- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The 90-Day Miami Beach Real Estate Report Q3 2021 | Miami Beach Condos and Homes

Our First 90-Day Miami Beach Luxury Real Estate Report Q3 2021

The $3M-$5M | $5M – $10M | $10M+ Market

Welcome to our first 90-day Miami Beach Real Estate Report Q3 2021. Due to the dynamic of the Miami Beach real estate market we have decided to introduce 90-Day real estate updates. Stefania Cambarau of the David Siddons Group will provide you with a complete overview of the market in less than 10 minutes. Her reports will give you the most important market data (months of inventory, number of active listings, sales and pending deals, key sales in the area and average sales prices per SF) in combination with our signature social narrative.

This report compares the last 90 days (essentially quarter 3 of 2021 to the same periods of time in 2019 and 2020).

The 90-Day Miami Beach Real Estate Report Q3 2021 for the Miami Beach Condo Market

One of the Most Significant Miami Beach Condo Sales

The 90-Day Miami Beach Real Estate Report Q3 2021 for the Miami Beach Single Family Home Market

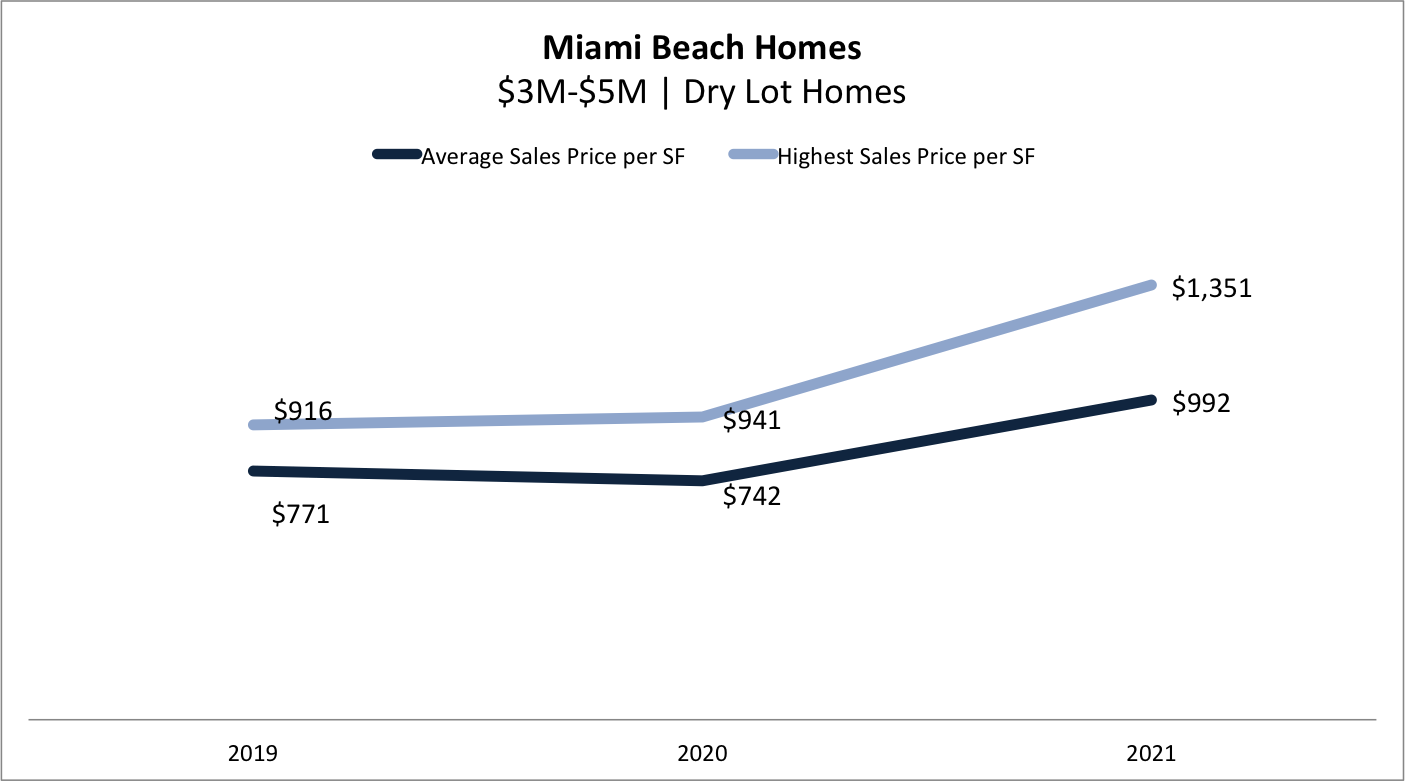

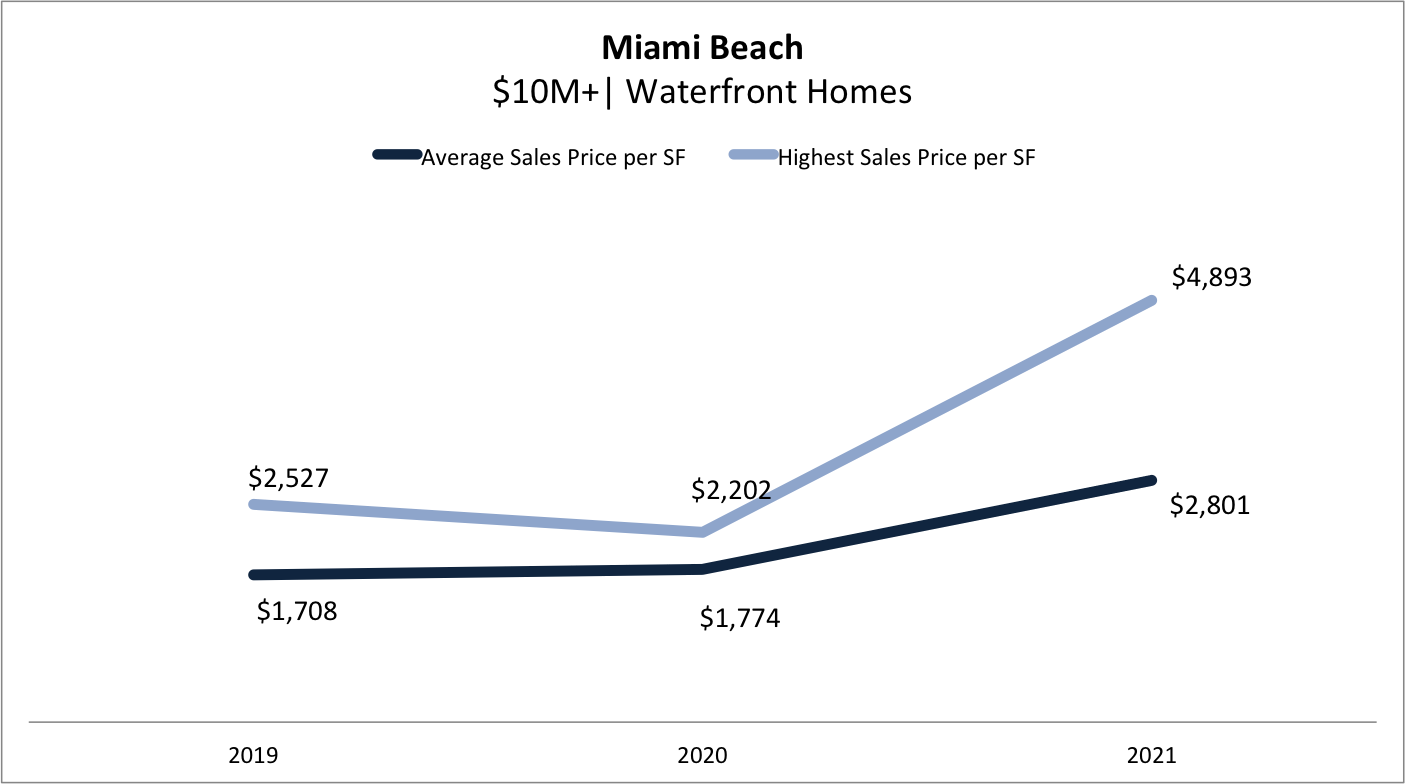

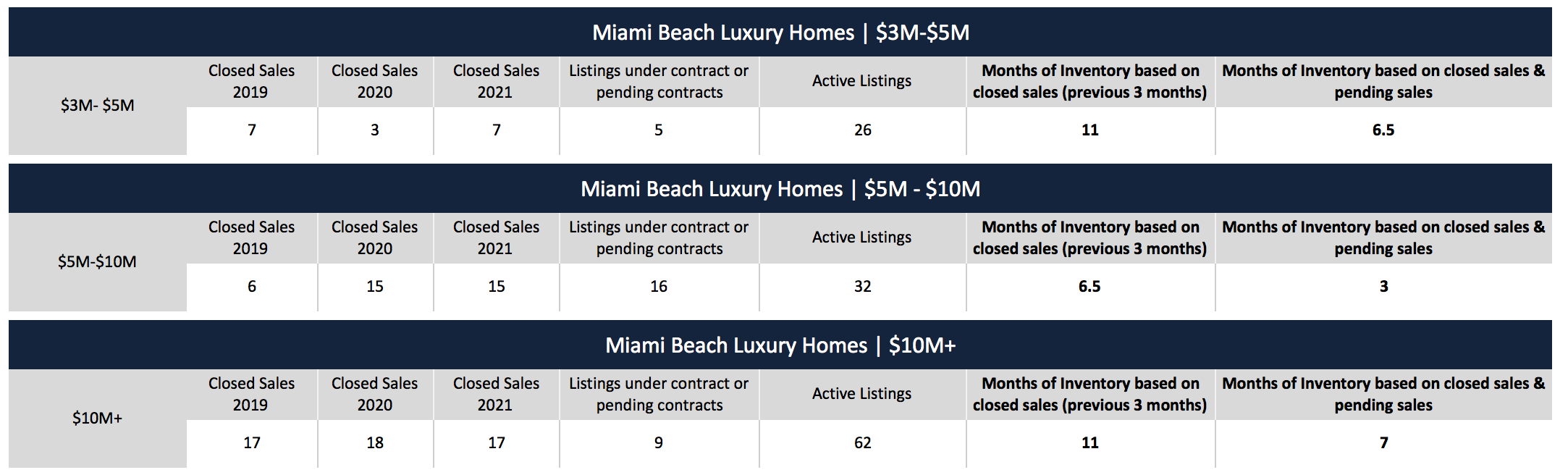

The $3M-$5M market only recorded 2 waterfront sales per quarter and due to these limited data sets we decided not to show the data for waterfront homes in this price. The $5M+ market in 2019 and 2020 did not have an dry lot sales while the $5M-$10M showed no less than 8 dry lot homes in 2021. This says a lot about the demand for property in the Miami Beach luxury market. While before the $5M+ range was reserved for waterfront homes, these days we also see a high amount of dry lot homes trade in this price range. The dry lot home traded on average for $1,260 per SF ranging from $874 to $1,717 per SF.

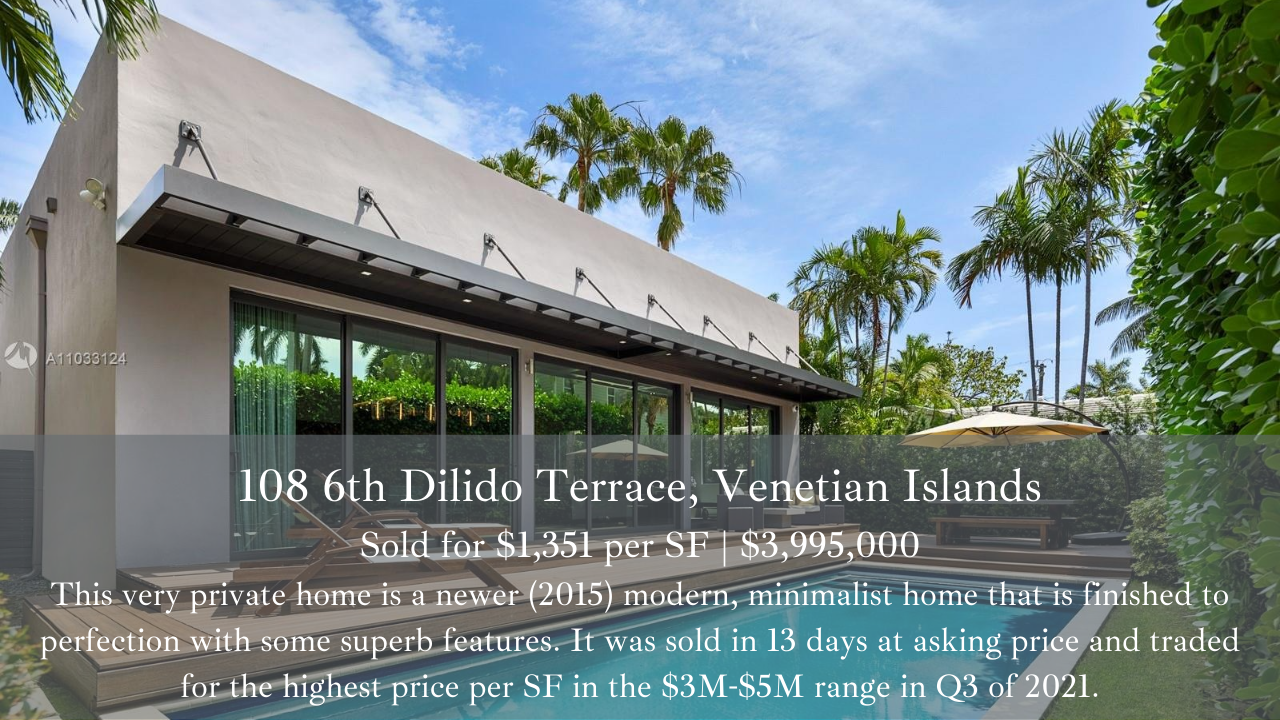

One of the Most Significant Miami Beach Single-Family Home Sales

Who is Buying in Miami Beach?

Just like in the rest of Miami, buyers of Miami Beach real estate are mostly coming from the high-tax states. Buyers come from NYC, NJ, Chicago, Boston, San Francisco and LA. They are all coming for the tax advantages, favorable business climate and a better lifestyle. Now the US is open for international travelers again we expect European, Canadian and Brazilian buyers to start coming in as well.

What is Happening to the Inventory?

The inventory of single-family homes started to decrease rapidly in 2020. The demand for luxury homes was so high, many buyers started looking at new (waterfront) areas that previously were not that desired. We started seeing many off-market deals in which sellers of off-market homes received a “Make-me-move-offer”. Since 2021, the condo market is also seeing very low levels of inventory. The inventory shrank by 30%-40% over the last few months while these are historically the slowest months of the year. The high season is still to come in the winter months, which is normally Miami Beach’s peak season.

The Peak of the Miami Beach Condo Market is nearing!

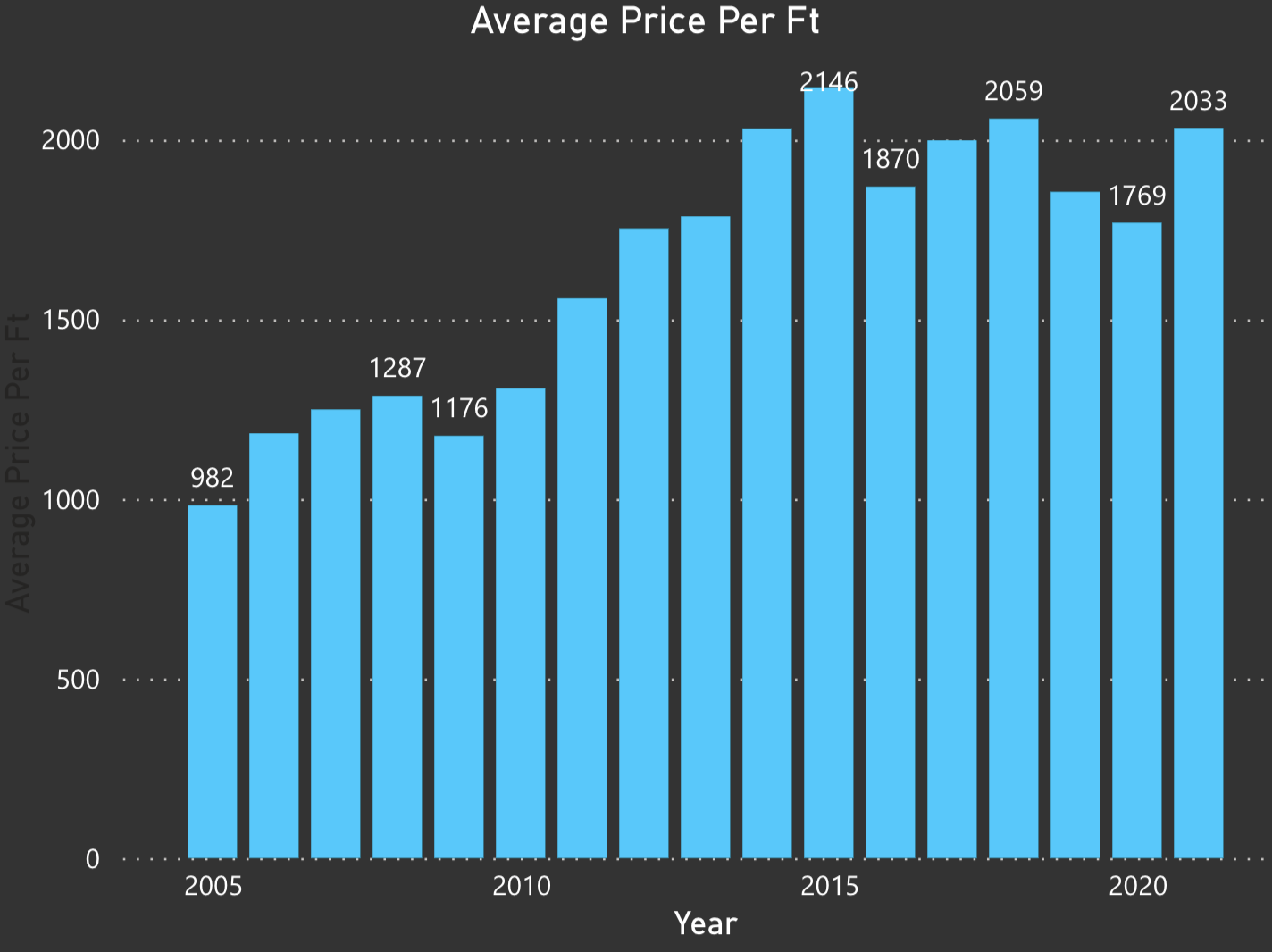

The Miami Beach luxury condo market is nearing the peak prices seen in the 2015 Miami condo market. Inventory is down to 5 or 6 months and we are seeing record sales prices. As cherry on the cake, the United States will reopen in November to air travelers from 33 countries including the UK, Brazil and most of Europe who are fully vaccinated against COVID-19. We have 5 buyers from the UK who have been following the market for over a year now and are eager to come into town to buy a property. We for sure won’t be the only ones in town who have UK or other European buyers lined up to fly in and invest. This means the next wave of buyer frenzy is coming just in time for what is normally known as Miami Beach high season! Another indicator of this strong Miami Beach market is the rental market. The market is currently seeing overheated rates that are 40%+ higher than in previous years. Properties that rented last year for $8K per month are now renting for $20K. The market returns are very high right now.

Data taken from CondoGeeks. Condo Geeks is a brand new and sophisticated tool, which is essentially a Bloomberg terminal for real estate. The tool empowers you to analyze entire neighborhoods, individual condos or a selection of condos. It provides users with the ability to look at the performance of a neighborhood / condo over time (amount of sales, prices per SF, discounts given and days on market) or to compare neighborhoods / condos to one another. It is essentially the best tool for consumers to see what a market is doing.

How much more is my Miami Beach condo unit going to be worth in the Months to Come?

Owners of Miami Beach condos are sitting on gold and they know it. Most of the condo owners do not want to sell and are extremely bullish on the current real estate market. Those who bought condos for $3M nearly 2 years ago are now getting offered $5M. The rental market is equally hot. We have seen properties that used to rent for $8K a month now rent for $20K per month. The extreme numbers make people hesitate to sell. What if it gets even better? The reality is that we expect this up coming high season to become the peak of the Miami Beach condo market. The numbers are high and with the next big wave of buyers (the Europeans, Brits and Latin Americans) we will see the prices reach its absolute top before the market will start to level again.

Historically the condo market has been more cyclical or volatile than the single-family home market. Prices increase fast, but they will decrease equally fast. An ideal market for some that like to take big risks with the chances of winning big, but not a market for everyone. When the economy is up everyone wants a second home or an investment condo, but when the first signs of recession start this is the first assets they get rid off. The single-family home markets are more stable as they are normally used by end-users and are therefore more of a necessity and less of a discretionary purchase. For this reason we would normally advice our clients to also take single-family homes into consideration as it is a better market in the long run.

Two Changes to Consider when Owning Miami Beach Real Estate

- Biden wants to get rid of the 1033 Exchange which allows you to move property while post-phoning capital gains till a later moment.

- Biden wants to change the capital gains from 20% to 40%

So lets say someone bought at Continuum in South Beach a $3M condo in 2018 and wants to sell that now for $5M, which is very well possible in this market. Over this $2M dollar profit the seller used to pay $400K in taxes and this same seller will now, under this new law, have to pay $800K+ in property gain taxes. Some sellers told me they will to sell until next year as they think in one year they will get more for their unit. Yes, the market will go up, but will it offset the increase in capital gains? Besides this, the new policy will have a cascading effect and once it becomes a new law people will want to dump their investment product. More people will be looking to sell and avoid increased taxes over their capital gains. You want to sell when people are buying, at the absolute peak, not when most are looking to sell.

How much longer will the Miami Beach Single-Family Home market be sustainable?

This market has always been a strong market. Demand has always been high, but since 2020 the supply/demand curve is experiencing extremes, which benefits the sellers. Do we expect this market to drop? No, you might expect it to level, but we doubt it will drop. Demand is up, supply is extremely limited. Miami is growing sustainably and businesses are moving into our city bringing along their C-suite. We have experienced that NOT many of them are moving back. The city is doing everything to cater to businesses and HNWI and this will benefit the Miami Beach home market. This is to say that the market won’t go down in many cases, but outlier properties that suddenly sell at 50% more than they sold 2 years ago (so called “Make-me-move” offers) will become less likely. With other words, we will see less anomalies in property prices as exceptions to the rule will cease to exist. These anomalies are caused by hysteria and this will stabilize soon. If you want to know more about how sustainable this market is we invite you to read the below article, which dives further into this topic and discusses what could potentially change supply or demand in this market.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS