In Miami’s condo market, the difference between big gains and million-dollar losses comes down to avoiding a handful of costly mistakes. The worst-performing buildings share the same red flags: poor locations, high renter ratios, the wrong unit lines with blocked or inferior views, overhyped branded residences that fail to deliver, and cramped or poorly designed floor plans. Add in risky bets on short-term rentals, overpaying without representation, ignoring fine print, and waiting too long to sell, and you have a formula for lost value. Smart buyers focus on location quality, owner-occupancy, protected views, livable space, and hard-nosed due diligence, because in Miami real estate, the details decide your fortune.

- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

How to Lose $1M in a Miami Condo: 10 Costly Mistakes Buyers Keep Making

After 20 years and billions in Miami real estate sales, I’ve seen just about everything, especially the Miami Condo Buying mistakes. From first-time buyers to hedge fund veterans, there’s one universal truth: you can still lose a fortune if you don’t know what you’re doing. In this podcast I discuss the 10 most common (and costly) Miami condo buying mistakes. I’ve seen buyers make, and how you can avoid becoming one of them. Also read: How to Lose $1M in the Miami Housing Market.

The Warning Signs That Can Save You from Miami Condo Buying Mistakes

This article was the basis for The Real Deal’s viral post “Are these Miami-Dade condo buildings underperforming?“

The Worst Performing Condos in Miami

We’re proud to see our analysis influencing national conversations in the Real Deal

- ONE THOUSAND MUSEUM | Four-bedroom residences here typically trade between $6M and $7M, in a market that recorded only 16 other sales above $4M over the past year, most of them within the Aston Martin Residences.

- PARAMOUNT WORLD CENTER | There are a staggering 75 units for sale at this project of which 60% has been on the market for over half a year already. A sharp contrast to just 16 sales in the past year.

- MUSE SUNNY ISLES | Muse began selling at around $1,100 per SF in 2018. After a brief peak in 2022–2023 at approximately $1,600 per SF, prices have now settled back to about $1,380 per SF.

- PORSCHE DESIGN TOWER | Porsche’s resale drop is rare; from about $2,000 after launch to $1,200 per SF nowadays. Today, 25% of the tower (31 units) is for sale, with 60% listed for over six months.

- AR MANI CASA| 25% of the condo sold within two years of launch, a red flag. Even more unusual for this market, it hasn’t appreciated at all in the past four years.

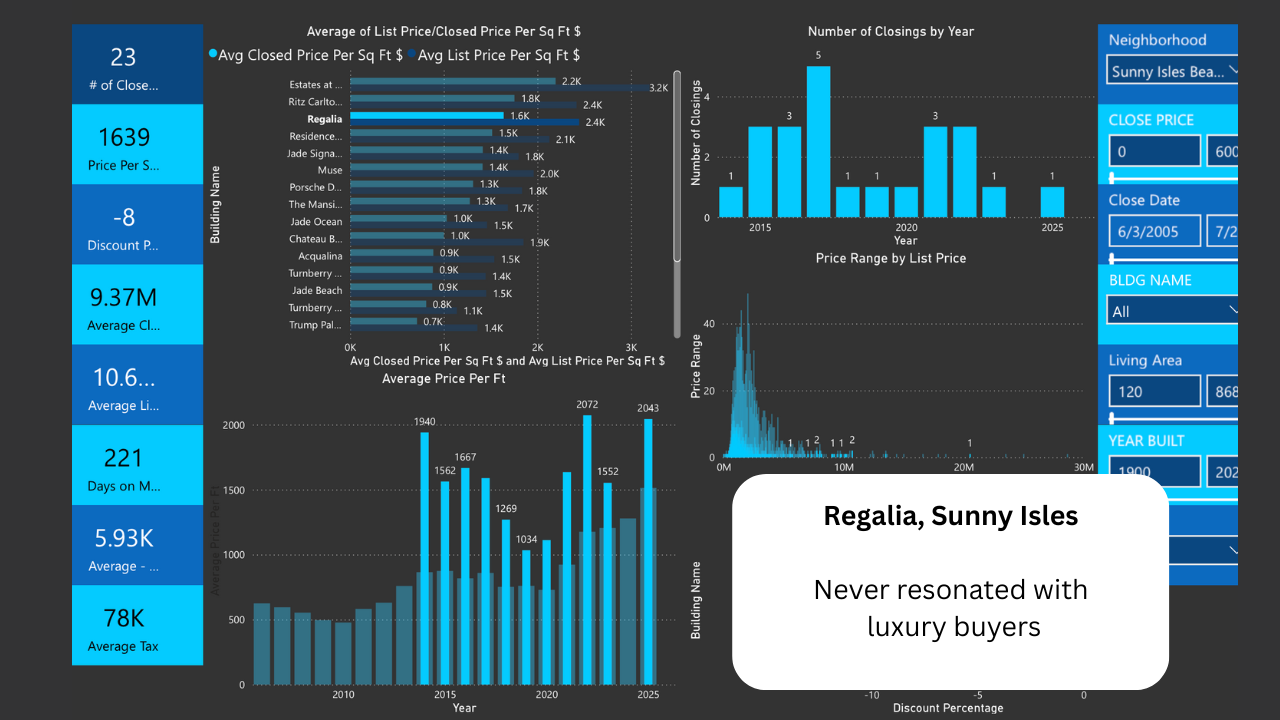

- REGALIA, Sunny Isles | The Sunny isles Condo that sees the highest percentage of discounts from its asking price. On average 15% discount was given in the last 2 years.

- FAENA HOUSE | Over the past four years, values have fallen from $3,200 in 2022 to $2,750 in 2025, while HOA fees have surged 50–60% in the

- ICON BRICKELL | While HOA fees have risen 50%, rental prices are down 5% from 2024 and 10% from their 2022–2023 levels.

- KENILWORTH Bal Harbour | Current values at the condo are about $550 per SF, the same as in 2014–2015, showing no appreciation over the past decade.

- NINE AT MARY BRICKELL | Prices are now about $550 per SF — only 16% higher than the $462 per SF seen in 2015.

- RISE Brickell City Center | Current values sit at $785 per SF, down 10% from the 2023 peak, with no appreciation recorded since 2021.

- ASTON MARTIN RESIDENCES | 94 out of 391 condo units are currently for sale, 33% of the building. This unusually high inventory puts significant downward pressure on market values & buyer perception.

The Best Performing Condos in Miami

- PALAZZO DEL SOL Fisher Island | Eight of Fisher Island’s 10 priciest sales were in the Palazzo del Sol and Palazzo della Luna, with prices reaching an impressive $5,285.71 per SF.

- MURANO AT PORTOFINO | Values have gone up by 116% in the last 5 years. The last sales was recorded at $2,320 per SF.

- APOGEE SOUTH OF FIFTH | Since the 2022 pandemic peak, values have climbed another 30%, with a record sale this year at $3,913.96 per SF.

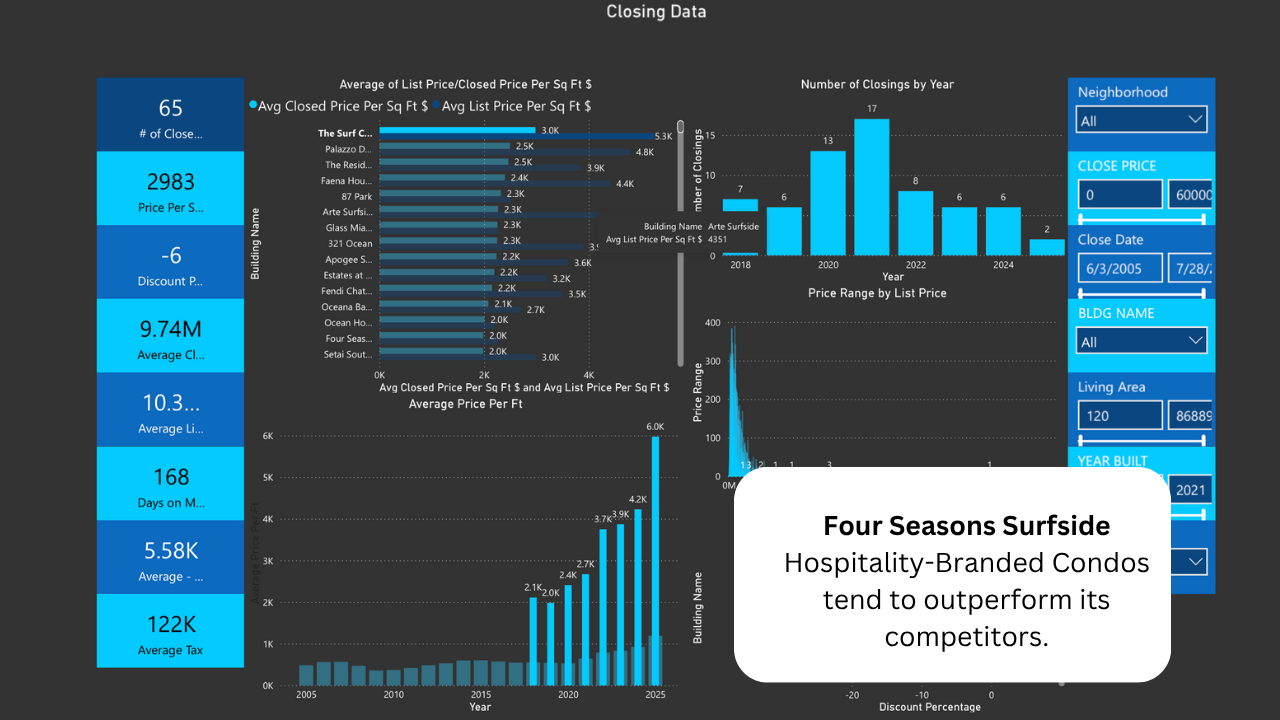

- SURF CLUB FOUR SEASONS RESIDENCES Surfside | The Surf Club led Miami over the past year with a record $6,731 per SF and claimed 7 of the city’s 10 highest condo sales.

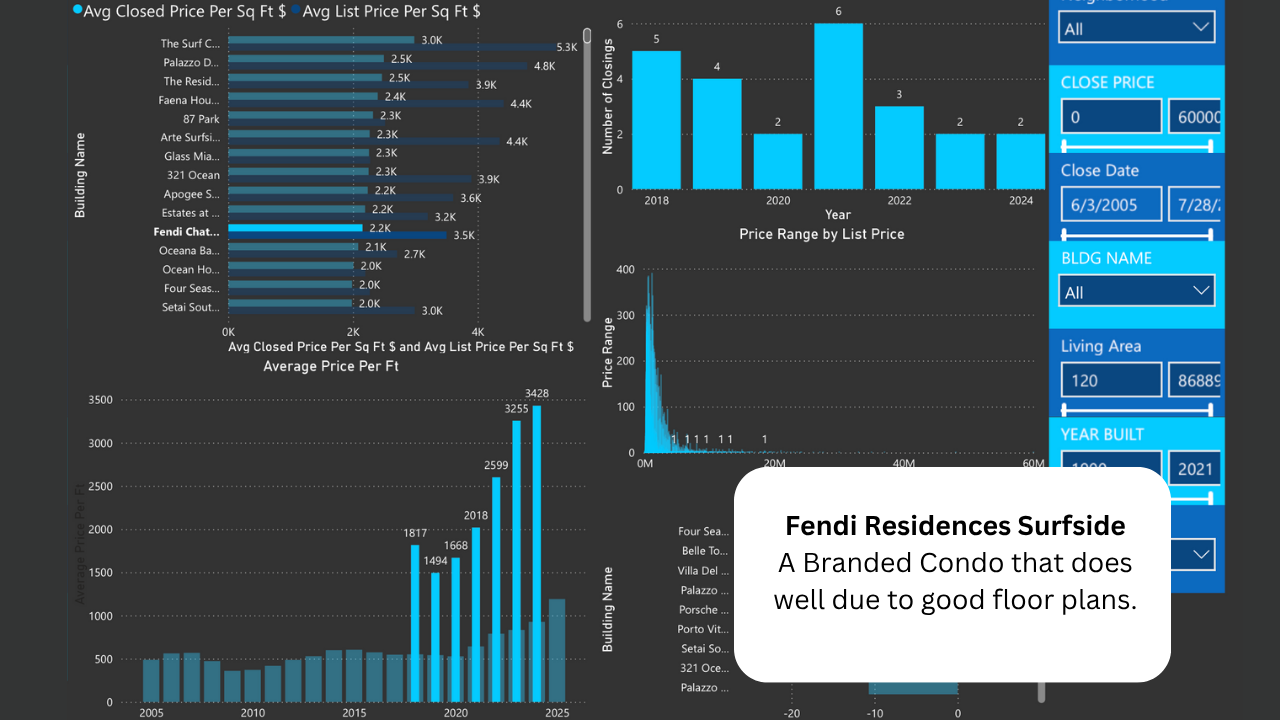

- FENDI RESIDENCES SURFSIDE | Since the 2022 pandemic peak, values have climbed another 35%, with a record sale this year at $3,420 per SF.

- ONE PARK GROVE Coconut Grove | A record $3,849.71 per SF was achieved this year for Unit 15A, 17% higher than its 2024 sale price.

- CONTINUUM SOUTH BEACH | Shattering records yet again, with 5 sales this year alone nearing the $5,000 per SF benchmark.

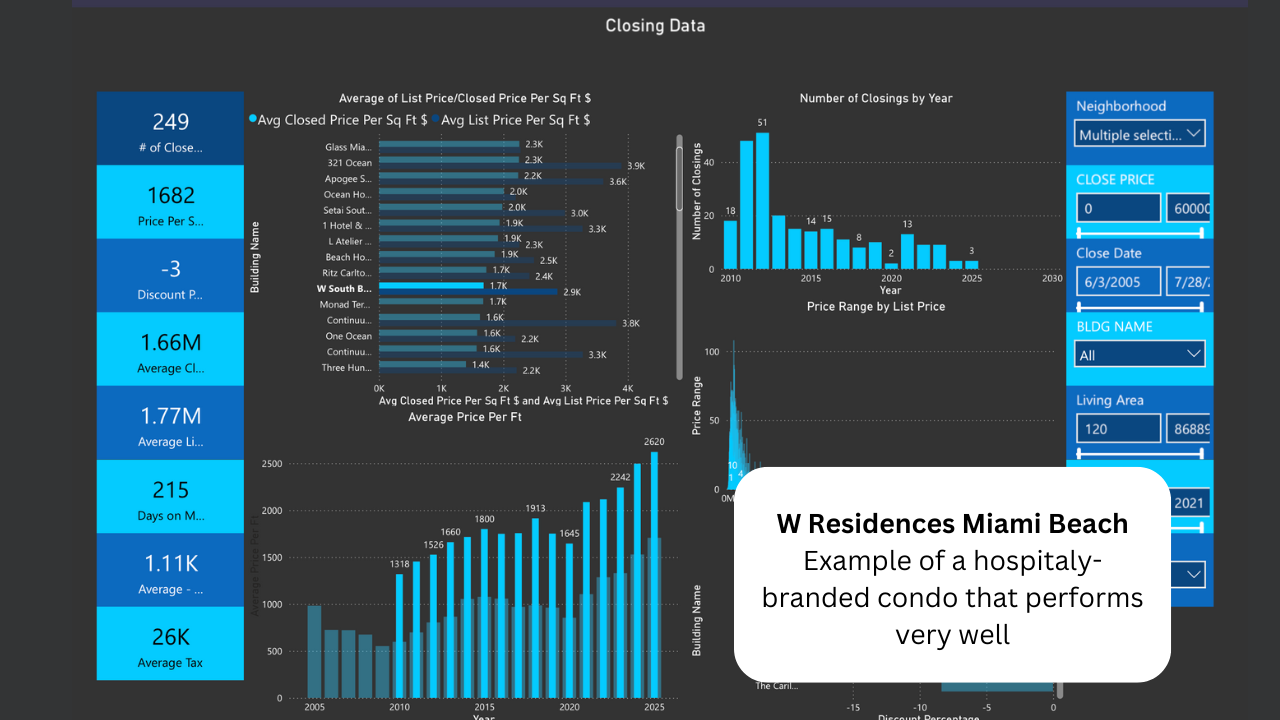

- W RESIDENCES MIAMI BEACH | This year, 4 of the 10 condos sold for more than $2,600 per SF and two sold for more than $2,800 per SF.

- FOUR SEASONS BRICKELL | Four of the highest prices ever recorded occurred in 2025, including a record $1,989.78 per SF and one of the all-time top sales at $14.8M.

1. Buying the Right Building in the Wrong Location

You fall in love with the tower… but forget to look at the block. A luxury building surrounded by low-end developments and slow-to-improve infrastructure will struggle to hold value. One Museum is a textbook example, great finishes and floor plans, but the neighborhood didn’t evolve fast enough. I know plenty of buyers who loved the condo, but could not appreciate the neighborhood. Don’t buy the renderings, buy the reality. Look for real surrounding value, not promised future upgrades.

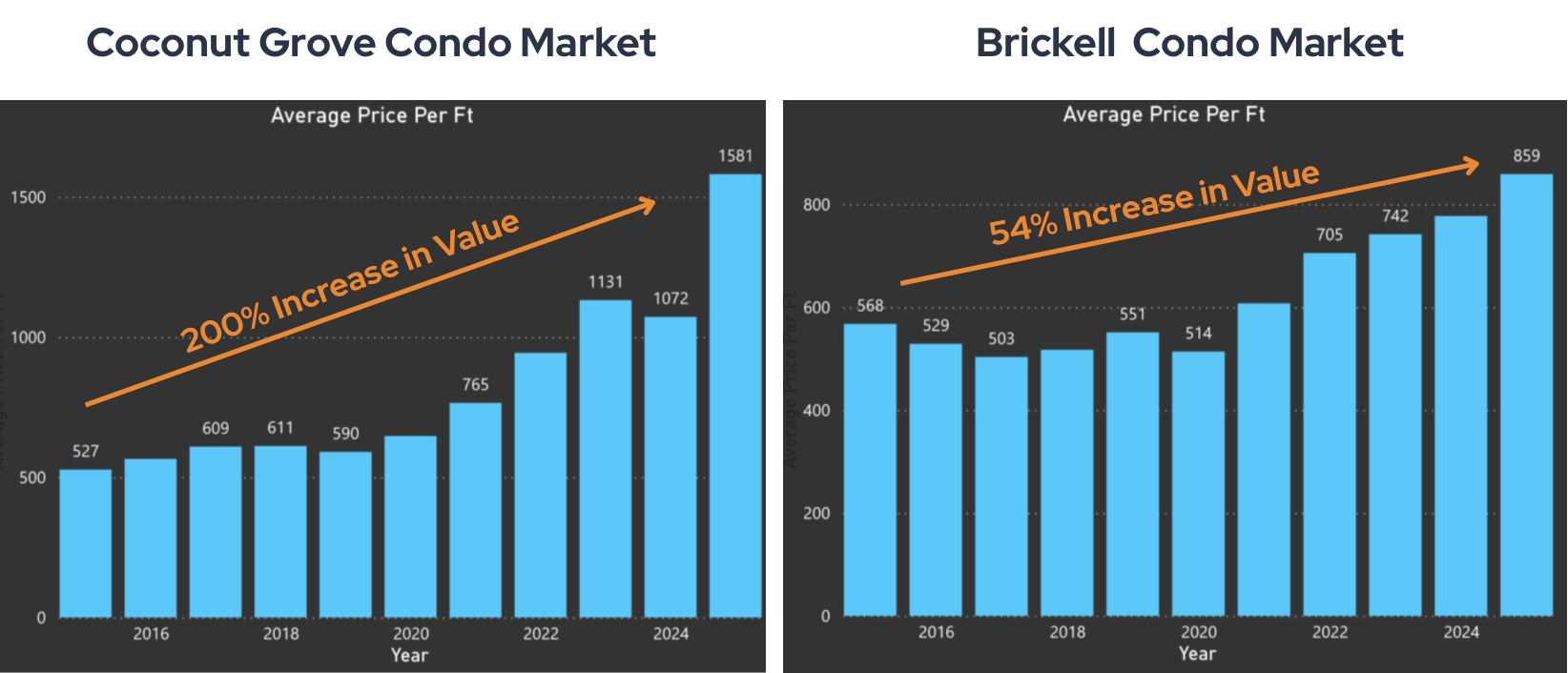

2. Ignoring the Owner-to-Renter Ratio

One of the most seen Miami condo buying mistakes. One of the most overlooked but critical factors when buying a condo is the owner-to-renter ratio. In buildings with a high percentage of renters, property values are often tied directly to rental income potential. If rents drop, whether due to economic shifts, inflation, or competition from newer developments—property values tend to follow. I’ve seen this pattern play out repeatedly in Miami over the past three real estate cycles, especially in the urban core. Investors rush into a new building, often buying multiple units, with little intention of living there. Initially, rents might be strong, giving the illusion of a solid investment. But over time, as more rental-heavy buildings come online, competition increases, units age, and rents plateau or decline. Unlike end-user buyers, renters rarely pay a premium for ownership, so appreciation remains limited. The contrast is striking when you compare long-term data: rental-heavy buildings in areas like Brickell have seen little to no value growth over the past decade, while primarily owner-occupied communities, such as Park Grove in Coconut Grove, have appreciated by 200–250% in some cases.

3. Buying the Wrong Line

When buying a condo, you’re not just buying in a building, you’re buying a specific line (the unit’s position and view). “Deals” that are well below the building’s average price per SF often signal problem lines with bad layouts, wasted space, or views likely to be blocked by future construction. Once a view is gone, values rarely recover. The best-performing lines are those with permanently protected, unobstructed views, like certain south-facing lines at Ritz-Carlton Sunny Isles, Continuum South of Fifth, and 87 Park or the A-Line at Park Grove, which remain irreplaceable and appreciate over time.

VIEW THE FULL LIST OF NEW CONSTRUCTION CONDOS IN MIAMI

4. Falling for the Brand Mirage

Just because it’s branded doesn’t mean it’s better. Branded condos are everywhere in Miami, and many are pure marketing. Often, the brand has little involvement beyond licensing the name. Worse, resale values tend to fade fast when the next shiny new brand launches across the street. If you’re paying 20% more for the label, make sure you’re getting actual substance, not just Versace pillows. For more information on branded condos and their pitfalls, click here.

Hierarchy in the Miami Luxury Condo Market

5. Walking Into New Construction Without Representation

The sales center is not your friend. You’re not saving money by skipping an agent, you do not get a discount because you come in without an agent. you’re just flying blind. Developers release units in waves (“drawers”), and what’s offered first is rarely the best. You need someone who knows floor plans, elevations, views, and contract terms — including hidden costs, vague timelines, and risky developer clauses. Don’t go it alone.

6. Believing the Airbnb Fantasy

Short-term rentals sound sexy… until they aren’t. High volatility, heavy wear and tear, regulatory changes, and inflated management fees all eat into your bottom line. Plus, short-term product rarely appeals to end-users, which limits long-term value. And when the glamor fades, so does the resale market. If you’re buying for short-term gain, don’t expect long-term growth.

7. Choosing Bedroom Count Over Livable Space

Don’t be fooled by bedroom count alone, livable square footage matters far more. Many developers squeeze three bedrooms into as little as 1,500 sq. ft., creating cramped layouts with undersized bedrooms and closets that turn off end users and crush resale value. Always ensure the space and dimensions are functional and proportionate, or risk ending up with a unit that’s nearly impossible to sell.

8. Waiting Too Long to Sell

Waiting too long to sell or overpricing from the start can be fatal to a condo’s value. Once a unit or building is seen as a “dog” by buyers, it rarely recovers, often taking years to regain lost ground. Ignoring comparable sales and hoping for a market rebound usually backfires, hurting both your sale and neighboring values. Pricing right and acting at the right time are critical to avoiding long-term damage.

9. Skipping the Fine Print

Assessments, hidden fees, construction delays please read everything or hire an excellent attorney. We’ve seen buyers blindsided by surprise assessments, amenity closures, and major HOA issues. Always review building minutes, projected expenses, and legal clauses. A good agent and attorney can save you hundreds of thousands here. Don’t skip this step.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Close

Edit Search

Close

Share this property

Recomend this to a friend, just enter their email below.

Close

Your email was sent successfully

Close

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS