- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The 2024 Miami Real Estate Market Forecast

Introduction to our 2024 Miami Real Estate Market Forecast

In this podcast I’m sitting down again with Craig Studnicky, CEO of RelatedISG and market analyst, to discuss the Miami real estate market in Q3 of 2023. After a highly successful podcast on the Q1 and Q2 market, we are now sharing our observations and trends seen in Q3. We aim to provide an impartial perspective derived from conversations and data from reliable sources and our hands-on, day-to-day involvement in this dynamic industry. We aim to provide a clear picture of market trends and where this market is heading.

Mainstream news lags behind by 60-90 days in reporting real estate trends, while our content stays current, reflecting the present market conditions. Our 2024 Miami Real Estate Market Forecast provides up-to-date insights based on on-the-ground experiences and observations.

Will Interest Rates Go Down in 2024?

During our discussion a month ago, we anticipated another increase, but it did not materialize. The latest news is that the Federal Reserve decided to keep interest rates unchanged in the range of 5.25% to 5.50%. Fed Chair Jerome Powell expressed uncertainty about whether current financial conditions are tight enough to control inflation or if further restraint is needed, as the U.S. economy continues to perform well. According to the latest news, Powell mentioned the possibility of raising rates if inflation progress stalls but also emphasized the need to avoid disrupting the ongoing job and wage growth dynamic. Annual inflation remains above the 2% target, with the Fed’s preferred measure at 3.4% in September. The next policy meeting will take place in December when new decisions about rate changes will be made.

Most economists, about 94 percent of them, believe that the Federal Reserve might start reducing interest rates in 2024. A smaller group, roughly 6 percent, thinks the Fed will lower rates in 2025 or beyond. This information comes from a survey conducted by Bankrate in the third quarter.

Who is most impacted by the current high-interest rates?

In my analysis, it seems that nearly everyone is affected, but the most significant impact is observed in the single-family housing market, particularly in the $2M to $8M range, affecting the working wealthy. For instance, if we look at the overall sales in Coral Gables, they have decreased from 376 to 301, representing a 25% decline compared to the previous year. However, when we focus on the most affected group, which includes homes priced between $2M and $3M, the number of sales has dropped from 144 to 104, indicating a more substantial 28% decrease.

If we broaden our perspective to encompass the entire Miami area and consider properties falling within the $2 million to $8 million price range, we find that in the first nine months of 2022, there were 781 home sales. In 2023, this number decreased to 571 sales, marking a 27% decline from the previous year. This decline is primarily due to limited inventory and the classic stand-off between buyers and sellers. This also has an impact on the condominium market which historically tends to be more investment driven.

Inventory is Down, But Prices are Not

Home sales have been sluggish mainly due to a shortage of available homes, as some sellers are hesitant to sell, preferring not to refinance. Despite good quality homes selling quickly and prices remaining stable, finding such homes is challenging. The limited inventory has led to some sellers listing their properties more out of curiosity than a genuine intent to sell, resulting in many properties lingering on the market for extended periods.

I’m observing SF prices ranging from $1,300 to $2,000 for some properties in the Grove area, with ten currently available listings. However, only one property has sold for over $1,300 per square foot in the past six months. A similar pattern is noticeable in Ponce Davis and Coral Gables, where 15 homes are currently listed at prices exceeding $1,300 per square foot. Yet, in the last six months, only one has been sold, and two others are pending.

As a result, there’s a substantial amount of inventory just sitting there. This situation exemplifies the disconnect between buyers and sellers. Buyers are hesitant to make purchases, and sellers are reluctant to part with their properties. That’s why we notice some properties reducing their prices by 10-30%. The news might say it’s a “correcting market,” but it’s actually sellers becoming more realistic. They’ve shifted from aiming too high to being more reasonable. This situation isn’t about market correction; it’s about the difference between what sellers expect and what the market actually values.

Miami Real Estate Market Forecast: What if Interest Rates Drop?

If interest rates drop in 2024 what can we expect? According to Craig, we will see the average price of single-family homes go up 15 to 20% and that of condos by 10%. Why so much? Because there is tremendous pent-up demand. People are waiting for that opportunity. The inventory for homes is scary low and people are literally waiting to make the purchase.

There are two sides to this. Firstly, the sellers who are waiting to make a move up, but do not want to refinance at higher rates. They might now finally sell and look for their next home. In other words, current owners that are trading up and freeing up new inventory. In addition, there is the actual pool of buyers looking for a first home or those coming from elsewhere in the US. Remember we mentioned that just 63 companies of a total of 174 have moved her. Image what we have seen in the last three years was just one-third of high-earning professionals coming into the city.

Miami’s Commercial Markets Defy the National Trend

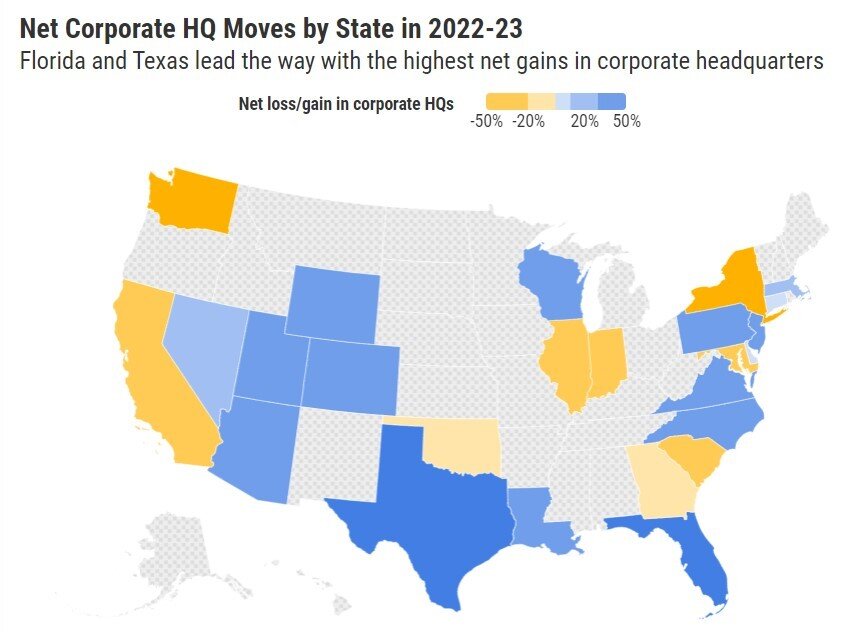

Miami is defying the national trend of empty office space. In Miami, we have a 1%/2% vacancy rate for Class A office space which is not surprising given Florida had 86% more corporations move their HQ here, compared to the number of companies that chose to move out, the highest net gain of any state! Miami is in the top 10 cities with the highest net gain in corporate relocations.

According to the NYT, New York’s office vacancy rate has surged more than 70 percent since 2019; there are some 96 million square feet of office real estate available for lease in the city, up from 75 Million SF several months ago. Delinquency rates for office loans across the United States are at a pandemic-era peak of nearly 5 percent. The same bear market is experienced in markets like Chicago and LA.

The 2024 Miami Real Estate Market Forecast: Miami to become an economic powerhouse.

More than 100 Companies are still to come!

According to Major Suarez 174 companies are moving to Miami, while only 63 of these companies are already here. The rest is still to come. We are talking big players like Blackstone, Oracle, Icahn Enterprises, Hewlett Packard, Goldman Sachs, Elliott Management, Balyasny Asset Management, Lever X, and Starwood Capital. The newest announced companies include Vanguard, the World’s Second Largest Asset Manager, Anaplan, and Guggenheim Partners. These companies need to work from somewhere and they need space ASAP. We receive more businesses than any other city yet we are behind on office space which is something we are working on.

Where will all these companies rent office space? Several new Class A office spaces have been announced

- 830 Brickell (2023)

- One Brickell City Centre

- Brickell Avenue (848 Brickell Ave)

- One Southside Park

- Tower 36

In a recent report by Barron’s, Miami is set to become one of the new economic powerhouses in the US because of its burgeoning financial center and gateway to Latin America. The Miami Real Estate Market Forecast is bullish!

Population Growth and Replacement

While the media loves to highlight how many people are leaving Miami, the truth is we are still gaining new residents. We are not just receiving more residents, we are receiving a high-earning, highly educated population. According to Smart Advisor Florida and Texas gain the most young high earners ($200K), while New York and California lose the most. Florida gained a total of 2,175 high earners aged 26 to 35 after accounting for both inflows and outflows, while Texas gained a net of 1,909. Despite the losses, New York (-5,062) and California (-4,495) still have the highest count of young high earners of any state by a wide margin.

Another Empire Center article highlights the trend of high-income households leaving New York during the pandemic and favoring lower-tax states such as Florida. This trend is reflected in the fact that in 2020, 8,841 New York filers and their dependents relocated to Miami-Dade County. Their average income was $671,075, and among them, 3,644 migrants from Manhattan had an average income of $1.2 million, as indicated by 2,515 tax returns filed by both single and joint filers. 3,600 Transactions at that level? That certainly moves the needle.

Finally, according to a report published by Henley and Partners, Miami is growing as a hub for the ultra-richwith over $10 million in investable assets. They Miami ranked 4th in millionaire growth rate over the past decade with 75%. Of that list, the most billionaires (12) live in Miami.

A Luxury Real Estate Boom Fueled by the Bullish Ultra-Wealthy

Driven by the ongoing purchases of properties by billionaires and millionaires, in Florida’s wealthiest areas, spanning from Palm Beach to Miami Beach, luxury home prices are soaring to unprecedented levels. Very high-end homes are bought up in record time and large condo units are now more desired than ever. As we mentioned in our previous report, luxury condo prices have increased by 20% as the home market has dried up.

Record-Breaking Prices in the Pre-Construction Condo Market

I actually got curious about what happened in the new construction market and started calling developers and Sales Directors. What I found is that in every single area around Miami that offers a high-end new construction condo, there was a record-breaking sale in terms of price per SF or actual price point.

| New Construction Condo | Neighborhood | Record-Breaking Sale |

| The Perigon | Miami Beach | $7,800 Per SF Penthouse |

| St. Regis | Sunny Isles Beach | $55M Penthouse |

| Cipriani | Brickell | $3,500 per SF Penthouse |

| Vita Grove Isle | Coconut Grove | $36M PH* |

| Shore Club Private Residences | South Beach | $100M PH** |

| * Vita Penthouse is under negotiation ** The Shore Club Penthouse is not confirmed officially | ||

Conclusion of the 2024 Miami Real Estate Market Forecast

Despite facing extraordinarily high-interest rates, the real estate market remains robust, supported by significant capital awaiting deployment. Only 33% of companies have completed their move to Miami, indicating an ongoing trend of businesses and high-net-worth individuals relocating. However, the market is still grappling with limited inventory. Despite these challenges, we maintain an extremely bullish outlook on the market, anticipating another surge when interest rates eventually decrease.

This positive trajectory aligns with notable figures like Warren Buffett, whose Berkshire Hathaway recently invested over $800 million in homebuilding companies, signaling confidence in tangible assets. Other major players, such as Goldman Sachs and JP Morgan, echo this sentiment, recognizing a shift towards tangible assets over high-debt stocks. Notable individuals like Eric Schmidt, Jef Bezos, and Ken Griffin actively acquiring South Florida properties further contribute to the overall optimism in the market. The main factor holding us back is interest rates.

Schedule a Meeting with David (Via Zoom or in Person)

Craig Studnicky’s Q3 2023 Report

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS