- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Miami Real Estate Predictions for 2024

David Siddons and Ana Bozovic Forecast the Miami Real Estate Market

Introduction to the 2024 Miami Real Estate Predictions

In this blog post, we explore the Miami real estate market’s outlook for 2023 and 2024. We delve into the state of the Miami Real Estate Market in 2023, and examine both the luxury condo market and the housing market. We highlight the prime areas to consider for living and investment in 2024, and what areas or markets to avoid.

Our track record reflects a consistent ability to accurately forecast market trends, guiding readers on what to invest in and what to steer clear of. Today, we provide insights into the transition from the 2023 market to 2024.

David Siddons and Ana Bozovic correctly predicted the market for 4 years in a row. In this podcast they provide us with the latest Miami Real Estate Predictions Going into 2024

David and Ana’s Impeccable Track Record In Predicting the Miami Real Estate Market

Ana and I are both real estate agents and market analysts who study the market on a daily basis. What sets us apart is that we do not just look at the numbers but identify the driving forces behind these numbers. Only when you identify what drives the market, you can predict where the market is heading. Miami has had amazing growth over the last few years and everyone initially thought it was a temporary movement caused by COVID-19. However, we predicted in 2020, that this would become our new reality. We understood the underlying factors of the mass migration. Therefore, we mentioned that Corona was merely accelerating the trends that were already in place. Two years after the start of the pandemic the world started talking about how Miami’s growth and price levels were unsustainable. In our 2022 report, we refuted these statements again by showing the underlying drivers of the movement of families and cash flow into Miami.

What is Happening with the Miami Real Estate Market in 2023?

Inventory is Low, Prices are Up

Numerous videos and articles discuss the rising costs and slowing migration in the Miami Real Estate Market. While there was a surge in both volume and prices, this trend is not expected to be perpetual. In 2022, the Miami real estate market witnessed record-high prices, and there was concern that increasing interest rates would weaken it. Surprisingly, prices either continued to rise or remained stable in most markets. The luxury market, in particular, did not lose any of its strength.

The reality is that we are dealing with low levels of inventory and high demand. There are many buyers who are waiting to jump on opportunities. In my last podcast, I discussed the luxury market with Craig Studnicky. We mentioned that the Miami luxury condo market faces high demand with lots of buyers waiting for an opportunity. One of the Miami real estate predictions we made in that podcast is that any potential interest rate decrease could spark a market surge as sidelined capital is unleashed.

According to FIU Professor of Real Estate Eli Beracha*, we are still in the expansion phase of the real estate cycle. Given we are not building sufficient housing units to cover the 4 million in shortage, we do not expect to enter the hyper-supply phase any time soon. Please click here to watch the entire podcast on what is going on with the Miami real estate market.

*Prof Eli Beracha is ranked 3rd in the world for his real estate research productivity

The Luxury Market Sees the Highest Growth

Ana found that the higher the price per SF, the more drastic the price changes have been since Covid (Sometimes a shocking 400% higher). We are talking about properties that sell for $1,000 per SF or more. These are the newer, prime properties in prime locations such as Coral Gables, Coconut Grove, Pinecrest, or Miami Beach.

- Dry lot homes in Coral Gables or Coconut Grove (brand new or from the last 8 years).

- Trading for $1,000-$1,400 per SF, pre-Covid these numbers were $400 to $700.

- Homes in Gated Communities.

- Trading between $1,000 to $2,000 per SF, pre-Covid this was $500- $800.

- Waterfront Homes.

- Trading between $2,000 and $4,000 per SF. Pre-Covid a $2,000 SF+ sale was an anomaly.

In August we saw 31 sales sales in the $1,000 – $2,000 per SF range and 7 over $2,000. In 2019 we saw just 3 sales between $1,000 and $2,000. While a $2,000 per SF was an anomaly, we now see 5 of these per month.

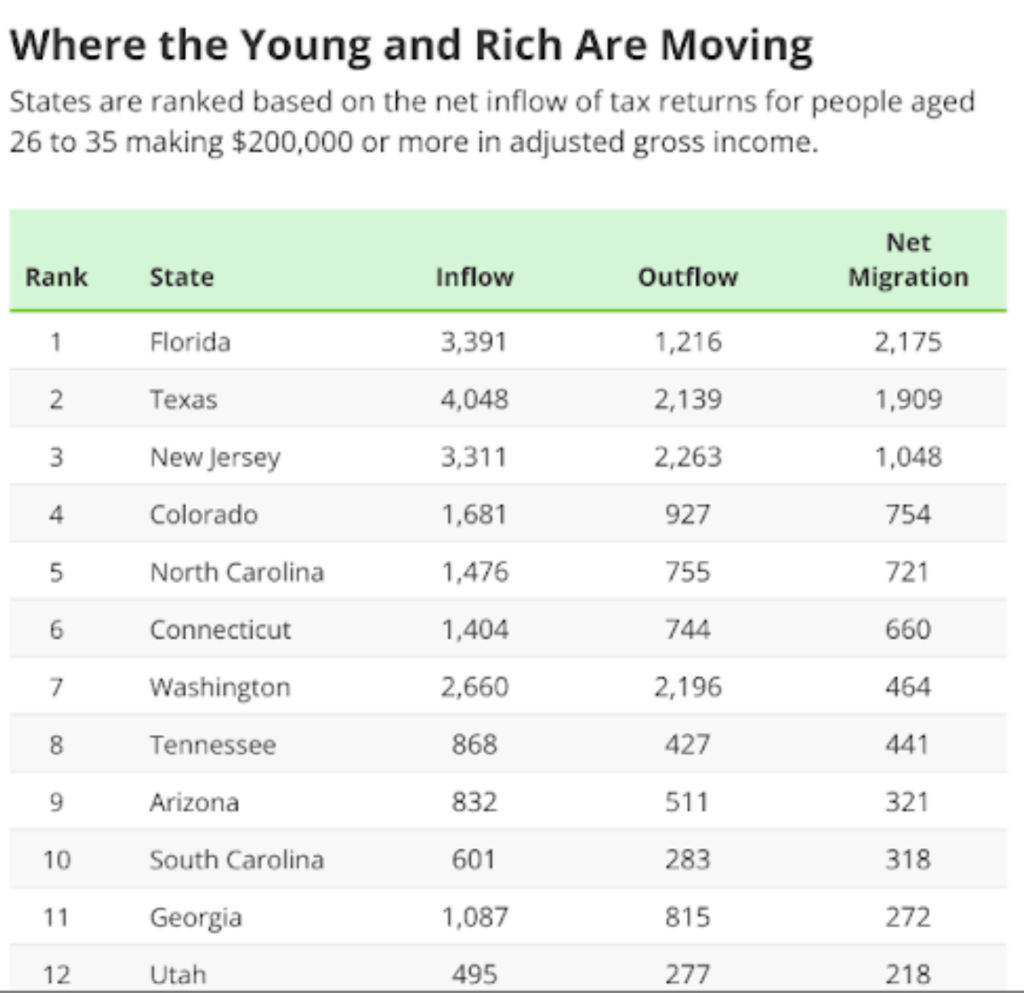

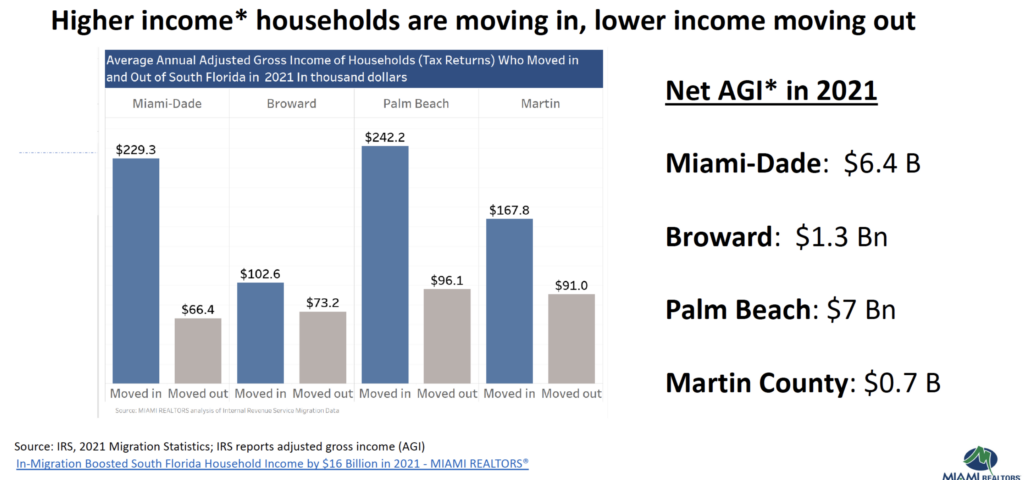

Migration in Ongoing

Migration has slowed down, but that is compared to the levels of 2021/2022. We still get many relocation requests. Last week alone I spoke to two families from San Francisco and Connecticut who were looking to make the move. I also spoke to a Californian law office that will relocate its business and 15 of its top executives to Miami. According to a recent Bloomberg study, NYC and CA have each lost firms that managed assets encompassing $1 trillion in the last 2 years. Miami was the biggest recipient of these firms. We are at the start of becoming a new capital of the world and there is so much cash moving into Miami.

There are several indicators pointing to the fact that Miami’s net migration is still stronger than it was before the onset of the COVID-19 pandemic. For instance, in 2023, we’ve seen a significant uptick in license plate changes, indicating a noteworthy influx of new residents. What’s especially noteworthy is the influx of young people and businesses into the city, a vital factor in its ongoing economic evolution. The introduction of new talent into the workforce is a significant driver of this transformation.

Attracting Major Corporations

Notably, Miami has attracted major corporations like Citadel and witnessed a surge in technology and business ventures. It’s safe to say that the city is still in the early stages of establishing itself as a formidable economic engine within the United States. Wealth continues to flow into Miami, showing no signs of slowing down.

A remarkable statistic is the number of new business applications per capita over the past year, which surpasses that of any other city. This trend represents a genuine force driving Miami’s economic growth. It’s not just about individuals seeking a haven for their pensions or a place to park their money. Miami has transformed into a place where people come to generate wealth actively, altering its perception.

Pending Buyers

There are many buyers waiting for interest rates to go down and jump on that opportunity. In addition, there are sellers who would like to move but with current rates, a trade-up makes little sense. Migrations are still happening and buyers are asking us what to buy and what to focus on. “Should I build a home or renovate a home?” and “What are the prime values?”. As mentioned before the luxury end of the market is what moves the most and sees the highest appreciation. There are so many transactions at high value and buying at this level will still provide for yield cause you are not buying the most expensive home on the street anymore. The city is growing at a fast pace and when you can, you should lock in prime or waterfront land.

Miami Real Estate Predictions: Best Places to Invest/Live in Miami?

So once you decide to invest in Miami where do you go? Basically all around the urban core (30/40 min drive) is a prime location. We are talking about Coral Gables, Coconut Grove, Ponce Davis, Pinecrest, Miami Beach, or Key Biscayne. Miami is a relatively easy commutable city and where you want to live is more of a personal choice. These areas however offer prime real estate and are close to A-rated schools and the downtown area.

More and more people are now buying a condo as a primary residence, while before these were considered more for the investment market. As the Miami housing market is drying up, buyers are targeting large condos that can replace a single-family home. The luxury condo market is up 30% in the last 12 months as the supply for large residences has dried up. Those that can’t find a home will look at large condos and they are extremely limited. We are talking about the real luxury condos (see our top 10 condos), prime units in the condos are extremely hard to come by. The supply of new products is also extremely limited. Although new condos are answering this gap in the market we will only see 1100 new units coming in in the next year and 4400 in the following 4 years if all goes according to plan. That is not enough to answer the demand. Building a home takes even longer around 2.5 to 3.5 years.

Is Miami Real Estate at risk for climate change?

The environmental impact on Miami is an often-mentioned point of debate. While Miami seems to be getting most of the comments the same goes for many coastal areas in the US or the world. The problem is real, and therefore we are building according to strict codes. Our homes and condos are constructed to resist hurricanes, and we are adapting and reinforcing seawalls. All the engineering around real estate construction is done to protect us against the elements and our building codes are very strict.

Miami Real Estate Predictions: What Miami Real Estate Poses Most Risk?

Risks in the Condo Markets

When considering real estate investments in Miami, it’s crucial to exercise caution, especially when dealing with older buildings. The collapse of Champlain Towers resulted in a reduction of the assessment period from 40 to 25 years, underscoring the need for maintenance and renovations in aging condominiums. Many of these older condo complexes will inevitably require significant repair work. For some condo owners, meeting the financial demands of these assessments, which can easily reach millions of dollars, can pose a considerable challenge.

In such cases, developers often step in to purchase these condos, taking advantage of the potential risk associated with older properties. With the new reserve rule in place, which mandates the presence of financial reserves to cover these assessments, associations are striving to be well-managed. However, the inherent risk remains substantial.

We thoroughly evaluate various aspects of a condo, including its finishes, location, amenities, floor plans, and financial aspects. The importance of effective management cannot be overstated, as numerous pitfalls can arise when it is not handled properly. If management fails to acknowledge reality or hasn’t allocated sufficient funds when necessary, it could ultimately lead to long-term difficulties for the property owners.

In the current market, buyers face challenges in finding new condos, especially in the $3 million to $5 million price range in Miami Beach. This shortage often directs attention towards older condominiums. It’s essential to clarify that we don’t advise avoiding all older condos. We emphasize however, the importance of caution and thorough research. Furthermore, it’s worth noting that older condos may be particularly susceptible to rising insurance costs, as discussed in one of our Podcast episodes.

Risks in the Single-Family Markets

When it comes to homes, I warn buyers of homes in flood zones in Miami Beach, Coconut Grove, or Coral Gables. Older homes are experiencing large increases in insurance premiums. These premiums can go up to $50K/$60K, superseding your annual taxes. Therefore, you should avoid older homes (even renovated homes) in the flood zone. If you want to be on the water look for a new home built according to the latest code. I have a lot more to say about this, so if you want to get granular, please pick up the phone and call me.

Conclusion

After years of predicting the market correctly, we feel confident we know what drives this market and what to expect in the year to come.

We have strong confidence in the robustness of this market, and Miami remains a consistent magnet for corporations and affluent individuals looking to relocate. The demand for Miami real estate is substantial, but the availability of properties is constrained. Both buyers and sellers are anticipating a drop in interest rates, and when that occurs, we expect the market to experience another surge. The luxury market offers high appreciation potential for both condos and homes.

Please, give me a call today for more information. If you have read my blogs or watched my videos, you know I am not only sharing positive news. I share the good, the bad, and the ugly. I will tell you what to buy and what to stay away from. I’m here to help my readers and clients make better decisions, and I prefer a long-lasting relationshop over a quick commission check.

Schedule a Chat with David (In person or via Zoom)

Lets have a chat about Miami Real Estate Predictions or the market in general.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS