- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Myth of the Miami Real Estate Bubble: What the UBS Report Gets Wrong — with Analyst Ana Bozovic

In this episode of Better Decisions, David sits down with Ana Bozovic, founder of Analytics Miami and one of South Florida’s most respected real estate analysts, to unpack the latest UBS Real Estate Bubble Index Report. Together, they cut through the clickbait and dig into what “bubble” really means , and whether Miami’s market fits the description. Expect data-driven insights, sharp opinions, and a clear-eyed look at the reality behind the hype.

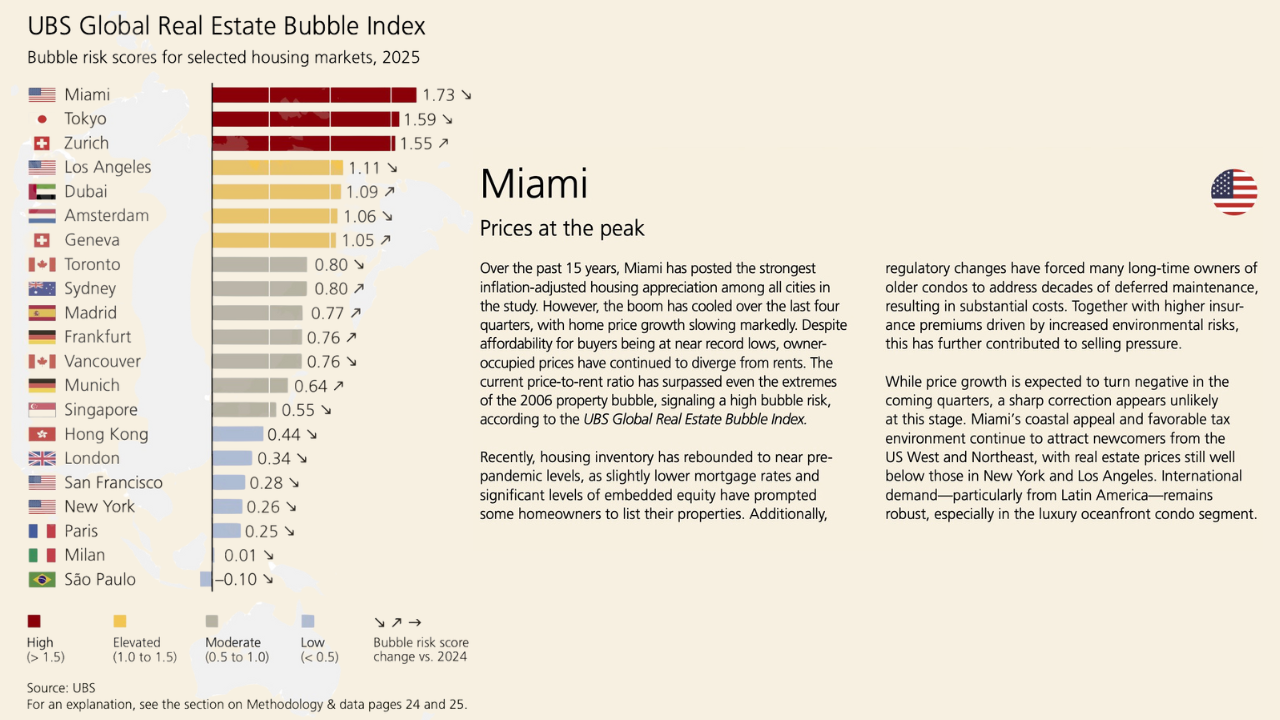

UBS Claims Miami Is a Real Estate Bubble — The Reality Behind the Headline

The 2025 UBS Real Estate Bubble Index grabbed global attention by naming Miami the city most at risk for a housing bubble. But the report’s logic doesn’t hold up under scrutiny. While UBS defines “bubble risk” as the chance of a large price correction, the same report admits that “a sharp correction appears unlikely at this stage.” It also notes strong ongoing demand, favorable tax migration, and international interest, factors inconsistent with a market on the verge of collapse.

The core problem isn’t that UBS analysts are overseas; it’s that the methodology is opaque and internally inconsistent. Miami is treated as a single monolithic market, when in reality it’s made up of nearly 20 submarkets, each behaving differently. This broad-brush approach makes for a sensational headline, but it distorts reality and risks misleading readers who rely on the report without digging into the fine print.

Is the Miami Real Estate Bubble Real? UBS Says Risky, But Unlikely

How UBS Misreads Miami: Price to Income / Rent

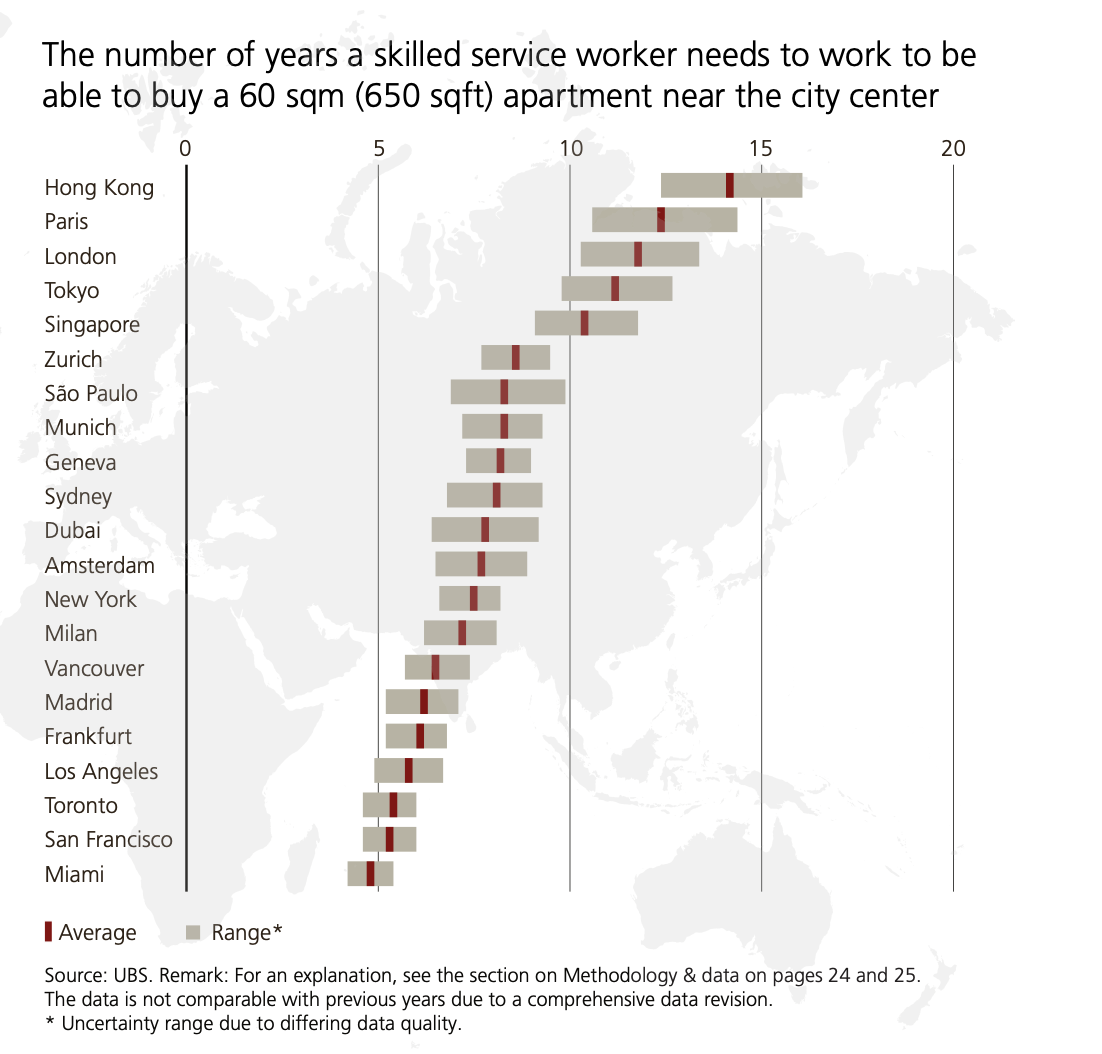

UBS’s “bubble risk” report paints Miami as a speculative market on the verge of collapse, but their conclusion rests on shaky ground. They only published two of the five sub-indices used to build the ranking: price-to-income and price-to-rent ratios. In both of those, ironically, Miami actually scored strongest, ranking first and second globally. That alone should raise questions about their methodology.

The bigger issue is context. UBS used average local income to measure affordability, which might make sense for Zurich or Toronto, but not for Miami, a city whose housing market is driven by global and domestic wealth migration, not local wages. Median household income in Miami-Dade hovers around $60,000, but the buyers driving transactions in Coconut Grove, Brickell, or Miami Beach are not earning local salaries, they’re moving here with millions in liquidity from New York, California, or abroad. By blending local income data with luxury market prices, UBS effectively merged two separate economies into one distorted picture. The result is a misleading “bubble” label that ignores Miami’s true demand base. What they’re really measuring is income inequality, not housing risk.

Why the Market Fundamentally Defies Miami Real Estate Bubble Fears

A true bubble occurs when prices rise on leverage and speculation, only to collapse when debt-fueled demand evaporates. That’s not the Miami story. Nearly 80% of condos over $2,000 per square foot and 74% of million-dollar units are purchased in cash. Liquidity, not debt, is driving price growth, and most buyers are long-term residents or relocating high-income earners.

Miami’s strength comes from structural trends: migration from high-tax U.S. states and global wealth hubs, coupled with lifestyle and economic opportunities that make the city a permanent home for new residents. For a real bubble to form, the city would need a dramatic reversal—wealth fleeing, safety declining, or livability deteriorating. None of these are remotely likely.

Rather than speculation-driven instability, Miami’s market reflects enduring demand, cash transactions, and genuine lifestyle appeal. It’s a collection of micro-markets thriving on real fundamentals, making it one of the country’s most resilient luxury real estate hubs, not the most at risk as UBS would suggest.

Better Measures of Bubble Risk

If we want to assess whether Miami is in a bubble, we need to focus on how homes are being purchased, not just how much they cost. The first critical measure is leverage—the percentage of sales financed with debt. During true bubbles, markets are fueled by risky loans and over-leveraged buyers. That’s not the case in Miami. In fact, roughly 60% of luxury transactions are all cash, and those financed typically have conservative loan-to-value ratios. The absence of speculative borrowing means prices aren’t being propped up by unstable credit.

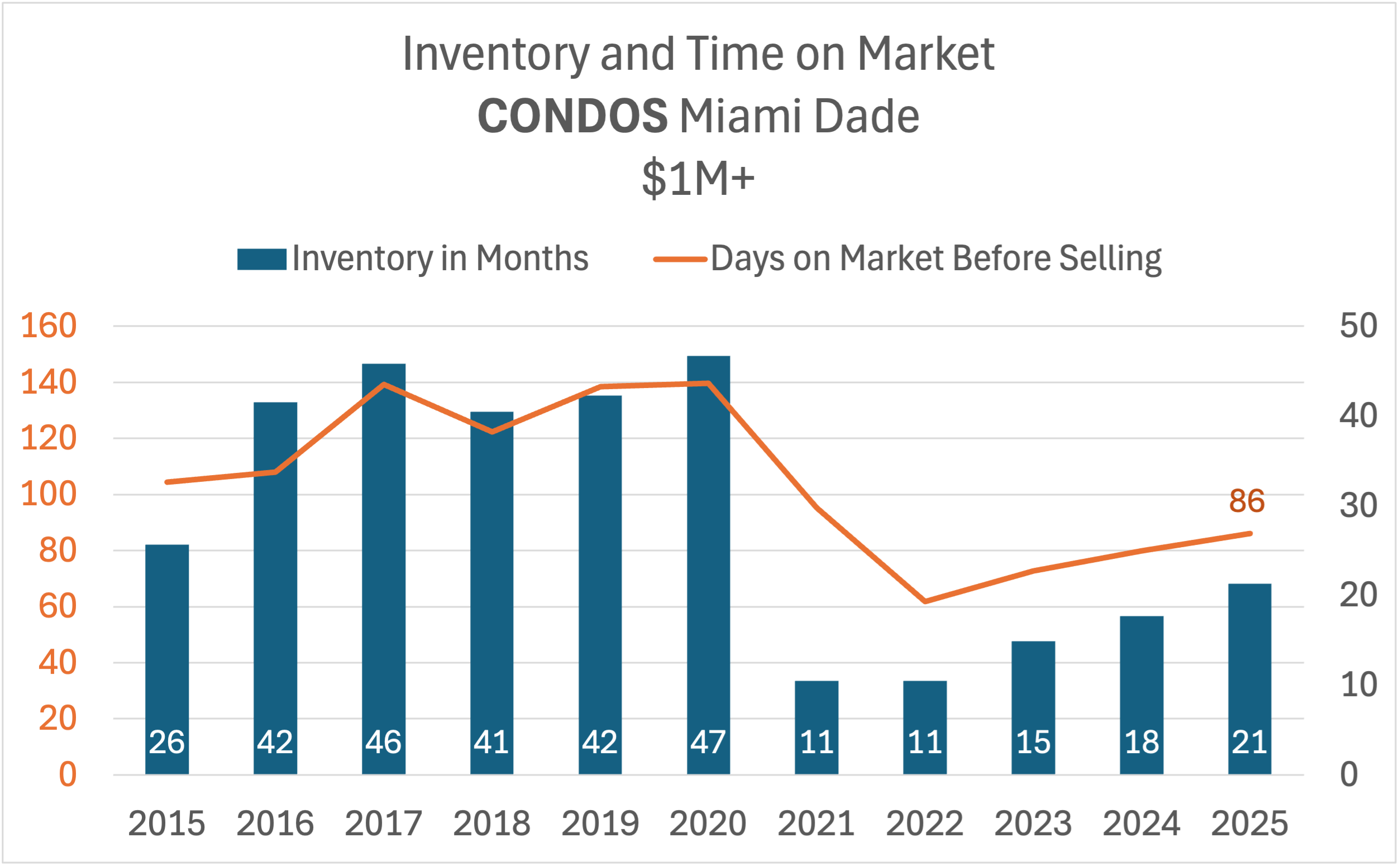

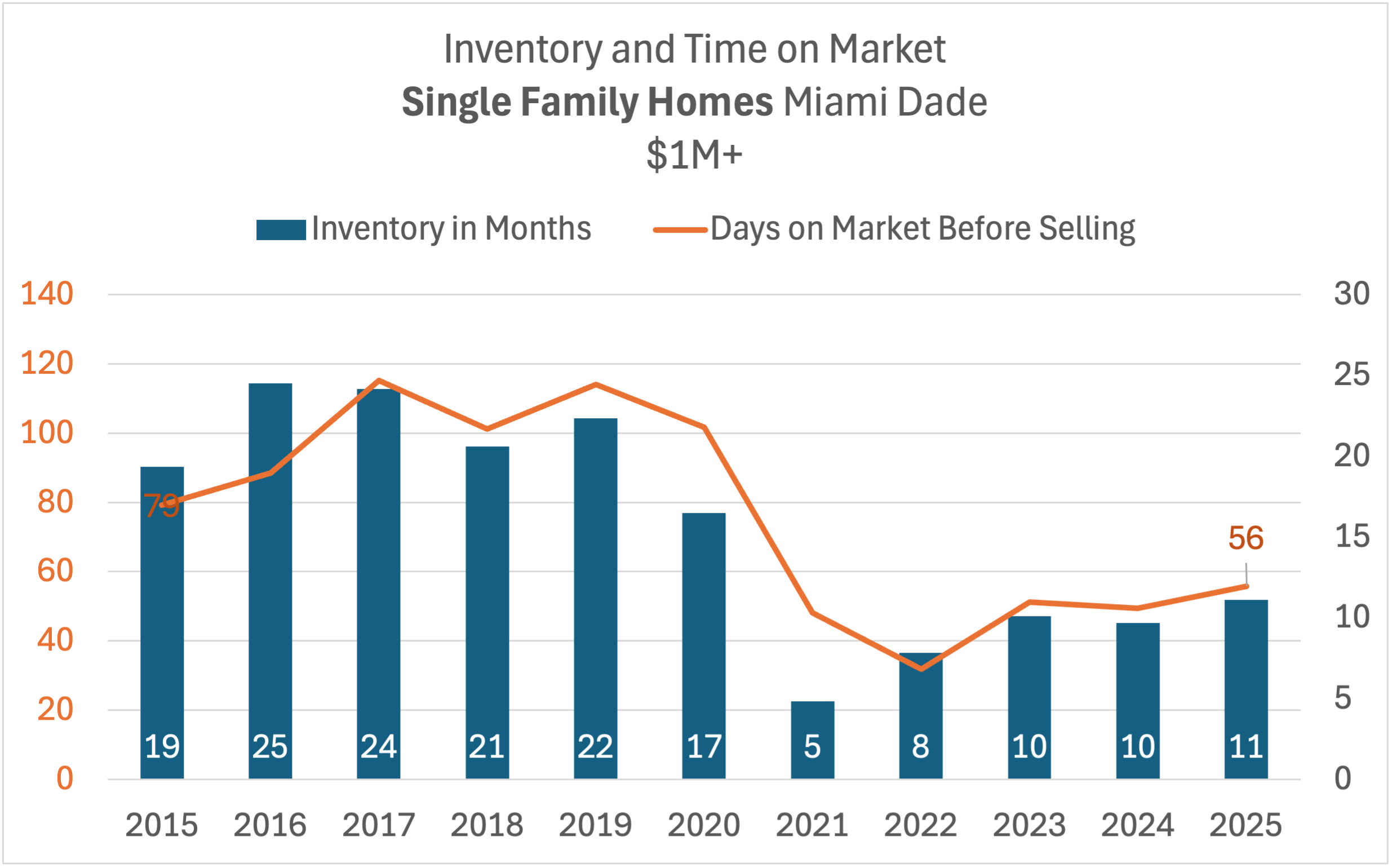

The second key indicator is inventory. Bubbles occur when supply balloons and demand collapses. In Miami, the opposite is true. Inventory under $500,000 has dropped more than 80% since 2019, and luxury supply remains significantly below pre-COVID levels. Even with new development, most projects are presold or selling faster than expected. When buyers are paying cash for limited inventory, and that inventory continues to shrink, it’s the opposite of bubble behavior. Inventory in Miami is often reported as a warning sign, but this can be misleading. Headlines focus on short-term slowdowns or specific units that aren’t selling, while overall inventory remains historically low. In small segments—like high-end or generic units—even a single sale (or lack of one) can make trends appear extreme, giving a distorted view of market risk.

The third, often overlooked, factor is time-on-market. During overheated speculation, listings sit longer as buyers vanish. Today, Miami’s absorption rate remains historically strong—well-priced properties in key neighborhoods often sell within weeks. This kind of velocity doesn’t point to a fragile market but to one with enduring demand strength.

Miami’s Reality: Wealth Migration and Demand Strength

To understand Miami’s current trajectory, you have to understand who’s moving here and why. Over the past five years, Miami has seen one of the most dramatic wealth migrations in the country. High-earning professionals, entrepreneurs, and family offices from states like New York, New Jersey, and California are relocating for tax efficiency, lifestyle, and the ability to work from anywhere. These buyers are not speculative—they’re end users creating genuine demand. This migration has fundamentally reshaped Miami’s buyer base. The market is now dominated by individuals purchasing primary residences or long-term assets, often with minimal financing. They’re building businesses, enrolling their kids in local schools, and anchoring their lives here. That’s not speculative froth—it’s sustainable population and capital inflow.

Meanwhile, Miami’s global positioning has evolved. It’s no longer a resort city dependent on foreign second-home buyers—it’s a year-round business and financial hub. Wealth from Latin America, Europe, and now the U.S. domestic elite all converge here. That diversity of demand insulates Miami from any single economic shock. So when UBS labels Miami “at bubble risk,” they’re not measuring risk—they’re misunderstanding transformation. The city isn’t inflating artificially; it’s restructuring upward into a wealth-based market. The fundamentals—cash-heavy demand, limited inventory, and long-term migration—suggest not a bubble about to burst, but a baseline that’s permanently higher than before.

It’s Not All Perfect: What to Avoid in Miami’s Market

If you want to stay out of trouble, focus on what not to buy. There are three main categories where risk is highest:

1. Older Condos with Rising Costs

Buildings 30–50+ years old carry hidden dangers. Post-Chaplin Tower, many require massive structural updates, new reserves, and skyrocketing HOA fees. Pools, lobbies, and infrastructure need constant attention. Some have doubled or tripled their fees in just a few years. These are the units where “throwing good money after bad” is a daily reality. Even if the location seems desirable, the maintenance burden and financial unpredictability make them high risk.

2. Oversaturated Rental and Micro-Unit Buildings

Small studios, micro-lofts, or buildings heavy on short-term rentals often face an oversupply problem. The market for these units is narrow, and any glut causes prices to stall or drop. Even newer buildings in these categories can struggle to sell, leaving owners chasing the bottom. Look for high rental concentration or repeated developer launches in the same submarket—this is a red flag for microbubbles.

3. Branded or Hype-Driven Condos

Beware of developments that sell on name recognition rather than quality. Brand-focused projects can inflate prices for marketing alone. The “psychological bubble” of a luxury brand often collapses once the market realizes finishes, layouts, and amenities do not justify the cost. These products may start high but quickly stagnate, leaving owners stuck with units that are hard to sell.

The Bottom Line:

Avoid old buildings with rising maintenance costs, micro or rental-heavy units, and hype-driven branded condos. These segments carry the greatest financial risk and market volatility. Stick to well-built, thoughtfully managed newer luxury developments that meet real buyer demand. Miami’s market rewards quality, location, and sustainability—not nostalgia, gimmicks, or overcrowded product types.

Final Words on the Myth of the Miami Real Estate Bubble

In short, Miami’s real estate market is not a bubble—it’s a highly segmented, thriving ecosystem driven by long-term migration patterns, global wealth, and demand for prime, well-built product. Headlines may scream “bubble,” but the fundamentals tell a different story. For a true market reversal, the city would have to become hostile to wealth, unsafe, or unattractive to live in—all highly unlikely scenarios.

Buyers should focus on long-term fundamentals: lifestyle, location, quality of construction, and sustainable value. Avoid old, poorly managed buildings, oversaturated rental units, or hype-driven branded condos. Instead, invest in well-designed, modern properties that satisfy the real, enduring needs of residents.

Thank you for joining us on this episode of Better Decisions. Don’t forget to subscribe to our channel and explore our neighborhood reports, where we break down markets with hyper-specific data, graphs, and predictive insights for the year ahead. If you have questions or want to dive deeper, reach out—we’re always here to help guide smarter real estate decisions.

Stay tuned for the next episode, and as always, make better decisions.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS