- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Sunny Isles Real Estate Market 2025: A Segment-by-Segment Breakdown for Buyers and Sellers

By Nada Serry, Territory Expert Sunny Isles Beach

Sunny Isles Beach is entering a new era—defined by discerning buyers, elevated design expectations, and a market shifting toward premium inventory. While the broader economy has sent mixed signals in 2025, the high-end condo market here tells a more focused story. The numbers are in for the first half of 2025, and while some headlines suggest a softening market, a deeper dive reveals a more nuanced, strategic transformation underway in this elite oceanfront enclave. The market is undergoing a quiet transformation—defined by elevated expectations and a reallocation of capital toward newer, design-forward inventory, leaving outdated and underwhelming product behind. This is a condensed overview. For the full analysis, click here.

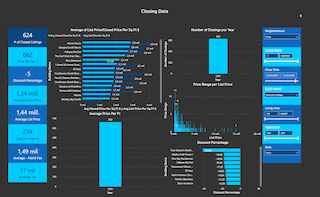

Key Data for Sunny Isles Condos | Jan – May 2024 vs Jan – May 2025

| $1M-$3M | Change | $3M-$6M | Change | $6M-$10M | Change | $10M+ | Change | |

| Sales Volumes | 99->63 | -36% | 28 ->32 | +14% | 11->10 | -9% | 1->5 | +400% |

| Price per SF | $945->$934 | -1% | $1,482->$1,554 | +4.8% | $1,926->$1,783 | -7.5% | $2,610-> $2,500 | -4% |

| Median Days on Market | 97->133 | +37% | 148-> 209 | +41% | 121->204 | +68% | 71->388 | +446% |

| Ratio Sales Price to Original List Price | 93.8%->93.9% | - | 92.6%-93.8% | +1.3& | 91.8%->89.4.1% | -2.6% | 99%->89% | -10% |

| Months of Inventory | 12->31 | +158% | 19>24 | +26% | 31->30 | -3% | 34->25 | -26% |

$10M+: Quiet but Explosive

This ultra-prime tier is small but mighty. In 2025, just five transactions were recorded, yet they generated an impressive $89.7 million in total volume—accounting for 20% of Surfside’s entire condo market. That’s a staggering 560% increase year-over-year, considering only one sale closed in this tier in 2024. The top sale alone reached $28.6 million, more than double last year’s highest price, signaling renewed strength and demand at the very top of the market.

Despite the low transaction count, this segment is commanding both attention and dollars. The buyers here are ultra-high-net-worth individuals who know exactly what they want—and are willing to pay for it. They’re not bargain hunters; they’re seeking turnkey, lifestyle-driven properties in newer buildings with stunning views, exceptional design, and low-maintenance ownership. And when those boxes are checked, they don’t hesitate.

Top-performing building: Estates at Acqualina remains the gold standard.

Advice for Buyers: There is limited supply, and when the right unit comes to market, it rarely lasts. If you’re shopping here, be prepared to move decisively—and don’t expect discounts on best-in-class product.

Advice for Sellers: Trophy properties sell—if they are truly trophy-worthy. Anything less will linger.

$6M–$10M: High Expectations, Weak Results

The $6–10M segment is Sunny Isles’ weakest-performing tier in 2025, weighed down by a 17% drop in sales volume, the highest months of inventory, and the steepest discounting across all price points. It’s also the only tier to experience a decline in average price per square foot, falling by 7% year over year.

Many of the properties in this bracket are caught in an identity crisis: not quite ultra-luxury, yet priced as if they are. The result is market stagnation. Buyers at this level are hesitant—some are stretching into the $10M+ tier for true exclusivity and branded appeal, while others are retreating to the $3–6M range, where value, liquidity, and deal flow are stronger.

To regain momentum, properties in this segment will need to either elevate their product to match their price or adjust pricing to reflect current buyer expectations. As it stands, this mid-high tier is struggling to justify its positioning, and buyers are responding with caution—or not at all.

Top-performing building: Acqualina Estates continues to be the dominant player, although Acqualina Mansions is seeing more visibility.

Advice for Sellers: This is not a segment where you can “test” the market. Pricing and presentation must be sharp, or expect prolonged exposure and heavy discounting.

Advice for Buyers: There may be opportunity here—but only if you negotiate strategically. Expect room on price if the property isn’t turnkey.

$3M–$6M: The Market’s New Sweet Spot

The $3M–$6M tier has quietly become the engine of the Sunny Isles condo market in 2025. While overall transaction counts are lower than in previous years, this segment has gained traction—now representing 33% of total sales and posting a 16% increase in sales volume year-over-year.

What’s driving the shift? Buyers are migrating upward from lower price brackets to access newer, design-forward inventory. Many of the newly delivered or recently renovated buildings fall into this range, offering modern layouts, contemporary finishes, and a turnkey ownership experience that resonates with today’s market. These properties are also achieving stronger prices per square foot, with less discounting required to close deals—evidence of growing demand and value alignment.

In a market still finding its footing, this tier is emerging as a sweet spot: elevated, yet attainable—delivering the quality and convenience buyers want, without crossing into the ultra-luxury premium.

Top-performing buildings:Armani Casa, Jade Signature, Ritz-Carlton Residences, Turnberry Ocean Colony.

Advice for Buyers: If you’re looking for a move-in ready product in a quality building without entering ultra-luxury pricing, this is your sweet spot. Expect competition on top units.

Advice for Sellers: Well-designed product moves quickly here. If your condo fits the bill, the current market may yield a strong return with minimal discounting.

$1M–$3M: Once Dominant, Now in Retreat

In 2024, the $1M–$3M segment was the workhorse of Sunny Isles, delivering 71% of total sales and serving as the go-to for buyers seeking affordable luxury and quick turnover. But 2025 tells a very different story. Sales volume is down 40% year-over-year, and this once-dominant tier has seen its market share significantly reduced.

What’s behind the pullback? Buyers are increasingly bypassing this bracket in favor of newer, higher-quality product in the $3M–$6M range. Many of the properties in the $1M–$3M tier are older, with dated finishes, rising HOA fees, and looming assessments. In a market where buyers are more discerning, these factors are proving difficult to overlook.

Interestingly, the time on market for this segment remains shorter than higher price tiers, suggesting that well-positioned units can still move—if priced and presented correctly. But overall, the momentum has shifted. The value equation no longer favors older stock, and buyers are showing they’re willing to pay more for better.

Top-performing buildings in this tier (2025): Trump Towers, Ocean I–IV, Oceania, Parque Towers, with Jade Ocean entering the mix.

Advice for Sellers: If you’re in this tier and haven’t updated your unit, expect a longer wait or a necessary price reduction. Renovated units still move—but only if they align with what today’s buyer is seeking.

Takeaway: The Market Is Curating, Not Crashing

Sunny Isles Beach isn’t softening—it’s refining. The biggest shift? Buyers are prioritizing quality over quantity. Old inventory is stagnating, while newer, design-forward product is commanding strong prices and quick deals.

What’s Selling:

- New construction or fully renovated, design-driven condos

- Buildings with strong branding and high-end amenities

- Residences offering lifestyle, not just square footage

What’s Not:

- Outdated buildings with deferred maintenance

- Units with high HOA fees and looming assessments

- Properties priced as luxury, but lacking luxury finishes

Conclusions

The Sunny Isles Beach condo market is not contracting—it’s curating. While inventory is rising and average days on market have lengthened, it is not an indication of a weakening condo market, but rather a waking market becoming increasingly selective and recalibrating toward quality. Buyers today are shifting away from value-hunting to lifestyle-oriented investing— placing emphasis on refined design, finishes, and quality inventory that align with their elevated standards of luxury oceanfront lifestyle. New developments, recently-delivered buildings, and meticulously-renovated resale units are attracting the spotlight, while aging inventory is quietly slipping out of favor. This is a market that rewards quality, rejects mediocrity, and moves quickly on product that aligns with the expectations of today’s luxury buyer.

For sellers, the mandate is clear: upgrade, reposition, or risk prolonged market exposure. For buyers, the current environment presents a strategic window to secure premium

oceanfront property at pricing that remains below adjacent coastal markets.

For investors, it’s a rare opportunity to acquire assets in a market defined by rising global

interest, competitive yet stable pricing, limited land availability, and strong long-term potential—especially as aging inventory sets the stage for future redevelopment and

value growth. With a growing appetite for elevated living, high-end inventory on the rise and a limited coastline, Sunny Isles Beach remains one of South Florida’s most attractive luxury

coastline corridors and investment opportunities and demand is expected to continueto rise.

Connect with the David Siddons Group

For more specific questions or help in selling or buying a Sunny Isles property contact Nada Serry (Sunny Isles Expert and author of this report) or David Siddons at 305.508.0899 or schedule a meeting via the application below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS