- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Fort Lauderdale Waterfront Homes in 2025: 5 Key Insights Every Buyer & Seller Should Know

Market Summary

The 2025 Fort Lauderdale waterfront housing market shows a divided landscape. Some price points are accelerating with renewed confidence, while others are slowing under the weight of price sensitivity, overpricing, and outdated inventory. For buyers, there are clear windows of opportunity—particularly where seller motivation meets market fatigue. For sellers, pricing and presentation are more critical than ever. The story is not uniform across price brackets, and understanding your tier is essential to making smart decisions. Click here to read the Fort Lauderdale Condo Market report.

Key Takeaways: What You Need to Know

1. $3M–$6M is the most dynamic and active segment.

Sales are up 38%, homes are selling twice as fast as last year, and motivated buyers are targeting turnkey, high-quality homes in walkable, boat-friendly locations. Sellers who meet these standards are being rewarded.

2. $10M+ demand is strong, but pricing missteps are costly.

Sales have more than doubled, driven by lifestyle buyers prioritizing new construction and custom homes. Yet, 40% of listings are overpriced, and more homes expired than sold. Sellers of older homes must accept that they can’t compete with new builds on price alone.

3. The $6M–$10M tier is showing weakness despite a 55% increase in sales.

Listings in this bracket linger on the market, with many offering outdated layouts or finishes. Absorption is slow, and nearly 40% of sales were preceded by a discount. Sellers need to upgrade or reset pricing expectations to move product.

4. The $1M–$3M range is cautious and highly value-driven.

Sales are down 19%, and financing-dependent buyers are taking longer to act. Inventory is balanced, but homes that are not well-priced or well-maintained are sitting. Overpricing is common, and almost as many homes expired as sold.

5. Rising rents are validating buyer demand.

Waterfront rentals are up 32%, with a 70% surge in $5K–$15K/month leases. This reflects strong mid-luxury demand and provides both sellers and buyers a benchmark: owning still makes long-term sense, especially for seasonal users.

$1M–$3M: Stabilizing Inventory, Buyer Leverage Increases

The $1M–$3M market has cooled significantly, with sales down 19% year-over-year. Higher interest rates and buyer caution, especially among financing-dependent purchasers, have created a more price-sensitive environment. Homes that are outdated, poorly located, or have limitations like fixed bridge access are struggling to sell. Inventory has stabilized at around 10 months, signaling a more balanced market. Buyers now have more options and greater negotiating power, particularly in less premium waterfront locations. Sellers, however, face increasing scrutiny. While well-priced and well-prepared homes are still selling, the margin for error is shrinking. Notably, 46 homes expired this year compared to 75 that sold, and 21% of listings are still priced above the premium threshold. The average discount off original price is 6%, and homes are sitting longer than they did last year. Overpricing remains a major pitfall in this tier.

$3M–$6M: Sales Surge, But Standards Are Rising

In contrast, the $3M–$6M segment has seen a 38% increase in sales activity, making it one of the most improved tiers of 2025 so far. This bounce is largely driven by renewed confidence from end-users and second-home buyers seeking lifestyle upgrades. However, despite the uptick in volume, buyers remain selective, prioritizing newer builds, quality finishes, and move-in-ready condition. Properties that do sell tend to sell at double the speed as they did last year. Inventory is improving, down to 15 months from 18, yet still favors buyers. Despite this, demand for high-quality homes in walkable areas with good boating access is gaining momentum. Sellers in this range can be optimistic, but only if their home delivers on location, layout, and condition. A large portion of homes still miss the mark: 28 listings have expired this year and 31% are priced above the premium threshold. The average discount is 7%, confirming that buyers remain value-conscious. Sellers must price and present carefully to stay competitive.

$6M–$10M: Momentum Slows, But More Room to Negotiate

Sales in the $6M–$10M tier are up 55% year-over-year, but momentum is uneven. Inventory remains high, especially for homes that lack updates or suffer from awkward layouts. Median days on market have stretched to nearly a year, and despite steady pricing around $1,300 per square foot, absorption is lagging. This disconnect creates clear opportunity for buyers. Many properties, especially those sitting on the market, are open to negotiation, with an average discount of 7%. For sellers, this market demands action. If the home is not well-presented or competitively priced, it’s likely to expire. This year, 15 properties expired while only 23 sold. Sellers must either improve their product or adjust expectations to compete effectively.

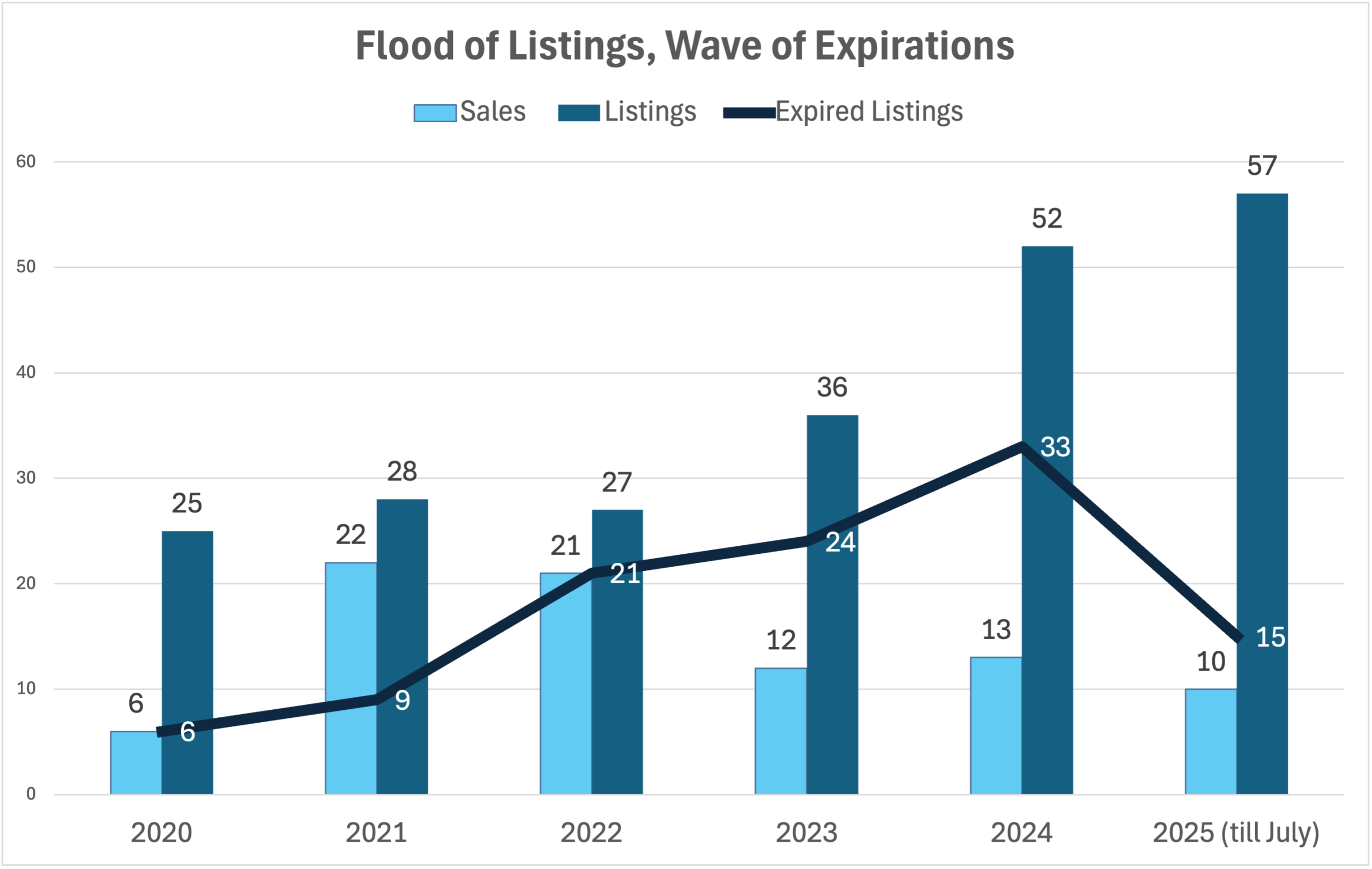

$10M+ Market: Booming Sales, Fierce Demand, But Overpricing Still Sinks Deals

At the top of the market, dynamics shift significantly. Sales in the $10M+ segment have more than doubled, yet inventory remains steady at approximately 40 months. About 40% of active listings are new construction, and these properties are selling faster and with fewer price reductions. Buyers in this tier are largely insulated from interest rate concerns; their decisions are driven by lifestyle priorities, brand appeal, and long-term functionality. Median days on market have dropped from 450 to 350, yet pricing misalignment persists. Around 40% of listings are still overpriced, and the average closing discount sits at 10%. This points to a clear disconnect between seller expectations and market reality. Tellingly, more homes expired than sold—15 expired while only 10 closed. This trend suggests many sellers, particularly of older homes, are pricing as if they’re offering new construction. The market is making it clear: that strategy doesn’t work.

- For sellers with modern architecture, luxury finishes, and distinctive water access, this is a prime moment to capitalize. Pricing has held strong, and the year’s top sale at $27.8M underscores the depth of demand in the ultra-luxury category.

- Buyers should be ready to act quickly when standout properties hit the market—competition is increasing, and high-quality supply is tightening.

Rental Market as a Benchmark – A Telltale Sign of Broader Demand

Fort Lauderdale’s single-family rental market grew by 32% year over year, with a 70% increase in $5K–$15K monthly leases. This increase indicates robust demand in the mid-luxury tier, likely driven by concerns about ownership and rising interest rates. For sellers, strong rental demand reinforces the market’s appeal and can support interim leasing strategies. For buyers, rising rents may justify purchasing sooner rather than later, especially if holding the property long-term or using it seasonally.

Buyer Psychology – Confidence at the Top, Caution in the Middle

Buyers in the $1M–$3M range are more cautious, driven by rising ownership costs and rate sensitivity. They’re taking longer to act and focus on properties that are well-maintained and well-located. For sellers, patience and flexibility are key. By contrast, buyers in the $ 10 million+ bracket remain confident and decisive. Financing is less of a factor, and decisions are lifestyle-driven. New construction, top-tier locations, and branded builds are getting the most attention—offering strong signals of where the market direction.

2025 Fort Lauderdale Waterfront Real Estate Strength & Weakness – A Tale of Two Markets

The Strongest Market

Among all price points, the $3M–$6M segment stands out as the strongest in 2025. Sales are up 38% year-over-year, and homes in this tier are selling twice as fast as they did last year. While inventory is still somewhat high at 15 months, it’s steadily improving. Buyer demand is focused and motivated—particularly for newer construction and turnkey homes in walkable neighborhoods with good boating access. Sellers who meet these expectations are seeing solid activity and relatively low discounts, making this a promising space for those pricing and presenting their homes correctly.

The Weakest Market

In contrast, the $10M+ market, despite its doubling in sales, is the weakest performing segment when you look deeper. Inventory remains stubbornly high at 40 months, and pricing disconnects are stalling sales. Forty percent of listings are overpriced, the average discount is 10%, and more homes expired than sold—15 compared to just 10 closings. Many sellers are trying to price older homes in line with new construction, and the market is rejecting that approach. While demand exists at the top end, it’s narrowly focused on modern, move-in-ready waterfront estates. The rest of the segment is suffering from overpricing and unrealistic expectations, making it the least efficient and most volatile tier today.

Conclusions

Fort Lauderdale’s 2025 waterfront market is no longer a rising tide that lifts all boats. It’s a selective, performance-driven environment where only the right product at the right price thrives. Success now depends on understanding your market tier, knowing exactly what today’s buyers want, and aligning price, presentation, and timing accordingly. For sellers, this means being strategic, not hopeful, market-ready homes in prime locations will continue to draw strong offers, while overpriced or outdated listings risk languishing and expiring. For buyers, opportunities still exist, especially in segments where inventory lingers and seller motivation is high. But when high-quality properties hit the market, hesitation will cost you.

Connect with the David Siddons Group

Connect with Elaine Tatum (305) 793-0540 or David Siddons (305) 508-0899 to learn more about the Fort Lauderdale Waterfront Real Estate market. Give us a call or schedule a meeting via the application below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS