- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Smart Strategies for Investing in Miami Real Estate | Part 1 Investing in Miami Condos

Investing in Miami Real Estate | Understanding the Economic Cycle and Identifying the Right Miami Condo Investments

We have been analyzing the Miami real estate market for more than 10 years now. We are always analyzing the Miami real estate market, forecasting the market and educating our buyers and readers on this very market. We don’t just look at property level comparing one condo to the other, instead we always try to give our readers and buyers a more holistic view of the Miami real estate market. Every day we get phone calls from potential buyers asking whether today is a good day to start investing in the Miami condos for sale. They want to know where in the economic cycle we are and whether they will be buying at the right price.

We will look at the economic cycle of the Miami Real Estate Market in the last 10 years to give you a better understanding of investing in Miami real estate. This specific vlog/blog discusses Investing in the Miami condo market, we will follow up with a blog on Investing in the Miami Single Family Homes market. Both markets are completely different animals that work in completely different ways.

Investing in Miami Condos for Sale | The Economic Cycle

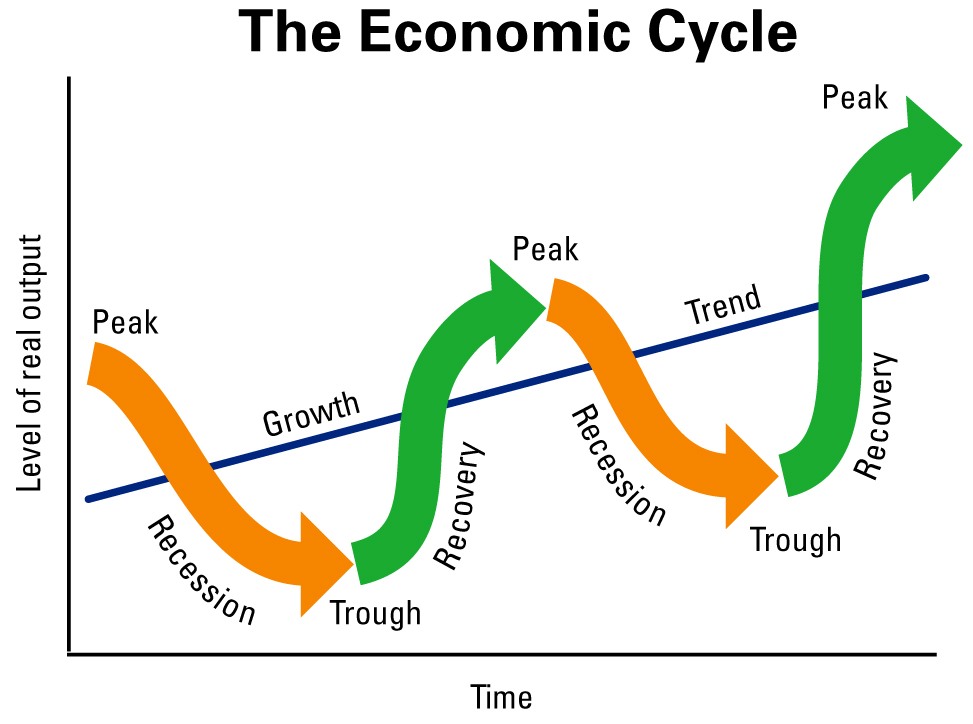

Economic cycles work in waves, they go up and down while increasing from cycle to cycle. Each peak will be higher than the next peak, while each low will be less low than the previous low.

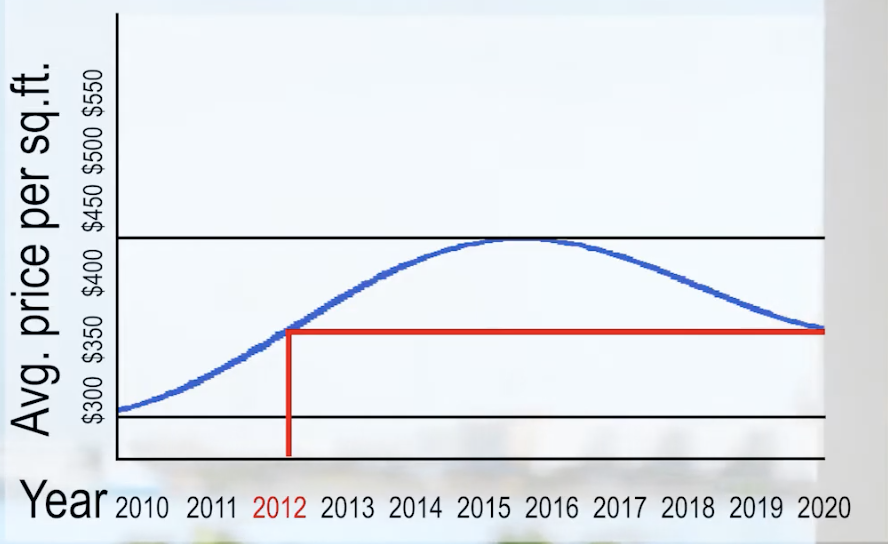

Miami’s economic cycle started to rise in 2010 after the recession years of 2007 and 2008. In 2010 Miami’s real estate market boomed and we saw an aggressive rise in prices towards 2015. Depending on the neighborhood we are talking about, the general peak was near the end of 2015 and start of 2016. This is essential to know in order to establish the price range we will need to work with. We have to look at the base and the peak of the previous cycle to see the baseline of this cycle and to establish how much range we have. As we are currently on the downturn of the cycle (For condos), I’ll project back (see the below picture on the right) and look at 2012 as a baseline. The price levels of 2012 should then give me a good guide of how much I should want to pay in 2020. I need to make sure I do not pay more than the 2012 baseline prices.

Text book example of an Economic Cycle

Establishing and extrapolating a baseline in the Miami Real Estate Cycle

Miami Condo Investments: Identifying the right product

I follow several rules when I guide my clients with their Miami condo investments. Some of the most important ones are:

- Avoid generic product

- Focus on unique, waterfront product

- Look for robust buildings with primary residents

Miami Condo Investments | Avoid Generic Product

If you follow this blog you might have read this 100s of times before, but it is so essential!

When looking at the Miami condo market look for non-generic product! What is generic product? Generic condos are those thirteen in a dozen condos that do not offer anything unique. In the Miami condo market these are the typical 1 or 2 bedroom condos ranging between 700SF and 1,000SF that offer nothing special. They do not have exceptional features such as large balconies, great views, superb locations, high-end finishes etc.

Standard condos (often sold as luxury for elevated prices) are those who will suffer most when the economy suffers. It is the kind of product that is bought up in mass by investors and is destined for the rental market. Generic product will always get crushed. It will never have the same level of appreciation or growth as unique condos even when the market is peaking, because there is simply too much of it. You will be able to get good deals here, but your buyers will most likely be investors who will not live in the property themselves. These units are economically fragile.

Miami Condo Investments | Focus on Unique Miami Condos for Sale

I always encourage my buyers to go for the larger and unique units. Those units that are destined for primary residents, where individuals or families would like to live all year round.

These unique condos offer unique features that makes them stand out in the crowd: condos in superb locations, unobstructed water views, condos that offer unique floor plans or buildings with high-end finishes. For specific units you should focus on flow-through units, corner units, units with extra high ceilings, large terraces, the best views and penthouses.

Unique, stand out product will appreciate over time, because what is hard to replicate is most desired and scarce! Therefore it is very important to know that even in good condos there are bad floor plans. When buyers ask me whether condo X is a good investment, my standard answer is: “That depends on the floor plan”. A condo may outperform all other condos with certain lines, but if you own the least performing line this doesn’t give you much of a benefit when selling

Miami Condo Investments | Look for Economically Robust Buildings with Primary Residents

Look for economically strong and well-managed buildings that are desired with primary residents. You do not want to live in a condo where half of the residents are renters. These condos are economically fragile and will suffer most in an economic downturn. Buildings with primary residents tend to be better managed and kept as the owners live their and invest in their home.

Our Extensive Tools to Understand the Market and the Best Products

To better understand the neighborhood of your choice we offer the Economic Health Score Indicator on our “Live Analytics” page. This neighborhood health score indicates the current economic health of an area and its likelihood to fall ill or to be susceptible to illnesses. So this score does not predict the future, it merely provides the current status of a market and provides you with an indication of the market’s defense mechanism aka: its strength to process future hits. It is not about bear or bull markets. It’s about the market’s elasticity; about robustness and resilience of the market against economic change.

To identify the right product we are launching “Condos Geeks“. This brand new tool provides high grade models and analyses using the most advanced data to identity the right product for our readers and buyers.

More about “Condo Geeks’ Soon!

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS