- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The 2021 Miami Real Estate Market Report | The Sustainability of an Euphoric Real Estate Market

Will The Booming 2021 Miami Real Estate Market Remain Sustainable?

Most of my buyers ask me this question: “Is this market sustainable?” and although I have answered this question in several blogs and videos, I wanted to dedicate this article specifically to this question.

The David Siddons Group flipped this property for a client who bought it for $2.4M in August of 2020 and sold it with a 20% profit in May 2021.

The Key Groups of Buyers and their Psychology

The undeniable surge of demand for Miami homes and condos mostly comes from relocation buyers. New Yorkers, Midwesterners and Californians are still flocking into Miami for what we identified as 2 key reasons: tax advantages and an enhanced lifestyle (better weather, better education, lower crime), yes I said better education! Call me and I will happily explain why, but in short it gets a little political. The people that are moving right now come from 3 definable demographic groups:

- Those looking for a home for their families; they have already enrolled their kids in the local schools and they need to buy. We still see families moving to Miami and with a very low supply, prices will continue to rise.

- Those moving their business or those looking for business opportunity / starting a business. The ‘run it from anywhere’ reality has meant the ability to live in a better environment at a lower cost with better quality of life. This includes empty nesters and those yet to even start a family.

- Those who are accomplished business owners who were looking for a second home. They realize that with the tax savings the ‘second home’ becomes a ‘first home’ reality. This crowd will still keep their place in NYC or elsewhere, but make Florida their primary residence.

- The Investors looking for a promising and growing real estate market.

The Demand in the 2021 Miami Real Estate Market

The buy up right now is born out of necessity, but what if the ‘desire’ to buy dropped? I use the word desire because it’s a strong human emotion.

The demand for Miami real estate goes down if:

- Relocation buyers cannot get their kids into schools, because there are no more spaces. This will not have a heavy impact on the buying process, maybe just a slow down. Many of Miami’s private schools are actually expanding at this very moment to be able to handle the large influx of new students.

- Tax laws will change. This is unlikely to happen any time soon.

- Businesses cannot run from anywhere. Also unlikely to happen given the new reality we live in.

The demand for Miami real estate goes up if:

- The herd repositions itself. ‘Birds of a feather flock together’. If Miami becomes the next tech hub and more companies relocate, it will only further accelerate moves as likeminded people desire to be close to other likeminded people.

- More good schools are built. The ‘Avenues school’ is set to open in 2022 and other schools are expanding campus sites to take more students: Palmer, Gulliver, Betham, Cushman are all expanding.

- Other cities remain second fiddle to quality of life in Miami. Once people move out of certain cities there is a vacuum effect where even more people want to leave.

-

For the investors the real estate market is less of a necessity and more a conversation about the right utilization of capital. Comparing real estate to other asset classes real estate makes much more sense now. At the rate money is printed, you do not want to sit on money. Stocks are at an all time high, much higher than during the dot.com bubble and well above the values just before the mortgage crisis. Although we don’t have guarantees about how high the stock market can go it definitely seems to suggest that you are buying at more of a peak than buying in the Miami real estate market, therefore making it riskier. The Miami real estate market is seeing high prices, but it is not at the same peak yet as seen during the last cycle, specially for the condo market and many of the luxury markets. Other assets such as bonds are limited as investment rates are already near a historic low. Real estate in 2021 seems still one of the best choices for investors.

Other X factors that can change the demand for the Miami Real Estate Market

Weather – What will happen if a Hurricane happens? Actually it has been seen that new development and buy up opportunities accelerate after such events, although undeniably certain areas become less desirable or more prone to insurance issues, which can detract from desirability. This question is therefore very GEO specific. Old home get torn down or are destroyed. New homes remain. Newer homes won’t be affected while destroyed homes will be snatched up. These markets will reposition themselves and see a surge in brand new homes.

Market Psychology

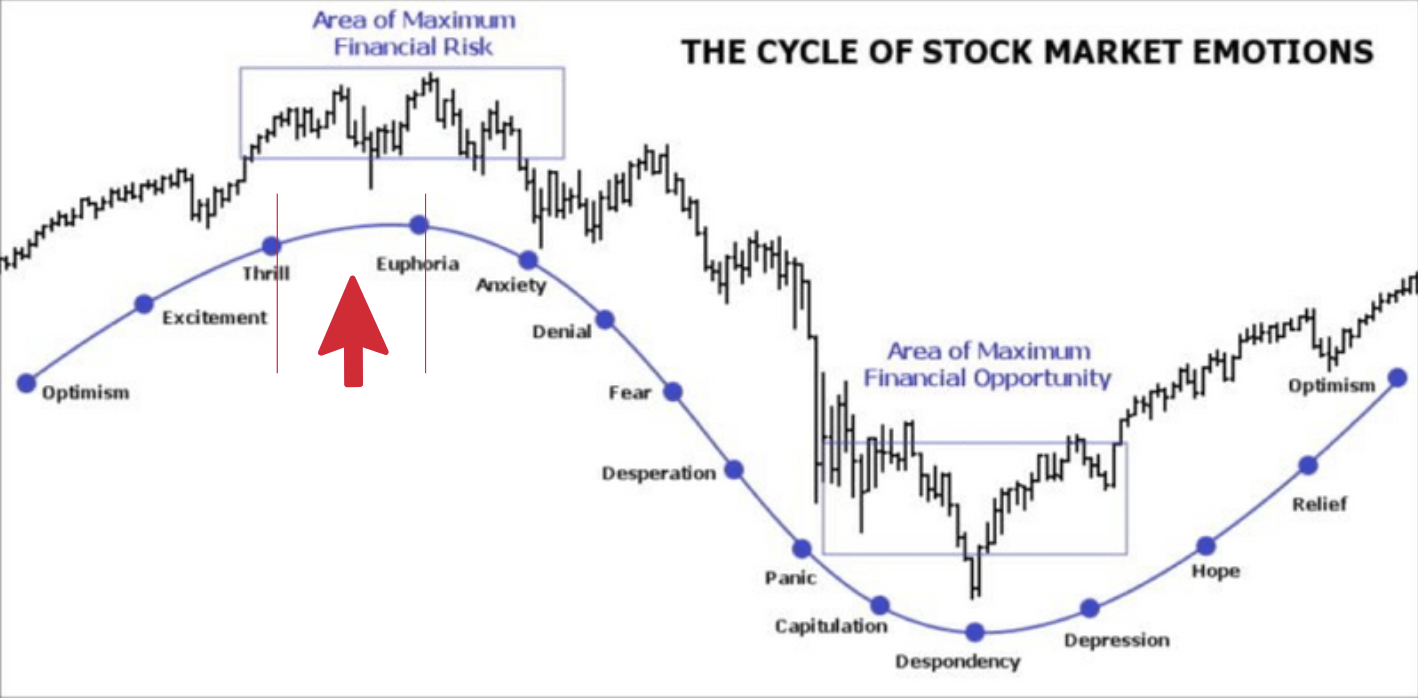

Economics is the study of human behavior as it relates to prices, markets, production, and consumption and economic cycles are a reflection of changes of human behavior and therefore a state of mind over a period of years. The emotional rollercoaster of: fear, hope, optimism, confidence, over-confidence, hysteria, calmness and back to fear. The more aggressive a market moves up or down the shorter the emotional state and thus the shorter or longer the cycle.

“EMOTIONS HAVE A POWERFUL ROLE ON OUR DECISION-MAKING AND UNDERSTANDING OUR EMOTIONS MAY BE ONE OF THE MOST IMPORTANT TOOLS TO MAKING INFORMED AND INTELLIGENT INVESTMENT DECISIONS” Ray Dalio

At the top, we feel successful, accomplished and hopeful it will last forever. The positive feelings allow us to underestimate risk associated with an investment. At the bottom, we feel depressed, despondent and foolish. The negative feelings allow us to stay on the sidelines where it feels safe. Both extremes feel indefinite when in reality, neither is true. Economies grow overtime and undergo the highs and lows of cycles.

The 2021 Miami real estate market has passed the stage of confidence and is now in the stage between thrill to euphoria. Hysteria is only sustainable for a certain moment of time. There will be a price level at which buyers are no longer willing to buy. This period of concern can, if not managed, lead to fear which will then lead to price adjustments. Fear of an overpriced market where buyers could pull back or wait until prices become obtainable. How much these prices could adjust we simply do not know exactly, but we won’t see the market crash. What we can expect is a moment of stand -off between sellers and buyers. Buyers won’t stop coming, but price negotiations will become tougher and the market will normalize.

Please keep in mind that our city is changing, more and more money is floating in and prices in Miami’s most desired residential areas will remain higher than previously seen. The core markets of Coral Gables, Pinecrest, Coconut Grove and Ponce Davis are very strong. Buyers are primary residents who in most of the cases bought their home in cash.

The Supply in the 2021 Miami Real Estate Market

Supply will undoubtedly go up at one moment, but do not expect a massive surge in sales in the main residential markets. These markets consist of primary residences and families live here all year long. This is not an investors market, this is a market based on a necessity. These markets have always been very stable and inventory levels have always been healthy.

The supply for Miami real estate can vary because of:

- Capital Gain Taxes. Sellers are asking themselves: “Should I sell or should I hold off?” Many sellers realize they can get top dollar, but do not necessarily know where to go to next. This keeps inventory at extreme low levels. A reason to sell now might be President Biden’s new tax proposition. The President is expected to propose doubling the tax rate wealthy Americans pay on investment returns when they sell stocks and other assets. Investors currently pay a 23.8% top rate on long-term capital gains, but if this new proposal becomes a law, capital gains tax might be raised to close to 40%. Those who know they’ll be selling a highly appreciated asset next year, should consider doing it now just in case capital-gains taxes do increase.

- One element to consider for sellers is the extreme ‘potential profits’ that are realized for those who bought as recently as 2 years ago or less, but have been able to sell at 25% or even more (we have seen 50% increases in values of some more unique single family residences over this time). Of course you only actually realize your profit if you do sell. Otherwise it is all hypothetical and lost if prices correct. Simply put, some homes are selling at over inflated numbers. This is to say that the market won’t go down in many cases, but outlier properties that suddenly sell at 50% more than they sold 2 years ago will become less likely. With other words, we will see less anomalies in property prices as exceptions to the rule will cease to exist. These anomalies are caused by hysteria and this will stabilize soon. Sellers can only profit from massive gains in a certain window, which is NOW. This window of opportunity will go away in the next months and the market will normalize.

This property on Royal Palm Ave sold in 2018 for $4,250,000 and just traded in June of 2021 for $6,100,000 after being on the market for 3 days.

- Rental market – one of the biggest problems we have seen is the extreme shortage of rental properties. One of the reasons I have observed why many high-end home owners won’t sell now is because the rental market is crazy. As one client explained: “I love the idea of selling at $1M above the market, but it does not make sense if I have to then spend $400,000 on rent and then buy my next home at an elevated price point.” As property owners are rarely moving out of town and as the next price point / level is affected across the board, these properties do not sell in a vacuum. It’s a knock on effect. As I describe to clients it’s like slow moving traffic, that turns into a traffic jam that turns into a car pile up. Buyers are coming physically and ‘psychologically’ into the market at great speed, but sellers are leaving at a much slower speed.

- New Builds – Those who sell often move up into a different neighborhood, gated community or waterfront property. They buy a new construction home, a shell home or a rehab home to then create their dream property. There is a huge appetite for new homes, but pent-up demand means it will take 3 years to build a new home and these new homes are being far more expensive as the cost of construction is 30% higher than 18 months ago. There is also a shortage of labor and in the US as a whole we are experiencing a 5 year shortage of new homes. In a year from now new construction homes may become more stable and we might see less extreme price points.

- New Condos- Unlike the last cycle we have far fewer new condos than before. During the last economic cycle 30+ new condos were announced, many of which were generic units. 10,000’s Of units flooded into the market. This cycle we see very limited new condo product (Mr C Residences, Monad Terrace, Waldorf Astoria, Five Park, Eighty Seven Park, 57 Ocean). Furthermore the condos in this cycle are more high-end, larger and better finished. With other words they are being constructed for primary residents. These new condos are also more boutique style condos with a lower density.

- The unknown factor- due to the Champlain Towers, potential buyers will move away from older buildings and focus on newer condos. It takes many years to build new condos and oceanfront lots are getting scarcer and scarcer. Newer condos will do better as supply is limited and there will be more demand. Another consequence of this might be that potential buyers shift to homes.

Conclusion of the 2021 Miami Real Estate Market Report

We are economists, but because we are on the ground selling real estate we talk to buyers and sellers every day so we know their psychology. We represent buyers and sellers and therefore we provide for transparent, unbiased information for both groups.

It is important for sellers to know there is a window of opportunity right now to sell for top dollar. This window will soon be gone. Yes we know it’s hard to find the same property elsewhere, but there is opportunity now to cash in and to buy a bigger/better home elsewhere. We have helped several clients with this upgrade and we have personal experience with this. Both me and one of my top agents have just sold the family home and bought land or a shell home to create the ultimate dream home for our families.

For buyers we advise that it is ok to buy but don’t drink the Kool Aid. You will end up overpaying. The market is selling at high prices and most of these high prices can be justified. There are however sellers that are just testing the market and asking for outrageous prices. You do not want to buy at the peak prices! We help clients go off-market, but that doesn’t mean you have to overpay. We protect our clients and we warn them when they are overpaying.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS