- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Q1 2020 Miami Real Estate Report: The 5 Hottest Miami Real Estate Markets that Sell.

Part 1: What neighborhood sub markets are selling at all-time highs?

The 5 Hottest Miami Real Estate Markets that Sell!

This blog is part 1 of an 8 part report in the ‘Q1 2020 Miami Real Estate Report and Forecast‘. What will become immediately apparent in this report is the screen sharing of both our ‘Advanced Analytics’ dashboard and our ‘Condo Geeks’ Dashboard. These are live systems that update either by the quarter or by the day. Feeding directly from the Miami MLS, these systems ensure that our reports act as useful ‘historical points of reference’ or work as ‘evergreen’ material for buyers now or in the future. What will also be apparent is the sheer amount of verbalized social and economic narrative to accompany these tables, and because we actually sell real estate as opposed to just analyse it, we can talk from a point of experience and ‘in the field knowledge’. This is something that other reports and data providers have a very hard time doing because they don’t actually sell; lots of general data, nothing specific and little explanation and guidance to make individuals decisions. This report breaks that mold.

Part 1 covers the ‘hottest markets’, looking at their performance through Q1 of 2020, reflecting back on how this compares to their Q1 2019 performance and assessing their likely performance through the un-chartered waters of Q2 through Q4 of 2020. The market detailed below are specific neighborhood submarkets that are really the most desirable places to live (a neighborhood market becomes a submarket by virtue of price point). What you will notice is that the majority of these ‘hot’ markets are single family ‘primary market’ neighborhoods, driven by residents who live all year round in Miami. Many as you can well believe also happen to be ‘Tax Relocation’ hotspots, which are currently driving a large number of purchases in our hottest markets.

The questions this section will raise are not just what are the hot markets, or why they are hot but more importantly if these hot markets can remain hot, if their price per sqft can climb further or if they have in all likeliness hit a peak or could even drop? In the current market it will also help manage buyer expectations. In the face of current severe economic challenges we are seeing buyers attempting to successfully make offers well below market value (as much as 30%-40% in some cases). Although that may work in some markets, if the inventory is already low as it is in a number of these markets and good options are scarce then low ball offers will just be met with stone cold silence. If you are looking to vulture a deal in Miami then part 2 and part 4 which covers weak and vulnerable markets and condos will be an excellent read for you.

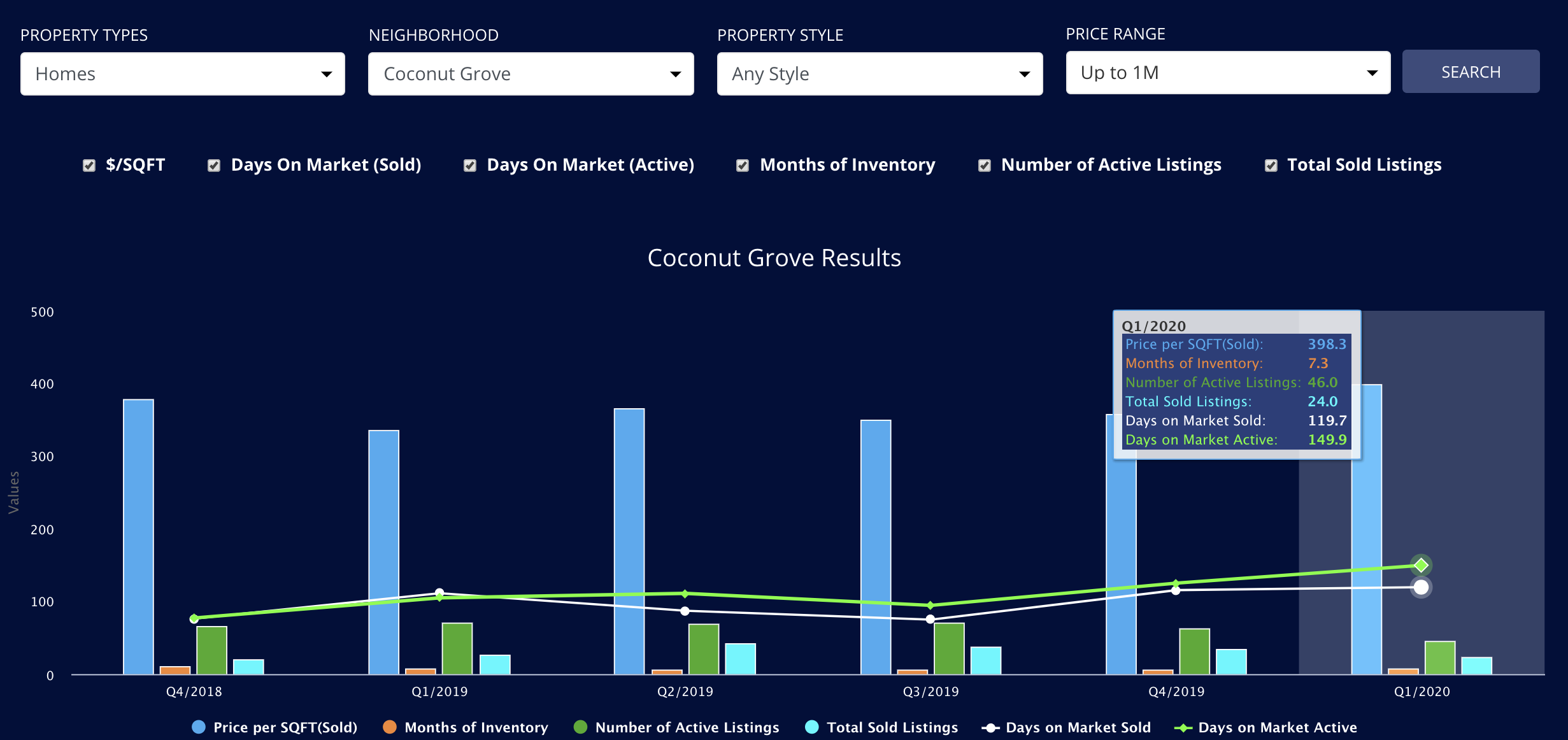

Coconut Grove Homes up to $1M

Coconut Grove (along with Coral Gables) is a focal point for tax relocation buyers coming into South Florida and therefore one of the 5 hottest Miami real estate markets that sell. This neighborhoods single family market offers excellent perfect proximity to the urban core of Brickell and Downtown and airport. More importantly the organic development of the Grove, laid back international vibe, great dining, large parks and beautiful and serene tree lined streets, coupled with proximity to the best private school in the state make it a hotbed of focus for families. With that said it is not a particularly large neighborhood which makes it hard to get in under $1M. There has been little available in terms of single family homes in Coconut Grove under $1M through Q1, but the demand is high and when product does come on the market it closes in an average of 126 days. Months of inventory is at just 4.8 months (based on closed and pending sales), so demand is far outstripping supply. The townhouse market is also very hot and townhouses which act as alternatives to the more spacious single family home are also now comfortably achieving over $1M. We can attest to the speed of sales in the single family market with the sales of 2215 Lincoln Ave (one of our listings) never making it to market and selling in less than 1 day for nearly full price, because simply put there was little product choice.

As of the beginning of April, there are 13 pending and 39 Active listings in the market. Do not expect to get anything particularly elaborate at this price point, with a $ per sqft of $494 for sold homes and specifically $564 for those with a pool. In short this market has little room for negotiation and if you are luckily enough to find a decent finished 3 bedroom home in the market your best advised to jump on it. You should also seriously consider Coral Gables where you will find more options.

I don’t expect this market to correct in light that there is just not enough product, and the outbreak of Covid-19 only hinders agents ability to list properties. Once the restrictions on travel are lifted and the ‘flattening of the curve’ happens expect a nice influx of listings but recognize that it will be met with an equal amount of ‘pent-up demand from buyers who have been waiting in the wings’.

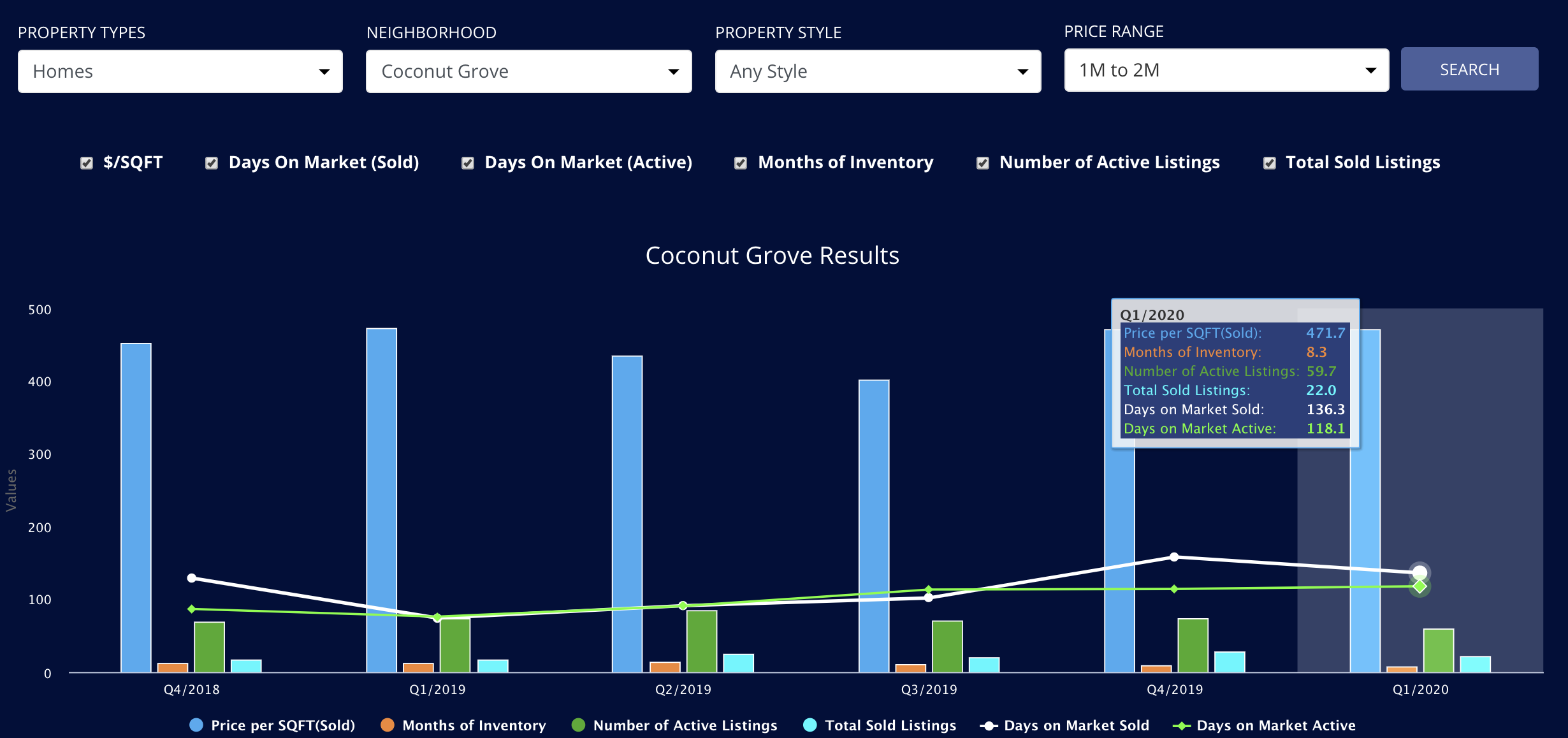

Coconut Grove Homes between $1M – $2M

Once you get into the $1M – $2M range the story is much the same as the $0-$1m range. With just 6.2 months of inventory we are statistically looking at a balanced market / flirting on the edge of a buyers market. A sellers market is under 6 months of inventory and a buyers market is over 6 months. My observations in the field is that the number of excellent homes in the price point you can typically count on one hand. Once again David Siddons Group holds the record here for the highest price per SqFt sold in this neighborhood with the sale of 3531 E Glencoe St. This has set a new record for the market at $806 per SqFt. Make no mistake, this is a hot market and if you low ball on an excellent home in a quiet street all you will hit a wall.

There were 25 closed sales across the first quarter of 2020, which represents a near 50% increase from the year before when there were 17 sales. The average sold price was $497 per sqft, a marginal increase over the 2019 figures of $487 per sqft. At the time of this report (the beginning of April 2020) there are only 8 pending sales left to close and 59 active listings. With a definitive slow down in possible sales (due to the limited ability for us Grove agents to show property) we are also experiencing the same limiting factor to list properties too! This stale mate scenario I don’t believe will cause any crash merely a delay in the system. The system right now is in the words of economist Paul Krugman in ‘an induced Coma’. I personally am not seeing a lack of desire for Coconut Grove homes from buyers, merely the lack of ability to execute. The necessity remains the same. I foresee that once the market does ‘open again’ we will see a flurry of new listings balanced with an equal number of anxious buyers looking to snap those homes up. What will most likely happen though is that we wont see any ‘crazy record breaking prices’, more of a balanced discretionary purchase with the best homes achieving $500 per sqft, which is more inline with the upper-mid range of previous achieved sales in Q1 (The top homes selling were at $550 per sqft or above).

At the David Siddons Group we are still engaging with clients on a daily calls on this market and are struggling to find new product for our clients. If you are a seller in this market between $1.5m and $2.5m: WE ABSOLUTELY WANT TO HEAR FROM YOU! Please call me and I will give you details of what our current buyers are looking for.

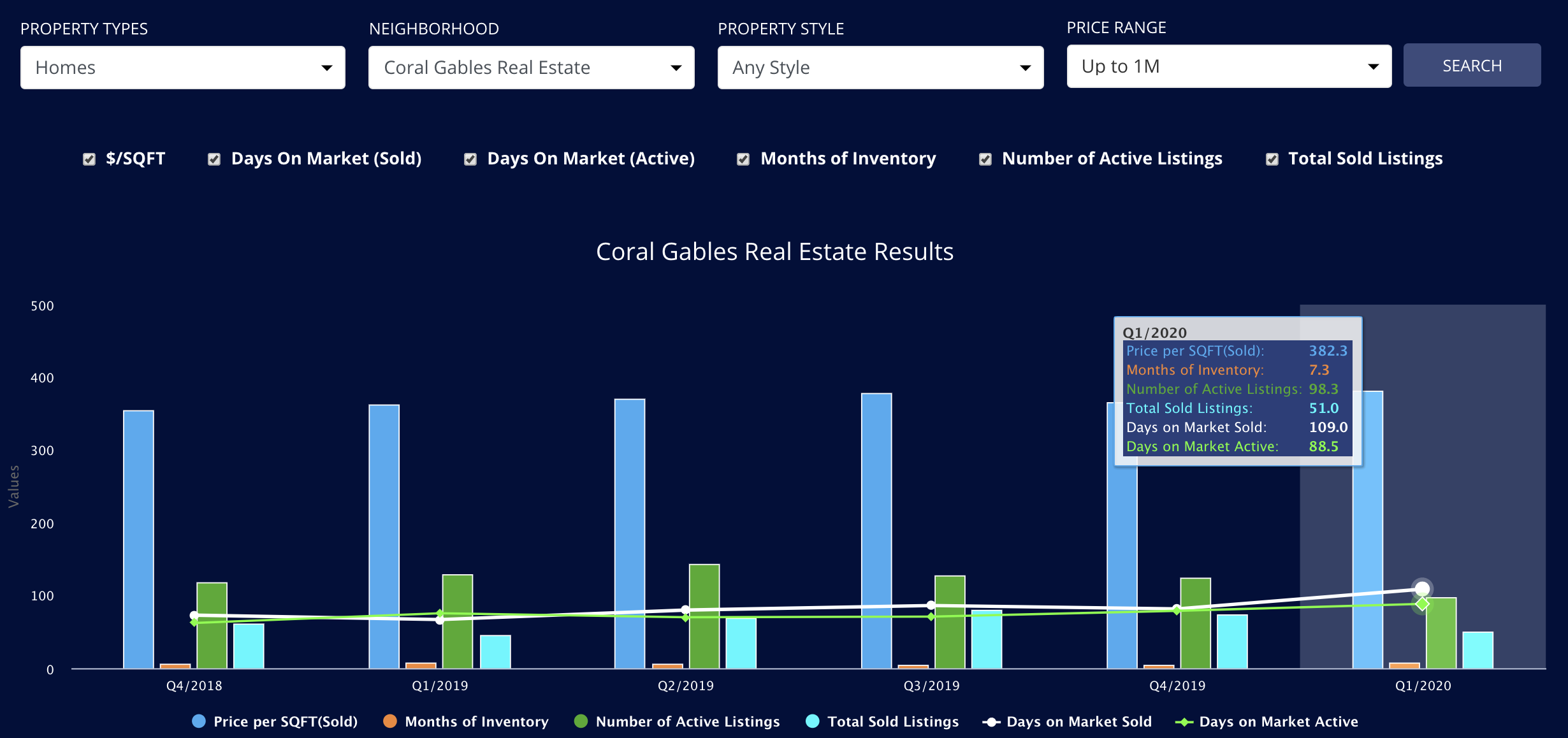

Coral Gables Homes up to $1M

Coral Gables is a much bigger animal than Coconut Grove and if you watch my Coral Gables Report videos you will see how we breakdown this complex market into 6 geographical sections. Regardless Coral Gables is home to the best private schools in South Florida and its wealth as a city is unsurpassed. The ‘City Beautiful’ has gained solid appreciation over the last year as relocating buyers flock into this market. With building and zoning law more strict, the benefits of sidewalks and a well funded police, ambulance and fire service not to mention bigger lots than you typically see in the Grove you can appreciate why this neighborhood has appreciated and will remain hot through 2020.

We recorded 52 sales in the last 3 months, which is roughly the same as the 50 sales that happened in Q1 2019, the big difference is that the $ per sqft achieved least year to this year is absolutely up. The peak dollar per SF achieved in Q1 of 2020 was a staggering $661 per SF and with 25 homes achieving over $400 per SF. The highest dollar per SF achieved in Q1 of 2019 was $612 per SF, and only 13 homes achieved over $400 per SF. (The average was $355 per SF).

With an average of 17 sales per month and 113 Active listings as of the beginning of April we have just 6.6 months of inventory. In the grand scheme of things this is not particularly high and the market could comfortably handle the slow down. With that said, buyers may be understandably more wary of paying a top end price per sqft (anything over $600 per sqft). As yet are currently still experiencing activity – even in the light of social distancing. Between 15 March and the end of March we saw 7 homes go pending and 14 close. We at DSG are still getting engaging with clients on a daily calls on this market and are struggling to find new product for our clients needs. If you are a seller in this market: WE ABSOLUTELY WANT TO HEAR FROM YOU! Please call me and I will give you details of what our current buyers are looking for.

Coral Gables Homes between $1M – $2M

This ‘hot’ submarket has 9.7 months of inventory (34 sales over 3 months against 111 listings). 29 Of the current 111 listings are asking over $550 per sqft. With just three sales in the last 90 days that achieved over $550 per SF sellers have to be careful not to over reach, especially in these uncertain times. The average price per sqft is $426.

How does this compare to last year? 2020 saw a 50% jump in the number of sales. There were 23 sales in the Gables between $1M-$2M in Q1 2019. The highest dollar per Sqft achieved in Q1 2019 was $718 per sqft, but this was a waterfront teardown in Gables by the Sea. 15 Homes achieved over $400 per SF, yet in 2020 22 (of the 34) home sold achieved $400 per sqft or more (More than double the amount). The average price per sqft was $459. The takeaway is that once again this sub-market performance of sales more than doubled from 2019 to 2020, yet there is no doubt a ceiling to this market and this ceiling seems to have been reached.

Once again, we at DSG are still getting engaging with clients on a daily calls on this market and are struggling to find new product for our clients. If you are a seller in this market between $1.5m and $2.5m: WE ABSOLUTELY WANT TO HEAR FROM YOU! Please call me and I will give you details of what our current buyers are looking for.

If you do step over $2m and are searching for a home in the $2-3 million range then the room to negotiate more heavily opens up, but do not consider these primary markets open to low low ball offers, if you consider pre-Covid 19 prices and post-Covid 19 prices you might if fortunate gain an extra 5% of negotiation but little more than that – of course this is our opinion as of March the 1st.

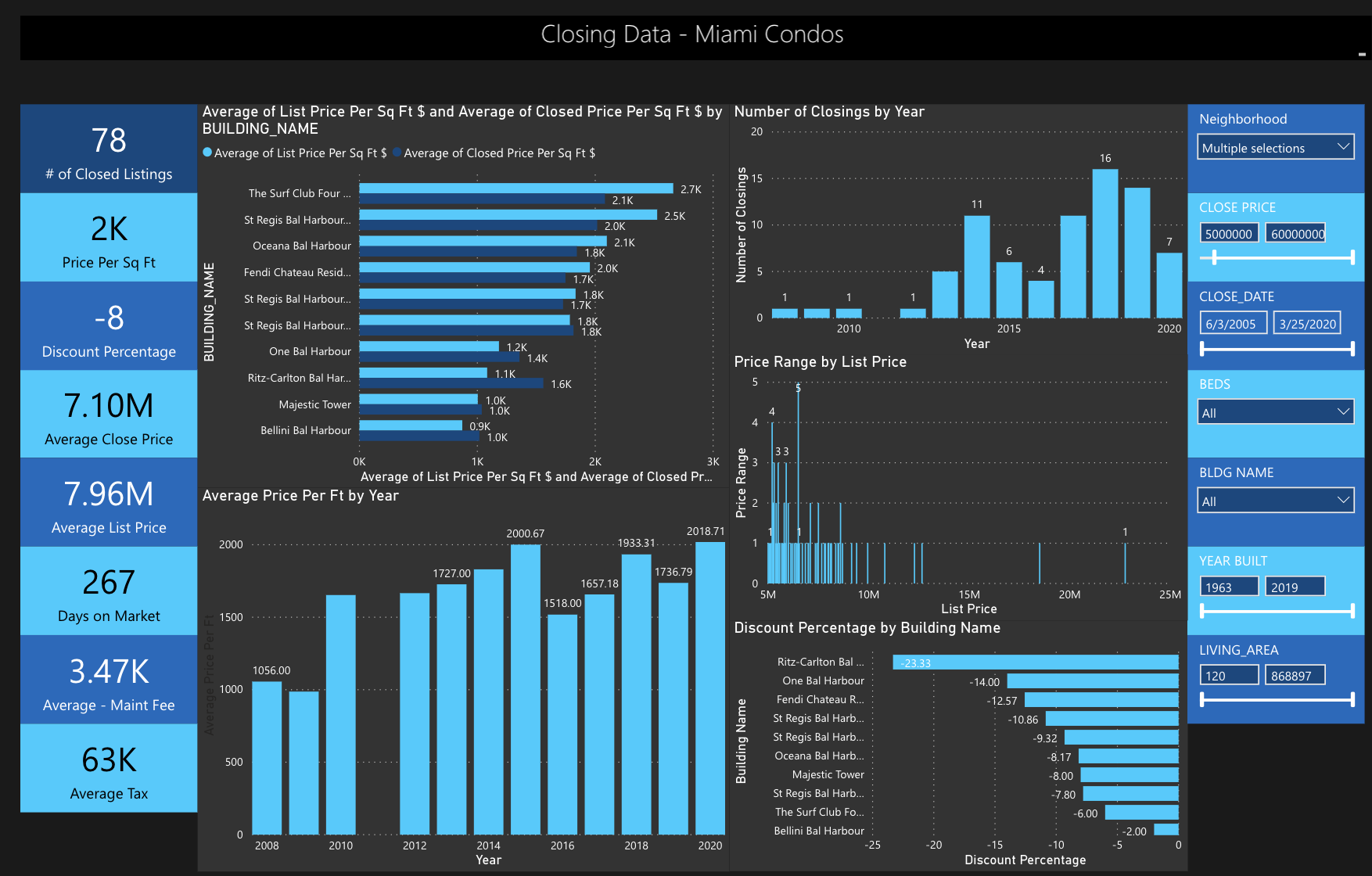

Surfside and Bal Harbour are certainly the hottest neighborhoods for buyers of luxury condos in Miami. This accolade previously was held by South of Fifth. In Q4 of 2019 and Q1 of 2020 17 condos sold in the $5M+ range. From these 17 condos, 9 were sold in 2020. Also from these 17 more than 50% happened in Surfside and Bal Harbour (6 sold in Surfside, 3 in Bal Harbour).This does not account for developer sales at the Surf Club Four Seasons Residences. This is significantly more than other notable luxury neighborhoods such as Miami Beach, Key Biscayne or South of Fifth.

In the first Q1 2020 and last Q of 2019 there were 9 sales at the Surf Club Four Seasons Residences, Oceana and St Regis – which are the buildings that rule supreme in this market. In the same period one year prior there were 7 in total of which 6 in the first quarter of 2019. To understand this market better you will gain an enormous amount of insight by reading Part 3 of this report which covers the ‘best 10 luxury Condos’. What is possibly most interesting is that while other neighborhoods saw gradual drops in their neighborhood $ per sqft, Surfside and Bal Harbour combined took a big hit in 2016 dropping down from $1800 per sqft to $1200 per sqft only to climb back up to $1802 per sqft in 2020, nearly matching their previous all time high of 2015. That is not something you can say about the other top neighborhoods like South of Fifth which is performing 10% behind , Miami Beach performing 15% behind, Key Biscayne performing 20% behind, or the rest of the luxury market which is also blending out at 10% behind the all time high of 2015. This trend will most definitely continue and widen as we move through the rest of the year.

Although Surfside and Bal Harbour really are the focus for luxury condo purchases in Miami at the moment and even though they command the highest price per SF in sales, (followed by South of Fifth), many purchases in this market are made out of desire rather than necessity – becoming second homes for many buyers. The good news is that with a solid amount of inventory and a range of units that are high quality yet highly negotiable there will be deals to be had. More importantly the quality of this neighborhood remains high yet with 30 months of inventory in Surfside and 40 months in Bal Harbour it is still very much a buyers market and this could only increase in the current climate. Please call me directly to discuss your specific needs.

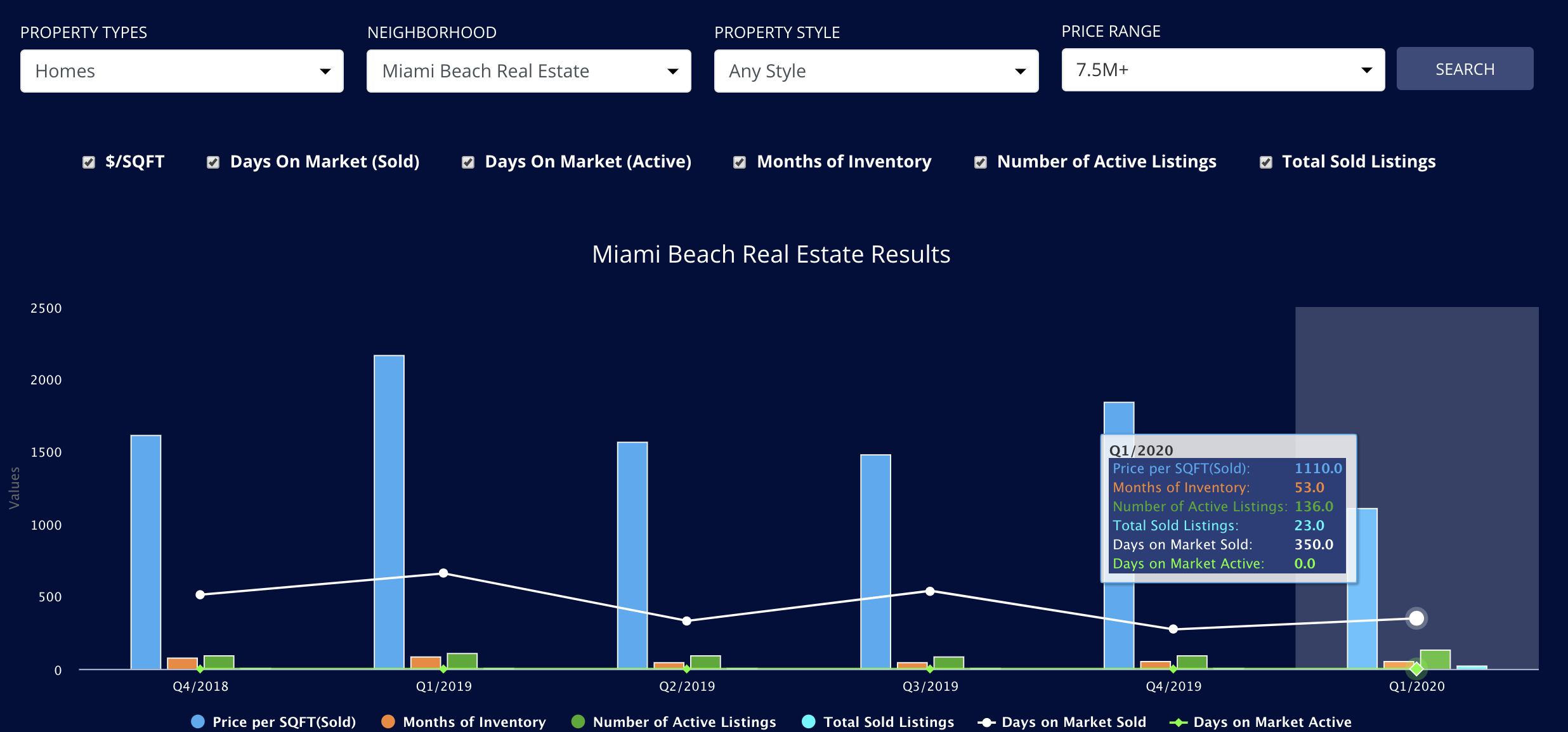

Miami Beach waterfront homes have had an incredible run through 2019 with 23 sales over $10M ,which is an all time record. In 2018 there were 14 sales over $10M, so 2019 saw a 65% increase in sales. With that said it is important to recognize that only 8 of the 23 sold properties sold over $2,000 per SF. I think that given the change in the economy we predict some serious slow down in this market. In Q1 2020, we have seen only 2 sales so far while there are 70 current listings, which translates into a 8 years inventory. Of these 70 listings, 41 are asking over $2,000 per sqft. So Miami Beach waterfront homes for sale were a hot market in 2019, which could well now become very overheated with so much highly priced product.

Across the rest of Miami we are starting to get emails on some very significant waterfront estates price reductions. You can probably expect to see this increase over the next couple of months. Expect some pretty stunning deals to come out in the next weeks and the David Siddons Group will be here to keep you informed. If you as a buyer fall into this category, please do call me directly at: 305 508 0899.

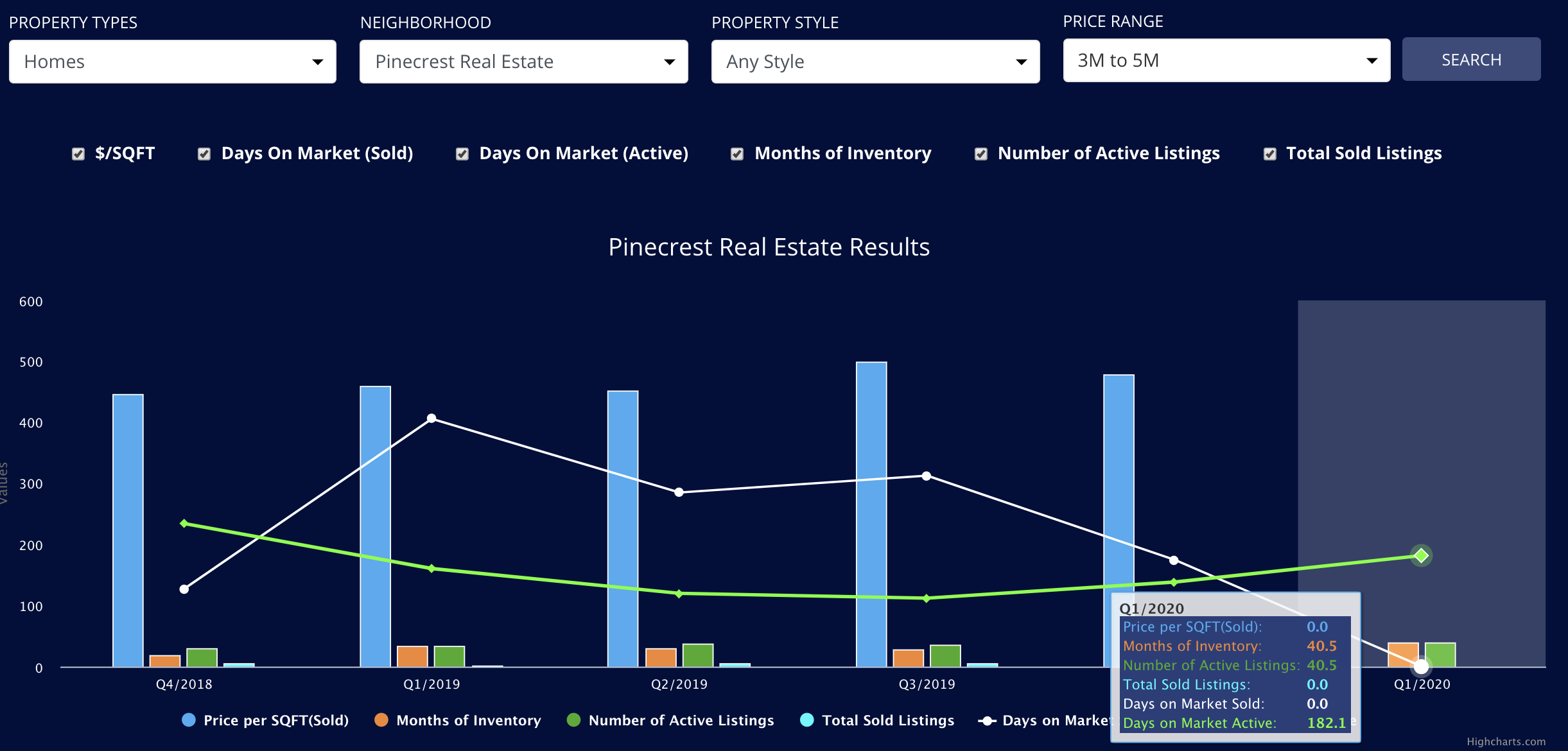

So if you are a relocating buyer or even a local buyer with a budget between $3M to $5M, then this is the part of this report that will interest you the most. If your focus is on buying a non waterfront house between $3M – $5M in Miami, then the area of Ponce Davis, North Pinecrest and South Gables area will offer up the best choice. It simply put is the number one choice for Miami house buyers in the $3-$5m range. In the last 6 months there have been a total of 29 home sales between $3M and $5M across the whole of Miami Dade. Almost 50% of these (14 out of the 29) have occurred in the Ponce Davis and Pinecrest neighborhood. If you look back a year before there were 10 sales at this price point for the same area.

Why is this area so desirable and how it achieve such a jump in sales? Simply put the legitimate demand increased with relocations COUPLED with the release of better product – we saw a number of new homes that were finished and came to the market. For those who are relocating and don’t know the market: the best private schools in Miami-Dade exist in this area or close to it and with so many tax relocations this has become the engine for this market. Additionally the lots are the largest you will find in any of the analyzed Miami neighborhood – almost all coming in between 1/2 acre to an Acre. Furthermore you will also find here the largest array of single family gated communities. Watch our video tour of the best gated communities in Miami and you will find almost all of them here.

The price per SF blends out around $490 per SF. This market admittedly holds a lot of inventory; currently there are 49 homes for sale between $3M and $5M and although the velocity of sales has been decent it is not pushing the envelope in terms of record sales or price per SF cost compared to other neighborhoods like Miami Beach, Coral Gables or Key Biscayne. Bear in mind that those in gated communities will do better.

This market as mentioned is much like the other markets of the Grove or Gables being driven by the fundamental necessity of relocating families. Do not necessarily expect the ‘wheels to fall off’ this market. Do however recognize that much like other well performing neighborhoods that although the markets wont go into free fall their previous all time peaks have most likely been reached. One possible economic effect that could play out is that real estate sales prices in NYC, New Jersey and Connecticut. If these markets do suffer and sales slow down, then this could have a knock on effect on the ability for those relocation buyers to actually have the liquidity to buy in Miami, as the proposition of holding two homes becomes less appetizing.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS