- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The South of Fifth Condo Market Report 2019

The South of Fifth Condo Market Report 2019 – The Last 6 Months (May till October 2019)

David Siddons and our South of Fifth condo expert and resident Stefania Cambarau spent the week analyzing the South of Fifth condo market to provide our readers with a clear overview of what has happened in the last 6 months, what trends we are seeing and what we expect from this market in the months to come.

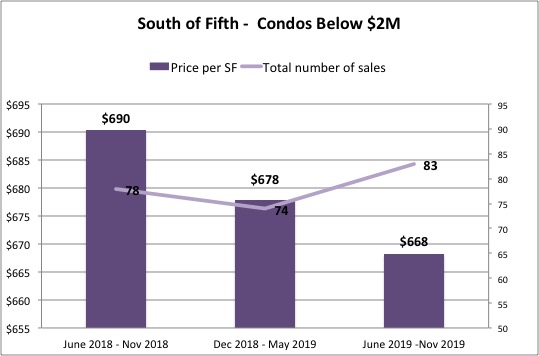

Observations in the South of Fifth Condo Market below $2M

- 229 Active Listings

- 86 Sales

- 14.3 Sales per month

- 16 Months of inventory

The South of Fifth condo market recorded 86 sales within this price range while there are currently (as per Oct 1, 2019) 229 listings. This leads to 16 months of inventory, which is not a bad number at all. South of Fifth is performing better than the rest of the Beach. This is mainly because of the desirability of the location, close to the elementary school (one must live in the perimeter to be accepted by the a rated public school), because of the more neighborhood lifestyle and the access to many stores and restaurants in walking distance.

The properties with the longest days on the market are generally the units in the more dated (pre-2000) condo buildings. The older buildings see a lot of product that stays on the market for 300+ days. Condos that can be rented for a short term or are income producing are selling very well and for a high amount per SF. In recent years we saw top dollar being paid for very well done units that were destined for the short term rental market. With the recent outlawing of platforms like AirBnB, we see that these prices per SF have decreased as the short term rental opportunities are now limited. The only buildings that keep on selling for a high price per SF (up to $1,000 per FS) are those buildings that allow short term rentals such as the yacht club or newer buildings such as Murano Grande, Murano at Portofino, Continuum or Icon.

Units in older building get less and less desirable, either because the buildings are not correctly maintained or managed or because a very costly special assessments is coming up. Newer buildings still have high HOA fees, but are more desired by renters as well and therefore make more sense as an investment.

Please be aware that it is not untypical to see 10% reductions from asking to sale price and in many cases when we look at properties being relisted we are seeing 25% discounts off original ask price.

The rental market saw 199 units being rented. Compared to 86 Sales in the same period this is definitely a rental based market.

What will the future bring?

This market has adjusted its price already and is much more balanced than before. Therefore we will see even more of a dynamic market in 2020, with more sales. The favorable interest rates are also a great push for this market.

Working Example

Observations in the South of Fifth Condo Market for the $2M- $6M Market

- 98 Active listings

- 16 Sales

- 2.66 Sales per month

- 37 Months of inventory

112 rented to 16 sales. Still a big rental market, although many owners decide to sell their unit in order not to loose more value.

What will the future bring?

We will see way more leases in the next 4 to 6 moths as the season is approaching. Many new units will hit the market for sale as well; something that happens a lot during the high season. This year we will see very competitive listing prices as the fresh inventory will add up to the existing one.

Working Examples

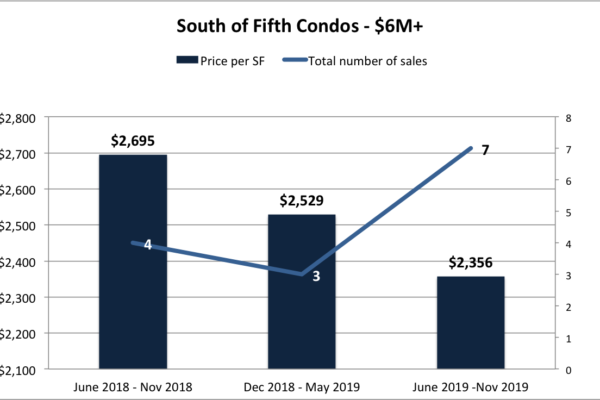

Observations in the South of Fifth Condo Market for the $6M+ Market

- 34 Active listings

- 7 Sales

- 1.16 Sales per Month

- 29 Months of Inventory

This market is fairing better than the mid-range market of $2M- $6M and the last 6 months this market performed much better than the 6 months prior where we had only 3 sales. This is a market that is less affected by economic change. The ultra-luxury market is now seeing very high-end products move again at a greater velocity than last year. This is due to the many price corrections and heavily discounted sales. I think this is also seen in other markets; High-end sales are moving better due to realized discounts of 20% or more.The over-confidence is gone and we are back to true market values. We do notice in this market that people are shopping for very well finished product or combined units with high-end details and those buyers are willing to pay top dollar for these kind of units.

The most expensive listing is listed at $19M asking price while the most expensive sales was $13M, again at Continuum. Just like in the mid range, almost 50% of sales are recorded at Continuum. The highest sales price per SF was just below $3,000 per SF, which was unit 3303 at Continuum that sold for a 20% discount.

33% of Product has been sitting on the market for over 1 year.

Only 3 rentals in this price bracket. The demand is very high for the high-end rentals, but the offer is almost absent. This happens mainly in the high season from November through April.

What will the future bring?

The market will stay strong. More inventory will be listed for sale, but buyers are coming strong in 2020

Working Example

1000 S Pointe unit 3501 sold at $9.3M while 6 floors below (same SF) sold for $4M less. Well-finished product moves much much better, but they must be very unique with unparalleled views.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS