- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Report That Exposed Miami’s Condo Market

The Real Story Behind Miami’s Best and Worst-Performing Condos

Miami’s condo market isn’t as simple as it looks. Some towers continue to break records, while others quietly stall, leaving buyers exposed to million-dollar mistakes. A recent Real Deal article spotlighted Miami’s Best and Worst-Performing Condos drawing from our in-depth report that revealed which buildings are truly holding value and which are slipping. This isn’t about hype or sales spin. It’s about hard data, clear patterns, and the insights buyers and sellers need to make smarter, safer decisions in one of the country’s most volatile real estate markets.

Beyond the Hype: Why We Take a Data-First Approach to Miami Condos

The goal was never to target developers or create clickbait, it was about letting the numbers speak. Too often, real estate commentary is filled with hype, where every building is pitched as “amazing” just to push a sale. This report took the opposite approach: an honest look at which condos are underperforming relative to price per square foot. That doesn’t mean a building is “bad”—in fact, for buyers, a dip in values can signal opportunity if a property is trading well below the market. It’s also important to note that performance isn’t just building-by-building, but sometimes line-by-line, with certain layouts commanding premiums that others in the same tower can’t match. By focusing on the data, the intent was to cut through the noise, avoid the pitfalls, and help buyers and sellers spot real patterns in a market where avoiding downside risk often matters more than chasing big wins.

Which Condos were Exposed as the Worst Performing Condos in Miami?

- ONE THOUSAND MUSEUM | Four-bedroom residences here typically trade between $6M and $7M, in a market that recorded only 16 other sales above $4M over the past year, most of them within the Aston Martin Residences.

- PARAMOUNT WORLD CENTER | There are a staggering 75 units for sale at this project of which 60% has been on the market for over half a year already. A sharp contrast to just 16 sales in the past year.

- MUSE SUNNY ISLES | Muse began selling at around $1,100 per SF in 2018. After a brief peak in 2022–2023 at approximately $1,600 per SF, prices have now settled back to about $1,380 per SF.

- PORSCHE DESIGN TOWER | Porsche’s resale drop is rare; from about $2,000 after launch to $1,200 per SF nowadays. Today, 25% of the tower (31 units) is for sale, with 60% listed for over six months.

- AR MANI CASA| 25% of the condo sold within two years of launch, a red flag. Even more unusual for this market, it hasn’t appreciated at all in the past four years.

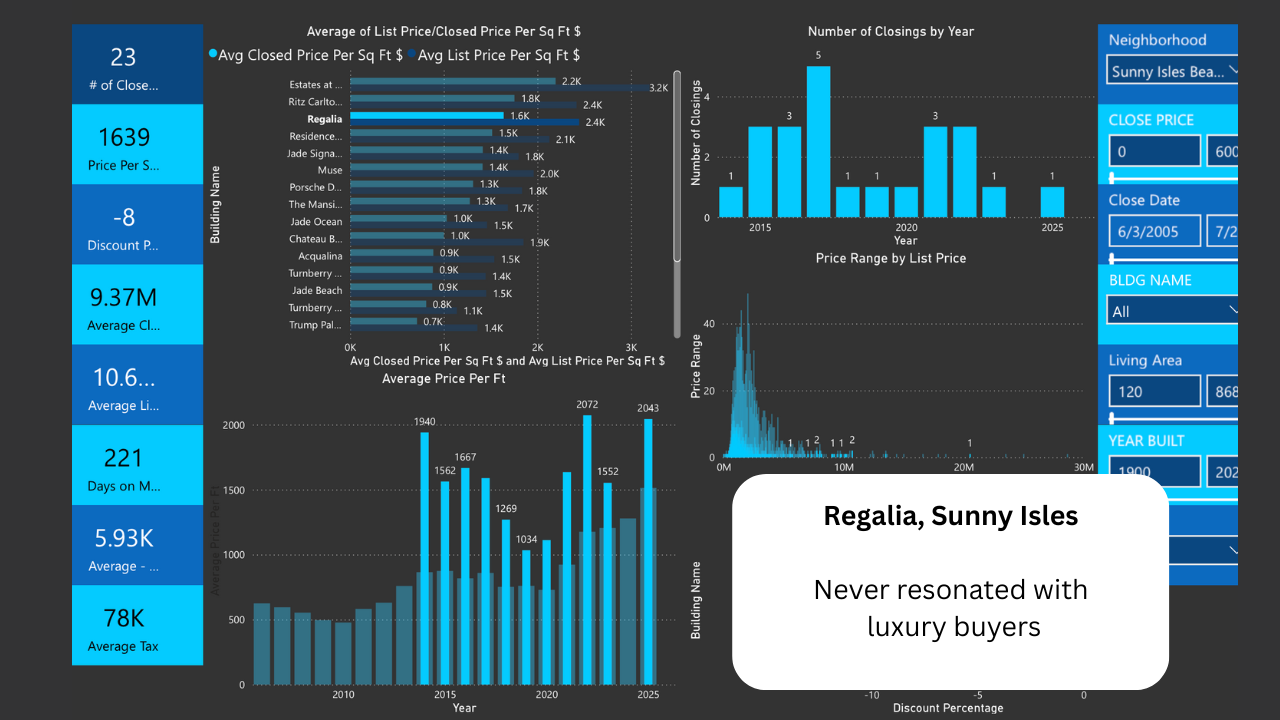

- REGALIA, Sunny Isles | The Sunny isles Condo that sees the highest percentage of discounts from its asking price. On average 15% discount was given in the last 2 years.

- FAENA HOUSE | Over the past four years, values have fallen from $3,200 in 2022 to $2,750 in 2025, while HOA fees have surged 50–60% in the

- ICON BRICKELL | While HOA fees have risen 50%, rental prices are down 5% from 2024 and 10% from their 2022–2023 levels.

- KENILWORTH Bal Harbour | Current values at the condo are about $550 per SF, the same as in 2014–2015, showing no appreciation over the past decade.

- NINE AT MARY BRICKELL | Prices are now about $550 per SF — only 16% higher than the $462 per SF seen in 2015.

- RISE Brickell City Center | Current values sit at $785 per SF, down 10% from the 2023 peak, with no appreciation recorded since 2021.

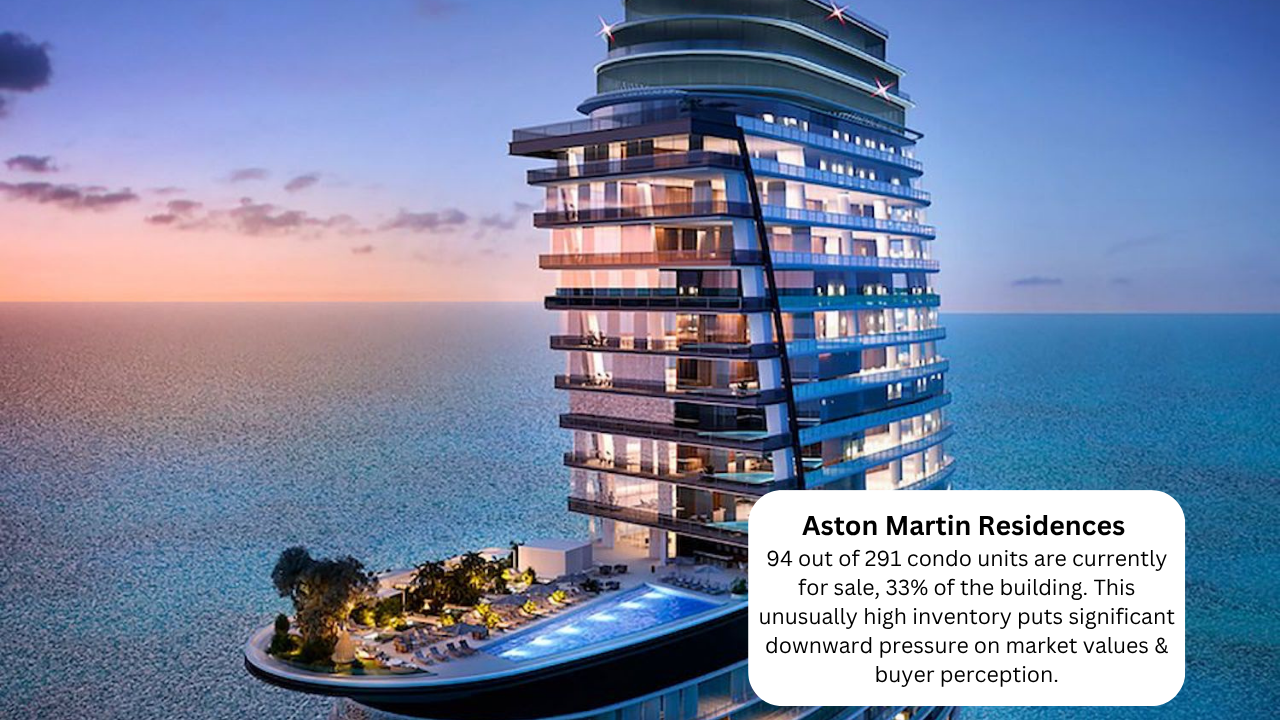

- ASTON MARTIN RESIDENCES | 94 out of 391 condo units are currently for sale, 33% of the building. This unusually high inventory puts significant downward pressure on market values & buyer perception.

The Real Metrics Behind Miami’s Best and Worst-Performing Condos

When we looked deeper into why certain Miami condos underperformed, clear patterns emerged. It wasn’t about headlines or “vibes” — it was data. Days on market, cumulative not reset; historical price-per-square-foot trends; the size of discounts from original asking prices; and how much inventory hit the market all told the real story. Add in high HOA fees, rising carry costs, and the financial strain of older buildings, and the picture became even sharper. Some developers argue that heavy resale inventory is normal for new buildings, but the difference is whether units trade above their original purchase prices or far below them. In short, it’s the fundamentals — pricing, inventory pressure, and hidden costs — that separate a condo performing well from one that quietly drains value.

The Hidden Truth About HOA Fees and Condo Carry Costs

One of the most overlooked factors in Miami’s condo market is the true cost of ownership. The HOA fees and carry costs that can make or break a building’s appeal. While developers often present early estimates, those numbers can shift dramatically once control turns over to the homeowners’ association and real costs come into play. Insurance premiums, reserves, and maintenance obligations frequently drive fees higher than buyers expect, especially in older or highly amenitized buildings. For savvy buyers, the question isn’t whether fees exist. It’s whether they’re realistic and sustainable. A building that underestimates these costs may look attractive upfront, but eventually the truth surfaces, and fees spike. In a city crowded with new and aging towers, separating healthy HOAs from ticking time bombs has become one of the most important parts of making a smart condo decision.

When the Hype Fades: What the Data Really Reveals About Miami’s Best and Worst-Performing Condos

The data shows us a truth that glossy marketing can’t hide: some condos shine long after delivery, while others fade once the hype wears off. Developers sell out and move on, but buyers are left with the realities of lawsuits, rental restrictions, inflated projections, and oversupplied markets. Time and again, we see the same patterns—investor-heavy buildings that stumble once units flood the rental pool, or generic product that depreciates like a mass-produced car. By contrast, rare, well-designed product with enduring demand, like the Surf Club, continues to thrive. The lesson is simple: history doesn’t repeat, but it rhymes. Ignore the past, and you risk repeating costly mistakes. Study the patterns, and you can separate the true winners from the properties destined to underperform.

Neighborhood Pressures, Market Cycles, and the Power of Reputation

Not every condo’s struggles come down to the building itself, sometimes it’s the neighborhood that sets the tone. Take Sunny Isles, for example: a market driven heavily by foreign buyers and second-home investors. When currencies weakened and owners needed quick liquidity, many rushed to sell, and values suffered. Contrast that with Coconut Grove, where condos are largely purchased by end-users downsizing from homes. With limited zoning and fewer buildings, demand remains steady, even when broader markets wobble.

Older building stock adds another layer of pressure, especially in parts of Miami Beach, where higher maintenance costs weigh on resale values. Meanwhile, investor-heavy neighborhoods like Brickell and the urban core often live and die by the rental market, creating volatility when too many units hit the market at once.

But the biggest factor isn’t just math, it’s reputation. Once a building gets a reputation for lawsuits, construction issues, or underperformance, it’s incredibly hard to shake. Buyers remember, agents whisper, and the market applies a discount that no amount of fresh paint or rebranding can erase. Some properties, like Apogee or Continuum, have proven they can weather any cycle. Others get stuck with a label they can’t escape—reminders that in Miami real estate, perception can be just as powerful as fundamentals.

The Formula Behind Miami’s New Construction Condo Success—and Failure

In Miami’s new development market, the margin between success and failure is razor-thin. Some developers are building at cost, essentially selling units for what it costs to construct them and betting on unsold inventory to carry the profits later. It’s a high-risk gamble, because if sales slow or the market shifts, those margins can evaporate overnight. Others face financing delays or even stall on paying commissions. Subtle signals that raise bigger questions about stability and execution.

At the same time, the flood of short-term rental products shows how uneven the playing field has become. A few projects thrive, while many others struggle to differentiate themselves, weighed down by oversupply or weak strategy. Contrast that with the rare “unicorns” like the Four Seasons or Aman Miami: these projects launch quietly, with little public marketing, but ride on quality, exclusivity, and reputation to set record-breaking prices per square foot.

The lesson is clear: new condo success isn’t just about delivering glass and concrete. It comes down to strategy, financial strength, developer credibility, and the ability to create genuine scarcity in a crowded market. Projects that master this formula win big; those that don’t risk becoming cautionary tales.

Cutting Through the Hype: Where Miami’s Condo Market Truly Delivers

Miami’s condo market isn’t one uniform story, it’s a patchwork of highs and lows. While some areas are slow, others, like Coconut Grove, are thriving, with new construction outselling resales three to one. Projects such as The Well and the Four Seasons Grove show strong demand from local buyers downsizing from houses but unwilling to leave the neighborhood they love. Grove’s appeal is real: a lush, walkable community with restaurants, marinas, and a laid-back, authentic vibe. That stands in stark contrast to glossy renderings that overpromise—depicting crystal-blue seas and endless greenery where the reality is busy streets and dense development. The truth is, Miami has both: towers weighed down by hype that doesn’t match reality, and timeless buildings like Apogee, Continuum, Park Grove, and Fisher Island that consistently prove their value. In a crowded market, separating marketing fantasy from genuine livability has never been more important.

The Key Condo Stories to Watch in the coming months

As 2025 rolls forward, one of the biggest stories in Miami real estate is which new condo projects will make it, and which ones may stall out. Reporters are closely watching developments that appear to be on hold, struggling with financing, or resorting to “fake” groundbreakings to project momentum. Some projects push dirt around without securing full funding, while others delay commission payments, raising questions about stability. In a market with rising construction costs and slower sales, the difference between a project that survives and one that folds often comes down to financing strength, sales velocity, and whether a developer can weather delays without abandoning the deal. These are the questions shaping the next cycle and the ones buyers, investors, and agents alike should be asking now.

Backlash Aside, Honest Reporting Builds Better Buildings

Reporting on these issues hasn’t always been popular, but ignoring them doesn’t make the problems go away. When stories like the “sinking buildings” piece or the recent condo performance reports hit the press, reactions were mixed. Some dismissed the findings, others bristled at the negative attention, yet many developers quietly reached out to learn from the feedback. That’s the point: honest reporting isn’t about tearing projects down, it’s about making the market smarter and the product better. Still, Miami real estate suffers from short memory , past lawsuits, construction flaws, and broken promises often get buried under fresh marketing campaigns. Unless these conversations continue, the same mistakes repeat, and buyers pay the price. Transparency may sting in the short term, but in the long run it builds trust, accountability, and stronger buildings.

Final Words regarding Miami’s Best and Worst-Performing Condos

At the end of the day, Miami’s condo market isn’t just about glossy brochures or headline-grabbing sales — it’s about understanding the numbers, the patterns, and the truths that shape long-term value. Honest reporting and open dialogue may ruffle feathers, but they help buyers avoid costly mistakes and push developers to deliver better product.

If you’re considering buying or selling in Miami, don’t settle for surface-level marketing. Reach out for a data-driven, candid conversation about which condos are truly performing — and which ones aren’t. Better decisions start with better information. Call me directly at 305.508.0899 or schedule a private consultation today.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS