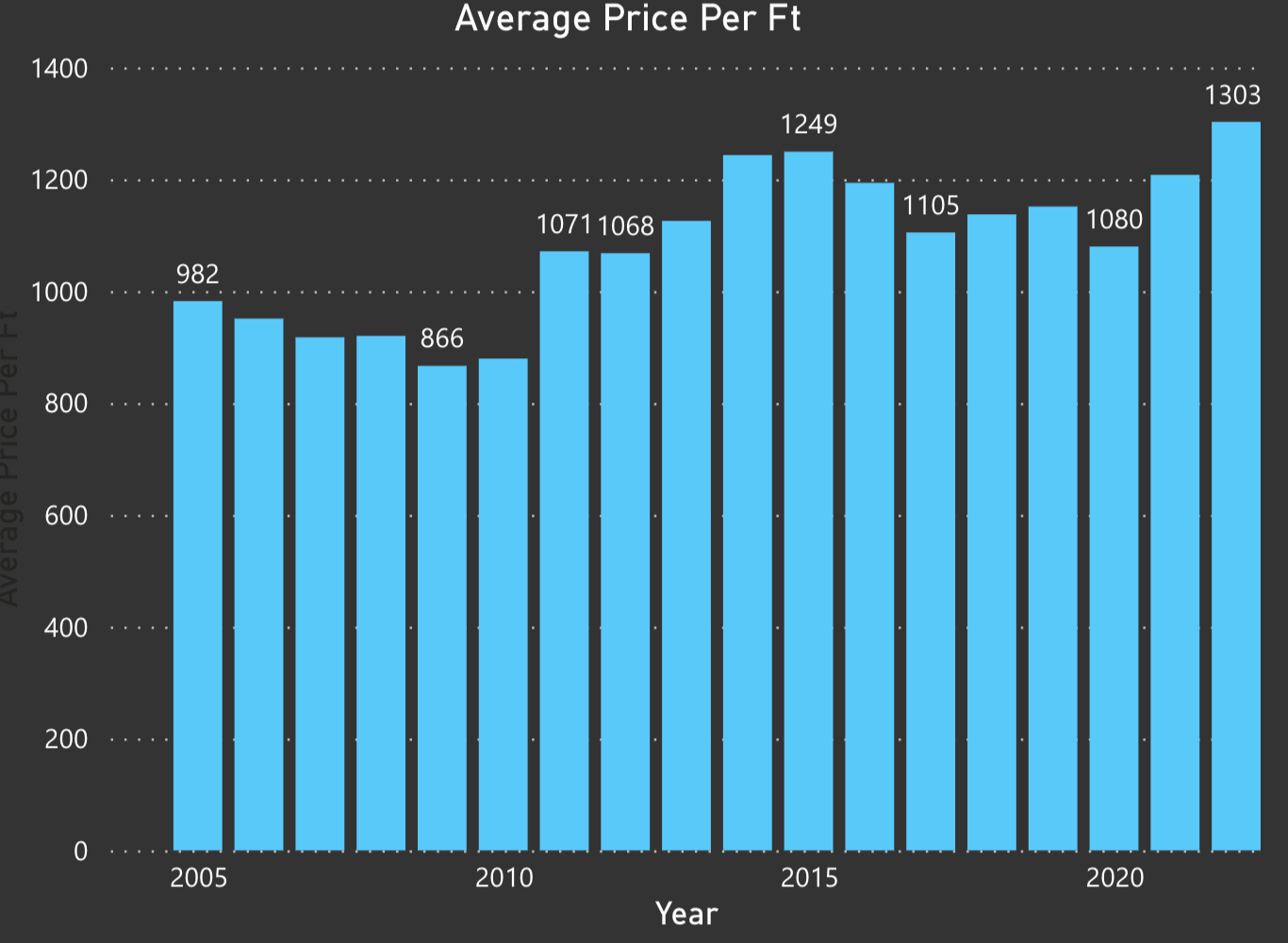

The Condo Life Cycle of Condos in the $2M-$5M Range

How much more will my Miami condo unit be worth in the Months to Come?

Q1 2022: Condo owners are sitting on gold, and they know it. We are noticing sellers are becoming increasingly unrealistic, and the sky is not even high enough. We have had clients who made an all-cash offer for a unit that was then being pulled from the market as the owners thought it would increase another 40% in 2022! Most condo owners do not want to sell and are bullish on the current real estate market. Those who bought condos for $3M nearly two years ago are now getting offered $5M. The rental market is equally hot. We have seen properties that used to rent for $8K a month now rent for $20K per month. The extreme numbers make people hesitate to sell. What if it gets even better? The reality is that we expect this coming season to become the peak of the Miami condo market.

Inventory is rapidly decreasing, but we also have a good amount of brand new condos that will be released soon or will start to take reservations. It is key to understand that condo demand is not motivated by necessity. People want a good investment, but there is a limit to a good investment. If Miami condo prices go up too much, there is no necessity for buyers to onboard that unit, unlike what we often see in the single-family home market where there is a real need. Relocation buyers from the high tax states relocated to Miami with high salaries. They paid top dollar for relatively affordable properties compared to properties in their home market. Miami condo prices increased, but these property prices stayed attractive for relocation buyers. Apart from a higher income, these buyers also saved on taxes. At one moment, migration will slow down, and the local market will no longer be able to afford these condos. Add to this the rising interest rates, making condos less affordable for many, and the potential change (Proposed by Biden) to the capital gains tax, which will increase this tax from 20% to 40%.

Like we told condo owners in 2015, you want to sell before the rest is selling, and now the market is at an all-time high!

Q3 2022: A third-quarter update shows that sales are down, pending sales are down, and listings are up. Purely looking at the Downtown, Brickell, and Edgewater area for the $500K+ market, we see a 35% increase in listings and 55% fewer pending sales. If you had considered selling, NOW is the time.

The Most Vulnerable Miami Markets

Some markets are more vulnerable than others. Some markets offer more generic products than others or are more investor driven than others. Some condo markets like Coconut Grove are more occupied by primary residents and less vulnerable to market changes. We will discuss the most vulnerable markets below. We have to mention that there are well-performing condos in vulnerable markets and vulnerable condos in top-performing markets. You can contact me at 305.508.0899 for more information.

The Brickell and Edgewater Condo Markets offer many generic condos. With generic condos, I mean condos that do not stand out in the crowd and do not offer unique features. These are very investor-driven markets, with many condos predominantly occupied by renters. As mentioned earlier in this article, many Miami residents need to move out of their condos as they can no longer afford the rising rents. There are good condos in this market, but several condos are only able to sell for top dollar when the market is high. These condos are the first ones to see massive discounts in a balanced or a buyers market.

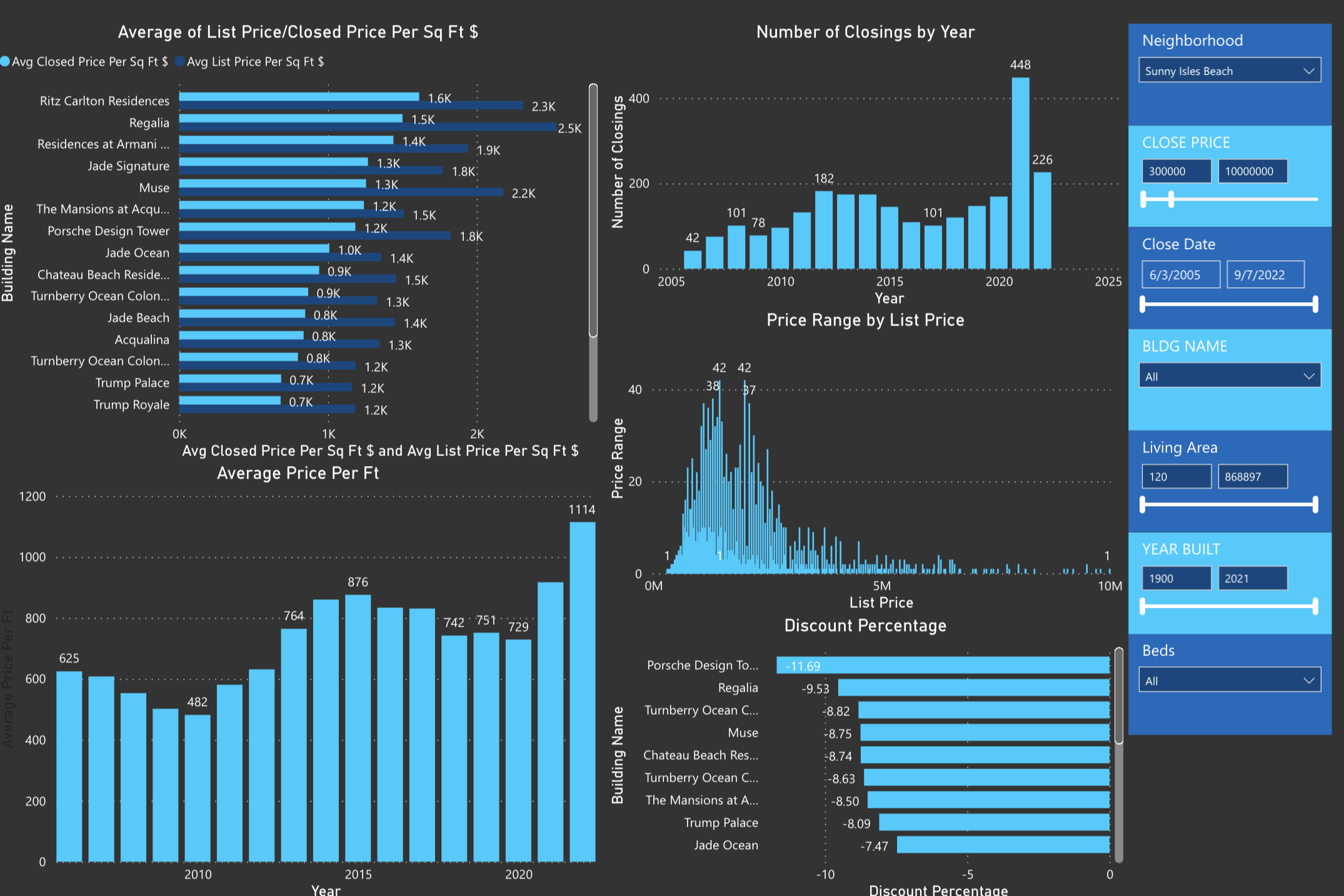

Sunny Isles Condo market. The Sunny Isles condo market saw a sprout in ultra-luxury residences in the last cycle. Many of these investors bought luxury residences to protect their wealth and keep their assets in dollars. We saw many condos resale for much less than what they were bought for. Over the years, this market has seen lots of inventory. There are several well-performing condos in this market as well.

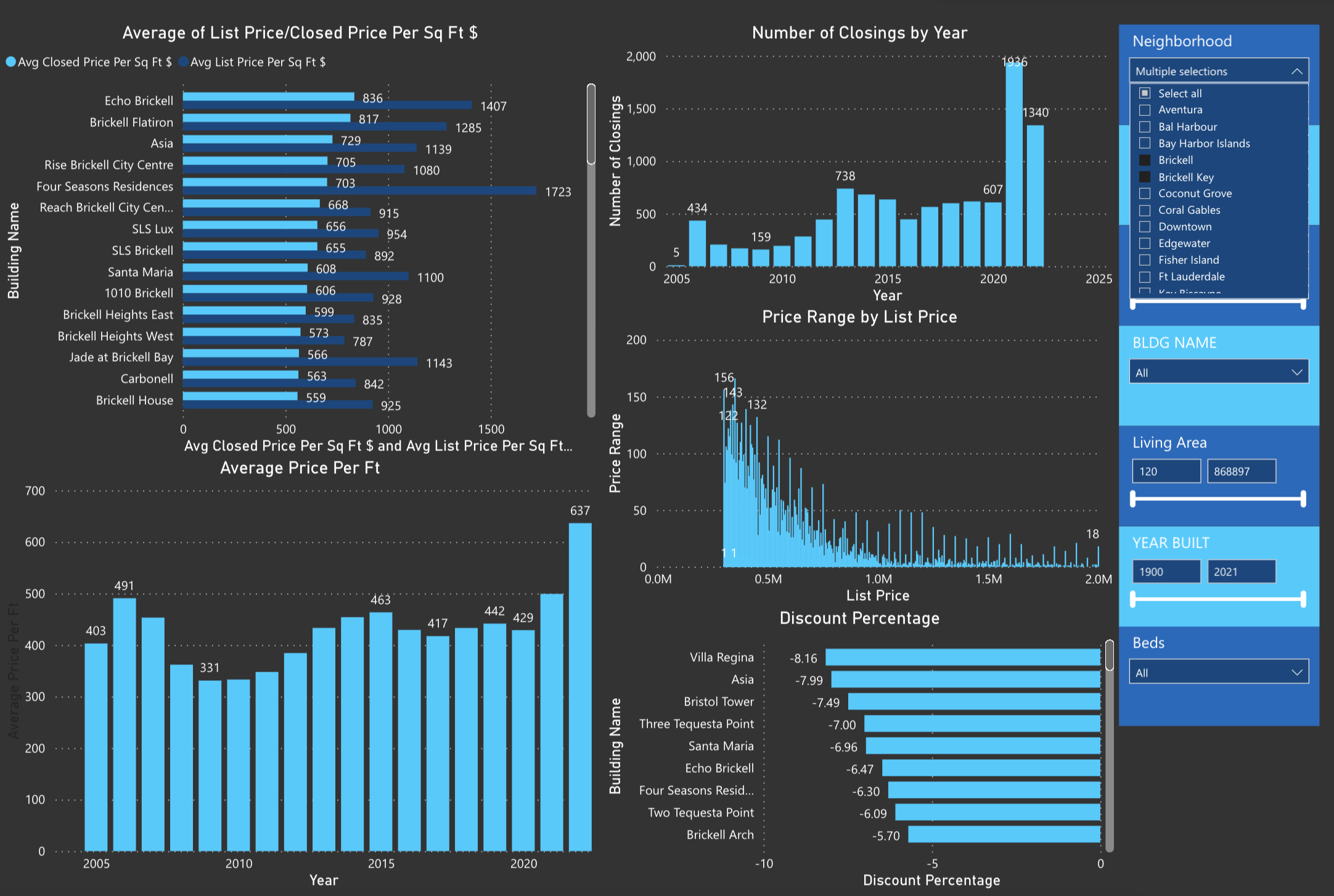

Data for the Brickell Condo Market

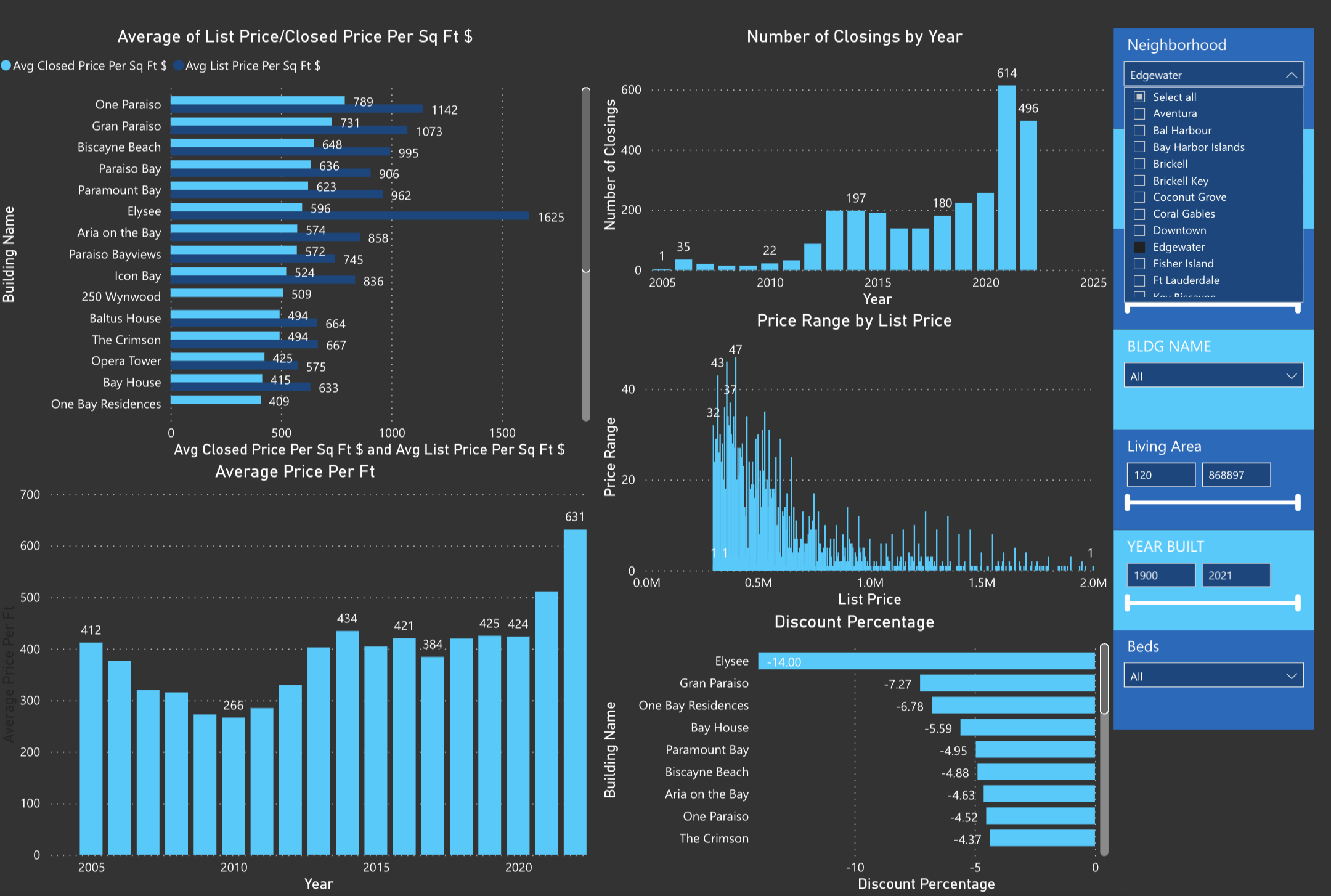

Data for the Edgewater Condo Market

Data for the Sunny Isles Condo Market

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS