- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Coconut Grove Real Estate Market Forecast | Miami Real Estate Market Predictions for 2023

Introduction to our Coconut Grove Real Estate Market Forecast

Welcome to our Coconut Grove Real Estate Market Forecast! Coconut Grove has become the darling of the relocation market. Buyers from across the country have discovered this neighborhood over the last two years, and almost all became bewitched by its quaint, organic, almost European feel. Appropriately coined as The Village in the City, buyers from across America’s best neighborhoods move here willingly and don’t look back. La Hoya, Greenwich Connecticut, West Chester, Malibu. They all settle comfortably in the Grove.

By the end of 2022, it felt like Coconut Grove was bursting at the seams. No one wanted to leave, and more families kept trying to buy. Prices have eclipsed new heights, but can they go higher?

For many local home buyers and current residents, the Grove has gotten too expensive. Many families who would move from Brickell to the Grove, now have to find alternative options. Inventory remains almost universally low across all submarkets, and the desire for new homes can only mean more old homes are bought, and tear-downs and more record land sale prices in 2023. The higher interest rates don’t seem to make a dent in this almost bulletproof market.

For the Grove condo market, we have seen huge upswings in the top end of the Grove condo sales market with Park Grove as the leading luxury condo. Mr. C has now officially sold out, and closings start Nov 2023.

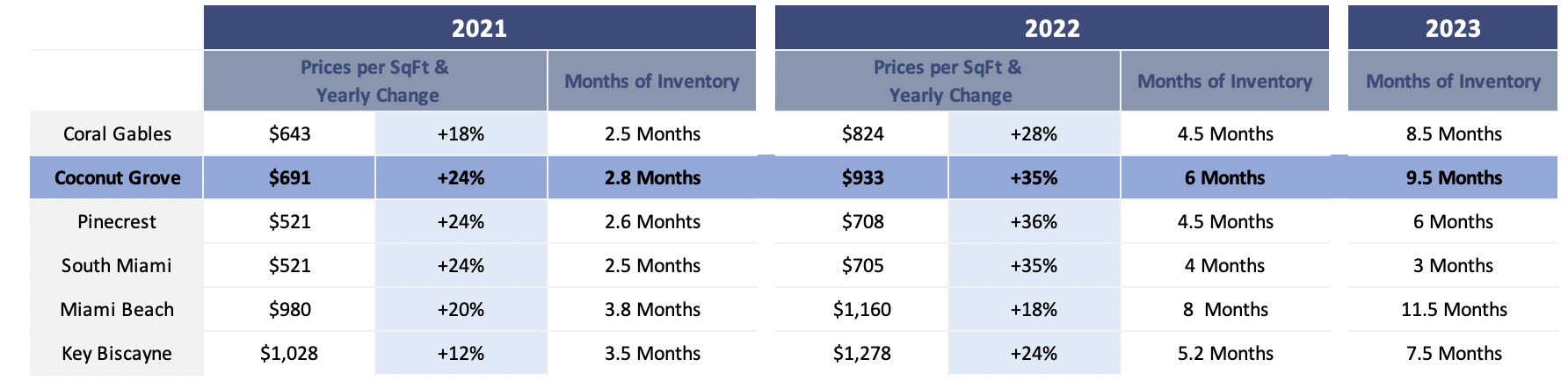

Comparing the Coconut Grove Housing Market to other Miami Markets

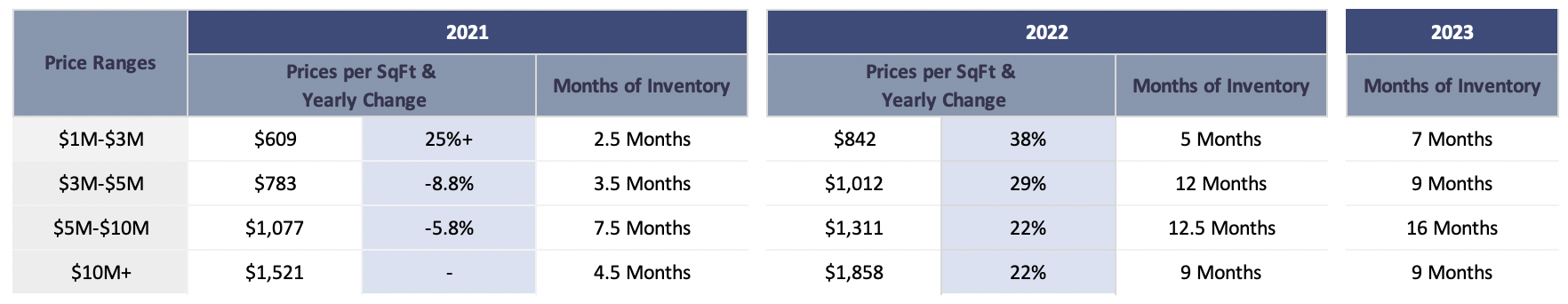

Comparing the Different Price Ranges within the Coconut Grove Housing Market

6 Observations

- Coconut Grove is still experiencing low inventory levels for single-family homes, especially quality inventory. This is the kind of market where a quality home will sell in a heartbeat. Newer, post-2015 homes start selling at $4.5M, which is the market where the highest volume of buyers is at.

- New Construction Homes are extremely scarce. This is a common observation across all the single-family home markets. The demand for new homes is high and those that are well-priced are sold very fast. The newer homes that come to market are stretching their asking prices as they know the demand for new homes is still high.

- 10% of the Current inventory is listed at $10M+. The Grove has always been an upscale market but saw fewer extremes than the Gables. Now 10% of the active listings are in the $10M+ range. All of these listings are located in gated communities, while almost half are waterfront. The Grove has seen sales prices per SF of $3,000 or more, something not often seen in Miami in pre-pandemic times. In addition, several $30M+ sales and Ken Griffith’s $106M purchase also happened in the Grove, changing people’s perspective of this market. Even dry lot homes are selling for $13M+, and now two listings at $20M+

- Coconut Grove is becoming too expensive for first-time home buyers. The properties that used to trade for $750K in pre-pandemic times are now selling for $1.6M. This market, which used to be a really good market for wealthier first-time homebuyers, now offers almost nothing for buyers looking below $2M. With this budget, the townhomes become attractive. As there is nothing available many sellers are still stretching the asking prices. This will result in surrounding markets getting more traction from buyers that cannot manage to buy in the Grove. Think of further west in Coral Gables, Shenandoah, Silverbluff, and the Roads.

- The rate of school applications doubled. Private school applications doubled in 2022, while the attrition rate is lower than ever. Signs of more people coming into Miami and fewer people being willing to leave. An indication that the market is strong, and stable for the years to come.

- The Luxury Condo Market remains almost void of inventory. Large units remain nearly impossible to track down. A severe lack of supply ensures a strong luxury condo market.

Homes

Although this is a strong market, extremely overpriced homes can still be passed over by more savvy buyers. Newer, well-finished homes can still ask for top dollar. If you own an older home, be careful if you live in South Grove and within the flood zone. You could be at risk of seeing massive jumps in your insurance premiums. This will have a direct and indirect effect on your property values.

Condos

Also an incredibly strong market. Having sold 19 units at Park Grove over the last five years, not a week goes by that I don’t get a call from another agent looking for a residence in tower 1 or tower 2. If you are thinking about selling in Park Grove, please call. If you bought at Mr. C and would consider a flip, also call. The desire for those units will also be excellent.

For all those who own real estate, please call me! You may be surprised how far you can push things without being overpriced and what options open up to you in other neighborhoods once you do.

Advice for Buyers

The Coconut Grove real estate market is still experiencing low inventory levels. As the negative media is bearish about the US housing market, buyers are underestimating the strength of the Miami market. If you are looking at older homes, there is more negotiation room than with the new product. Newer homes or well-finished homes, however, sell very quickly, and lowball offers are not even countered.

We have noticed a number of new homes that are really pushing crazy figures. That is not to say they won’t sell, but they won’t be bought by our clients! We do not want our clientele to overpay but always buy smart. If you are looking for new construction, contact me today. The market is dry, but I have access to some off-market products I can source for you.

Conclusions for our Coconut Grove Real Estate Market Forecast

The primary characteristic of Coconut Grove, combined with low supply and high demand due to ongoing family relocations, limited space, and the perfect location insulates the Grove more than any other market. For this market to lose strength, we will need to see inventory climb, which is unlikely to happen, especially given that private school applications doubled in 2022 and more and more families are looking for homes around these schools. For 2023, we project that the Coconut Grove property market will remain stable, with a slight rise in property values.

FAQ

These are the most commonly asked Google Real Estate Related questions

What is the average price for a Coconut Grove Home?

Coconut Grove homes range between $1M and $40M. The entree level price in this market is around $1.5M for a home that might be ready to move in. The average price per Sf ranges is around $950 but ranges anywhere between $850 and $1,850 per SF, depending on the price range you are looking at.

What areas are more affordable than Coconut Grove, but still close to Brickell or Coral Gables?

For more affordable or emerging real estate markets you might want to consider South Miami, Shenandoah, the Roads or Silver Bluff. Read this recent article about emerging markets, in case you would like to learn more.

How stable is the Coconut Grove real estate market?

The Grove is a primary real estate market that has seen a steady performance over the last decade. Its unique location, great schools and safety makes it very much in demand with families. On the other hand the area is very small and supply is limited. This is one of Miami’s safest markets to buy into.

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS