A 0.5% drop in mortgage rates typically increases purchasing power by about 5–6%, meaning a buyer approved for $2M at 6.5% could afford $2.1M–$2.12M at 6.0% with the same monthly payment. In Fort Lauderdale, this kind of shift has historically translated into a 10–15% boost in sales volume within a quarter, particularly in the $500K–$2M range where buyers rely most on financing. With today’s elevated inventory and slower absorption, a rate drop would quickly tighten supply, reduce the need for price cuts, and stabilize price per SF values. While the ultra-luxury segment sees less impact because of cash buyers, the mid-luxury market would feel an immediate lift, creating stronger competition and firmer pricing across much of the market.

- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Buy Now or Regret Waiting? How Rate Cuts Could Reshape Fort Lauderdale Luxury Real Estate.

Mortgage rates may be on the verge of shifting, and even a small change can reshape Fort Lauderdale’s luxury market. A half-point drop in rates doesn’t just boost affordability, it sparks noticeable jumps in demand, accelerates the absorption of quality inventory, and injects new urgency across every price point. For both buyers and sellers, understanding how these shifts ripple through Fort Lauderdale’s neighborhoods is essential to making the right move today.

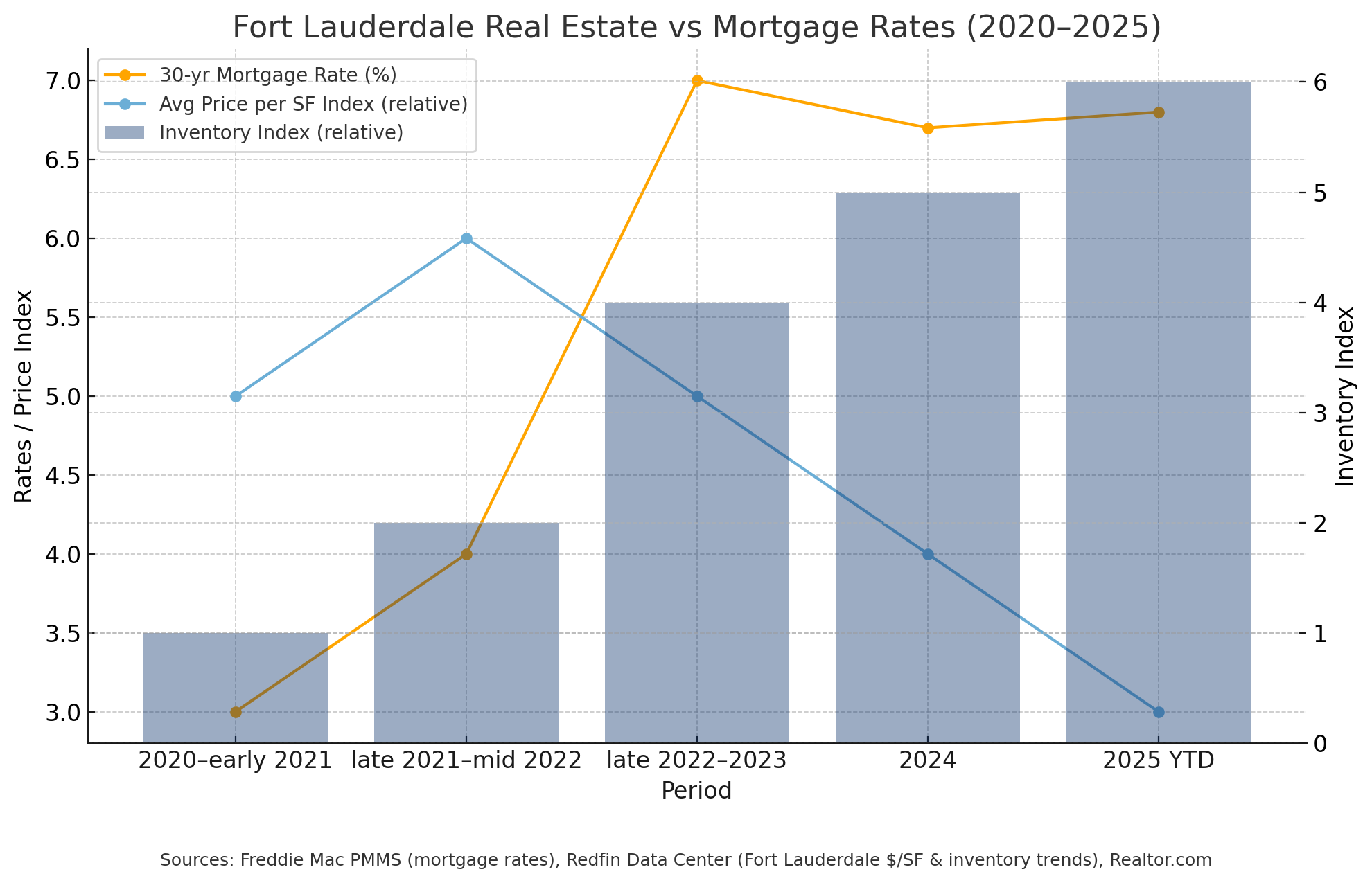

As mortgage rates climbed, Fort Lauderdale’s inventory increased and price growth stalled. Low rates in 2020–2021 drove tight supply and rising $/SF, while higher rates since 2022 have added supply and pressured prices. The chart shows how closely borrowing costs shape both demand and pricing power.

The Hidden Power of Half a Point: What It Means for Fort Lauderdale Buyers & Sellers

Will Lower Rates Push Fort Lauderdale’s Real Estate Prices Higher?

When demand rises, available supply is absorbed more quickly. The impact is strongest in highly desirable, low-inventory markets, where prices respond faster. In higher-inventory markets the effect is softer, but even there, stronger demand reduces the room for price negotiations.

Where a Small Rate Drop Creates the Biggest Buying Frenzy

Why Demand Rises Beyond the Math

In Fort Lauderdale, the $1M–$3M segment feels the most immediate boost from a 0.5% rate cut, since these buyers are more financing-dependent. But the impact doesn’t stop at entry and mid-luxury. At the top end of the market—where many transactions are cash-driven or structured through private banking—the shift is more psychological than financial. Lower rates signal stability, expand the future pool of financed buyers, and give wealthy buyers greater confidence in liquidity and resale values. The result? Decision-making on $5M–$10M+ properties often accelerates—not because affordability changes, but because sentiment shifts, creating urgency at the top just as much as accessibility at the bottom.

The Smart Buyer’s Playbook: Timing Your Move by Price Range in Fort Lauderdale”

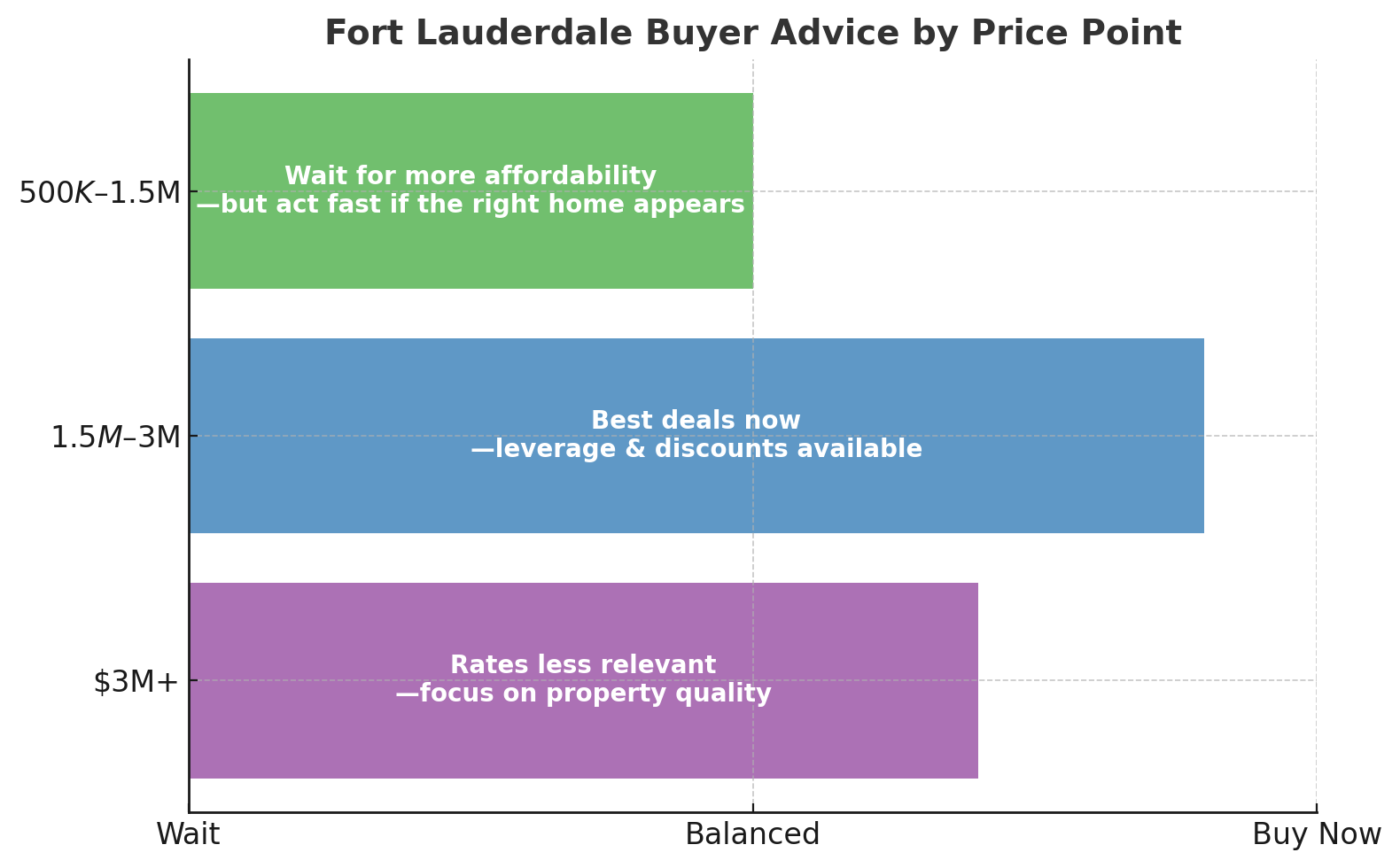

For Fort Lauderdale buyers, the impact of a rate drop depends on price range. In the $500K–$1.5M financing-heavy market, waiting for lower rates could give buyers 5–6% more purchasing power, but inventory here moves quickly, so acting now on the right property may avoid stiffer competition later. In the $1.5M–$3M segment, today’s higher inventory and slower sales mean buyers hold the leverage, with discounts and concessions available now that may vanish once rates decline — making this the best bracket to act in today. At the $3M+ ultra-luxury level, mortgage rates have little effect since many buyers pay cash, so the focus should remain on property quality and long-term value rather than timing rates. Bottom line: financing-driven buyers may gain by waiting, but risk losing negotiation power; upper mid-luxury buyers should take advantage of current leverage; and luxury buyers should prioritize the right opportunity over interest rate shifts.

Do lower rates benefit cash buyers too?

Yes—cash buyers gain from lower interest rates as well. When financing becomes cheaper, the buyer pool expands, strengthening resale values and overall liquidity when it’s time to sell. Rate cuts also boost confidence across the market, often driving prices higher, which means cash buyers who move early can capture value before demand spikes. Additionally, lower borrowing costs give you the flexibility to finance later and redeploy capital into other investments, while your ability to close quickly keeps you highly competitive when inventory is limited.

Are mortgage rates likely to drop?

Most experts anticipate a modest decline in rates toward the end of 2025 or into 2026 (Bankrate experts, Fannie Mae, Realtor.com, Morgan Stanley, NAHB). That said, a more cautious group (NAR, Forbes, and other analysts) warns that persistent inflation and broader economic conditions could keep rates elevated in the near term.

Connect with David Siddons

If you’d like a personalized strategy, whether it’s determining if now is the right time to buy or waiting for rates to adjust, or a deeper dive into specific Fort Lauderdale neighborhoods—schedule a call below or reach me directly at 305.508.0899.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Close

Edit Search

Close

Share this property

Recomend this to a friend, just enter their email below.

Close

Your email was sent successfully

Close

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS