- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Mid-Year Moves in the 2025 Coral Gables Housing Market: Subtle Changes, Serious Impact

Summary

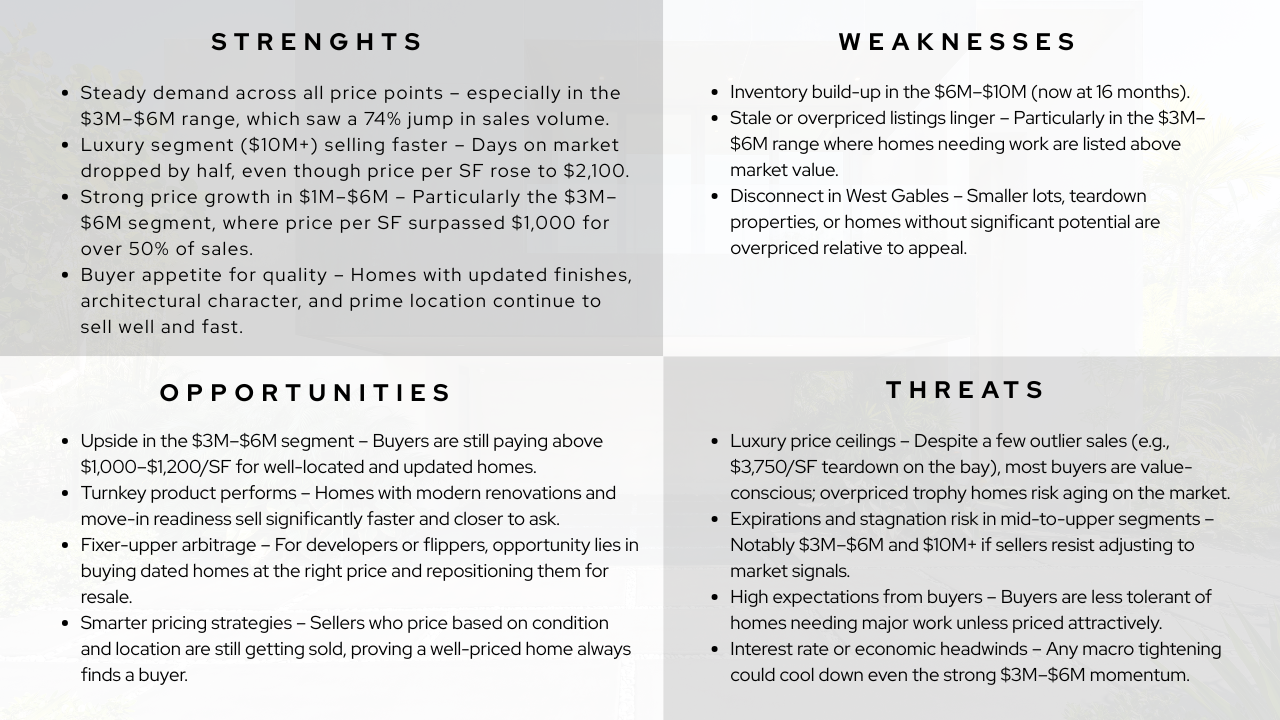

What’s Really Driving the 2025 Coral Gables real estate market? Early 2025 is revealing a market that rewards quality. The $3M–$6M range is setting the pace, while turnkey homes continue to attract strong offers across all price points. Meanwhile, inventory is rising in the $1M–$3M and $6M–$10M tiers, signaling a need for sharper pricing and better positioning. The gap between what sells and what sits is widening. And while buyers are active, they’re more selective than ever. So what does this mean for your next move? We’ll break it down using the latest data, paired with what we’re seeing daily on the ground—working with buyers and sellers in Coral Gables every day.

1.Buyers Want Quality, Not Projects

Well-finished and custom homes sell fast. Generic or outdated listings are being ignored.

2.Cautious Buyers, Selective Mindset

Due to macro uncertainty, buyers are patient, not impulsive. They’re circling until the right property checks every box.

3. Overpriced = Overlooked

Homes without standout features—or those priced above market—are lingering or expiring.

4. $3M–$6M Is the Sweet Spot

This is the top-performing segment with strong sales velocity and rising price per SF.

5. $1M–$3M Is Stalling

Still active, but momentum is slowing. Buyers are getting picky and inventory is rising.

6. $6M–$10M Is Overcrowded

A flood of inventory and price declines are putting pressure on sellers. Only standout homes are selling.

$1M–$3M: A Market on the Move — But with Caution

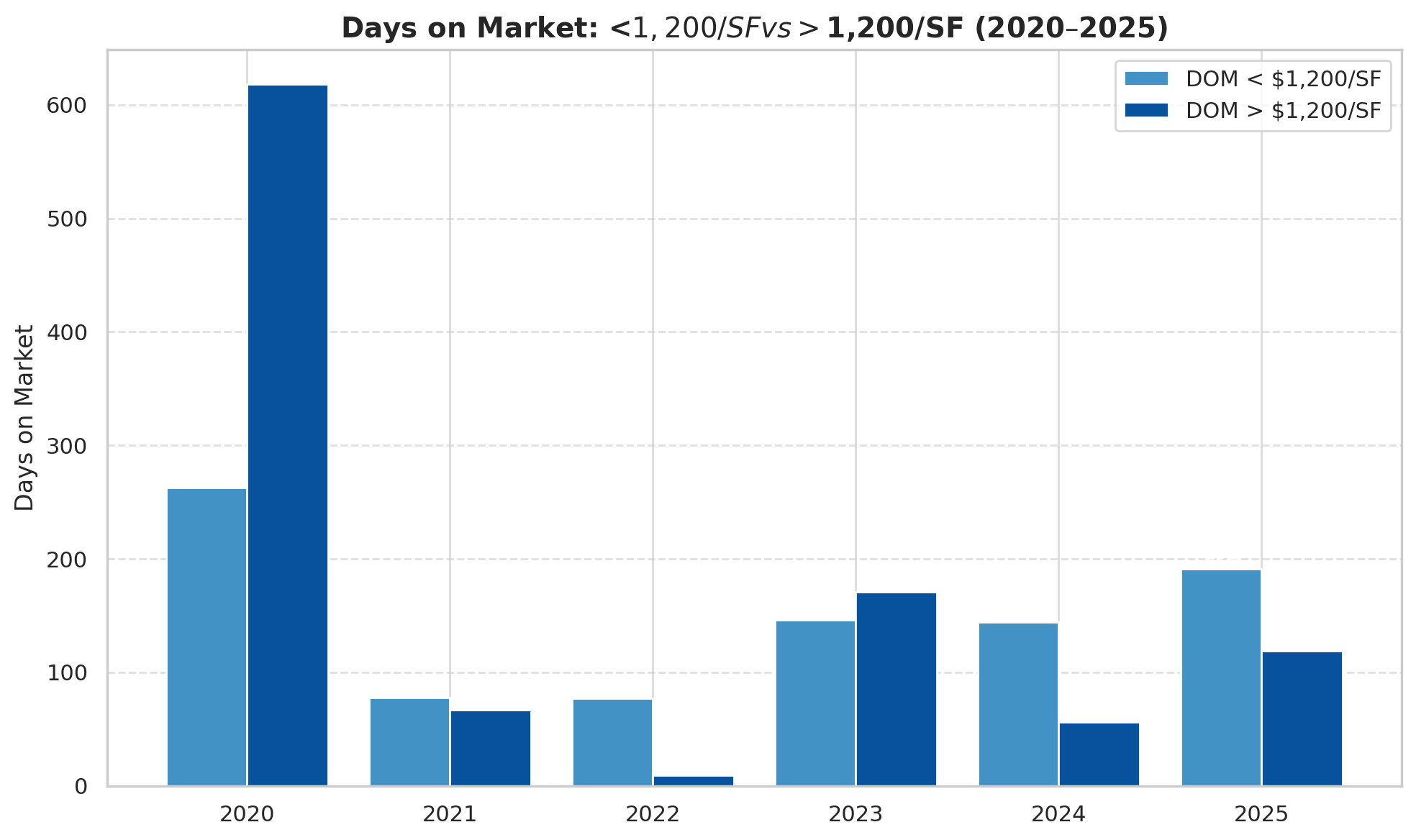

A Sorting Market — Fast Sales for Quality, Stalls for Overpricing. The rising days on market in 2025 reflect an increase in overpriced or dated listings, not a lack of demand. In fact, high-end, well-located homes are selling faster and for more than ever, as seen in the record $1,000+/SF sales.

The $1M–$3M segment has been the heart of Coral Gables real estate — the most active, most competitive price range. But as we step further into 2025, the tone is starting to shift. Buyers are still showing up, and they’re willing to pay a premium — especially for well-renovated homes in prime locations. In fact, more buyers than ever are breaking the $1,000/SF mark, signaling confidence in quality properties. Nearly 70% of all closed sales across the market sold within five months, with many of the fastest sales priced under $2M. But here’s the twist: that momentum is getting more selective. The market is no longer lifting all boats. Homes that need work, are priced too ambitiously, or lack a clear value edge are starting to sit — and the days on market are quietly stretching out. Inventory is building, and buyers are getting pickier. This means sellers — especially at the entry level — need to be razor-sharp. Pricing and presentation matter more than ever. If the home isn’t turnkey, it needs to be priced like an opportunity. And if it’s move-in ready and well-located? It still has the power to fly off the market. We’re not in a slowdown yet — but we are in a sorting market. Quality, strategy, and timing are starting to separate the winners from the lingerers.

Trend & Insights:

- Still the busiest price bracket, but showing signs of softening.

- Buyers are willing to pay over $1,000/SF for well-located, renovated homes. In fact, 2025 already logged 23 such sales, up from just 8 last year.

- However, many homes in this range are starting to linger longer on the market, especially those not move-in ready.

What to Focus On:

- Homes that are renovated, priced under $1,000/SF, or have a unique value proposition are still selling fast.

- Watch for listings that overreach on price or need work — they’re sitting longer.

- Entry-level Gables homes are becoming more price-sensitive, so marketing and pricing must be precise.

Outlook for the next 6-12 Months

Listings over $1,000/SF need to be either renovated or competitively priced to move. Dated or average units are sitting. Move-in-ready homes with updated finishes and a sharp price are still attracting interest, especially from relocation buyers looking for convenience.

The $3M–$6M Market Isn’t Just Heating Up — It’s Taking Off

Well-finished, high-quality homes often priced at $1,200/SF or more are selling quickly and rarely expire. In contrast, homes with dated finishes or weaker locations—often listed below $1,000/SF but still asking premium prices—are far more likely to sit on the market and eventually expire.

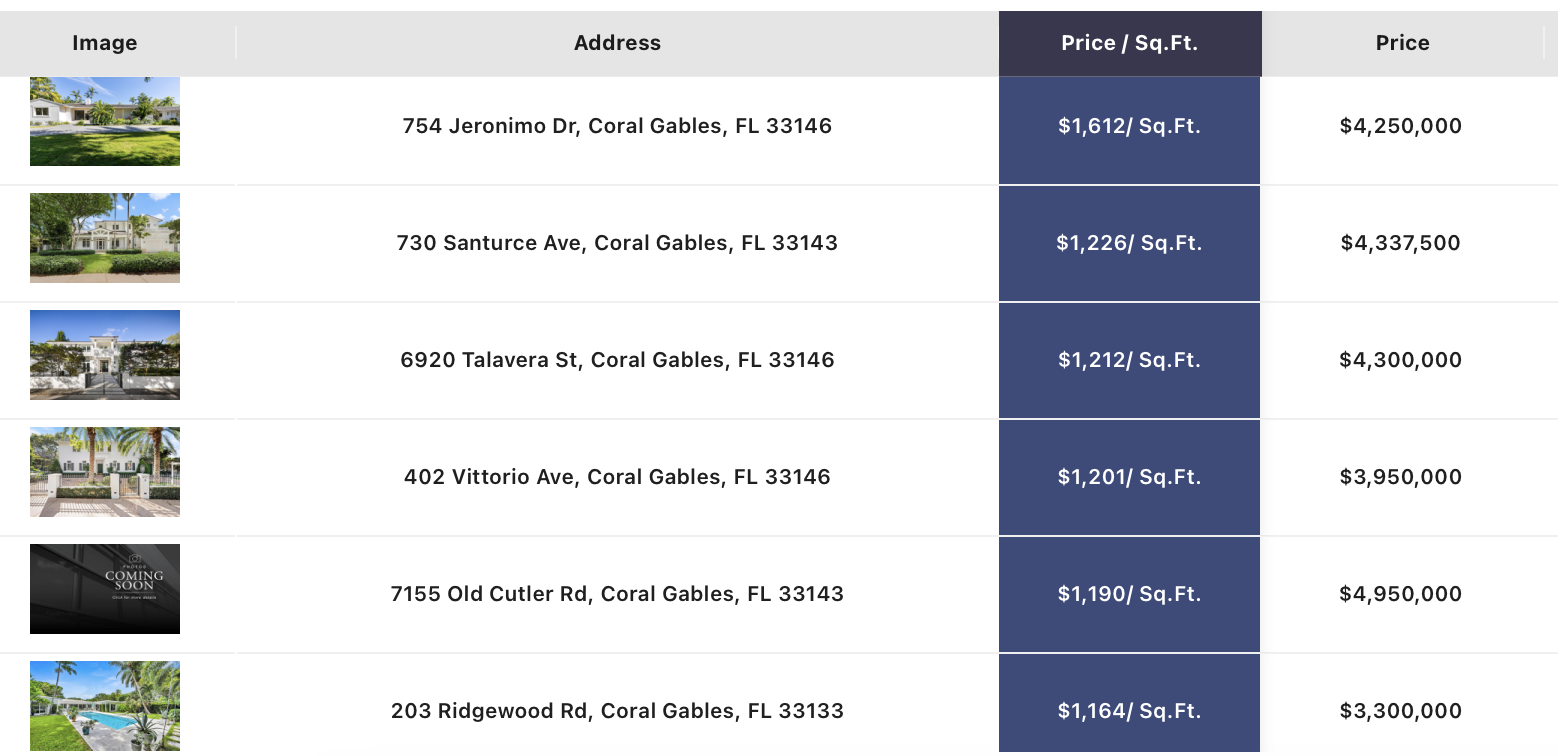

If there’s one segment rewriting the rules in 2025, it’s the $3M–$6M range. What used to be a slower-moving tier is now the breakout performer — with sales volume surging and buyers showing they’re ready to spend for the right product. This isn’t just momentum — it’s a shift in mindset. Buyers are no longer hesitating at $1,000 per square foot. In fact, many are blowing past that number for homes that deliver on quality, style, and location. Seven sales already crossed $1,200/SF — a signal that premium design and presentation matter more than ever.

Despite the explosive sales growth in this segment, a significant share of expired listings fall into this range. Many of the homes that failed to sell were dated, poorly maintained, or priced above what the market is willing to pay for their condition. Buyers here expect more — great lots, compelling design, and high-end finishes. Homes that need a full renovation or sit on small, less desirable lots (such as in parts of West Gables) will struggle unless pricing reflects their true condition and potential.

This is also a market with a sharp edge. Buyers are demanding. If a home is turnkey, architecturally compelling, or sits on a prime lot, it’s selling — often quickly. But if it’s dated, overpriced, or doesn’t tell a compelling story, it’s getting passed over or expiring altogether. This creates a huge opportunity for repositioning. Well-located but tired properties, if priced correctly and upgraded thoughtfully, can still catch the wave. But this is no longer a market where you can test the waters. You need to hit the market with clarity, precision, and product-market fit. Bottom line: This is the most dynamic price bracket of 2025 so far — but only for those who understand what today’s luxury buyers are really looking for.

Trend & Insights:

- This is the most active growth segment right now.

- More than half of 2025 sales (17/33) exceeded $1,000/SF, with 7 above $1,200/SF — a major jump in buyer willingness to pay premium for quality.

- That said, there’s a clear divide: homes that are turnkey or architecturally compelling are selling fast, while dated or overpriced homes are expiring.

What to Focus On:

- Product-market fit is critical: Buyers here expect excellence — great lots, design, and finishes.

- Homes needing full renovation must be priced well below $1,000/SF or they won’t move.

- Strong value-add opportunity exists for repositioning well-located but tired properties.

Outlook for the 2025 Coral Gables Housing Market

This price range continues to perform best, driven by buyers seeking quality in prime locations. Turnkey units in sought-after buildings can command strong prices, but anything overpriced or lacking standout features will face resistance. Buyers are value-conscious and comparison-savvy.

$6M–$10M: A Market That’s Selective — and Not in a Hurry

Buyers are selective and therefore the higher priced properties that deliver high quality, a great location or outstanding features spent less time on the market.

In the $6M–$10M tier, momentum is harder to find — and even harder to maintain. Yes, there’s been some growth, but it’s far from consistent. This segment is defined less by volume and more by caution. Buyers here aren’t rushing in — they’re circling, evaluating, and waiting for something that truly stands out. And in many cases, they’re not seeing it. Dry-lot homes or older waterfront properties are having a tough time justifying their price tags, especially as inventory builds and options expand. Buyers in this range want clarity — either new construction, prime waterfront, or a one-of-a-kind design statement. Anything less is sitting unless it’s priced well below the premium mark. That said, when a property checks the boxes — new, compelling, well-located — it still commands attention and top dollar. But these are exceptions, not the rule. This is a market that rewards precision. Sellers need to be strategic — flexible on terms, sharp on presentation, and realistic about value. Because while buyers are active, they’re also patient — and they’re not stretching for anything that doesn’t feel unquestionably worth it.

Trend & Insights:

- Market is not as clear-cut — fewer buyers, broader variation in product.

- Dry-lot homes or older waterfront homes are struggling to justify high prices.

- Highest prices in 2025 are in the $1,450/SF range, typically for either newer construction on the west side or waterfront fixers.

What to Focus On:

- Homes in this tier must either be brand-new, waterfront, or architecturally special.

- If a home needs work or lacks location prestige, expect longer market time unless priced under ~$1,200/SF.

- Inventory is growing, so seller flexibility and staging matter.

Outlook for the next 6-12 Months

This segment faces headwinds with longer inventory and less defined buyer demand. This segment is facing the biggest headwinds. Fewer active buyers and rising supply mean longer time on market unless a unit offers true uniqueness — penthouse views, top design, or a strong brand association. Strategic pricing is critical.

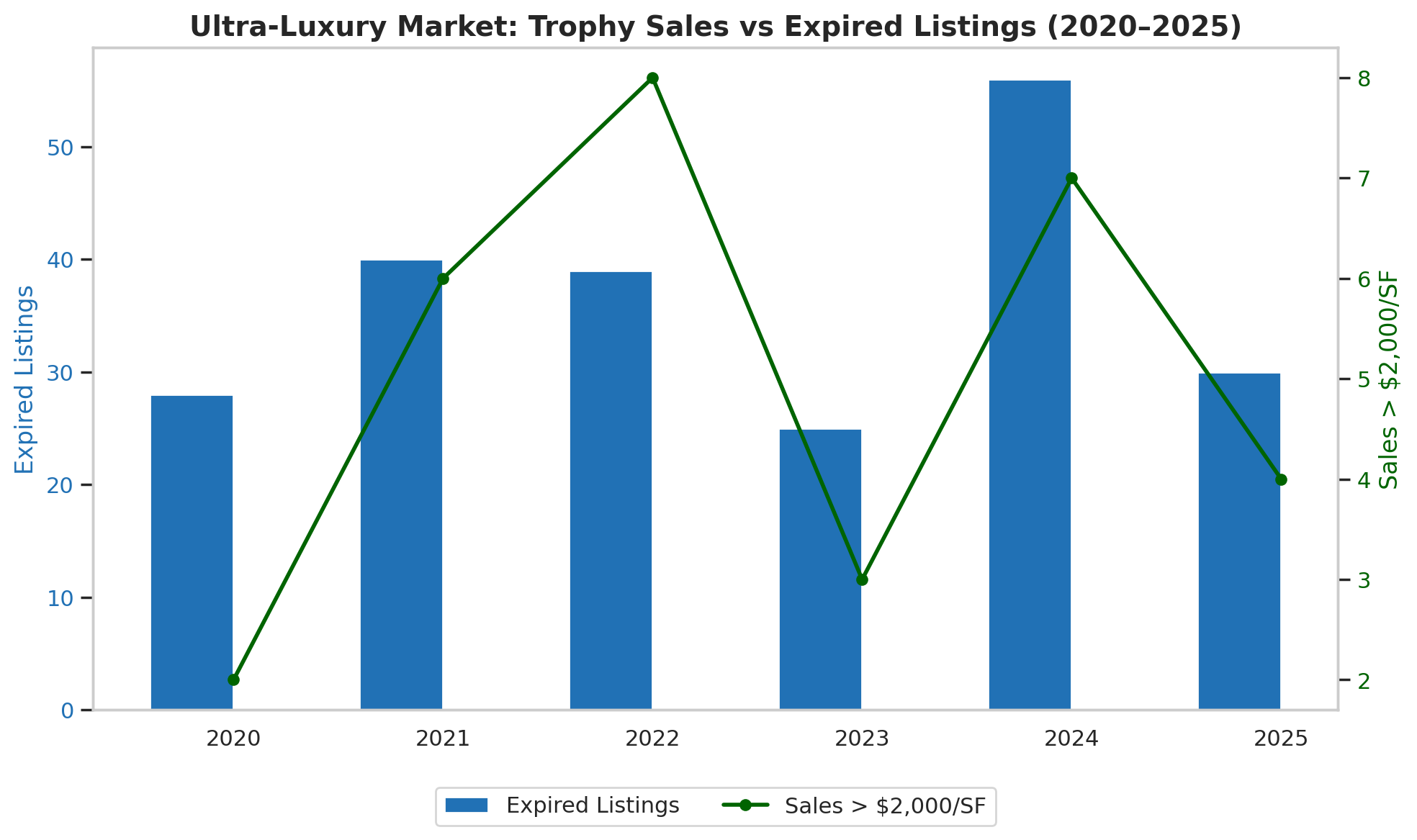

$10M+ Market: Rarity Rules, and the Right Homes Move Fast!

The ultra-luxury market isn’t about volume — it’s about uniqueness. And in 2025, that principle is holding strong. Sales in the $10M+ tier remains steady, but what’s really striking is how much faster the best properties are moving. Days on market have been cut in half — not because there’s a buying frenzy, but because buyers at this level are acting decisively when they see something truly special. This market isn’t forgiving. It’s sharp. Buyers are scrutinizing everything: lot quality, design, water access, and long-term value. They’re not chasing price — they’re chasing trophy status. Buyers are willing to break records, but only for properties that break the mold. Inventory remains high, so even in this rarefied space, competition exists. Homes that feel average — even at $10M+ — are sitting. A dated home, or one without that “wow” factor, needs a reality check or a repositioning plan. Bottom line: The trophy market is alive and well — but only for properties that earn the title.

Trend & Insights:

- Surprisingly shorter market time this year, despite high inventory (Drop from 146 days → 74 days, showing that trophy buyers remain active if the offering is compelling)

- Many expired listings reflect unrealistic pricing for homes that Need complete renovation, Sit on small or less-desirable lots or Lack architectural or location upside

- However, prices vary wildly based on lot quality, teardown potential, or new construction:

- This segment is driven by rarity, not volume — buyers move for unique homes, not generic luxury.

What to Focus On in the 2025Coral Gables Housing Market

- Best-in-class homes will sell, even at record prices.

- Homes that are dated, on average water, or don’t feel “trophy” enough will likely linger or expire.

- Price sensitivity is increasing — buyers at this level are scrutinizing quality and location more than ever.

Outlook for the next 6-12 Months

The ultra-high-end remains active for rare, best-in-class properties. Trophy homes with architectural appeal or new construction can still set records. However, older or uninspired listings will need price cuts to stay competitive.

Which Homes are Moving and Which are Not?

Across the market, well-positioned homes are still moving quickly—especially at the entry levels. Of the 126 closed sales this year, 87 (or nearly 70%) sold in under five months, with the fastest movement seen in the $1M–$2M range. Among the 204 properties currently listed above $1M, only 35% have been on the market longer than five months, suggesting that properly priced homes are still finding buyers.

However, when we look at expired listings, most fall into the $3M–$6M and $10M+ segments. In the $3M–$6M range, many of the homes that failed to sell were dated, in need of significant updates, or lacked architectural appeal—yet were priced at or above what move-in-ready homes are commanding. This is especially true for small-lot properties in less desirable pockets like some parts of West Gables, where a full rebuild is often the only viable option. Similarly, in the $10M+ segment, homes that don’t feel truly “trophy”—whether due to location, design, or potential—tend to sit unless priced aggressively.

The takeaway: homes with strong design, modern finishes, or prime locations (especially waterfront) still attract buyers. But if a property needs a full renovation or lacks upside, and the asking price rivals that of well-finished neighbors, it’s likely to linger on the market.

Winners, Losers & Watchouts: A Strategic Look at the 2025 Coral Gables Housing Market

Conclusions on the 2025 Coral Gables Housing Market

Advice for Sellers

- $1M–$3M: Price sharply and make sure your home is move-in ready. If it’s not, it needs to be clearly priced as a value opportunity.

- $3M–$6M: This is your moment — but only if your home is turnkey and thoughtfully designed. Overpriced or dated homes are expiring fast.

- $6M–$10M: Buyers are cautious. Only best-in-class or new construction will move. Be flexible, realistic, and stage to impress.

- $10M+: Trophy homes still sell — but only if they’re truly special. If it’s not best-in-class, reposition or reprice.

Across the board: If the home isn’t ready, price it like a project. If it’s premium, lead with presentation and precision.

Advice for Buyers

- $1M–$3M: You still have options — but quality homes move fast. Don’t hesitate on well-priced, renovated listings.

- $3M–$6M: Expect competition for great homes. Be ready to act fast and pay up for top-tier finishes and locations.

- $6M–$10M: Leverage growing inventory to negotiate. Don’t compromise on quality — the market isn’t rushing.

- $10M+: Trophy homes are moving quicker, but only the exceptional ones. Be selective — but decisive when it’s right.

Bottom line: The market is sorting winners from lingerers. Whether you’re buying or selling, quality and strategy are everything.

Connect with The David Siddons Group

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS