- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

6 Indicators It’s Time to Sell Your Miami Rental Property in 2025

When does an investment go from good to bad and when should you sell your Miami rental property? After an incredible 3 year run we are now experiencing some ‘chinks in the armor’. If you’re contemplating selling your investment property in 2025, this article is a must-read! If your property falls in any of the below 6 categories, we recommend you consider selling.

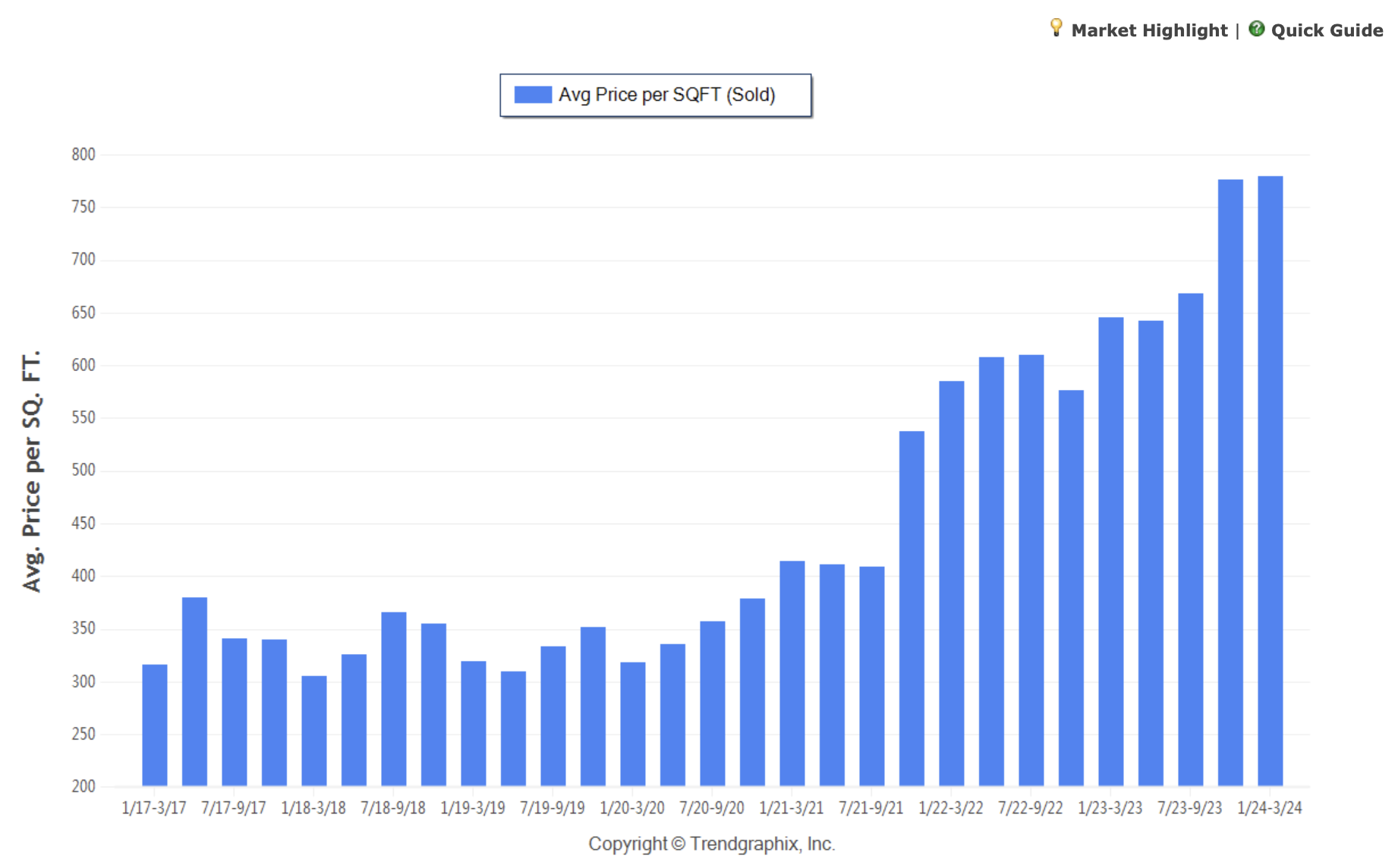

5 Indicators It’s Time to Sell Your Miami Rental Property in 2024. Do not only look at ROI, also look at asset appreciation. Since 2015 we have been telling investors to focus on Coconut Grove townhomes. They are scarce, have great return returns and their value appreciates year over year. Above you see the value appreciation since 2017!

2 Rental rates drop

The decrease in rental rates is particularly pronounced in high-rental areas, yet its impact is even more profound in “investment class markets.” This is due to the direct correlation between the value of these assets and rental returns, whereby buyers determine prices based on rental income. Consequently, this leads to a dual negative effect of reduced cash flow and diminished asset value.

In West Coral Gables, which is a primary market, we’ve observed that the average rental price per square foot in Q1 2024 has held steady compared to the same period in 2023. Considering the rising costs, it’s evident that this stability will affect your ROI. Besides that, the time to rent a property in West Gables has increased year over year from 28 days in 2022 to 76 days in 2024.

3 HOA Fees and Special Assessments Rise

Condo buildings older than 25 years that are coming to their 25 or 40-year assessment. Besides rising HOA and insurance fees, these assessments will likely bring attention to details that need to be brought up to current standards which tend to be costly. especially for owners who are living on a fixed income or a pension, it might be harder to keep up with rising fees. These condos will also become increasingly challenging to sell as buyers prefer newer condos especially when the older condos have high assessment costs or HOA fees.

4 Ballooning Insurance and un-insurability of the property

if you own an older home in the flood zone you have most likely already experienced an insurance hike or are about to. This situation is not getting any better and the situation is most likely to get worse. In high flood-risk areas, homes may lose value as insurance costs surpass property taxes, altering buyer behavior. Eventually, some become uninsurable, equating to land value alone. This trend is increasingly common, particularly for older homes, making them more challenging to sell.

For more information please listen to our podcast with Hugo Garcia about how the changing home insurance climate will affect homeownership.

Conclusions on Whether You Should Sell Your Miami Rental Property in 2o24

While many people focus purely on ROI, in a fast-growing city like Miami, the potential of appreciation should not be forgotten. When assessing your assets, it’s vital to monitor changes in costs and income closely. Rising costs without a corresponding increase in income can signify potential financial strain. Conversely, declining income may indicate operational inefficiencies or market challenges. Understanding metrics like Cap Rates and appreciation is essential in this evaluation.

Cap Rates offer insights into the relationship between a property’s income and its market value, while appreciation reflects its long-term growth potential. If costs are on the rise while returns remain stagnant, it’s a red flag for declining profitability, urging proactive measures to rebalance the equation and sustain healthy asset performance.

To see if your investment return is optimal you should always compare it to other products in the market. Invest in a property, collect ROI while it matures, and sell it once the market peak has reached to invest in something that still has the potential to appreciate and provide you with the same or a higher ROI. The viability of your investment return should always be measured against other investments. If your ROI on a Brickell condo is 5%, but a Coconut Grove townhome will give you 8% you should look at those.

How The David Siddons Group can help!

Schedule a Meeting with David (Via Zoom or in Person)

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS