- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

As the Miami Real Estate Market Shifts, Who is MOST Vulnerable?

What Will Happen to Miami Real Estate Prices in 2023?

Welcome back to another episode of the Better Decisions podcast. In this episode David Siddons speaks with mortgage broker Paulo Rodriguez of CrossCountry Mortgage LLC. In this podcast we discuss the state of the Miami real estate market and answer the most common question that we are asked every day: ‘What is going on in the market today?’ This podcast focuses on the state of the Miami real estate market as it pertains to the start of Q4 2022 and answers three key questions:

- What is happening with the Miami real estate market?

- In what areas could Miami real estate prices potentially drop in 2023?

- When should sellers get out and should buyers buy or wait?

In addition, we discuss mortgage rates, the rental market, historic value appreciation, and a growing inventory across a number of sectors. As always, please call me for a more granular analysis of your personal situation.

What is Happening in the Miami Real Estate Market?

Buyers and sellers want to know where we are, where we are heading, and what to do next. Many reports talk about the Miami real estate market slowing down. The market movement has slowed down but has not stopped or completely reversed. It went from 100 miles per hour to 60 miles but is not depreciating.

What Will Happen to Miami Real Estate Prices in 2023?

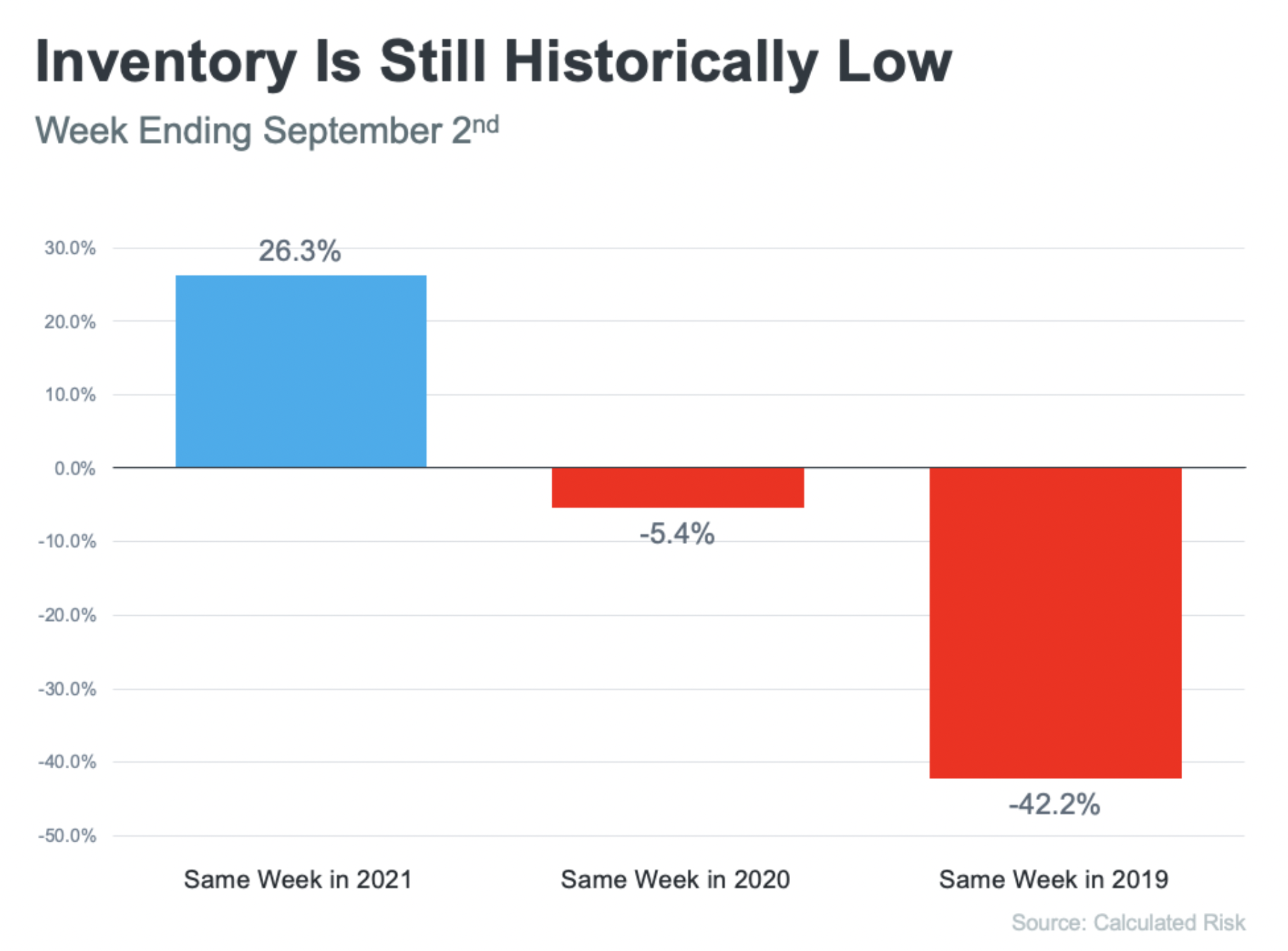

Sales velocity is slowing down because of a ripple effect of increasing mortgage rates, talks of a recession, and the pullback of the stock market. This all affects buyers and even sellers. The market went from the sublime to the ridiculous, and that kind of market is not sustainable. Trees do not grow to the sky, and the upward trend had to stop somewhere. We came from a position of mayhem and desperation. List prices used to be the floor of the negotiation, now they are the ceiling. Buyers have more options and negotiation power as more inventory enters the market. Will Miami real estate prices drop? No, we still have inventory issues in many of the markets. Inventory is increasing, but the levels are still lower (by 42%) than in 2019.

While Sellers look at the past, Buyers look six months ahead

We come from one to three months of inventory in markets where ten months would have been good. These days, inventory levels are growing, pending deals are down, and new listings are up. The quality of these listings, however, is not stellar. There is not a lot of wow-product, and sellers are still looking six months back when pricing their homes. While sellers look at the past, buyers look six months ahead. We experience a massive discrepancy between what one group wants to receive and what one group wants to pay. Sellers shoot for the moon and ask for too much money. They saw their neighbors do the same, and buyer desperation made this possible 6 to 12 months ago. Sellers will have to come to their senses and price their homes according to today’s market. Sellers who bought in 2021 and add 30% to that price in 2022, will not sell. That has nothing to do with the state of the market, it means sellers are unrealistic and need some time to realize the market has shifted.

The Role of the Media

The media often paints a different picture of the Miami real estate market. This is not always in line with what we experience in the market. Firstly, journalists do not have access to the same data we have. Secondly, they use click-bait titles to get as many clicks as possible. The dramatic titles are often taken out of context and create a level of fear or bearishness that is not justified. Miami sees a 100% increase in foreclosures sounds scary, but if we had one foreclosure last month and two this month, that is a 100% increase. Lastly, you cannot discuss the Miami market without looking at the different submarkets. Condos behave differently than homes, and the $1M market reacts differently to economic changes than the $10M market.

Appreciation

South Florida and Miami saw a 25% to 50% increase in real estate prices in 2020 and 2021. Previous to those years, the appreciation was around 6% to 9%. In 2022, 9% to 11% was expected, most already happened at the start of this year. The moderate expected appreciation for 2023 is 3.8%, which is the historic average appreciation.

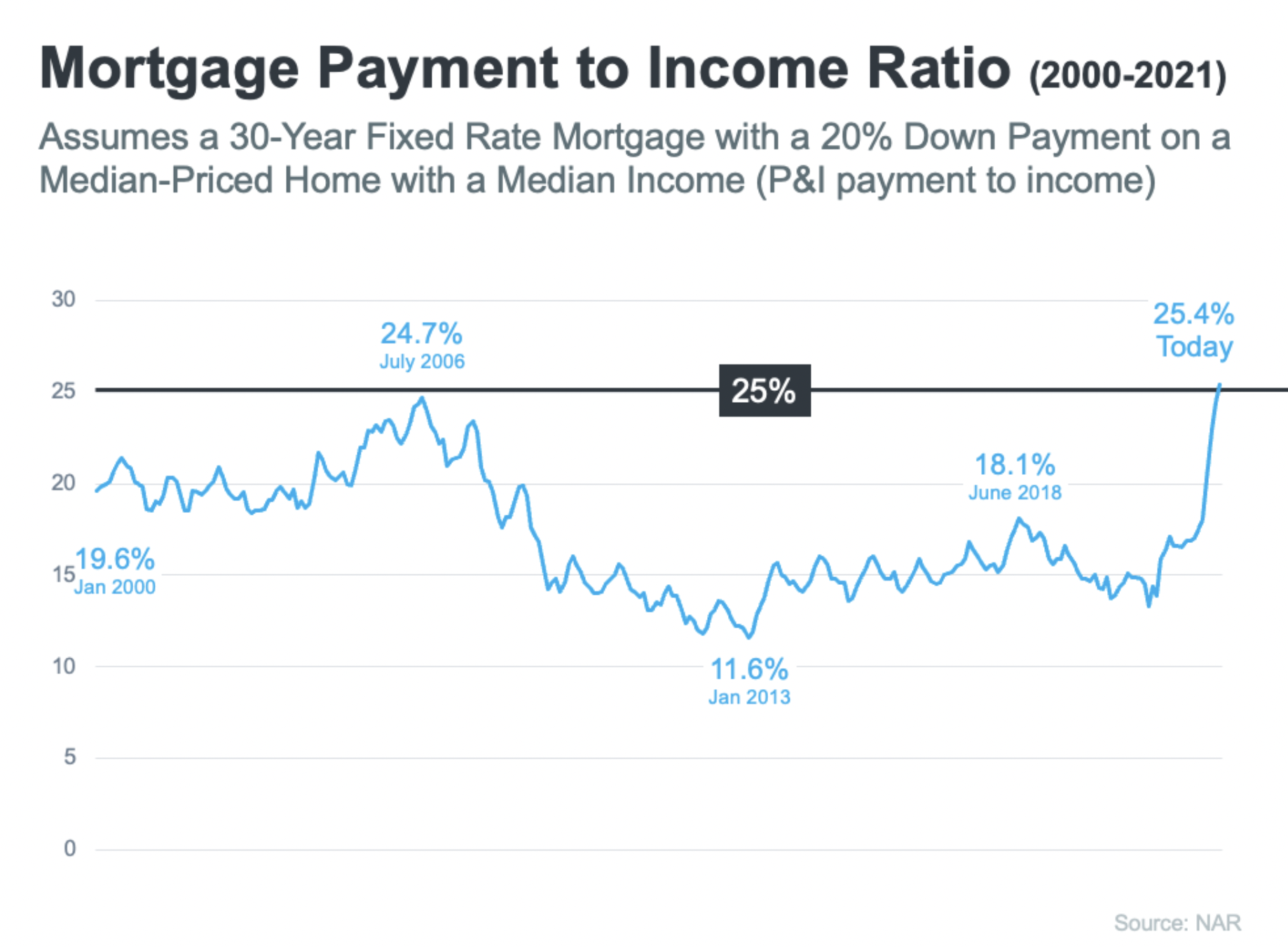

Mortgage Rates and Miami Real Estate

Many buyers ask about the effect of mortgage rates on the Miami real estate market. It does affect some sections of the market, but it does not affect our market around Coral Gables, and Pinecrest so much. The lower end of the market is most affected by interest rates. This market gets rates between 6% and 7%, while investors or the more exotic investments get an 8% to 9% rate.

The higher loan amounts of $1M and up have better rates in the mid to high 5% range. Banks are sitting on cash and are willing to lower these rates to acquire a client. Private bank clients with good banking relations can obtain an even better rate. Wealthy buyers also often use margin loans to finance a deal.

In some sections of the market, the interest rates will impact, but not so much in the luxury segment. Many of our buyers also pay in cash. According to Paulo, 50% or more of all $1M+ deals in Miami-Dade are not financed. In this market, the buying decision is more about the right time and less about the mortgage rates.

Is the Rental Market Sustainable?

The rental market has seen a massive increase in prices. The question is whether these high-rental markets are sustainable. Rental prices and the value of a property are closely correlated. A decrease in rent can lead to decreasing property values. The question is whether this hot rental market is sustainable. This is a very Miami-specific conversation since the Miami market behaves differently than the rest of the US market. The cost of living in Miami is out of touch with the median income. Relocation buyers or renters with income levels from NYC or California arrived in Miami. These buyers/renters are no longer paying state income taxes and encountered a real estate market that was very affordable compared to their home markets. They do not mind paying over the asking price because for them this market is still very affordable. As a result, they priced out local buyers and renters.

These days locals find it hard to afford a Brickell condo for rent. Condos that previously rented for $3,500 per month, are now going for $5,000 while income levels have not increased. This is something to worry about because any correction in this rental market will change the value of those properties.

Should Condo Owners Get Out?

The condo market is more investor-driven than the single-family home market. Within the condo market, we see different neighborhoods or price ranges perform differently. Our analytics tool Condo Geeks shows a 15 years overview of the sales prices per neighborhood, condo, or price range. This tool will help you navigate the different condo markets and provide insights into the more volatile markets.

There are several markets like Brickell that are very investor driven. Investor-driven markets, with short-term investors, will have some correction as inventory grows. If you have a 10-year horizon, there is nothing to worry about. If you are in this market for the short term or are looking to sell in the next two years, then today is a good moment to sell.

We see more inventory and fewer pending sales. In combination with negative press, whether true or not, it encourages the more speculative sellers to get out as soon as possible. This is a final call before the market makes a more substantial correction, and Miami real estate prices in the condo market might stagnate. Generic or older condos (especially the ones with impending assessments) are the most vulnerable at the moment. Larger condos, that are primary residences will be more resilient.

The Latin American Market

Several areas like Sunny Isles Beach or Miami Beach are still doing very well, although I expected to see a growing inventory. I can speculate it has maybe something to do with South American buyers coming into town. When socio-economic changes happen in Latin America, we see waves of buyers enter Miami to distribute their wealth and invest in the dollar. These wealthy buyers are relocating funds rather than being speculative or making quick investments. The current round of new construction condos sells from $1000 per SF. The best new condos are even in the $2,000+ range, with record-breaking prices for areas like Edgewater or Brickell. Please read our latest article in which I present our top 5 new construction condos in Miami.

There are risky sections in the condo market that are important to know. If you are an investor who speculates on the market and still wants to make money, now is the time to sell.

Should homeowners Sell Now?

The single-family home market has always been more stable than the condo market. Condos and homes behave differently. You can build a ton of condos, but you cannot keep building homes, especially in an area like Miami, bordered by the everglades and the ocean. Moreover, new homes take around 2 to 3 years to complete. We do not have enough land, and labor and material are expensive.

As mentioned earlier in this article, we have many new listings, and pending and closed sales are down. For the market to see a drop in value or for Miami real estate prices to drop, it would take a massive increase in inventory. The market is healthy, there is demand, and Miami is growing as a global city. In addition, we are still low good quality product. You cannot defeat the law of supply and demand.

The biggest problem right now is sellers not being realistic. Sellers have been asking for whatever they wanted, and this was met by buyer desperation. That momentum, however, is over. This is not the market we experienced 6 to 12 months ago. If you want to sell your home right now, you need to price your home right. You will still be able to walk away with a good profit. Many sellers bought for top dollar in 2020/2021 and are now trying to resell the property with a 50% increase. It will simply not sell in this market.

We just listed a newer home, and the phone rang non-stop. New homes are what everyone wants, and these will stay desired and can ask for a premium. Older, less unique houses, however, will be harder to sell. We do not expect any depreciations, but you will not see the same amount of profits anymore. List prices went from the starting point of negotiations to the absolute ceiling.

Conclusion

It all depends on what kind of product you have and how long you plan to hold on to it. Whatever you do, you have to be smart about it. It is best to talk to someone who knows the market, and the nuances of the different submarkets. If you want to know what strategy works best for your property, please call me at 305.508.0899.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS