- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Real Estate Market Forecast for Brickell and the Urban Core | Miami Real Estate Market Predictions for 2023

Introduction to the Miami Real Estate Market Forecast for Brickell, Edgewater, and Downtown Miami

Welcome to the Real Estate Market Forecast for Brickell and the Urban Core. The Urban Core is Miami’s most densely populated market that also happens to be completely made up of condos. These neighborhoods are also home to the highest percentage of renters across the Miami markets and have historically been one of the most volatile. We have been reporting on this market for over 15 years and have accurately predicted major previous market changes no less than three times! As always call us directly for a granular analysis of your specific situation.

These are the key takeaways from this report: The Urban Core condo market has shifted the negotiating power from a seller’s market to a more balanced one and several submarkets now favor buyers. Due to increased inventory, buyers feel empowered to walk away if they don’t receive a fair deal. The ongoing divide between buyers and sellers will persist in the near future as sales slow and inventory continues to grow. Successful sales will occur for those sellers who price their units wisely rather than trying to surpass current market trends. However, many sellers still have the opportunity to sell at record-high prices. The Urban Core condo market is undergoing some major demographic changes as wealthier migrants from NYC and Chicago are placing Brickell as their primary residence. More than 100 industry leaders are planning on relocating into the community.

With an influx of pre-construction developments, the Urban Core condo market is expected to increase in inventory, We will see this in the entry-level luxury market ($2M to $4M) and the higher, previously unserviced, ultra-luxury sector ($4M-$8M). For buyers, it is crucial to understand which building types have an advantage over upcoming new-construction condos in the next few years and which simply cannot compete. Additionally, approaching your condo search with a strategic mindset and avoiding overpaying for a property that does not offer actual value will help ensure a successful investment.

The residences at 1428 Brickell Ave. The surge of new construction condos in the urban core is expected to create an increase in inventory in the $2.5M+ condo market.

Comparing the Urban Core (Brickell, Downtown and Edgewater) to other Miami Condo Markets

Comparing the Different Price Ranges within the Condo Market in the Urban Core

Brickell

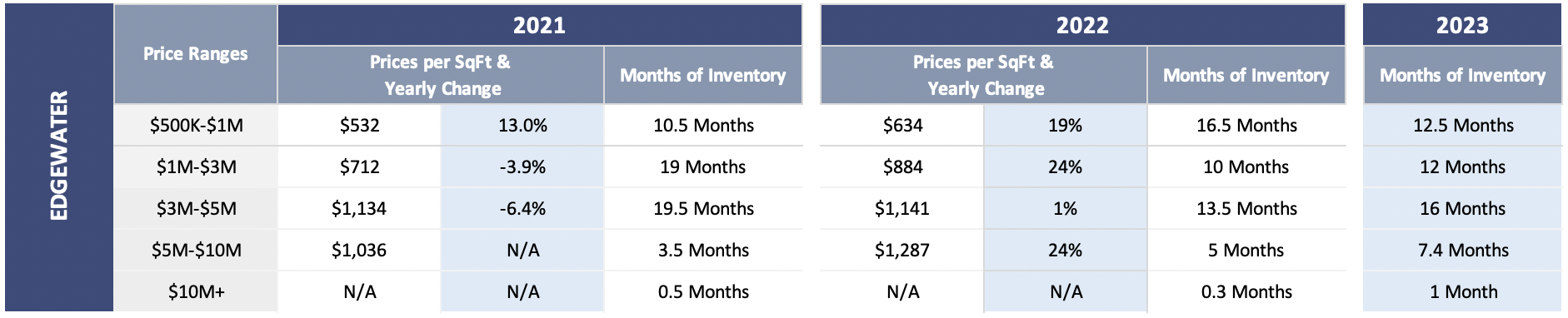

Edgewater

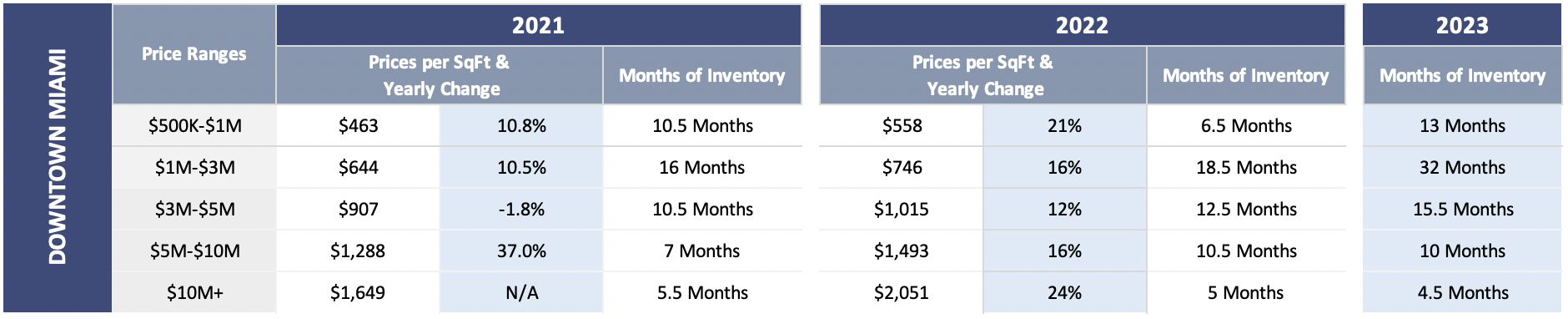

Downtown Miami

5 Granular Observations

- Merging the behavioral gap between buyers and sellers. The buy-side opportunities are slowly but surely being restored as we continue to see a rise in inventory levels. Condo units that are priced based on unrealistic benchmarks will result in inventory lingering on the market. Buyers are less emotional and more practical when it comes to acquiring a unit. They are using the relevant comparable sales as their primary pricing strategy. Sellers must recognize that Brickell and the Urban Core are traditionally made up of many investors and those that were drawn to buy in the last few years were acting and benefiting off very low-interest rates. Now that advantage has disappeared, buyers will naturally require better deals in order to satisfy acceptable cap rate returns on investment.

- Inventory priced between $1M and $3M will be most vulnerable. Condos priced between $1M and $3M are particularly susceptible to changes in inventory since most of the condos in the Urban Core fall within this price range. As of early 2023, we are witnessing faster growth in this price bracket than other sub-markets within the Urban Core. It is crucial for sellers to consider this when pricing their property strategically. This may present an attractive opportunity for buyers, as they will have greater bargaining power at these price points.

- Patience is a virtue that can provide you with value. During the market peak, many buyers were forced to overpay for their investments due to the scarcity of supply. With rising inventory levels, buyers can now choose from a broader range of options at more favorable prices. By familiarizing yourself with your preferred buildings, we can help you search both on and off the market to find the ideal unit at a competitive price.

- Remodeled units are still going for premium prices. Professionally remodeled units continue to command premium prices as buyers recognize the added costs and challenges, such as delays, shortage of labor, and elevated construction expenses that come with remodeling projects.

- We are approaching a prime buying season that presents opportunities. During mid-2022 Q2 to Q3, inventory levels surged with new market conditions entering the real estate scene, causing a drop in the absorption rate. As buyers resume their condo search, they take a more cautious approach. With the market’s continued development, we anticipate an influx of inventory in the near future.

Advice for Sellers

With rising interest rates and inventory levels, it’s important to note that selling sooner rather than later is key to maintaining seller leverage. The Urban Core condo market is expected to add over 15,000 units in the coming years, causing market saturation. Many condo owners are holding onto substantial capital gains. While you may not have sold at the market peak, selling now can still yield impressive results.

Advice for Buyers

With the market trend shifting towards a buyer’s market, starting your condo search as early as possible is advisable. The increase in available inventory presents attractive opportunities for buyers. We are at the start of a favorable market for buyers, making it crucial to ensure that you are paying a fair value for your purchase rather than a premium.

If you are a cash buyer then you will have the upper hand. Now that the market has removed a larger number of mortgage-based buyers from the arena your negotiating power has gone up and achieving previously impossible ‘deals’ will now become more realistic. This will set you up well for the future. Brickell’s commercial expansion and global positioning as a ‘financial hub’ is guaranteed and when interest rates do fall again we can expect another surge of buyers.

New Condo Construction is still very much a focus for many buyers and the impressive array of new ultra-luxury projects will provide a much-needed and refreshing alternative to the more tired older luxury Condos that Brickell and Downtown have previously had. Check out our new Condo Construction page for specifics.

Conclusions

The Urban Core condo market is now normalizing after a 2-year run of low-interest rates, which drew in enormous numbers of investors. Two distinct behaviors are emerging among buyers and sellers. As the market seeks equilibrium, buyers are becoming more cautious, stepping back and relying on comparable sales rather than overpaying. However, this shift in buyer behavior may result in inventory saturation as interest rates continue to rise, thus reducing sellers’ leverage. The market’s time sensitivity will become increasingly important as more units become available simultaneously. Inventory is expected to rise faster, with the influx of new inventory and buyers willing to let old inventory linger on the market. Brickell’s development of an ultra-luxury market for an ultra-luxury primary buyer is a sure thing as many new developments center around large luxury units at $3M++. A large buyer focus will remain as it has historically done on the newest product. As always, the Brickell market can and will most likely dip down for generic and older condos. In the long run, however, it will bounce back and take another leap forward in years to come as the product and demographic shift up with greater wealth.

FAQ

These are the most commonly asked Google Real Estate Related questions

What indicators can one use to determine whether a building is of high quality or luxury?

In which neighborhood could you find the best deals?

The Urban Core has three primary sub-markets: Brickell, Downtown, and Edgewater. Each sub-market has a variety of buildings that range in quality and price. If you’re looking for a deal, a neighborhood towards the southern pocket of Brickell is known as South Brickell. This enclave has been able to distinguish itself from the core of Brickell since the buildings are all bay-front and predominantly consist of primary or secondary homeowners instead of short-term investors. The average price per square foot in South Brickell is $543 (year-to-date), 24% less than the average PSF for Brickell’s core.

Which buildings should I avoid?

In general, one should avoid condo-hotel or short-term rental buildings as they tend to be more concentrated with investor owners rather than primary/secondary homeowners. These buildings usually have a high turnover rate and tend to create a more transient environment.

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS