Aston Martin Miami is struggling with post-delivery price discovery and market stabilization, as early buyers report finishes and details that fall short of ultra-luxury expectations. Its striking location comes with practical drawbacks, contributing to longer marketing times, wider discounts, and a 14% drop in price per square foot. With 33% of units currently for sale and a 16% rental rate, high inventory is creating downward pressure on both values and buyer perception. Click here for more

- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Miami’s Best and Worst Condos in 2026 | Our Predictions per Neighborhood

Miami’s condo market in 2025 is a tale of two cities. While some buildings are soaring in value, others are quietly sinking. Understanding which condos are performing, and which are underperforming, is essential for buyers, sellers, and investors alike. As we move toward 2026, the market is expected to become even more polarized. Interest rates are likely to stabilize, but supply from new completions will rise sharply, creating opportunities in certain neighborhoods while putting pressure on overvalued projects. Resale pricing may flatten in some luxury segments while newer, well-positioned developments continue to outperform. Using the latest data from the David Siddons Group, we’ve analyzed each neighborhood to identify the top three and bottom three condos — and what their trajectories tell us about where Miami’s condo market is headed next. Here’s a comprehensive guide.

| Neighborhood | The Best Condo | The Worst Condo | See the Full |

| Brickell and Downtown | Four Seasons Residences | Aston Martin | Brickell and Downtown |

| Edgewater | Elysee | The Venetia | Edgewater |

| South Beach | Continuum on South Beach | The Mondrian | Miami Beach |

| Miami Beach | Eighty Seven Park | Roney Palace | Miami Beach |

| Coconut Grove | One Park Grove | Grove Towers | Coconut Grove |

| Surfside and Bal Harbour | Surf Club Four Seasons | Champlain Towers | Surfside and Bal Harbour |

| Sunny Isles | Estates at Acqualina | Ocean 2 | Sunny Isles |

| Aventura | Privé | 4000 Williams Island | Aventura |

| Fort Lauderdale | Auberge | Galt Towers | Fort Lauderdale |

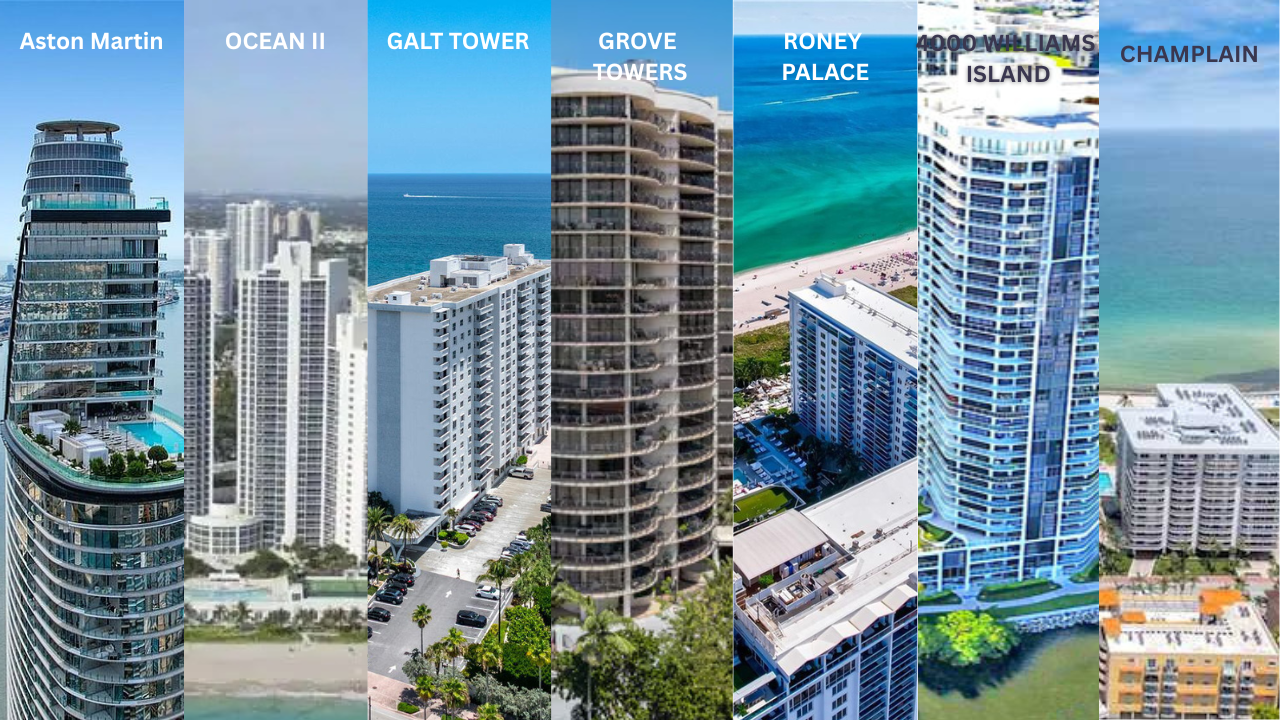

The 3 Worst-Performing Condos in Miami

Some condos in Miami are facing real challenges. High maintenance costs, huge assessments, investor-heavy ownership, and outdated amenities are common issues leading value stagnation and units lingering on the market for a long time without selling. Here’s where buyers should be cautious:

Worst Performing Condo in Brickell & Downtown: Aston Martin Residences

Worst Performing Condo in Edgewater: The Venetia

Worst Performing Condo in South Beach: Mondrian

Worst Performing Condo in Miami Beach: Roney Palace

Worst Performing Condo in Coconut Grove: Grove Towers

Worst Performing Condo in Surfside and Bal Harbour: Champlain Towers

Worst Performing Condo in Sunny Isles: Ocean 2

Worst Performing Condo in Aventura 4000 Williams Island

Worst Performing Condo in Fort Lauderdale: Galt Towers

The 3 Best-Performing Condos in Miami

Best Performing Condo in Brickell and Downtown: The Four Seasons Residences

Best Performing Condo in Edgewater: Elysee

Elysee is one of Edgewater’s most exclusive and architecturally distinctive towers, offering just 100 corner residences with sweeping bay and city views. Since its 2021 completion, prices have risen nearly 60%, stabilizing around $1,120 per square foot in 2025—well above neighborhood averages. With elegant interiors by Jean-Louis Deniot, extensive amenities, and a strong end-user base, Elysee remains Edgewater’s benchmark for boutique, high-end living. More information

Best Performing Condo in South Beach: Continuum

Best Performing Condo in Miami Beach: Eighty Seven Park

Best Performing Condo in Coconut Grove: Park Grove

Best Performing Condo in Surfside and Bal Harbour: The Surf Club Four Seasons

The Surf Club Four Seasons Private Residences is Miami’s premier oceanfront condo, offering unmatched privacy, flow-through layouts, and sweeping ocean and city views. With an on-site Four Seasons hotel, five-star amenities, and almost nonexistent rentals, it combines stability, exclusivity, and end-user demand. High HOA fees are justified by exceptional services, strong reserves, and a low-turnover community, making it a trophy asset and a benchmark for luxury in Miami.. Click here for more

Best Performing Condo in Sunny Isles: The Estates at Acqualina

Best Performing Condo in Aventura Prive

Best Performing Condo in Fort Lauderdale: Auberge

Understanding What Separates Miami’s Best-Performing Condos from the Rest

Across Miami’s most competitive condo submarkets, a clear pattern emerges between the buildings that hold and grow value and those that steadily lose momentum.

The difference isn’t luck or timing — it’s structure, stewardship, and the strength of ownership composition.

The Traits of the Winners: “End-User Fortresses”

The strongest-performing condos share a DNA built on end-user stability, disciplined financials, and intrinsic scarcity.

- End-User Dominance These towers are primarily owned by residents, not investors. Rental activity is minimal — often just a handful per year. This end-user composition creates a steady demand base and insulates pricing from the volatility of speculative sell-offs.

- Strong Financial Governance Well-capitalized associations, fully funded reserves, and proactive boards underpin confidence. HOA fees may be high, but they accurately reflect the true cost of maintenance, amenities, and insurance — ensuring the property’s integrity and long-term value.

- Scarcity + Prestige Winners share the advantage of limited resale inventory (often under 10% at any given time) and a brand or architectural pedigree that commands cultural cachet — whether through world-class design, luxury branding, or recognized artistry. This sense of rarity sustains premium pricing.

- Market Resilience Even in slower cycles, these buildings rebound first. Their buyer pool — typically ultra-high-net-worth end-users — prioritizes quality, security, and lifestyle over timing the market. Liquidity remains strong, and value erosion is limited.

→ The Result: Consistent appreciation, short days on market, and steady resale momentum through multiple market cycles.

Examples include Surf Club, Fendi Château, Oceana Bal Harbour, Estates at Acqualina, Four Seasons, Bristol, and Carbonell — all end-user-driven communities with governance and design integrity.

The Traits of the Losers: “Investor-Heavy Risk Towers”

Underperforming buildings are often trapped by weak financial structures, transient ownership, and aging infrastructure that erodes confidence and pricing power.

- Investor Saturation Buildings dominated by short-term or absentee owners tend to experience greater price volatility. When markets soften, these investors are the first to liquidate, driving prices down and compounding discounting cycles.

- Underfunded Associations & Hidden Risk Low HOA fees may look appealing, but they often signal underfunded reserves and deferred maintenance — precursors to large special assessments. Buyers increasingly view these as red flags, especially post-Surfside.

- Assessment Fatigue & Liquidity Drag Older condos (typically from the 1980s or earlier) often face 40- and 50-year recertifications, infrastructure updates, and insurance pressures. These costs, coupled with aging appeal, drive high days on market and require steep discounts to sell.

- Fading Brand Power or Product Relevance Some once-premium names — Trump Towers, Ocean II, or Echo Brickell — have lost pricing power as new developments redefine luxury with better design, amenities, and livability. Brand alone no longer guarantees performance.

→ The Result:

Stagnant or negative price growth, mounting assessments, and eroded buyer trust. Days on market extend beyond 250–300, and values can lag 30–50% behind area averages.

How Buyers and Sellers Can Identify Which Side of the Line They’re On

For Buyers:

- Look at rental ratios — fewer rentals signal stability.

- Ask for HOA financials and reserve studies — high reserves equal lower risk.

- Evaluate resale velocity — consistent, steady trades show liquidity and confidence.

- Consider design quality, brand authenticity, and maintenance culture — not just amenities.

- Study comparable price performance over 3–5 years — outperformers maintain tighter price bands through market swings.

For Sellers:

- Highlight end-user appeal, management quality, and low turnover in marketing materials.

- Address potential buyer concerns proactively (recent assessments, reserve levels, insurance).

- Price within the context of liquidity — top-tier condos trade faster but remain data-driven.

- Reinforce brand and lifestyle credibility with tangible proof: management practices, capital improvements, and community profile.

Connect with the David Siddons Group

For more information about Miami’s Best and Worst Condos in 2025, please contact David Siddons at 305.508.0899 or schedule a meeting via the application below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Close

Edit Search

Close

Share this property

Recomend this to a friend, just enter their email below.

Close

Your email was sent successfully

Close

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS