- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

2024 Miami Real Estate Predictions and Forecast

Miami Real Estate Warnings: Will the Market show any Correction?

Introduction

All real estate markets do not continuously appreciate without pause. They experience periods of adjustment immediately after periods of extreme growth. As astounding as property appreciation in Miami between 2021 and 2023 has been, over the last six months, we have seen some slowdown. This is not only normal but actually healthy as other aspects of the buyer’s market (such as earnings) need to catch up. In Miami, this incredible appreciation period has arguably led many sellers to become over-confident, hopeful that ‘trees will grow to the sky’ and overestimate their property values as well as over-estimate buyer confidence without factoring some of the economic ‘braking’ mechanisms, such as interest rates.

Real estate professionals are often accused of overly positive hyperbole. Touting phrases like “it’s always a good time to buy”. At DSG, we prioritize honesty. If you’ve watched any of my videos, podcasts, or reports, you’ll know I’m not one to shy away from the tougher conversations. In this report we endeavor to look at the head-on reality; we discuss both the drawbacks and opportunities. Let’s begin with discussing the warning signs the market is showing us. Highlighted throughout this report in the RED font are the key warnings that we want to bring to consumers’ attention – both buyers and sellers. With that said, despite concerns in certain sub-markets and products, we are very optimistic for the Miami market in the longer term (2025 and beyond). We’ll explore lucrative opportunities later in this report, but first, we’ll provide advice aimed at safeguarding your wealth as much as growing it.

What to Expect from our Miami Real Estate Predictions

Our Miami Real Estate Forecast for 2024 is discussed in 10 individual points. Outlined below are the 10 key Miami real estate predictions, forecasts, and trends for 2024. Some points give light to opportunity and some give reference to warning. These 10 points are all part of the big picture and we will expand upon them in separate blogs, videos, and podcasts in the upcoming weeks.

In red we highlight the dangers as we see them for both buyers and sellers. Some of these are economic factors while others are psychological factors that are equally important when strategizing. Regardless, we hope that you will read this and appreciate that our knowledge and understanding of the market is of significant benefit to you in your particular process. So please consider using my service as a buyers agent or a sellers agent to make your next move, and feel free to call me to discuss.

Our commitment to clients emphasizes advice that is honest, quantifiable, and actionable. These insights are intended to benefit both buyers and sellers at local, national, and international levels. Each point is open to further elaboration, and we plan to delve deeper into these topics through our YouTube channel and Instagram. Throughout the year, we’ll track these predictions as market conditions, awareness, and economic factors like elections, interest rates, exchange rates, and stock and bond markets evolve. Probably the biggest conversation, or at least the one that everything else is currently revolving around is the current real estate paradox between buyers and sellers. Most prevalently seen in the luxury sector.

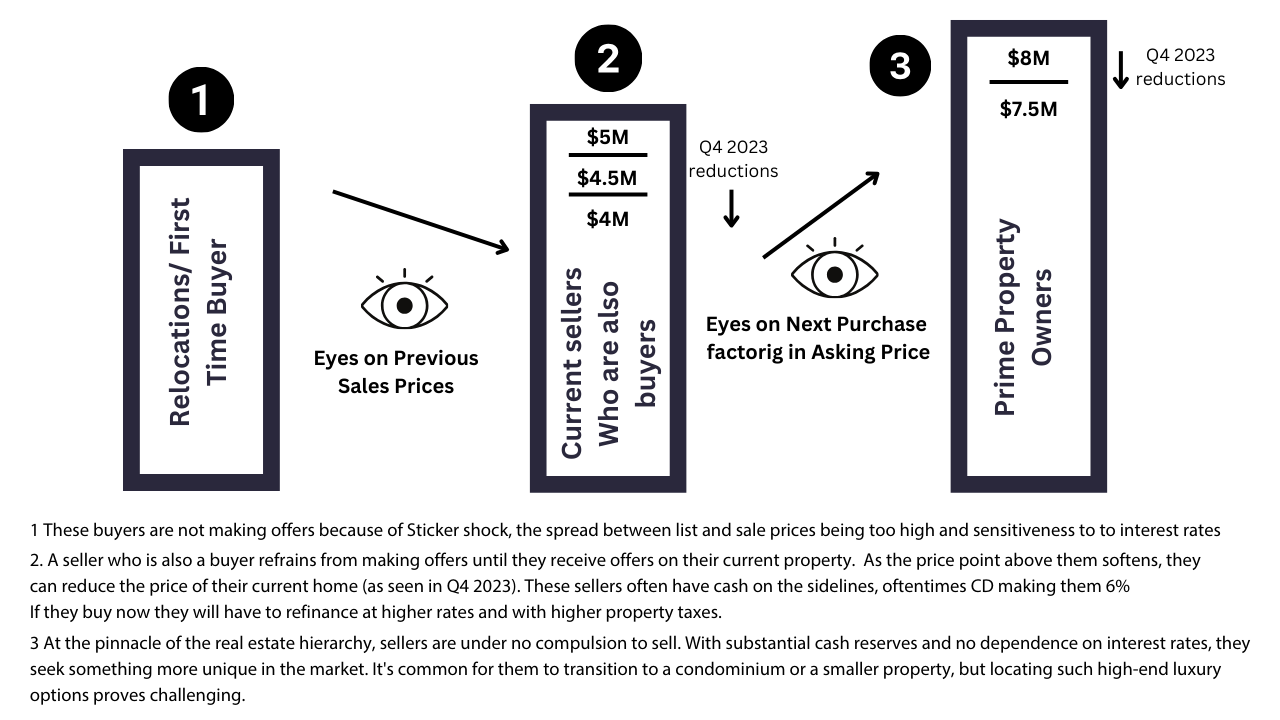

What is the current Miami Real Estate Paradox and why is it so important that you understand it?

The real estate paradox we talk about is with sellers who are not overly motivated to sell and buyers who don’t feel overly motivated to buy. This has created a ‘stand off’ in a number of markets and can well explain why we are seeing this slow down in sales with a lower number of transactions by Quarter. The reasons for this behaviour is well illustrated below in the drawing. Several variables are at play that could break this stale mate situation and we go into that with the report. Changes in Interest rates, CD returns (short term bonds yields), the urgency of migrating wealth and other asset value changes, all will play their role either short term or long term.

Buyer Psychology Associated with the Miami real estate paradox: Economic and psychological factors significantly impact the real estate market, especially in luxury property sales. Potential buyers hesitate due to observed price declines, anticipating further reductions, leading to caution and delayed decision-making. The lack of sales serves as a cautionary indicator, dissuading immediate offers.

Seller Psychology Associated with the Miami real estate paradox: At the same time, certain luxury and even not so luxury sellers deem their property exceptional and resist following market trends. However, those choosing to reduce prices are individuals serving as both sellers and buyers. They evaluate the market, noting declines in property prices, and believe they can obtain a better deal for their next home. This dual role increases their motivation to sell, driven by the opportunity to acquire a new home that has piqued their interest.

Buyers will need to appreciate that ‘replacement’ cost for many buyers is higher than ever. As property taxes will no doubt go up for that person and mortgage payments will mean substancial monthly cost increases.

Migrating buyers who are new to this market will look at sold listings, where the limited number of sales and lower dollar-per-square-foot values strongly influence their decision-making. They hesitate due to the shock of prices and the disparity between sales and asking prices. This hightlights a prevailing real estate paradigm that appears to be a significant takeaway in 2024.

1. Miami Real Estate Predictions | Prices coming down for Buyers in 2024. Overall… NOT LIKELY!

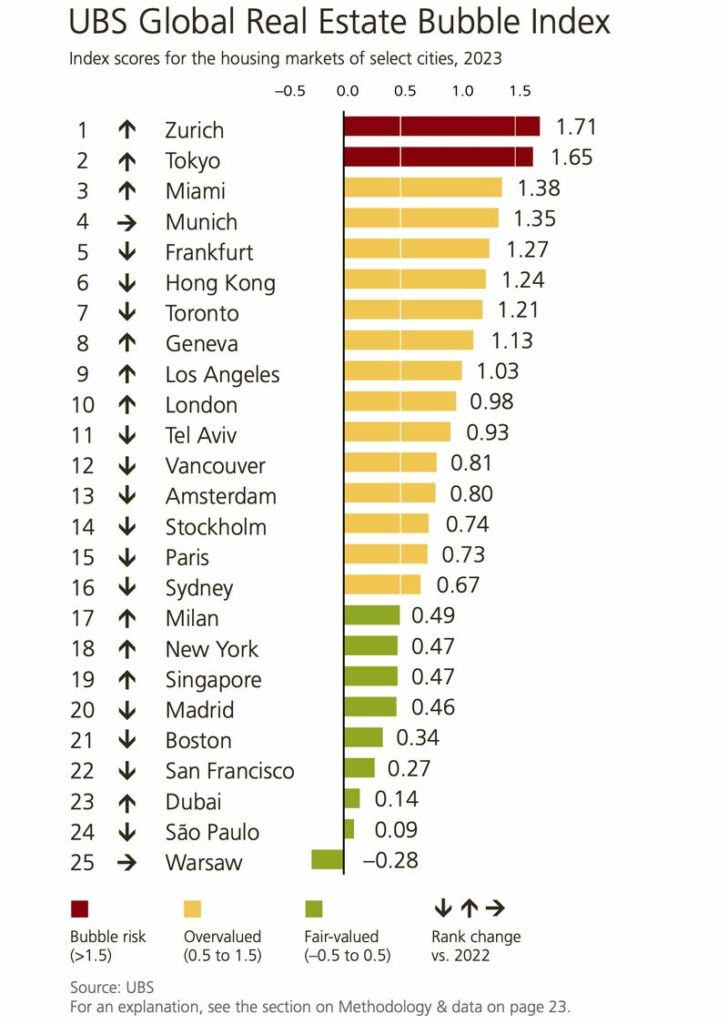

2. Are Miami Luxury properties Overvalued? In many cases: No. In some cases… Absolutely!

It’s hard NOT to think that when you consider the incredible appreciation on homes and most importantly when we are seeing a slew of properties attempting to eclipse the ‘record prices for the neighborhood’ even in the face of the new higher interest rates. Miami tops the list of overvalued housing markets in the U.S., ranking third globally in the 2023 Real Estate Bubble Index by UBS.. The city’s rapid price surges (40% in two years) and a high price-to-rent ratio contribute to this ranking. Studies from FAU and FIU place Miami among the top 15 most overvalued U.S. cities, emphasizing a potential premium paid by buyers.

However, to assume that all markets and all properties are systemically overpriced and that you are buying at ‘the top of the market’ would be a HUGE mistake. Arguments against overvaluation point to a stabilization trend, strong demand driven by lifestyle and job market appeal, and a limited housing supply preventing substantial price declines. Some proponents argue that Miami’s underlying fundamentals suggest very strong long-term price appreciation, mitigating short-term fluctuations. Despite high prices, a shift in Q1 2024 sees some sellers adopting a more pragmatic approach by reducing prices, allowing potential trade-up buyers to do the same. Systemic migration is still an overruling and all powerful influence in both the short and long term market views. Ignore these at your peril.

*Contributing Minds: Eli Beracha, Ana Bozovic and Craig Studnicky

3. Which Miami product will sell better in 2024. Condos or Homes?

When asked, ‘Which Miami Real Estate markets will be better and which will do worse in 2024? We say this….Consider the real estate paradox of buyers not wanting to pay top dollar and sellers not needing to sell and consider the Condo market and the housing market separately. Migration is systematically impacting both markets, but its effects are particularly pronounced in primary markets, as that is the primary focus of attention for those buyers who want a permanent residence in Miami. Acquiring new products or securing prime locations remains challenging. Primary product has traditionally been in the form of single family homes, but with the advent of large 3-5 bedroom Condos in Miami, many migrating buyers are looking at the ‘vertical living options’. Ultimately, success hinges on factors like location and pricing, with both avenues having the potential to excel depending on market conditions. New luxury condos are thriving due to a severe shortage of inventory. Prominent resale projects like Park Grove exemplify this trend, poised for success due to their quality and favorable location. The same happens in the housing market where location and finishes are the predetermining factors for buyers.

Secondary markets, where buyers don’t need to buy will most likely have a much worse time. As there is no direct or immediate pressure to buy (like kids going to the local school). Any seller fishing top dollar in a secondary market will most likely be met with deathly silence. We are already seeing this trend start to occur.

Finally on this point, it is worth mentioning that the much older Condos are going to have a more difficult time selling in Miami this year, and with so many pre 1990 Condo buildings in Miami experiencing sky rocketing assessments and HOA fees we anticipate corrections in a number of pockets on Miami beach and into Sunny Isles. We dive deeper into this point further down the report.

*Contributing Minds: Ana Bozovic and Craig Studnicky

4 Specific Miami neighborhoods that we expect to see corrections most occurring.

Primary markets such as Coral Gables, Pinecrest, and Coconut Grove outperform more investor-driven markets and are VERY unlikely to see systematic corrections of any kind. They may, however, seem individual corrections for overpriced properties.

5. Insurance premiums and HOA Fee hikes will ‘shake out’ many property owners.

Nearly two years ago we accurately predicted that the greatest challenge to South Florida home buying and selling was the insurance premium changes. Please check out our initial podcast with Hugo Garcia, a gentleman who used to work for the insurance companies and now battles them in court for settlements to policies!

Along with the rising costs of the insurance, which went up 30% in 2023, is the increase in HOA fees for many condo owners (particularly older condos). Although these can be enticing, they can become a poisoned chalice. We have warned owners of older homes in the flood zone and owners of older condos to be aware of this. If you are a home owner and you have not fully processed the gravity of this situation, allow me to provide a free consultation on where this is going.

Stay tuned for our follow up Podcast interview with Hugo Garcia which will happen in April, where we discuss the current 2024 state of the insurance market and what it means for your insurance premiums!!!

*Contributing Minds: Hugo Garcia

5 B. Older Condos should in many cases, be avoided are they go through major assessments with age.

With the 40 year assessment age coming down to 25 years, there are many condos who will experience crippling assessment costs on top of rising HOA fees caused by insurance premiums. Many of these buildings are inhabited by old retired couples and singles and with the rising inflation not offset up earning, you can imagine how these costs start to eat into their retirement savings and put pressure on these sellers. The reality is that although some of these condos could seem like an attractive deal, the real consequence can be dire if pool areas, terraces and the such are closed for long periods of time all while work is being done to bring the condo up to code. This can make some of these older condos unsellable.

6. They are still coming!!! Moves to Miami underway… underestimate at your own peril.

One of the most powerful forces that we believe will dwarf short term ‘murmurs’ in the buying and selling cycles of Miami real estate, is the huge migration of companies to South Florida.

So much press has been put out there in regards to the movement of business to South Florida. The ‘black swan’ event that was COVID has had real long term consequences. Although we have experienced the migration of many families and professionals, the re-establishment of major corporate headquarters takes time. In fact, it takes much longer than one might anticipate. While 176 companies have expressed the intention to move into Miami, only a handful have completed the relocation. Many more companies are in the process of moving, and once they do, the pace of migration is expected to accelerate. The delay is partly attributed to the fact that the new Class ‘A’ buildings required for these companies are still under construction or have not begun. We discussed these migration patterns in this article.

Our go to expert in this conversation is Ana Bozovik who runs Ana’s Analytics. We will be touching base with her in May to get an up to date look on the business migration phenomenon and where it is in the process.

*Contributing Minds: Eli Beracha, Ana Bozovic and Craig Studnicky

7. Real Urban and economic challenges will impact some Miami Markets as we experience ‘growing pains’. This can also spell opportunity for investors.

Every surge in growth brings along its own set of challenges, and Miami is no stranger to this reality. The rapid expansion comes with its share of difficulties that we must confront. The expansion of freeways is underway, but it has led to heavier traffic. School capacities are stretched thin, reflecting a shortage of available spots. Interestingly, the attrition rates are minimal, with less than 1% of the population leaving Miami, indicating that financial resources are staying within the city. This low attrition makes the likelihood of a correction or collapse highly improbable. Instead, it positions Miami to become more robust and resilient in the face of these challenges.

With that said some markets are going to experience challenges (like Brickell) where commuting becomes more problematic and times to get from home to office stretch further. If you are a buyer trying to figure out where to live, please call me for a consultation so I can explain the ‘big difference’ between living 1/2 miles in either direction and how that could increase time to school or home by as much as 15 minutes!

Another challenge for businesses moving to Miami with those who are employing some younger more entry-level staff is the higher cost of living. If you are an employer and are trying to figure out where to be, you need to consider the higher cost of living and rent acrosss parts of the city. It has been reported that Miami has the highest rate of inflation in the US.

With that said for investors this could spell opportunity as we see many workers start to move out further afield to buy homes and ’emerging neighborhoods’ start to develop even quicker in 2024. If you believe as we do that if emerging neighborhoods where you can still get a nice home under $1m or $1.5m. are doing well now, imagine how it will be when rates drop toward the end of 2024! We expect another spike in my prediction. Call me again, if you want to discuss the details of these emerging neighborhoods.

*Contributing Minds: Craig Studnicky

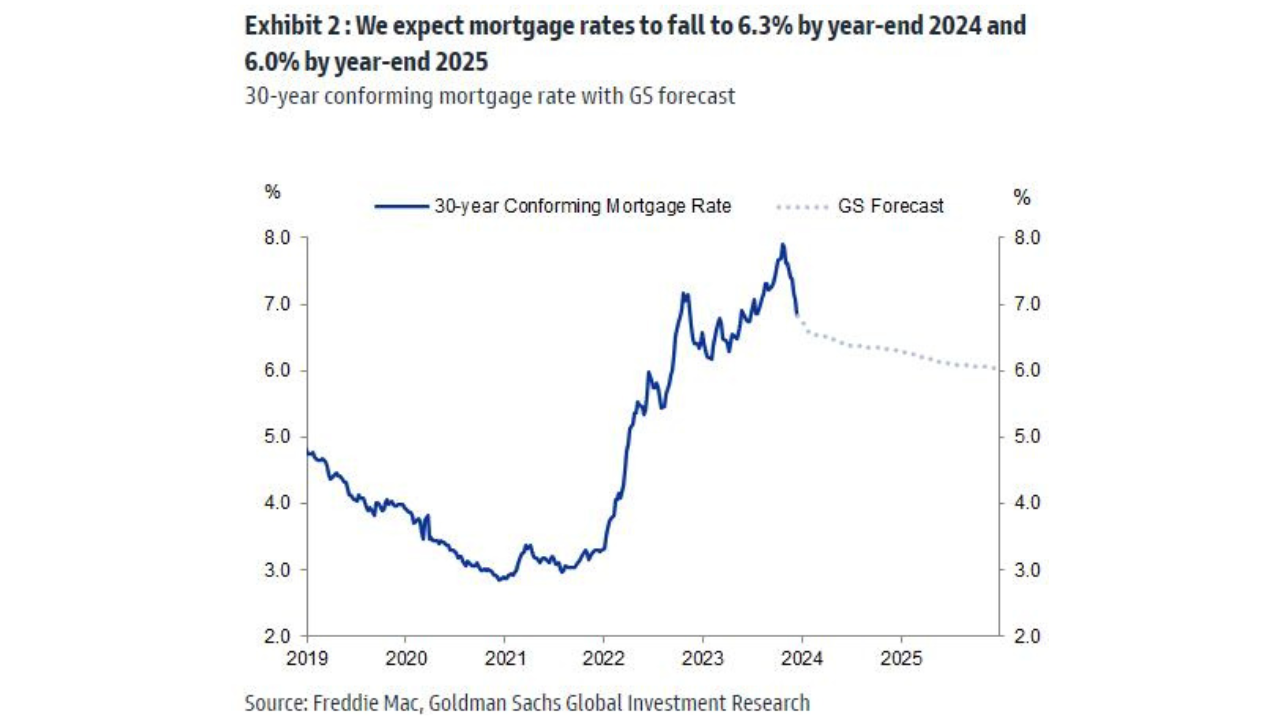

8. The Elephant in the Room! High interest rates will slow down some buyers, but not for long.

There is still so much cash floating around the system. The buyers are out there, just waiting for the right property. But as mentioned above in the real estate paradox they do not want to overpay and most certainly don’t want to meet an ‘aspirational sellers’ expectations of setting a new record in the market. Most certainly, working-wealthy buyers are being a little more aware of what they are paying.

In fact, I don’t believe it is interest rates that are creating ALL the issues on deal making in Miami in 2024, but more the appraisal process and the conservative nature of appraisers/banks is playing a huge role. They simply want to lend less. I encourage my sellers to be aware if this conservative nature and where possible take mortgage deals without appraisals or better yet cash deals. For my buyers… I flip the narrative and push for appraisals as it becomes a very useful negotiation tool down the line.

It is believed that the Federal Reserve might start reducing interest rates in 2024. Reduced interest rates will change buyer’s (and sellers) mindsets and result in the following:

- Short-term bonds will yield a lower percentage.

- Mortgage costs will decrease.

- Confidence in the market will rise, attracting more buyers.

- People who had funds on the sidelines may reconsider short-term bonds and explore alternative investment direction including real estate.

Interest rates undeniably play a pivotal role in the real estate market. When these rates decrease, a substantial amount of sidelined cash is poised to enter the market, simultaneously bolstering confidence. As I often emphasize, “Marry the house, date the mortgage.” A decline in interest rates is likely to lead to heightened competition, potentially sparking a new surge in prices. You might wait for the rates to come down by half a percent, but once that happens prices are increasing by 10% given the increased demand.

*Contributing Minds: Eli Beracha and Craig Studnicky

9. We predict, a surprisingly higher number of ‘well’ negotiable deals in plain site!

Having sold real estate for over 15 years I have experienced the ups and downs of the Miami real estate market and can tell you that in some years the ‘asking price is the selling price’. This very much happened in 2021. I do not believe that this is the case in 2024. I have had many conversations with sellers agents who tell me that they have a hard time getting their sellers to adjust the listing price, but are very negotiable. This is very much true in the luxury sector of the market.

When being hired in the capacity of a buyers agent I can tell you that I have this year negotiated some staggering discounts for my clients. Well beyond their expectations. Deals, if out there, are in plain site! You just need to know the back stories and understand the opportunities that exist. Want to understand this more? Give me a call.

*Contributing Minds: David Siddons

10. Miami New Construction Condos will dominate much of the Luxury Condo sales in 2024. Record prices for Condos will occur highest in this product class.

With more and more focus on new construction condos, this remains a relevant topic. Buying an unfinished product, not knowing what you get yourself into, might lead to headaches along the road. Be it because you walked inside the sales center without buying representation or whether you were represented by an inexperienced agent, there are risks involved. We will present you with a podcast with one of Miami’s top developers and we will discuss how well built Miami condos are, and how to distinguish the good projects from the bad ones. In addition, we will discuss whether the current wave of condos is on track to be finished on time, the importance of construction loans, and how sales are going at Miami’s newest projects.

Certain projects I advise against, while others, particularly those in the realm of next-level luxury, I am confident will thrive. The emphasis remains on attracting luxury buyers who are less sensitive to interest rates but hold a bullish stance on the Miami real estate market and its future prospects. This positive sentiment suggests that luxury new construction projects are poised for success.

*Contributing Minds: Craig Studnicky and David Martin from Terra

11. Bonus Point! The noise created from the Election can change some behaviours.

Every election cycle I see buyer and seller behavior shift as we run up to the general election. I don’t expect it to be any different this time either. We are still some way away from that, but it will happen all at once, and very often we see less educated buyers and sellers sit around waiting to see who is the next president. They stay glued to the TV, seemingly paralyzed from taking any action at all. In truth, this behavior is non sensical and has little influence or bearing in the end of buying and selling real estate in Miami. Every time, we have a ‘wait and see attitude’ then it is business as usual. I implore readers to not get caught up in this circus and look at the REAL long term influences of the market.

*Contributing Minds: Eli Beracha

Contributing Minds

We spoke to the following experts to create our 2024 Miami Real Estate Predictions.

| Contributor | Position/Title | Link to related Articles | Associated Video |

| Craig Studnicky | CEO at ISG World | Content | |

| Eli Beracha | Professor of Real Estate and Finance at FlU Director, Tibor and Sheila Hollo School of Real Estate Hollo Research Fellowship | Content |

|

| Ana Bozovic | Founder of Analytics.Miami | Content |

|

| Hugo Garcia | Managing Shareholder at Florida General Counsel | Content |

|

| David Martin | CEO of Miami-based development firm Terra | Content |

|

Schedule a Call with David

Schedule a call to discuss the Miami Real Estate Predictions or any other questions you might have.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS