- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

November 2024 – Miami Luxury Real Estate Market Update. Truths and Lies uncovered!

Podcast on Real Estate Trends and Performance for ALL the Key Condo and Home markets.

Welcome to our latest Miami luxury real estate market update. Today, we’re joined once again by Ana Bozovic, a trusted expert in the field who brings deep insight into the current trends and future outlook of Miami’s high-end market. Building on the valuable feedback from our previous discussions, we’ll dive into viewer comments, addressing questions and perspectives, including some common market critiques. I’ll be playing devil’s advocate to explore the mindset behind these views, shedding light on the factors shaping sentiment and decision-making as we approach the year-end and look ahead to 2025. Please note: this discussion is laser-focused on Miami’s premier luxury market—homes priced at $1 million and above—not the broader Florida or Dade County market. Our goal is to provide real, actionable insights, not just surface-level commentary.

Key Trends in Miami’s Luxury Real Estate Market

- Debunking Misleading Narratives – Media coverage often portrays Miami’s luxury real estate market negatively. However, the high-end sector continues to thrive, with cash transactions constituting 77% of sales and volumes up by 875% compared to pre-COVID levels.

- Shift to End-User Demand – The condo market has evolved from a focus on Latin American investors to primarily national end-users, particularly for units priced between $1-2.5 million. These buyers prioritize larger, owner-occupied units in Miami’s urban core, like St. Regis, where combination units meet rising demand.

- Strong Performance in Urban Core Markets – Areas near the urban core, appealing to primary end-users, lead in growth with limited inventory of single-family homes and premium condos. High-net-worth buyers sustain high per-square-foot prices, reflecting robust interest in luxury properties in central areas.

- Increased Competition in Beach Condo Market – In areas like Sunny Isles and Bal Harbour, rising inventory and aging properties create challenges. For sellers of older condos, renovations and strategic pricing are essential to compete with newer, premium developments, particularly in the $3-10 million range.

- Tight Luxury Home Market with Select Opportunities – Entry-level luxury homes below $2 million are scarce. Newer, move-in-ready homes in the $3-8 million range are highly competitive, while older properties benefit from updates or staging to attract relocating families and first-time luxury buyers.

- Impact of HOA Fees and Insurance – Rising HOA fees and insurance costs, especially in flood-prone areas, are crucial considerations. Prices for older homes in vulnerable areas may only reflect land value, underscoring the need for careful selection and understanding of individual building financials.

Why Negative Headlines Dominate

Miami real estate coverage often leans negative, highlighting issues over positive growth in the luxury market. Misleading media, often driven by out-of-state sources, can overshadow the strong demand and record-breaking sales in properties priced over $1 million. The focus

From Investors to End-Users: The Transformation of Miami’s Condo Market

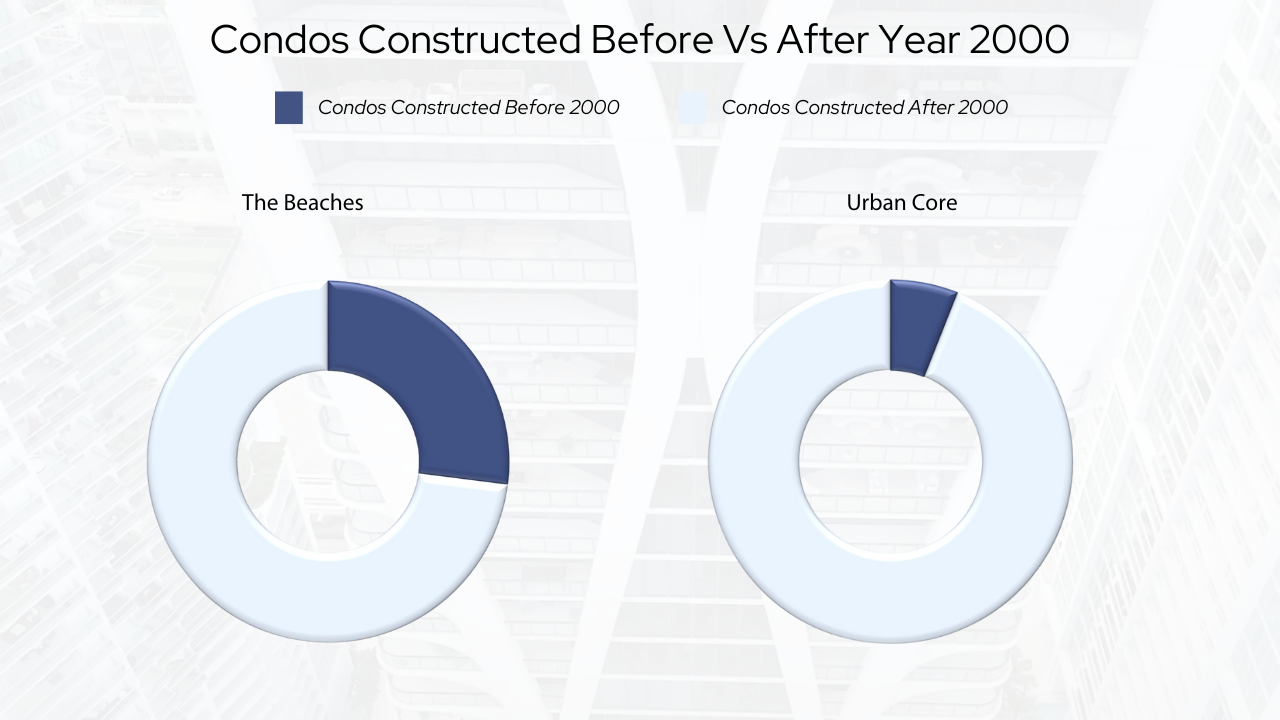

The Miami condo market is shifting from a primarily Latin American investor base to a broader national audience, driven by end-users seeking larger, owner-occupied units. Buyers relocating for financial sector jobs in the urban core are opting for combination units, as seen at St. Regis, to meet their needs. Rental and asset values are now aligning, especially in the $1-2.5M range for condos built between 2000 and 2015, where demand remains high, yet inventory is tight. The $2.5-5M condo segment is also thriving, with steady year-over-year growth. As single-family homes in comparable price ranges are increasingly scarce, owners of rental units may find end-users, not investors, as their next buyers—a trend linking the condo and single-family home markets and underscoring the need for more inventory in this active segment.

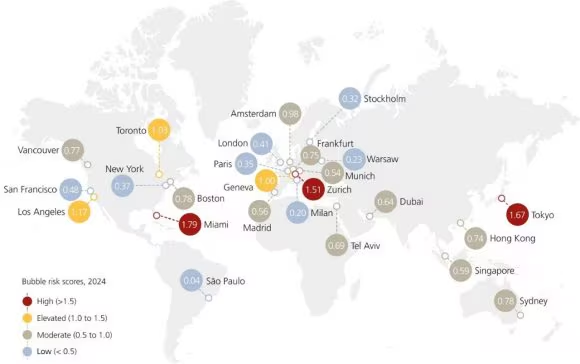

Surge in Millionaires and the Demand for Miami Real Estate

As global wealth continues to rise, the number of ultra-wealthy individuals is expanding rapidly, and Miami has emerged as a premier destination for high-net-worth residents. Demand for Miami real estate remains robust, as evidenced by a surge in inquiries flooding my phone. The luxury market is thriving, with record-breaking sales in the first three quarters, often exceeding $2,000 per square foot. Despite broader market challenges, Miami’s luxury sector is experiencing remarkable activity, with 77% of transactions made in cash and transaction volumes soaring by 875% compared to pre-COVID levels. This ultra-wealthy buyer pool is poised to sustain the high-value sales we’re witnessing.

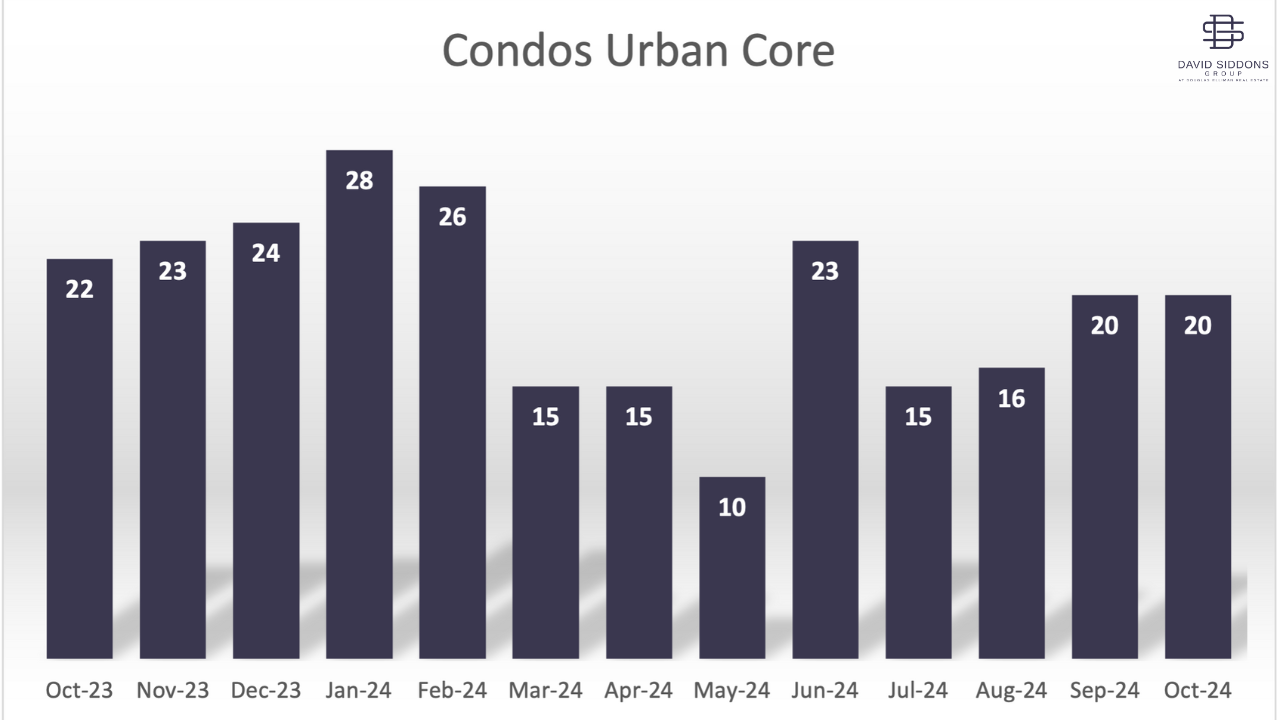

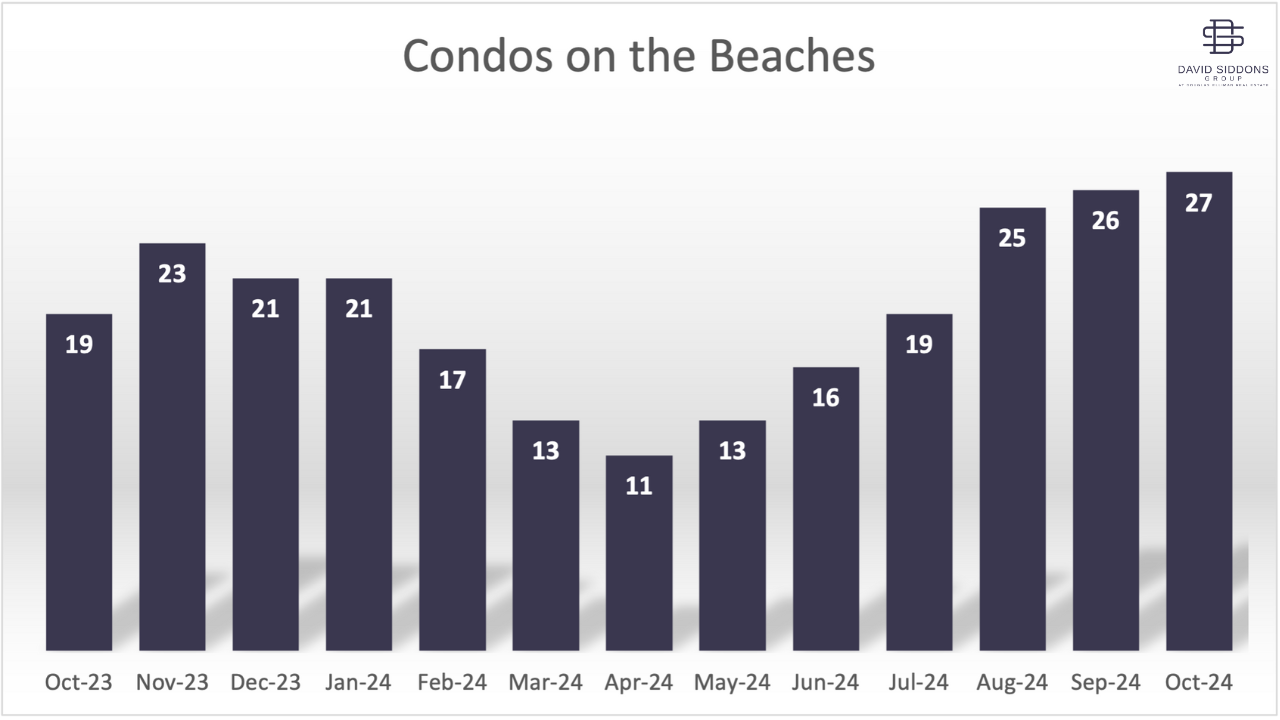

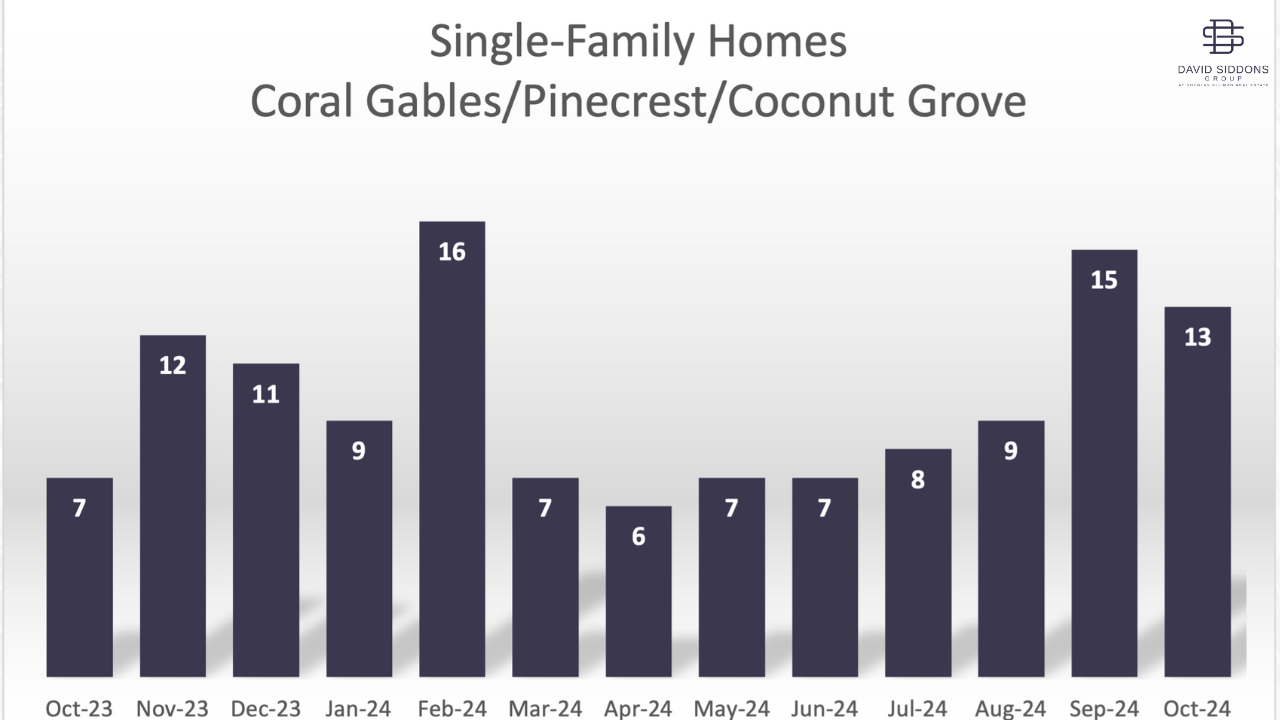

Months of Inventory across the different sections of the market

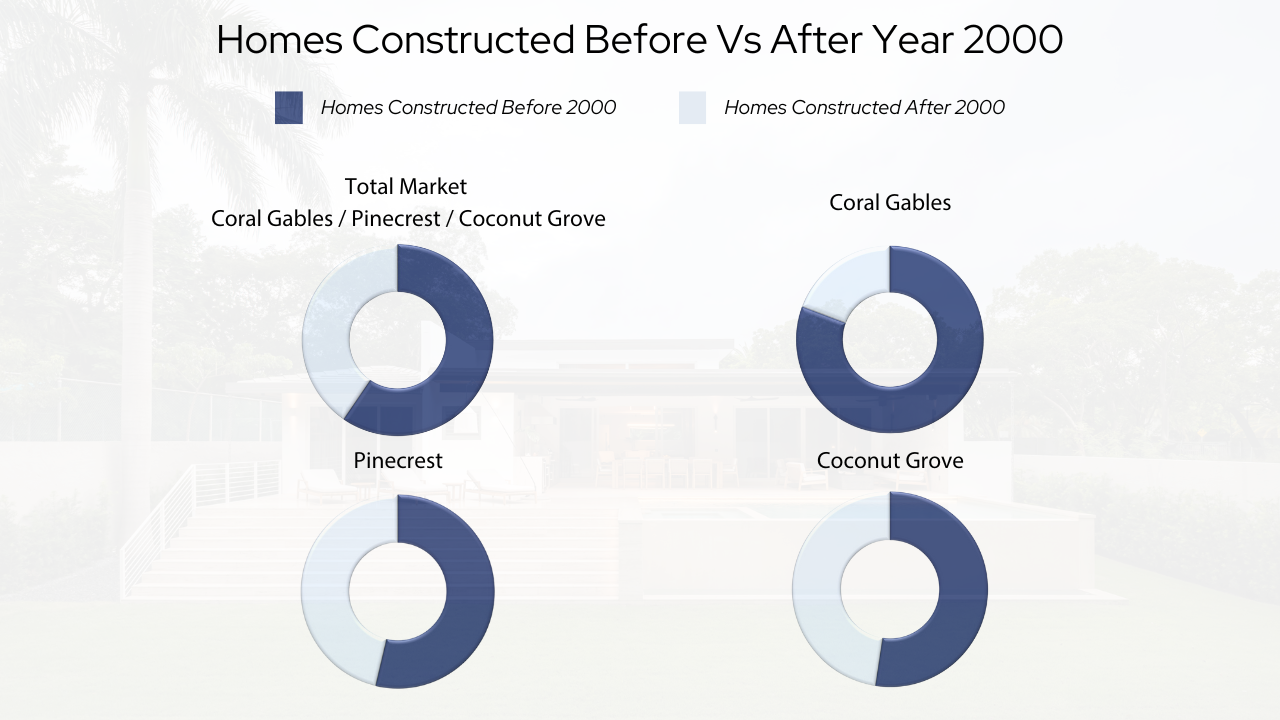

Property Age across the different sections of the market

Months of Inventory

Property Age

Understanding the Impact of HOA Fees and Insurance on Miami’s Real Estate Market

Navigating the complexities of Homeowners’ Association (HOA) fees and insurance is crucial in today’s Miami real estate landscape. Rising HOA fees have become a reality, yet fears of a “condo collapse” are largely exaggerated; median condo prices have remained stable, increasing by 1% year-over-year. While sales have dipped and inventory has risen, this doesn’t indicate a widespread crisis. Individual building performance varies widely: some older buildings with spacious floor plans, like Apogee, continue to thrive, achieving sales of up to $3,500 per square foot. Conversely, newer developments such as Porsche Design Tower, Muse Residences, and Rise in Brickell have shown mixed results.

In this evolving market, the impact of climate change poses additional challenges, particularly for properties in flood zones. Rising insurance costs can significantly reduce property values, often relegating older homes in these areas to land value alone. Therefore, exercising caution when considering homes in flood-prone regions is essential. Homes located outside these zones can mitigate risks and maintain value. Ultimately, effective market analysis requires a precise approach, focusing on specific buildings rather than generalizing across price points or neighborhoods, as the condo market is undergoing a significant transformation. While short-term challenges exist, these changes may ultimately offer long-term protections for buyers and investors alike.

Answers to Common Misconceptions

With the storms and climate challenges people are leaving Miami. According to Ana and myself this is nonsense. I speak to countless people on a daily basis that are still making the move or in the early stages of planning a move and most of the large corporates who have announced a move are still to come. This negativity often stems from identity politics and resentment towards the region’s recent success, as Miami evolves from a vacation destination to a hub for high earners. While outlets like Business Insider report a 12% drop in listing prices, their analysis may rely on incomplete data. In contrast, our reports leverage MLS data, off-market sales, and direct feedback from buyers and sellers, providing a more accurate and comprehensive perspective on the market.

There’s an oversupply of new construction. Truth is that most projects that have broken ground are already 50–60% sold, as financial backers require substantial pre-sales before construction. So, as these projects rise, they reflect actual buyer demand rather than speculative overbuilding. There is no data to support claims that values will decrease or that an oversupply of luxury condos exists. In the previous market cycle, approximately 20,000 condos were built, whereas this cycle has seen around 11,000 to 12,000 units. While the skyline may suggest significant new construction, it’s important to consider the scale of these developments. For instance, projects like Icon Brickell offered over 1,000 units, whereas today, a condo building with 300 units is considered substantial. Most current developments feature between 60 and 80 units, catering specifically to end-users. This means that the number of new buildings could effectively be condensed into a single larger structure compared to earlier cycles, indicating that the actual inventory is not as high as it may appear.

Conclusions

The markets nearer to the urban core, intended for primary end-users, are maintaining the most strength. With limited single-family homes and new condo developments, and constraints on further building, these areas are experiencing the fastest growth. As wealth and affluent buyers continue to rise according to recent census data, demand in these core areas is likely to stay robust. The high per-square-foot prices highlight strong interest in luxury properties here. When viewing the entire market in a single report, the high-end of the market often gets overlooked and this is where the Miami market is the strongest. Our luxury market is just beginning to benefit from the recent influx of wealth. Growing investments in Class A office space also signal a future need for more residential units to support this demographic shift.

Schedule time with David Siddons

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS