- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Miami Beach Condo Market Report 2019

The Miami Beach Condo Market Report 2019 – The Last 6 Months (April till October 2019)

David Siddons and our Miami Beach real estate expert and resident Stefania Cambarau spent the week analyzing the Miami Beach condo market to provide our readers with a clear overview of what has happened in the last 6 months, what trends we are seeing and what we expect from this market in the months to come.

With Miami Beach we refer to 5th street till 87th street (South of Fifth is analyzed independently)

Observations in the Miami Beach Condo Market of $500k – $2M

- 657 Listings

- 159 Sales*

- 24 Months of inventory

The Rental Market

- Only 10% sold over $1,000 per SF

- Over 50% of the closed sales are between $500 and $900 per SF

- 40% of the closed sales happened below the $500 per SF marker

- The highest price per SF achieved was an exceptional $1,678 at W hotel, which can also be rented short term

Working Examples

The first two examples are sales in buildings that do not allow for short term rentals, while the last 2 examples do allow for monthly rentals

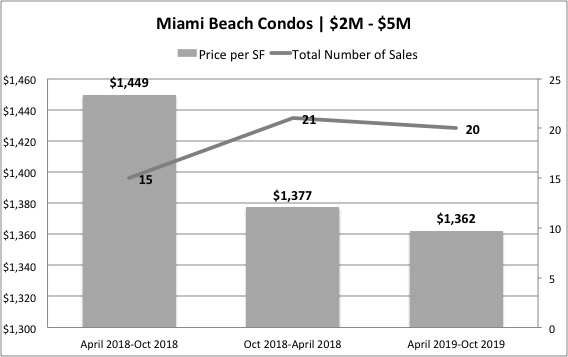

Observations in the Miami Beach Condo Market of $2M – $5M

This table is created over a slightly different time frame than the data collection below, therefore discrepancies between data might occur

- 113 Listings

- 16 Sales*

- 43 Months of inventory

The Rental Market

Working Example

4 Of the 16 sales happened at Il Villagio on 1455 Ocean Dr.The sale prices were on average around $1,500 per SF for 3 bedroom units with ocean views, while its 2018 sale prices were above $2,000 per SF. Unit #1509 (shown here) sold for $3,550,000 or $1,578 per SF

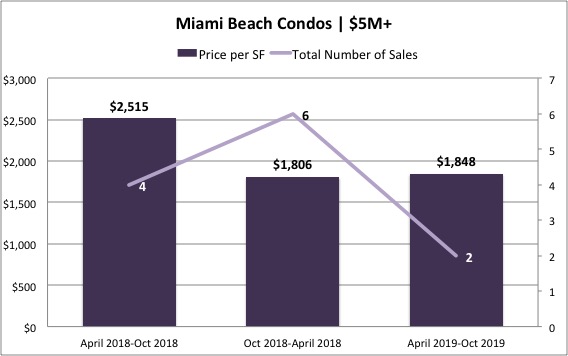

Observations in the Miami Beach Condo Market of $5M+

This table is created over a slightly different time frame than the data collection below, therefore discrepancies between data might occur

- 28 Active listings

- 1 Closed sale*

- 175 Months of inventory (this means 4 years to sell the current inventory, shall nothing else hit the market)

Working Example

PH 1612 at 1 Hotel and Homes , a 3 bedroom, 2,548 SF unit sold for$5,600,000 or $1,459 per SF after being listed for 262 days. The unit’s original listing price was $5,795,000

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS