- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Buyers are Targeting New Condos | Miami Beach Q1 and Q2 2023 Market Report

New condos leave older condos behind in the current Miami Beach market race

Miami Beach Q1 and Q2 2023 Market Report. Miami Beach condo market is the largest beach market in Miami Dade County compared to Key Biscayne, Bal Harbour, Surfside, and Sunny Isles. There are currently over 700 active units for sale. According to our Market Analysis Software, the months of inventory indicator based on closed sales currently sits at 7 months, making it a balanced market.

Furthermore, in our quarterly reports, we always take a close look at pended properties, as those are the ones showing the current rate of absorption in such a dynamic market. Currently, there are 115 properties under contract and pending. This shows that the market is speeding up with more transactions soon to be recorded and possibly lowering the month of inventory to less than 7 months.

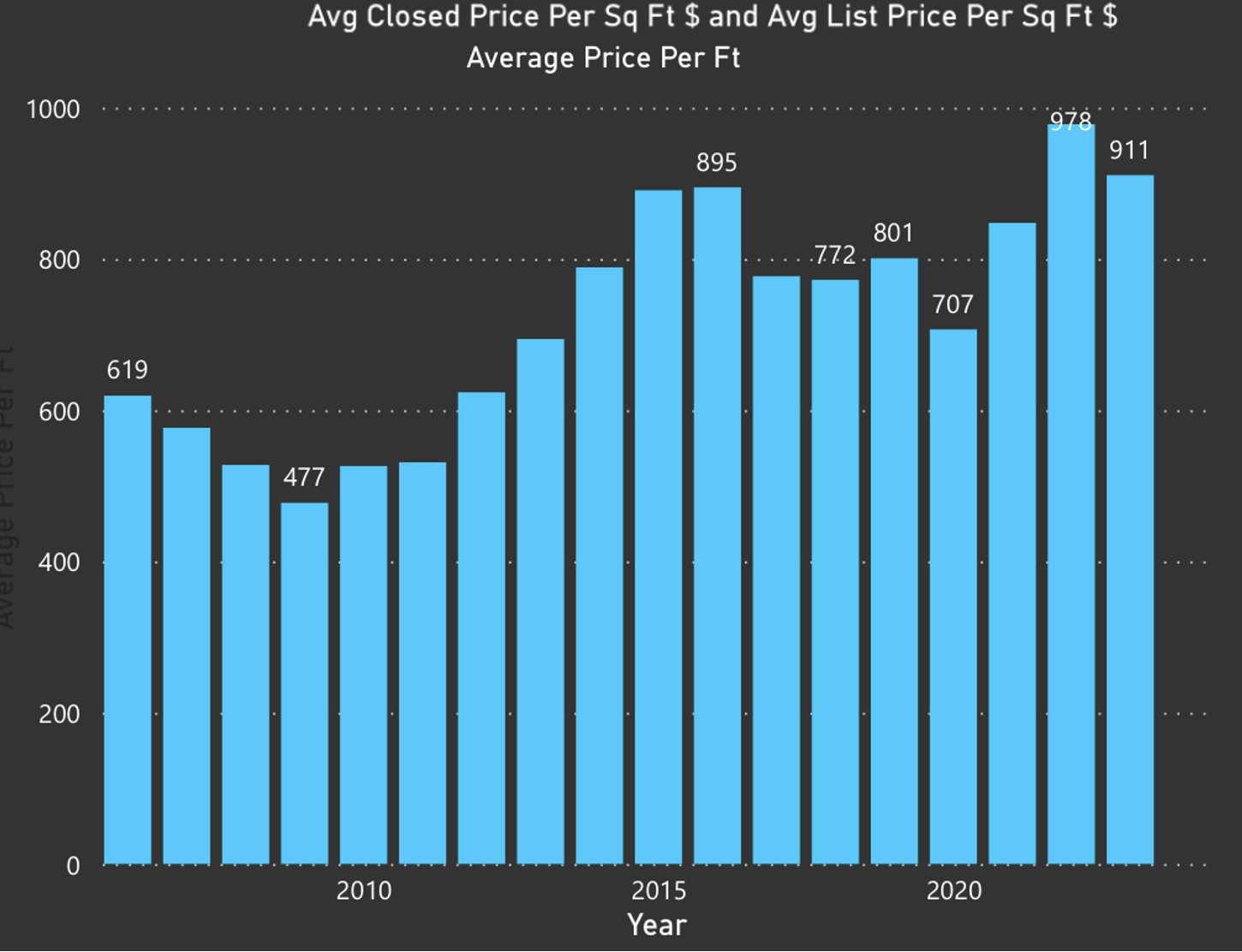

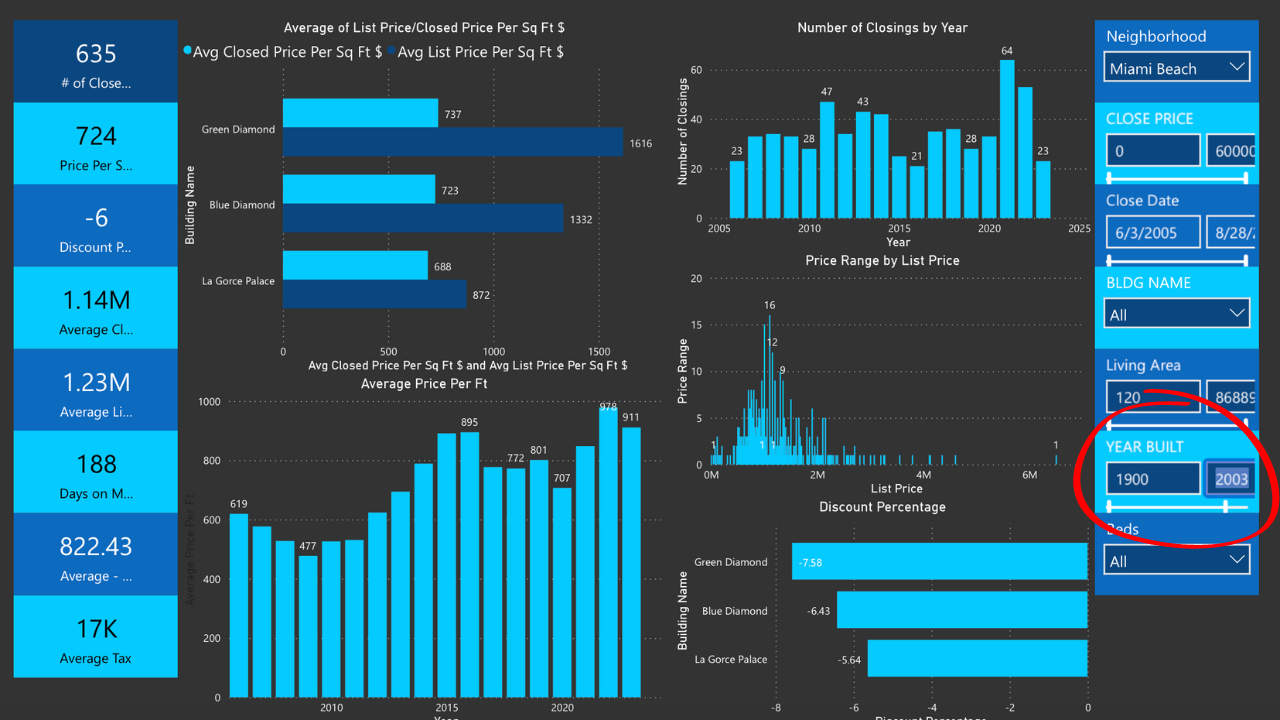

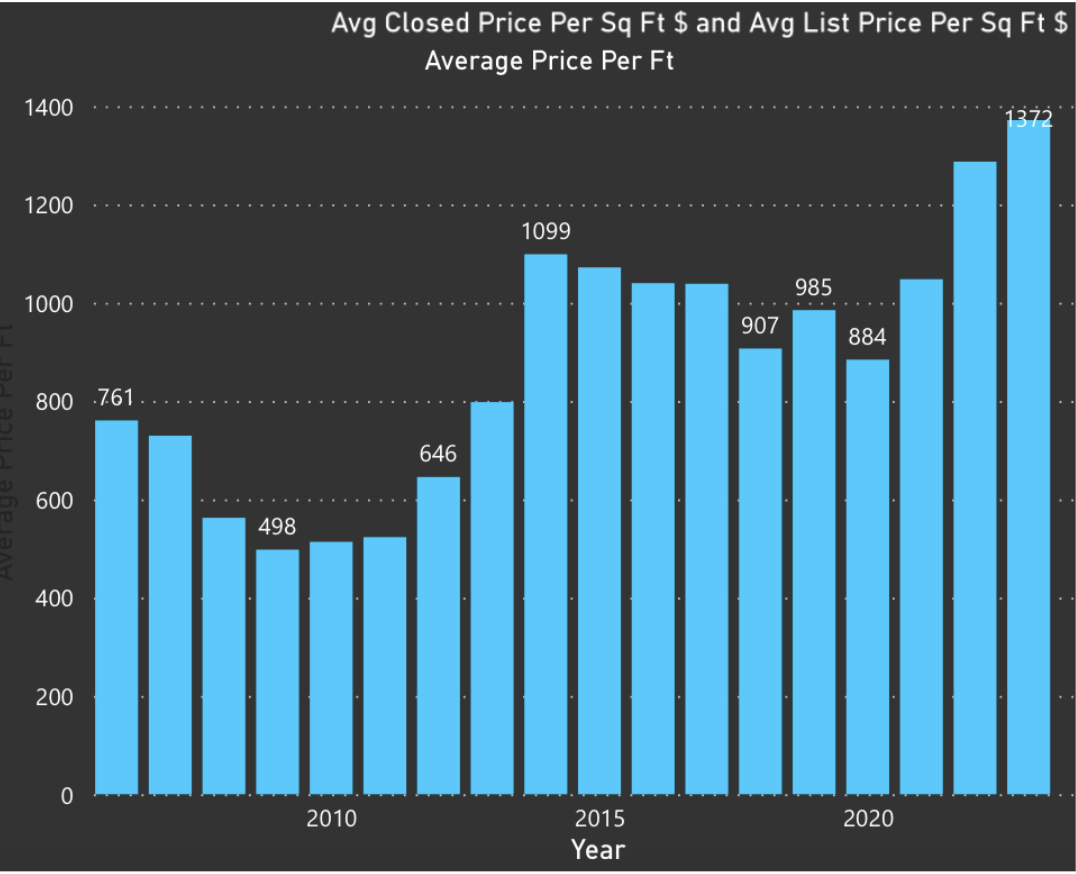

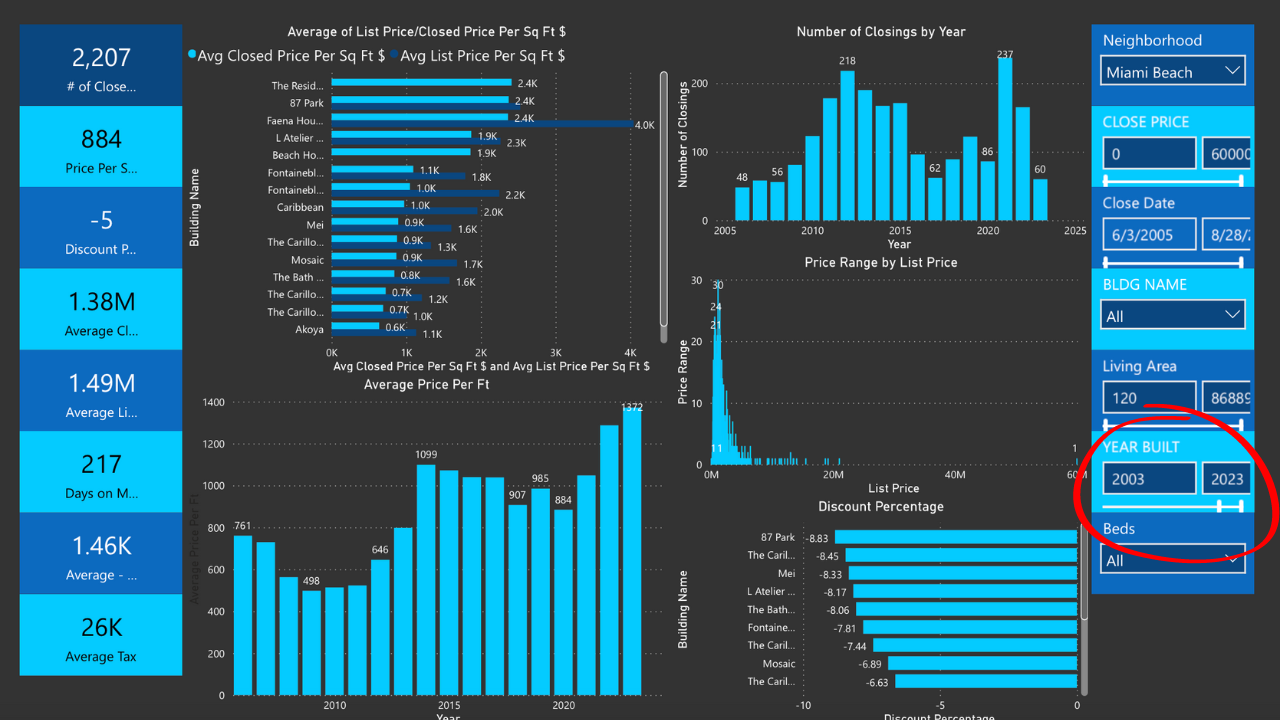

This is already happening before the high season – usually starting in November – when the number of transactions is traditionally much higher. Besides the quantity, we also look at the quality of the available units for sale, in particular the age of the condo units. The average price per sq ft in the last 90 days has leveled off or even slightly decreased (6% for condos older than 20 years). However, the value of condos built less than 20 years ago increased by 20% in the last 12 months. Average price per sq ft based on closed sales of condos older than 20 years.

Average price per sq ft based on closed sales of condos built before 2003!

Average price per sq ft based on closed sales of condos built less than 20 years ago.

The increase in value is driven by the strong demand for new condos from domestic and international buyers alike, in a market that offers almost no brand-new construction condos.

The gap between condos built more than 20 years ago, oftentimes hit by heavy assessments and increases in HOA fees, and relatively newer condos, became more obvious in the past 12 months with the two buckets of inventory increasing value on one side and slightly decreasing on the other side. Miami Beach condo market relies mainly on cash transactions. 68% of the recorded sales in the last 90 days were cash-only transactions. This is one of the reasons why this market is still quite solid despite the steep increase in interest rates. In our Miami Beach report, we always take a close look at the South of Fifth neighborhood, the most exclusive pocket on the beach that accounts for only 20% of the active units for sale but does account for the highest average price per sq ft achieved, currently at $1,263 with closed sales ranging between $600k and $15M.

The demand for condos in this area is quite high as the neighborhood offers the best walkability, safety, and proximity to the ocean and parks at the same time. The desirability of the neighborhood is now favoring the adjacent areas. Just North of Fifth Street the luxury condo new development of Five Park has just topped off construction. This building and the West Ave area will be connected to the Sofi marina through a pedestrian bridge by Daniel Buren soon to be built.

In short, the Miami Beach market keeps its desirability for primary and second-home owners.

Miami Beach Q1 and Q2 2023 Market Report | Advise for buyers

Whether you are exploring the Miami Beach market for the first time or keeping an eye on this market for a while, realize that the availability of good units in newer condos, or even remodeled units in older established condos, is extremely limited and worth the premium. If the beachfront is not a must for you, consider the available options offered by a new development like Five Park. Bay-facing units in the West Ave and Sunset Harbour/Belle Isles areas are great options and good value for the neighborhood. If you are considering an older condo, factor in the heavy assessment(Current and upcoming) into your purchase price. As always, contact us for off-market opportunities!

Miami Beach Q1 and Q2 2023 Market Report | Advise for sellers

If you own a unit in a condo built over 20 years ago and it’s not your primary residence, you might consider selling in the next six months. Condo values will hold until there are more newer options available on the market. If your condo is an investment unit, be aware that to have a decent return on your investment in the long term, you will have to come up with heavy costs of remodeling (whether that is relative to the unit or beautification and restoration of the common areas). If you own a newer condo or a remodeled unit in an established condo, your asset is limited, and you can command high prices for your unit in this market.

Read our other neighborhood and luxury reports

If you would like to get perspective on other specific neighborhoods or luxury reports. Please click here to go to our main database of reports. We update these every 6 months.

Schedule Time with David and Stefania (Our Miami Beach Expert)

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS