- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The 2020 Q2 and Q3 Miami Real Estate Report | The Miami Condo Market

Part 2. A Look back at the Miami Condo market during the last 6 months of COVID-19

Overview

This report will give you the best optics on the Miami condo market whether you are relocating, looking for a second residence or just looking for opportunity. This report will give you the insights of the market and will let you know at which price point it is safe to buy.

This report consists of 4 parts of which this is the second one. In this second part I go into further detail on how the Miami condo market has performed and how it differs from the single family home market. In part 1, myself and another market analyst who is also a real estate agent discuss the market before and during Covid, which will provide you with really good insights. In part 3 of the report we deep dive into the single family home market and we show how this market performs differently than the condo market. The last part is another interview, this time with South Florida’s top performing realtors including agents from Fort Lauderdale and Palm Beach.

The Miami Condo Market Before and After Covid-19

I wanted to start this report with making the following important note. Corona did not cause any of the market movements we have seen in the last 6 months, but rather accelerated the patterns we were already seeing in the market. There were clear signs of distress in some sub-markets while others saw signs of a bullish market. When Covid, with its radical uncertainty arrived, it just accelerated these trends. The Miami condo market has been seeing declined transaction volumes since 2013 and even before Corona we were seeing very high inventory levels. As always there are better performing sub-markets or price levels, but across the board the condo market was not a very strong market and has behaved completely different than the single-family home market.

The reason behind this is because the condo market is more of an investment market, one that relies heavily on outside money and is less of a necessity and more of a discretionary purchase. More on this topic can be read/heard in part 1 of this report in which I discuss the market and the difference between condos and homes with Ana Bozovic, a Miami Market Analyst.

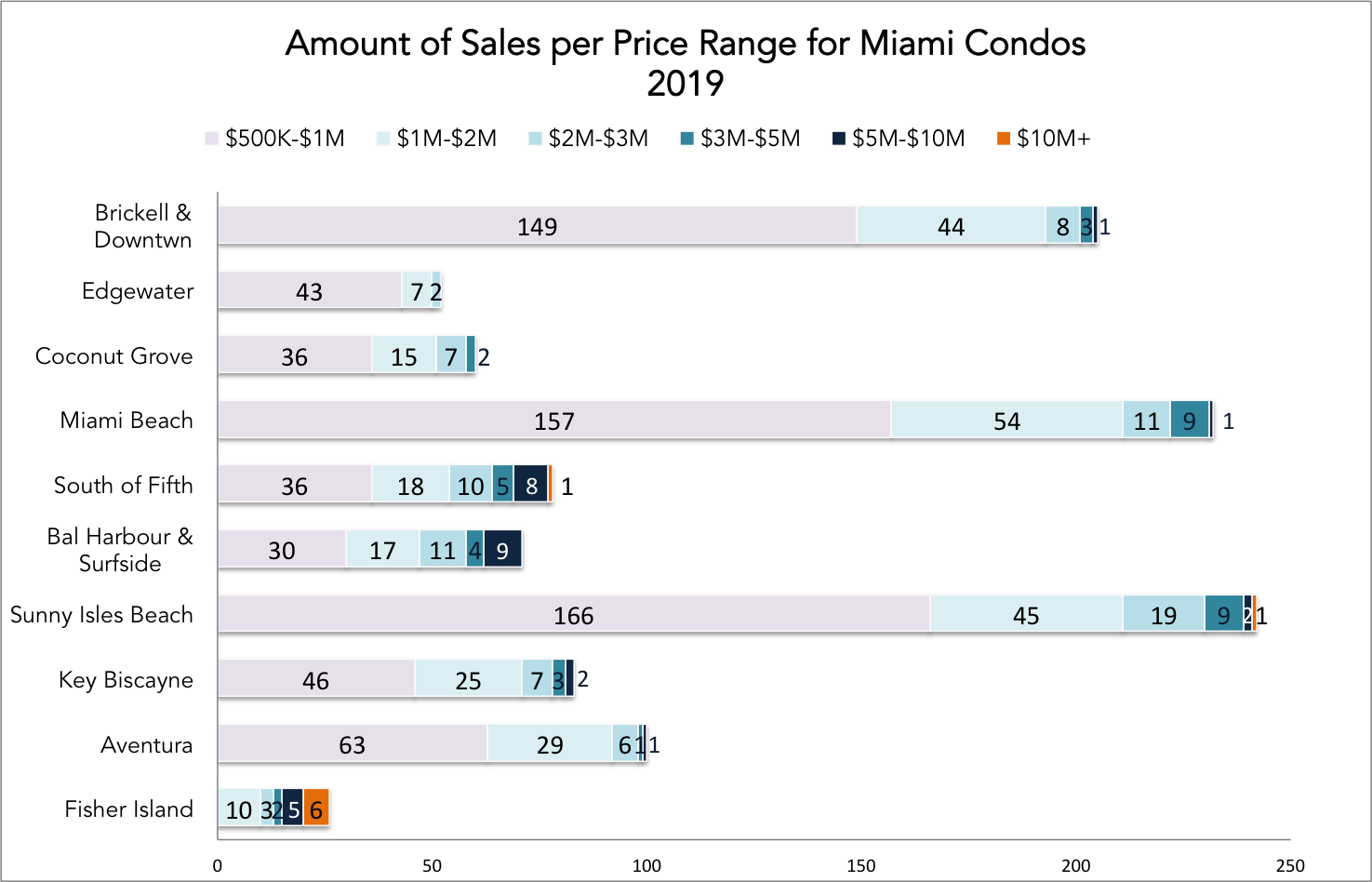

Comparing Condo Sales to Single Family Home Sales per Price Range

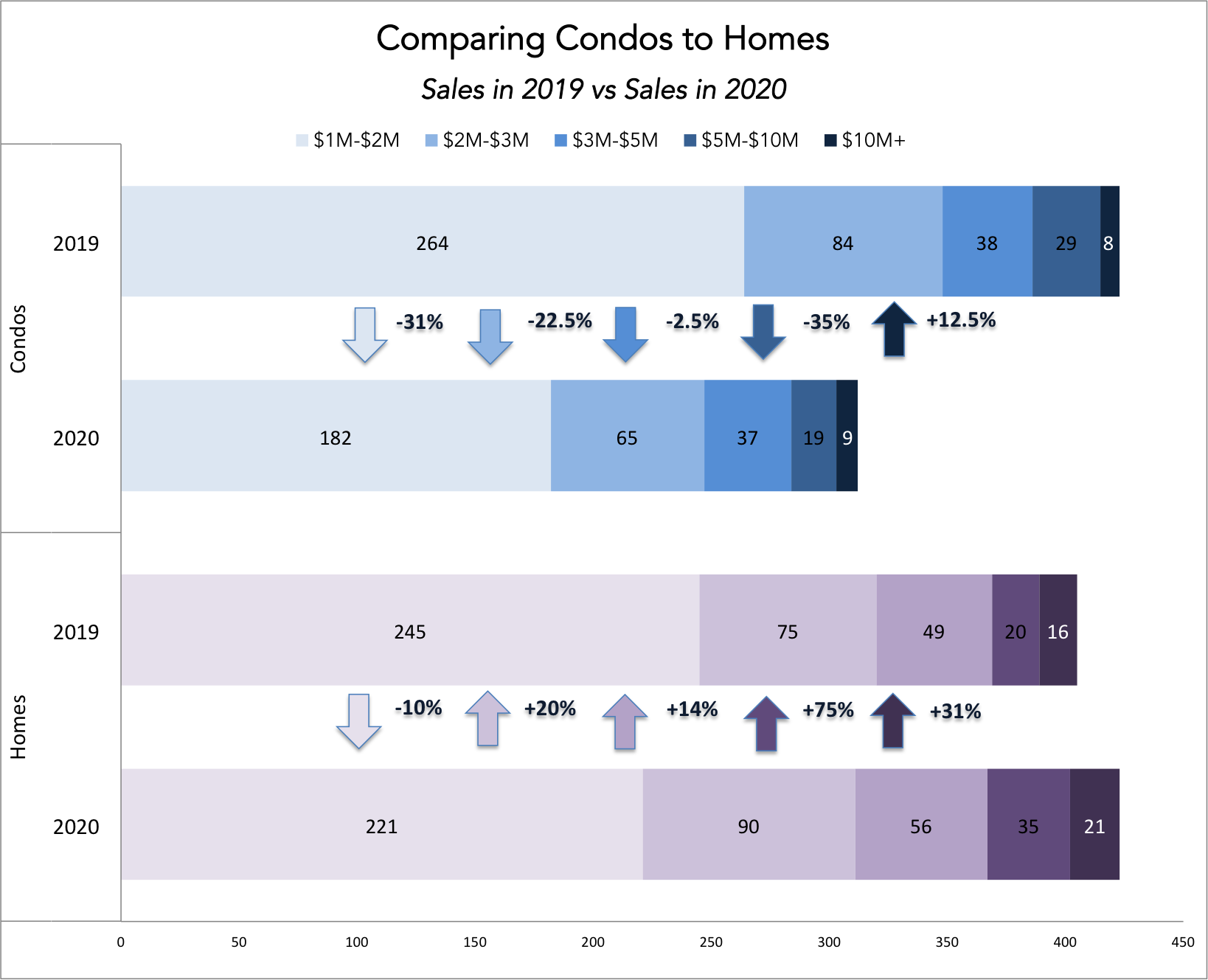

Comparing Condo Sales to Home Sales per Price Range you can see that the condo market has suffered much more during these last 6 months than homes. While condo sales pre-dominantly decreased since the same period in 2019, home sales has been up. Therefore one needs to approach this market with caution and with the guidance of an industry expert.

The $500K – $1M market is not showing here, but went down from 726 condos in 2019 to 442 condos in 2020, which is a 40% decrease in amount of sales.

Condo Sales in Miami’s Most Desired Residential Areas in during Covid compared to the same period in the year before

The amount of sales of Condos in Miami’s most desired residential areas in 2020 during Covid compared to the same period in 2019 (March 15-September 15). Swipe to the left to see the data of 2019 and see how there is a sales gap between 2019 and 2020.

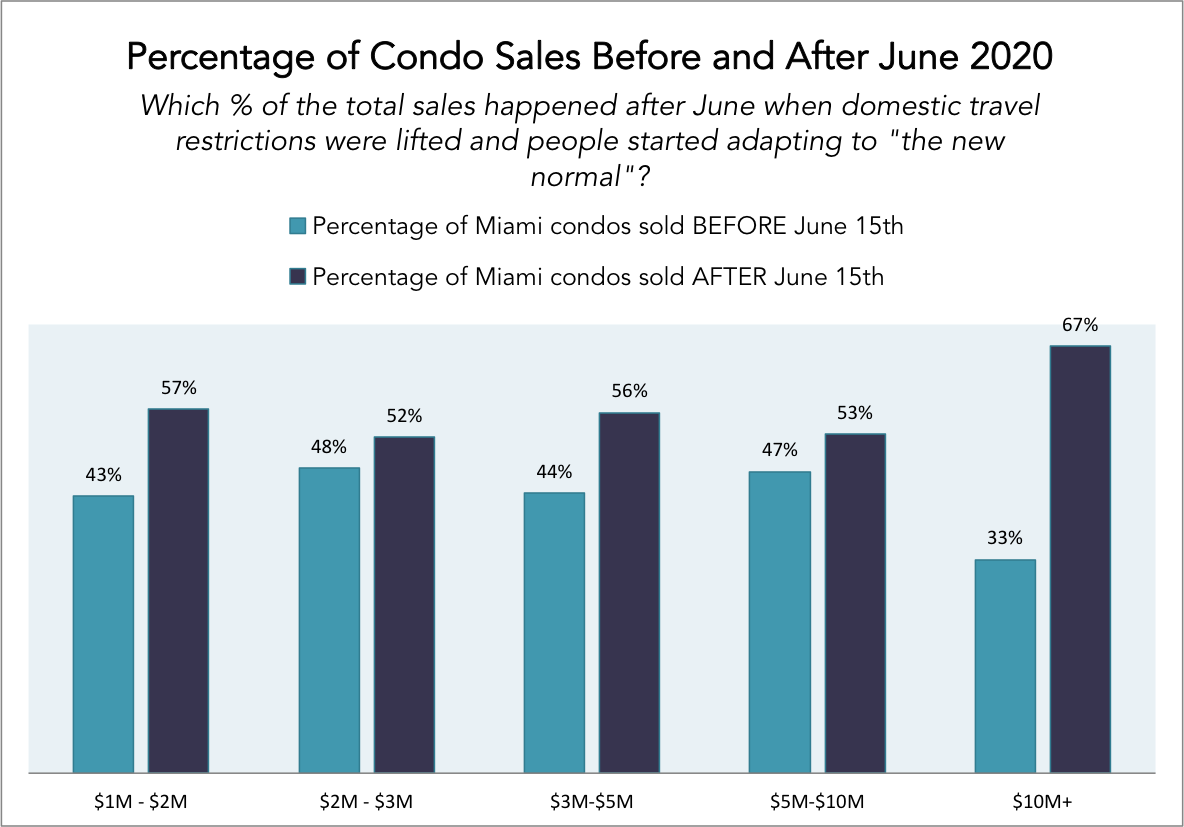

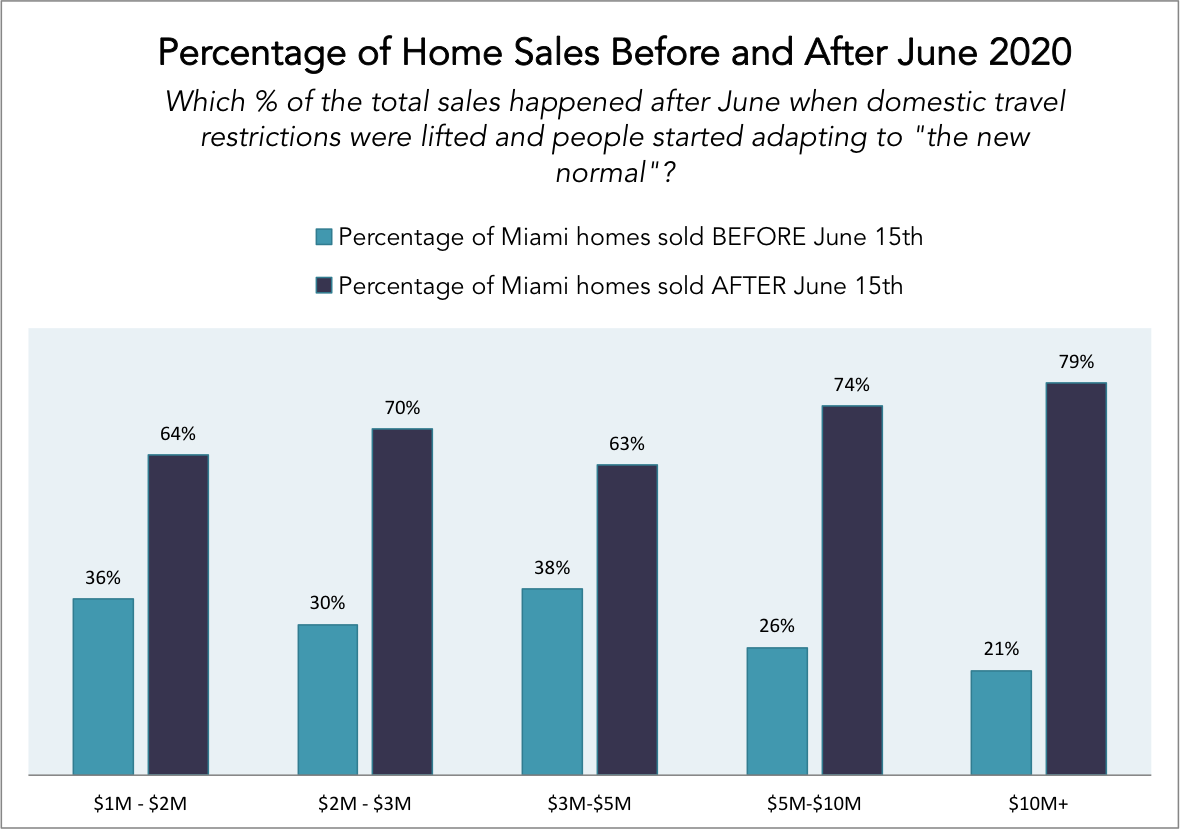

Percentage of Sales Before and After June 2020

Which % of the total sales happened after June when domestic travel restrictions were lifted and people started adapting to “the new normal”? Below you can see how condo sales did not pick up after travel restrictions were lifted and we settled into the new normal. The second picture depicts the single-family home market, which sees a clear jump in sales after the month of July.

A Deep Dive into the Different Price Ranges for Condos

The $1M-$2M Condo Market

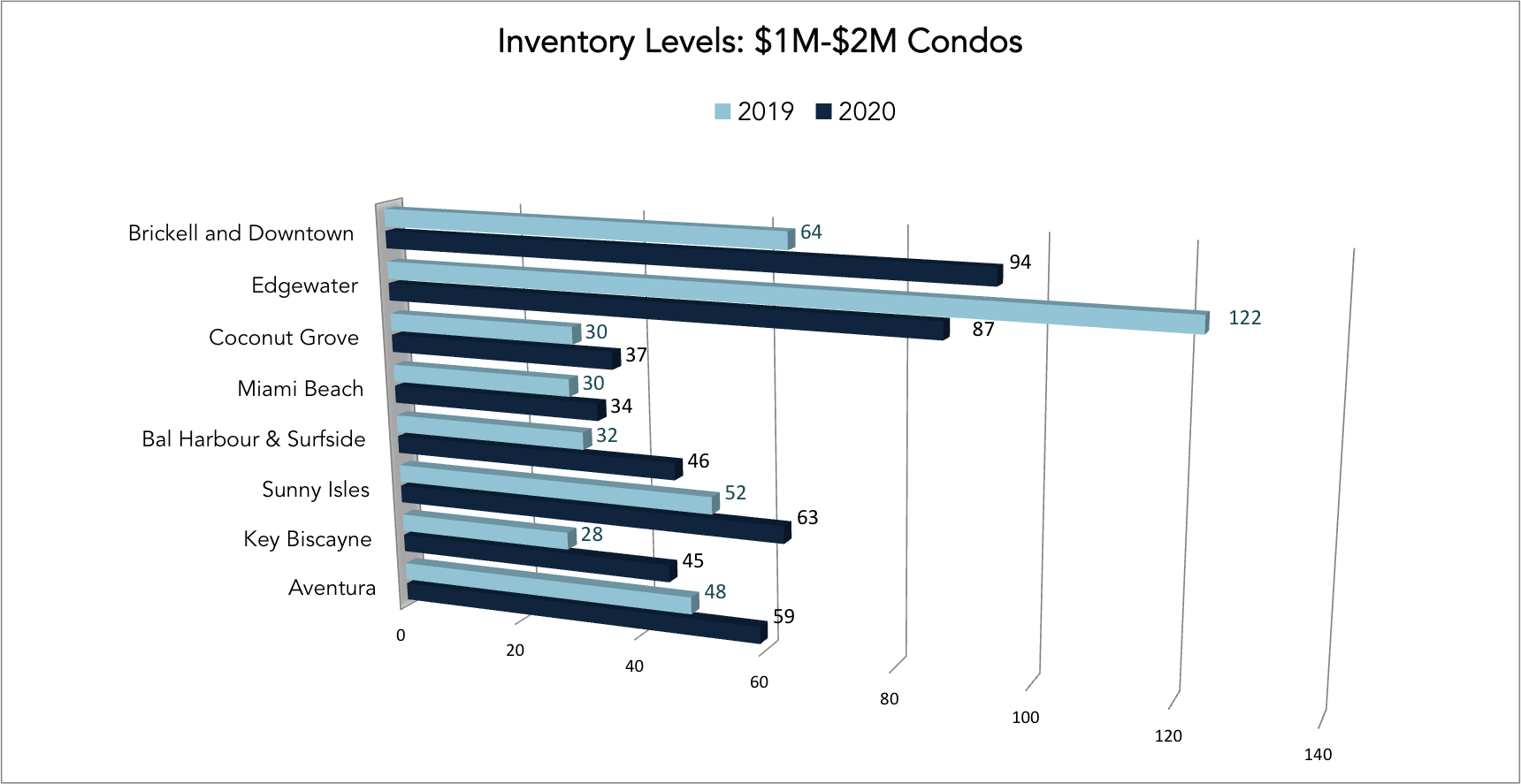

A market with a lot of listings and a limited amount of sales. At the time this study was conducted we recorded 1508 current active listings with 178 closed sales (between March 15 and September 15). That indicates a total of 50 months of inventory across the market. Most inventory sits in the greater Downtown area, which includes Brickell and Edgewater, while Sunny Isles and Aventura are also seeing a very high amount. Although none of these markets shows a very healthy amount of inventory, the Grove as well as the Beach show the most promising supply and demand relationship. This price range has 78 pending sales most in the Downtown area (18), Miami Beach (15), Sunny Isles (11) Bal Harbour & Surfside (7) and South of Fifth (5).

This market has suffered considerably from Covid-19. In 2019 we saw a total of 254 condos being sold in the city’s most desired areas while in 2020 in the same period we saw 178 condos being sold. That is a 30% decrease in sales. The highest decrease in sales was seen in Aventura, Miami Beach, Bal Harbour & Surfside as well as in Downtown. The Edgewater market on the other hand didn’t see a change in sales within this price range. While the single-family home market bounced back after travel restrictions were lifted and we settled into the new normal, the condo market did not see significantly higher numbers of sales after June.

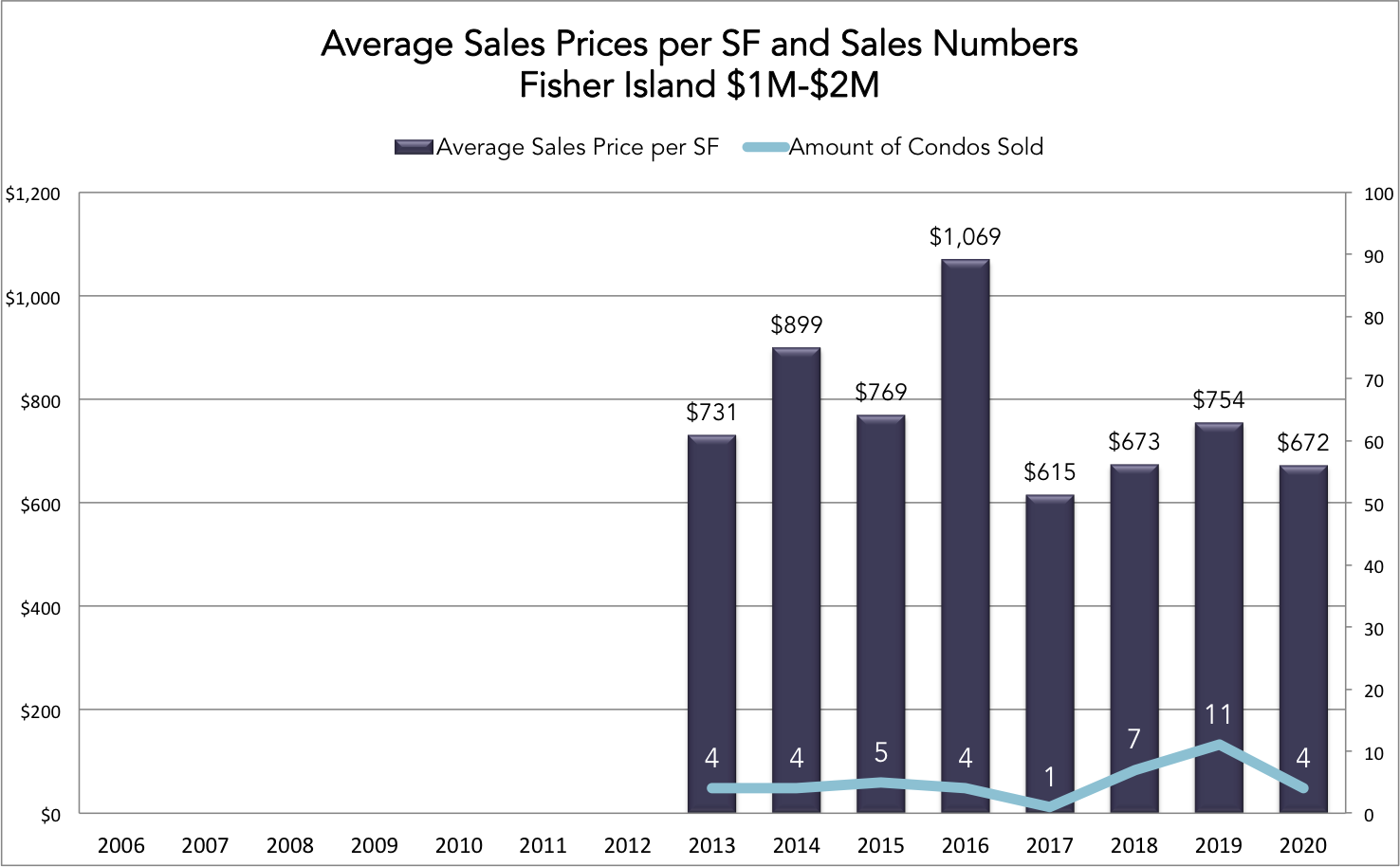

Have prices gone down? In the below graphs you see per Miami neighborhood was the prices have done in the last 15 years. Some areas saw price levels remain stable in 2020 while others saw a decline. High inventory and downward prices do not mean one should not buy. There is actually a lot of opportunity out there and the time to make great deals is now!

At what price point should you buy? As you will see in part 1 of this report, in which I speak with another market analyst, you have to look for the bottom prices of the previous cycle, which in the case of the Miami condo market is 2012. If you follow this rule you will be safe, assuming you buy a good quality property. As a safety net we look at prices achieved in 2012/2013. So once we reach these price levels it is safe to say you are buying at the bottom or near the bottom of the market. A good example here is the Miami Beach market. As you see today’s prices are around $961 per SF, which is equal to the prices achieved in 2012/2013. This does not mean that all properties at this price level are a good buy. This is the average price. Very well-finished ocean facing units will trade for more while fixer-up units should ask a lower price per SF. Will the market reach the prices achieved in 2008/2009? Most likely not, this was a real estate crash and a completely different situation than we are living in today. Also always remember the bottom of the market will always be slightly higher than the last lowest point.

Contact the David Siddons Group for more information about specific units or for a more personalized chat about investing in the Miami real estate market!

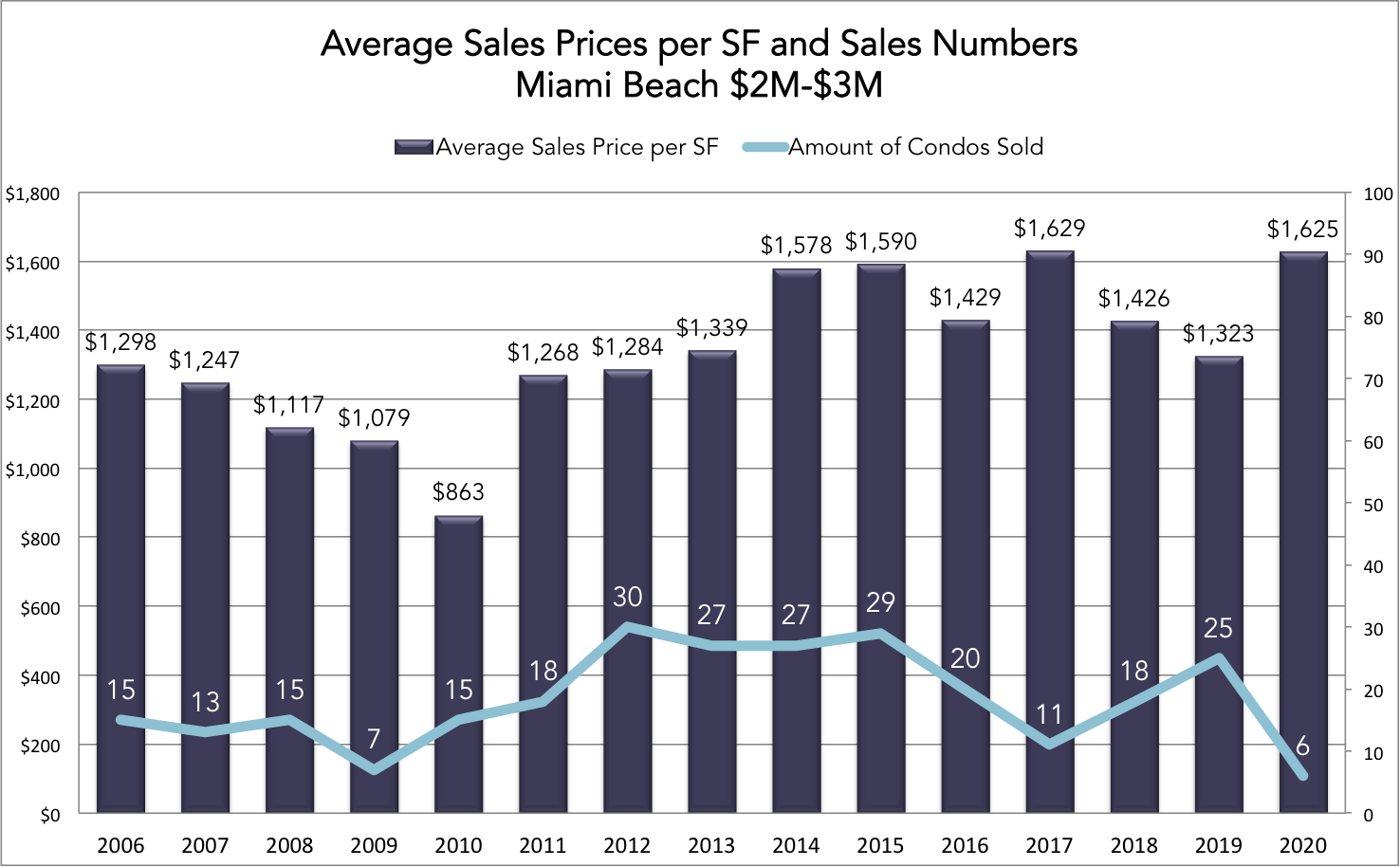

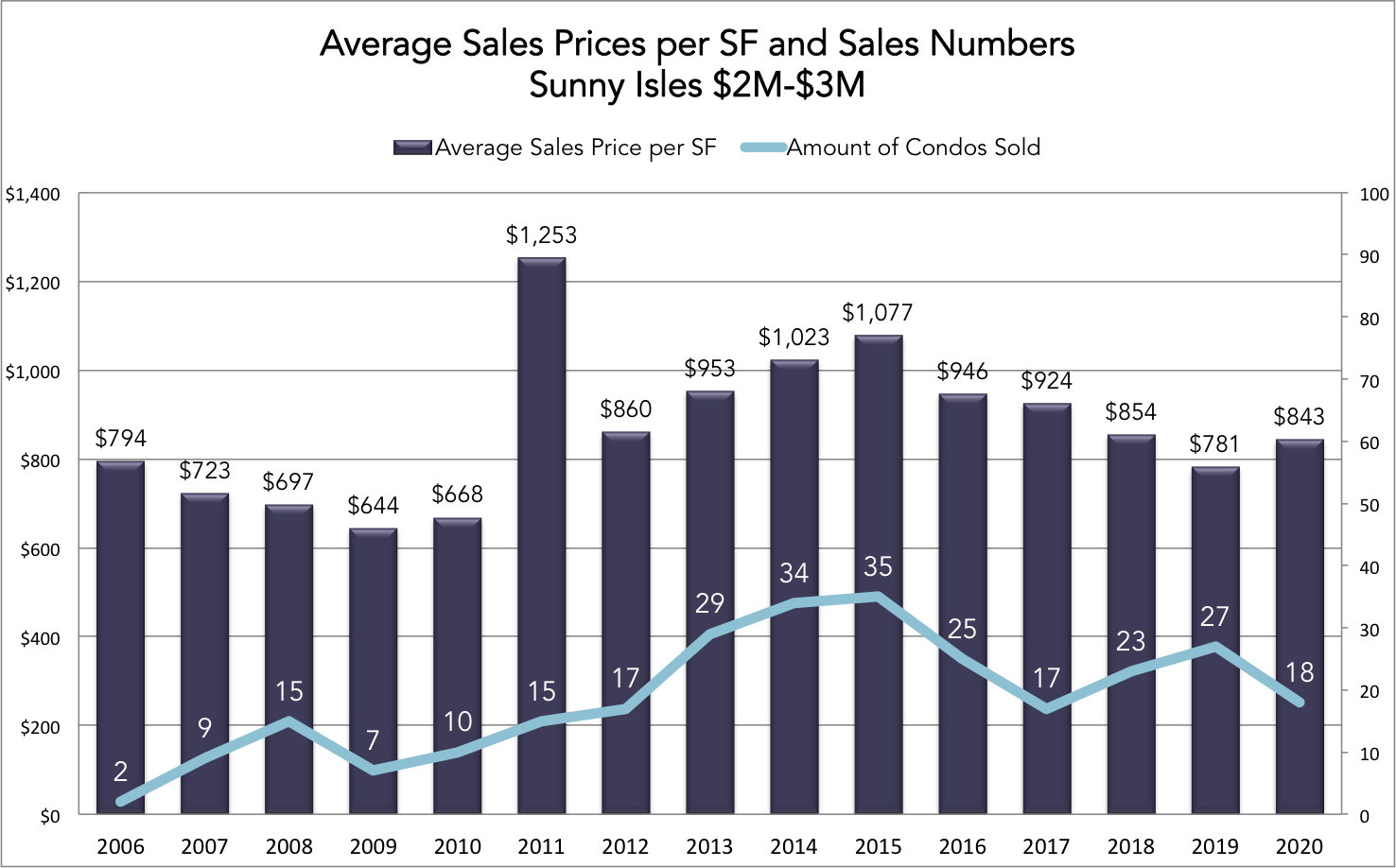

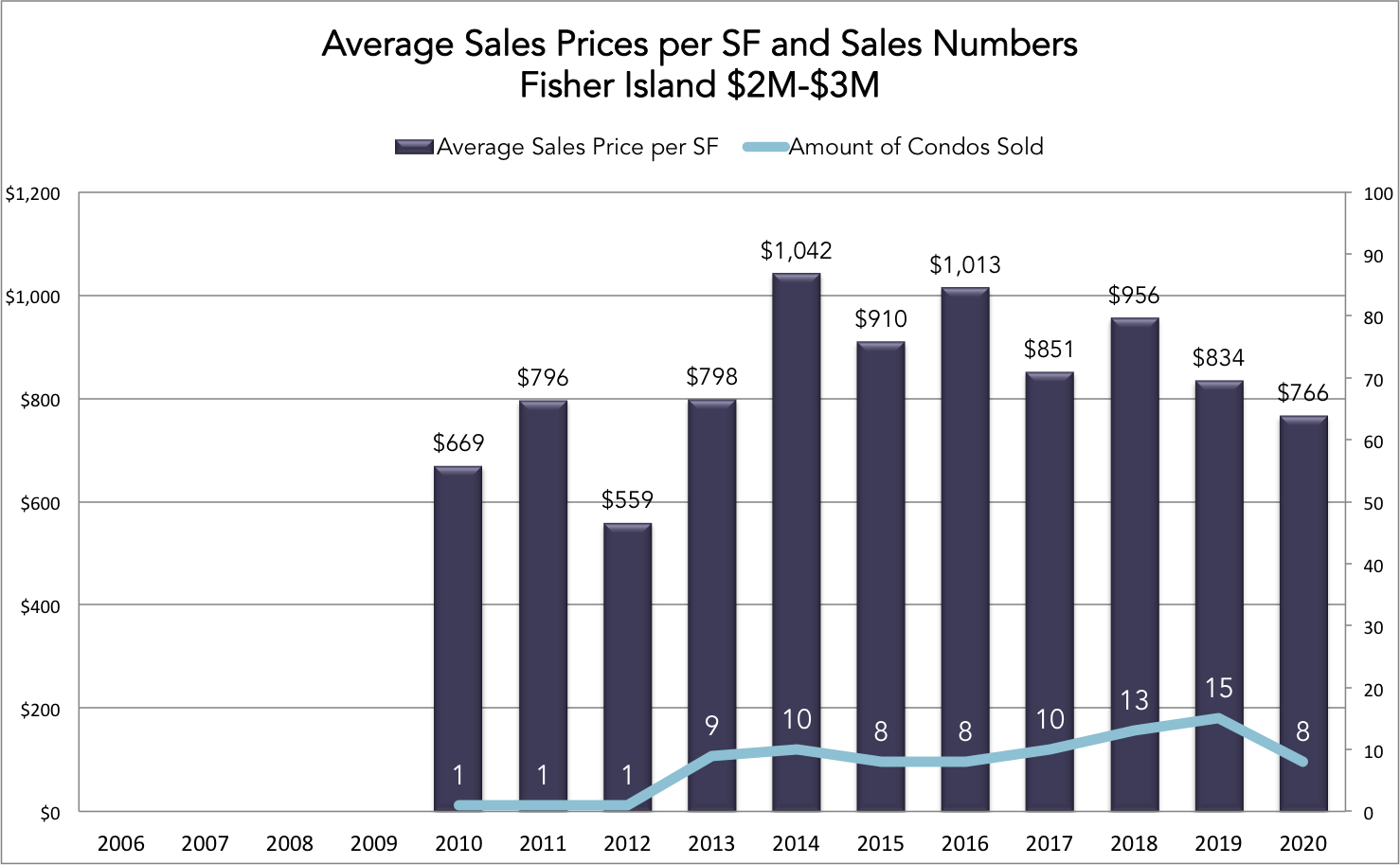

The $2M-$3M Condo Market

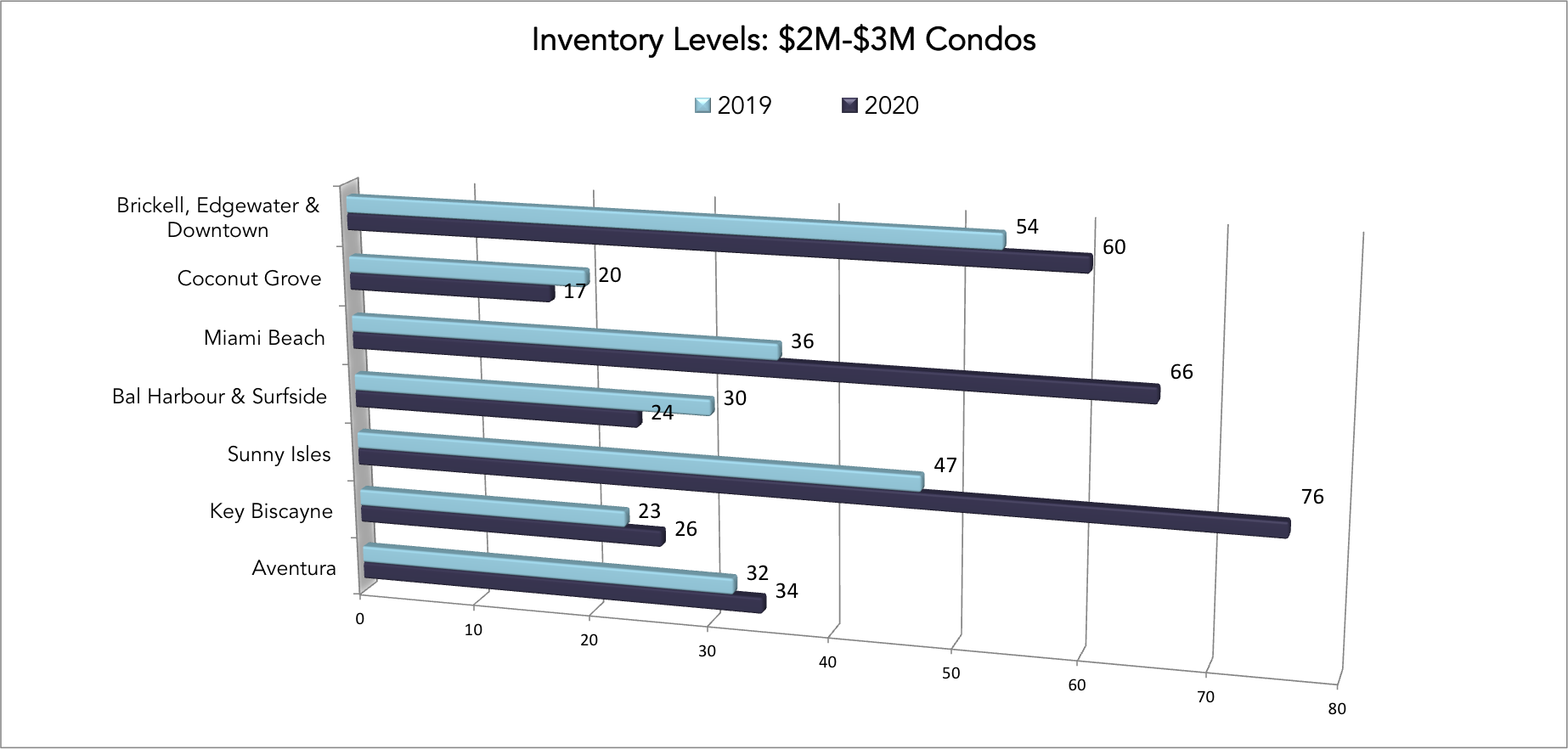

At the time this study was conducted we recorded 476 current active listings with 61 closed sales in the last 6 months. This is considered an unbalanced buyer’s market. Compared to last year we saw a 25% decline in sales. As this market is one that heavily relies on investor money and caters less to the local population, this market suffered considerably. Most inventory sits in the greater Downtown area, Miami Beach and Sunny Isles. There are 25 pending sales in this area most of which on Miami Beach (6), Sunny Isles (5) and the greater Downtown area (7).

Have prices gone down? In the below graphs you see per Miami neighborhood what the prices have done in the last 15 years. Please also keep an eye out for the amount of sales. Some areas saw less than 5 sales in 2020, which can create outliners in the achieved average prices.

At what price point should you buy? As a general rule of thumb I follow the “2012/2013” rule. We use the prices achieved in these years as a safety net for good investments. These prices are close to the bottom prices of the last cycle and will be a good level to buy at, assuming you are looking at good quality units. In the below tables from our brand new Condo Geeks Analytical tool, you can see the historic prices per SF and per area and you will see what price levels were achieved at the bottom of the market during the last cycle. This is extremely helpful to get a better estimate of what you should be paying today to be close to the bottom of the market.

Good deals can be had in any of these markets as long as you buy the right line in the right condo for the right price. Which ones are those? Here is where you should call me for more information at 305.508.0899

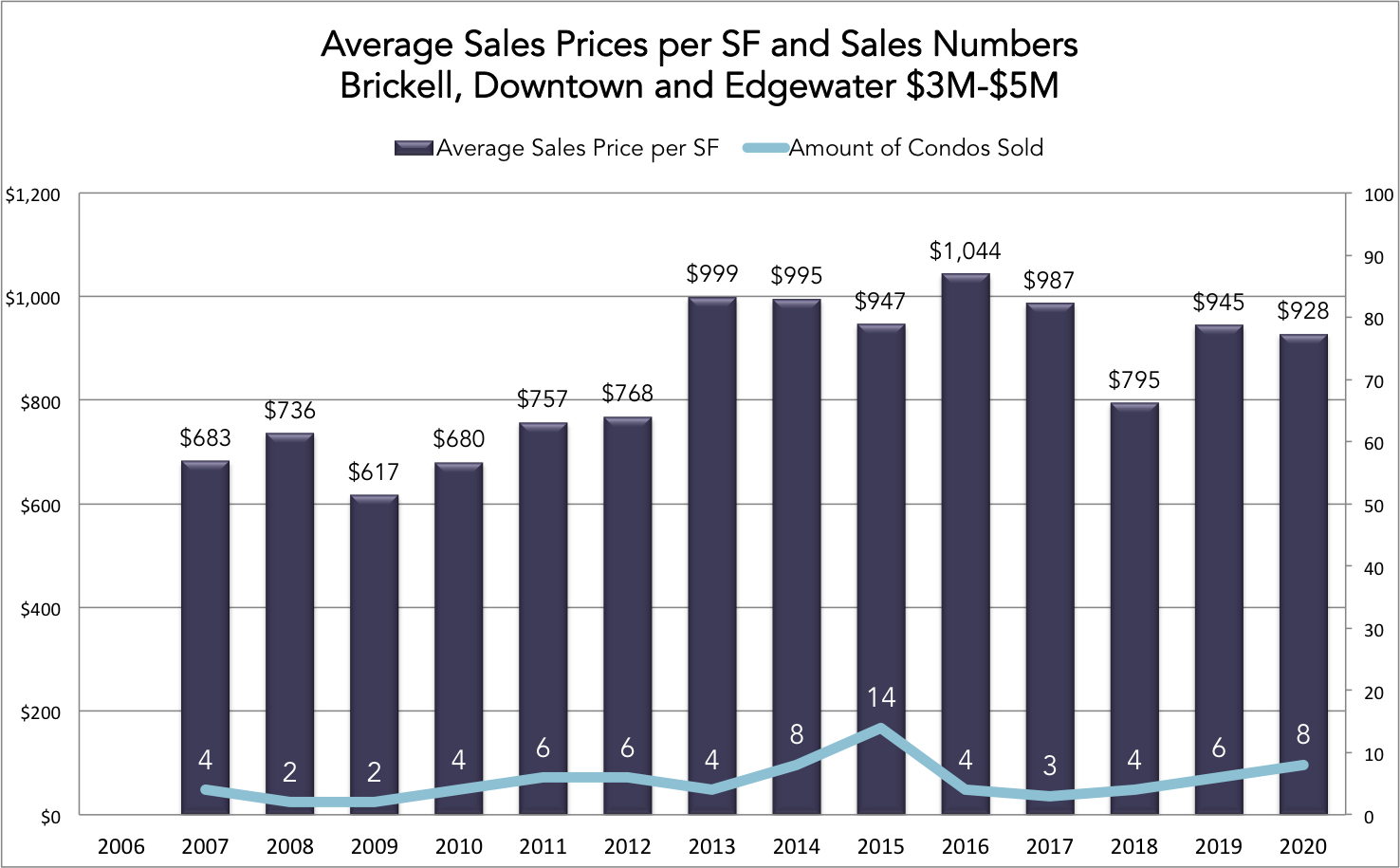

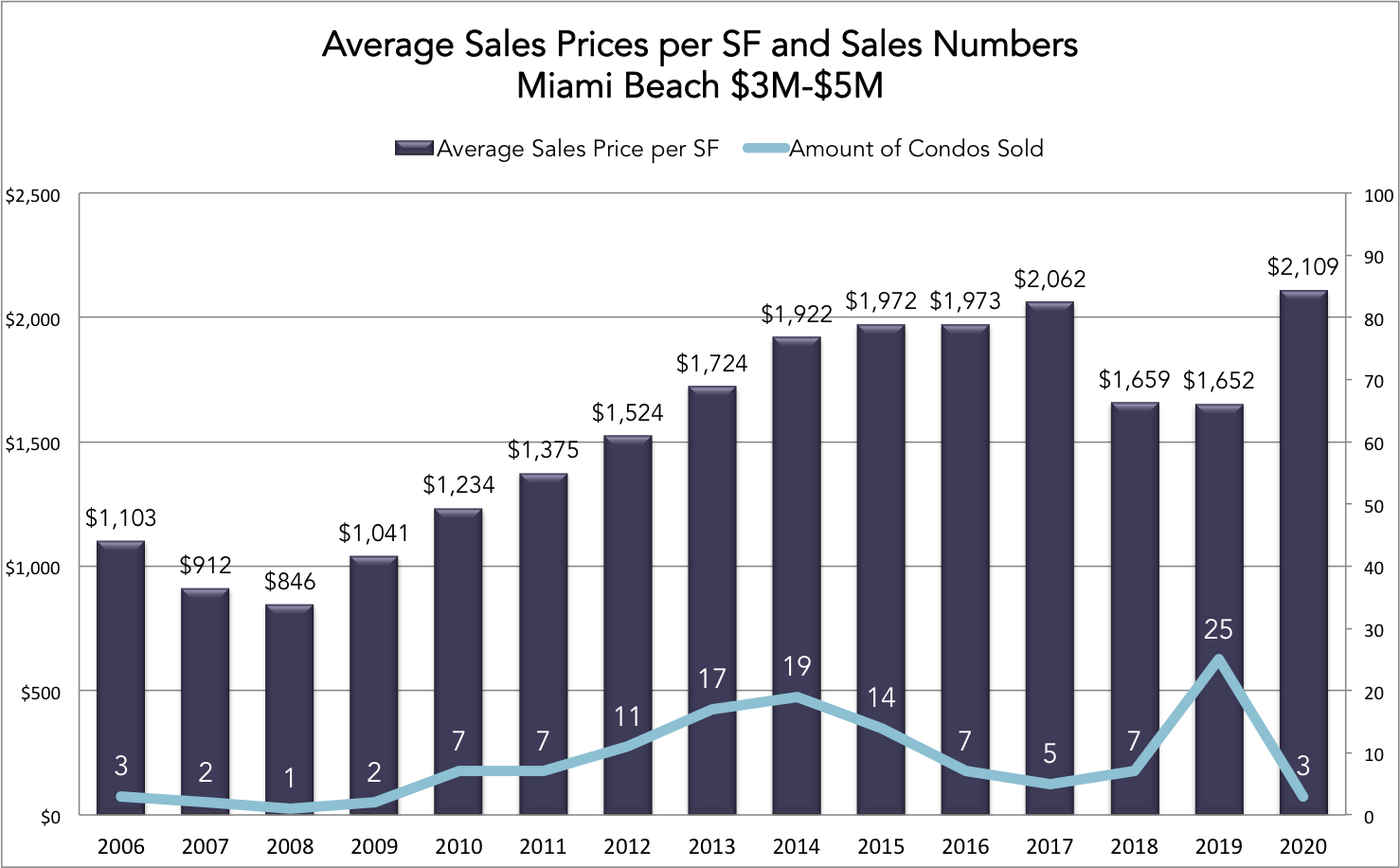

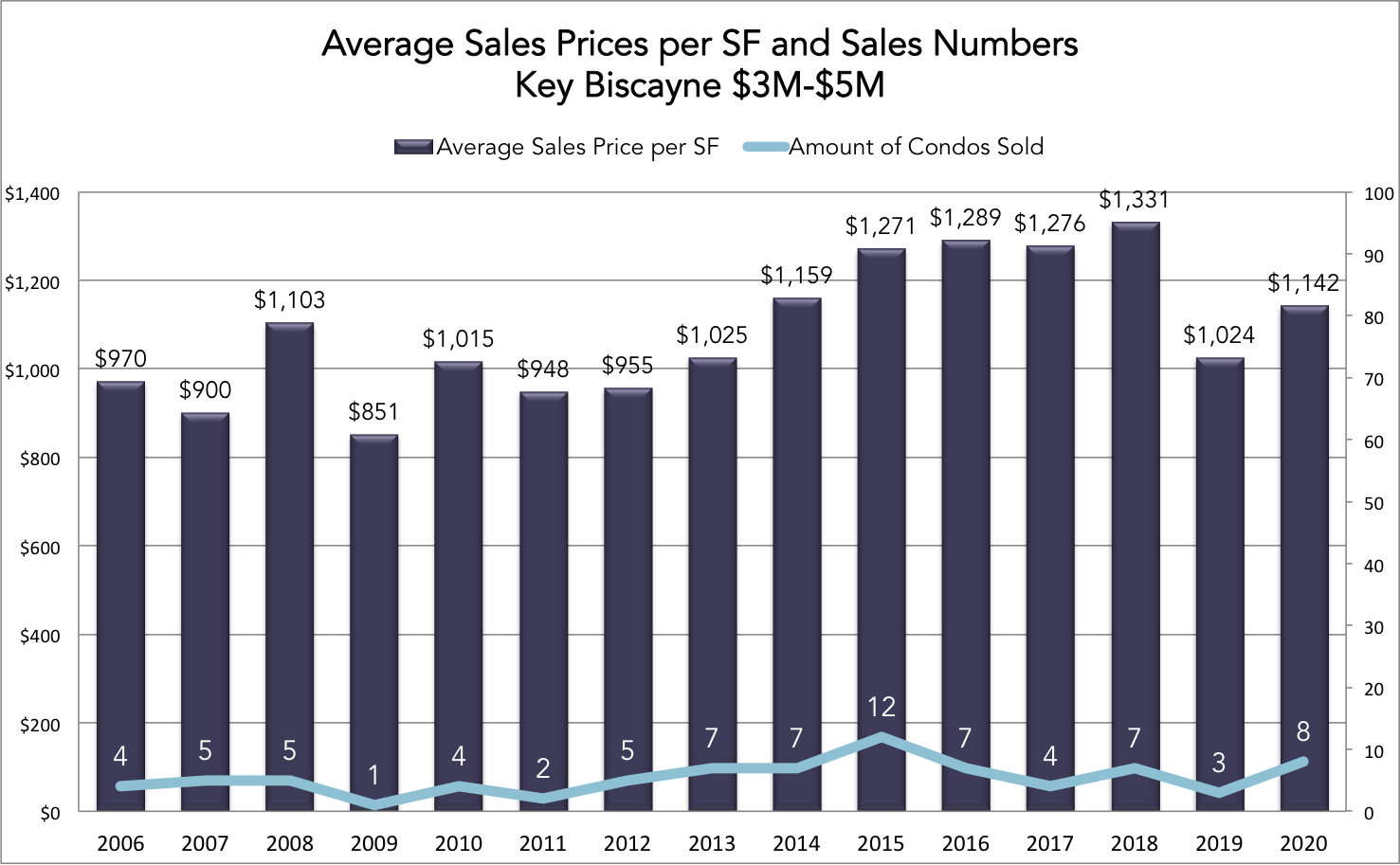

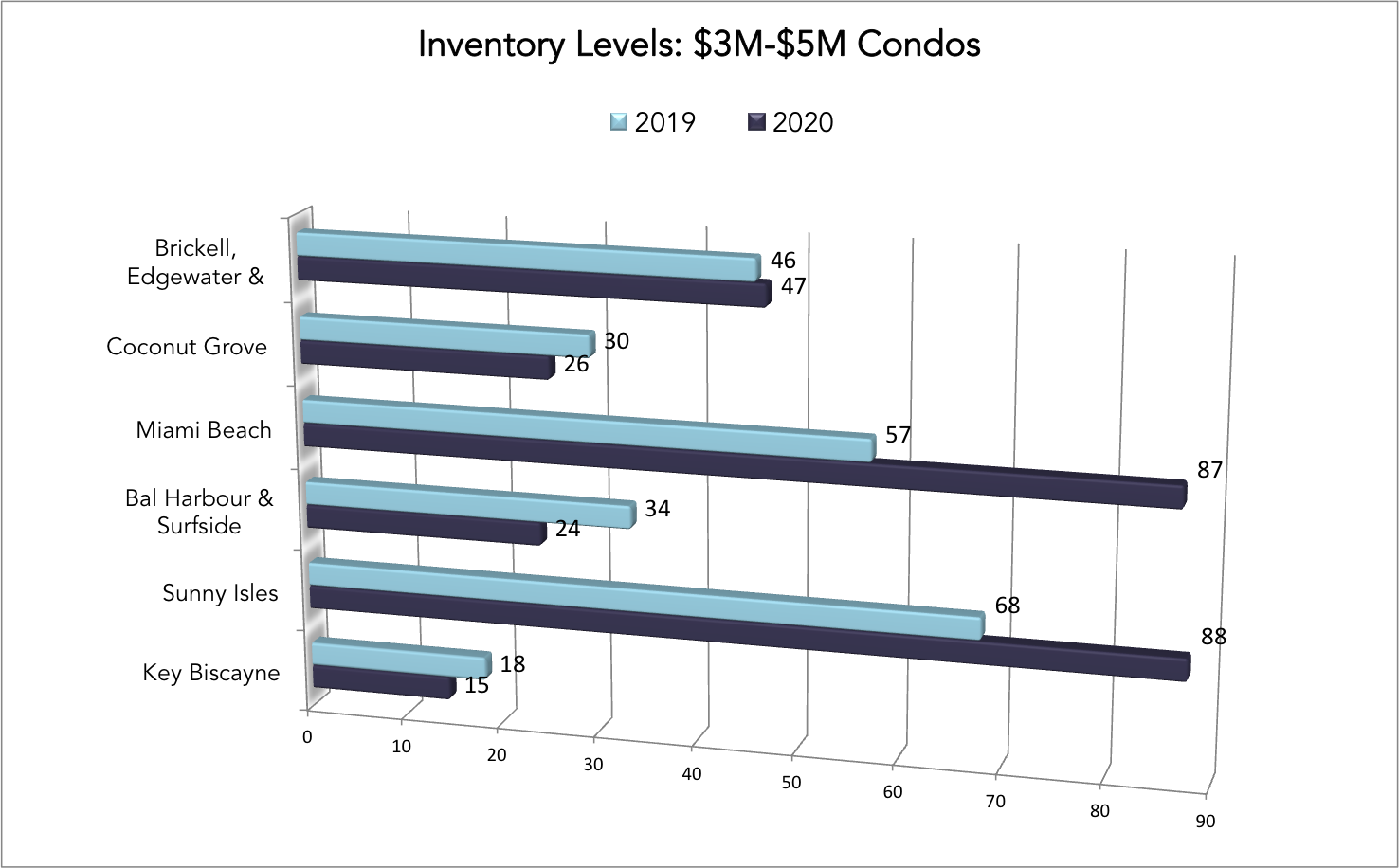

The $3M-$5M Condo Market

The smallest change happened in this market which went from 38 sales in 2019 to 37 sales in 2020; a 2.5% decline in sales. With 392 active listings and 31 sales in the last 6 months you can tell this market is unbalanced. The highest inventory levels can be found again in the greater Downtown area, Miami Beach and Sunny Isles. There are 16 pending sales in this price range, most in the greater Downtown area Miami Beach and Sunny Isles.

Prices have gone down considerably since the market’s peak although the limited amount of sales within this price point can easily lead to price fluctuations that do not property represent the market. For example Miami Beach saw two top sales happen in 2020 in the area’s most exclusive condos, which inflated the average price per SF for 2020. In the below graphs you see per Miami neighborhood was the prices have done in the last 15 years.

We created the below graphs with our Condo Geek Analytical tool, which is capable of tracing the condo market back to 15 years, and to compare the different condos to one another regarding prices per SF, inventory levels and historic performance. Here you can see what prices per SF these condos traded at during the last market cycle. As a rule of thumb we say it is safe to pay prices near the 2012/2013 levels. For example, the South of Fifth market is a good market to get deals. The market has reached 2012 price levels and is one where good quality units can now be purchased for a more attractive price.

It is important to note that some condos are still selling very well. Even if a market is seeing downward price levels and high inventory that does not mean this market does not offer a set of condos that do very well. As mentioned before we offer the right tools to tell the good from the bad.

Contact the David Siddons Group for more information about specific units or for a more personalized chat about investing in the Miami real estate market!

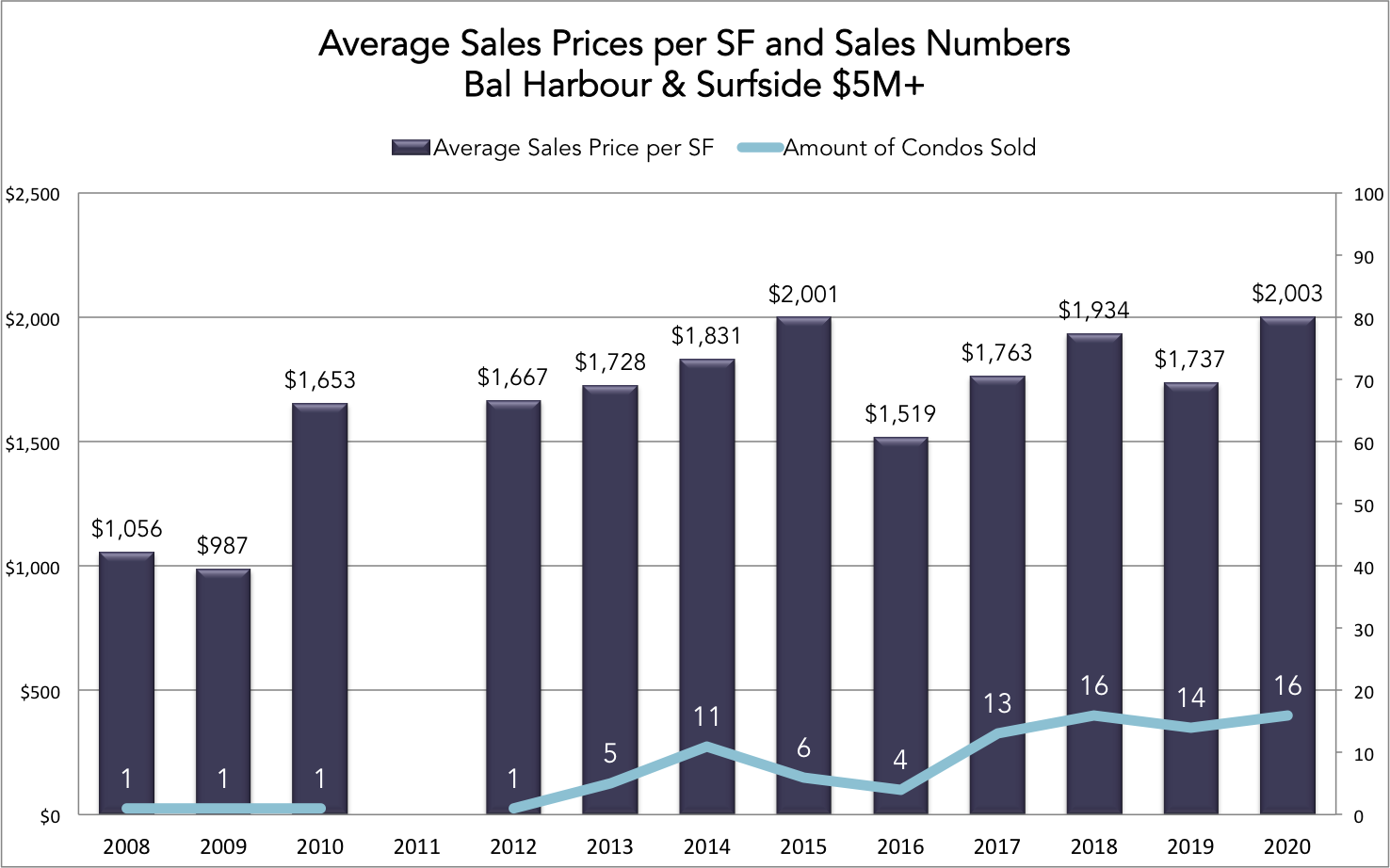

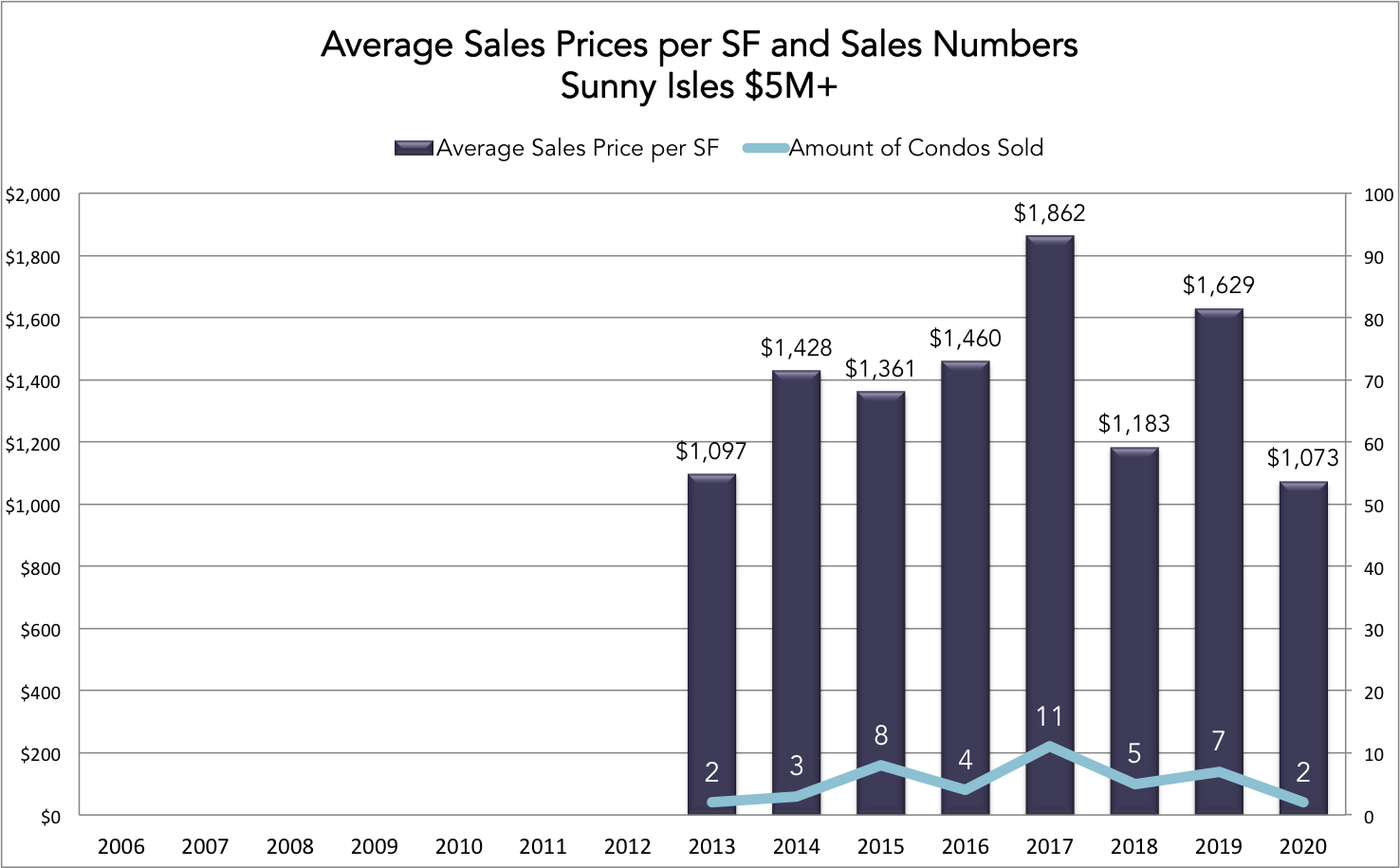

The $5M+ Condo Market

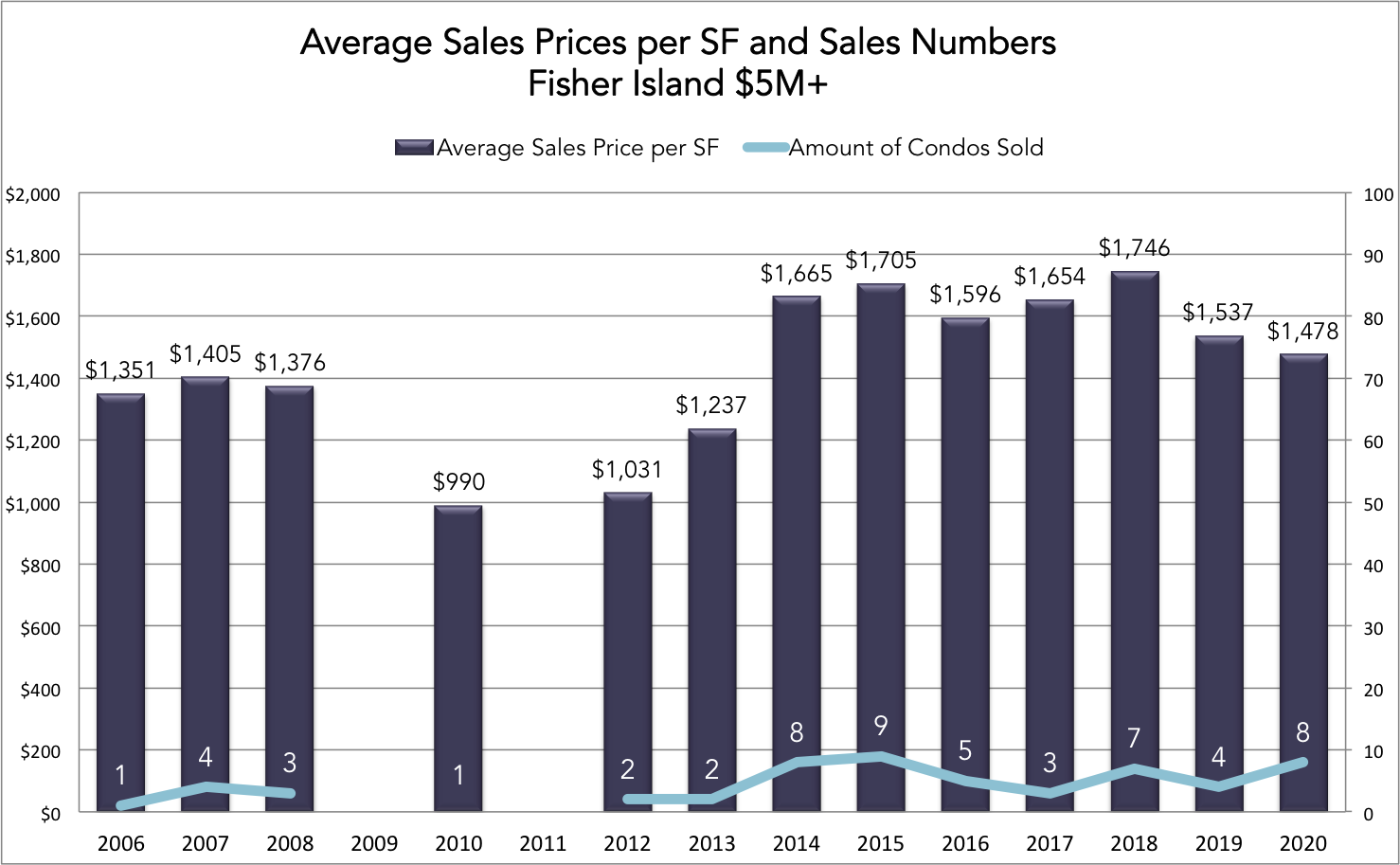

In the last 6 months (March 15 – Sept 15) we recorded 28 sales in the $5M+ market compared to 37 the year before. This 24% decrease is a striking difference with the single-family home market that flourished (+55%) in this price bracket and went from 36 sales in 2019 to 56 sales in 2020. From the 28 closed sales we saw a concentration of sales in Surfside and Bal Harbour, which represented 35% of all sales (10 out of 28). Other preferred areas are Fisher Island (7 sales) and South of Fifth (3 sales). A lower number of sales occurred in Downtown (3 sales at One Thousand Museum), Key Biscayne (1), Sunny Isles (2) and Miami Beach (2). In total there are 7 pending sales here; 2 on Fisher island, 2 in Sunny Isles, 2 on Miami Beach and 1 on Key Biscayne.

While Sunny Isles and Miami Beach were once the center of attention there has been a shift of luxury buyers. Luxury sales is now in hands of mostly New Yorkers (and buyers from the high-tax states in the northeast) and therefore Sunny Isles and the southern parts of the beach are less desired while the mainland doesn’t even offer that type of product. These buyers lean more towards areas such as Bal Harbour, Surfside or the ultra private Fisher Island. They are looking for privacy, service and tranquility, large units and supreme finishes. Condos that fare well and see lots of sales are Oceana Bal Harbour, St Regis, the Surf Club Four Seasons, 87 Park, Palazzo del Sol, Palazzo della Luna.

No less than 347 condos are available in this price range. With 28 sales in the last 6 months we are looking at 75 months of inventory. Meaning it will take up to 6 years to years to absorb all current inventory if market conditions will remain equal. Most of the inventory sits in Sunny Isles and Miami Beach, while desired areas such as Surfside or Bal Harbour are also seeing an elevated level of inventory albeit a decreasing level. This is a very overheated market still! The other problem is that the market is lacking good quality product. Most product gets always sold in the same buildings as mentioned earlier, which are St Regis Bal Harbour, Oceana Bal Harbour, 87 Park, Palazzo del Sol, The Four Seasons in Surfside etc.

We see that the Beach has seen a large decrease in prices per SF over the years meaning there are some good opportunities to be had. As mentioned before most of the good quality buildings still trade very well and will not be sold with large discounts (generally speaking!). Sunny Isles is a luxury market that is currently experiencing lots of trouble. These condos were constructed during the peak of the last cycle and sold for top dollar. Upon delivery many owners were disappointed with the quality (value/ price relations were off) and resale values were very low. Besides this, many of the buyers for this type of product experienced currency exchange difficulties and demand plummeted. This market was extremely fragile before and the pandemic just rubbed salt into the wounds. Important for buyers to know is that the condos that do sell often sell for a considerable discount where 10-20% off is no exception. This market is perfect for savvy investors to get some great deals. Use the table below to see what kind of price levels you should expect to pay for a good deal.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS