- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Buy Now or Wait? How Falling Mortgage Rates Could Impact Miami’s Luxury Market

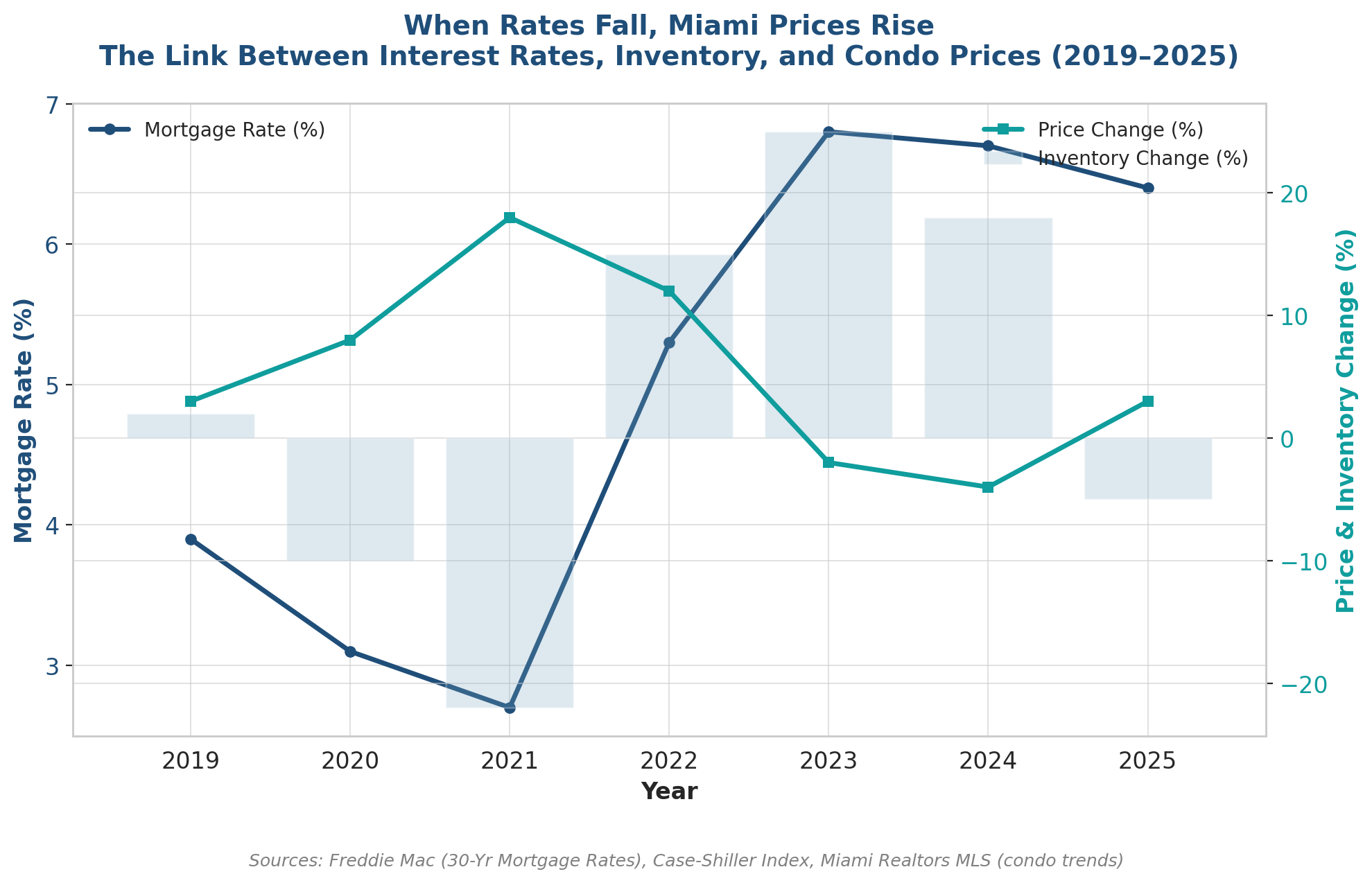

Mortgage rates may be poised to shift, and even a small move can reshape Miami’s luxury market. A half-point drop in rates doesn’t just increase affordability, it triggers measurable jumps in demand, faster absorption of quality inventory, and renewed urgency at every price point. For buyers and sellers alike, understanding how these shifts ripple through Miami’s neighborhoods is key to making the right move today.

How Much More Can You Afford if Mortgage Rates Drop 0.5%?

On average, every 0.5% drop in mortgage rates boosts purchasing power by about 5–6%. Example: If you qualify for a $2,000,000 home today at 6.5%, the same monthly payment at 6.0% could stretch to $2.1M–$2.12M. In the case of Miami, when rates fell 0.5% in 2020–2021, Miami-Dade condo sales jumped 12–15% the following quarter, especially in the $500K–$2M range where buyers are most financing-dependent.

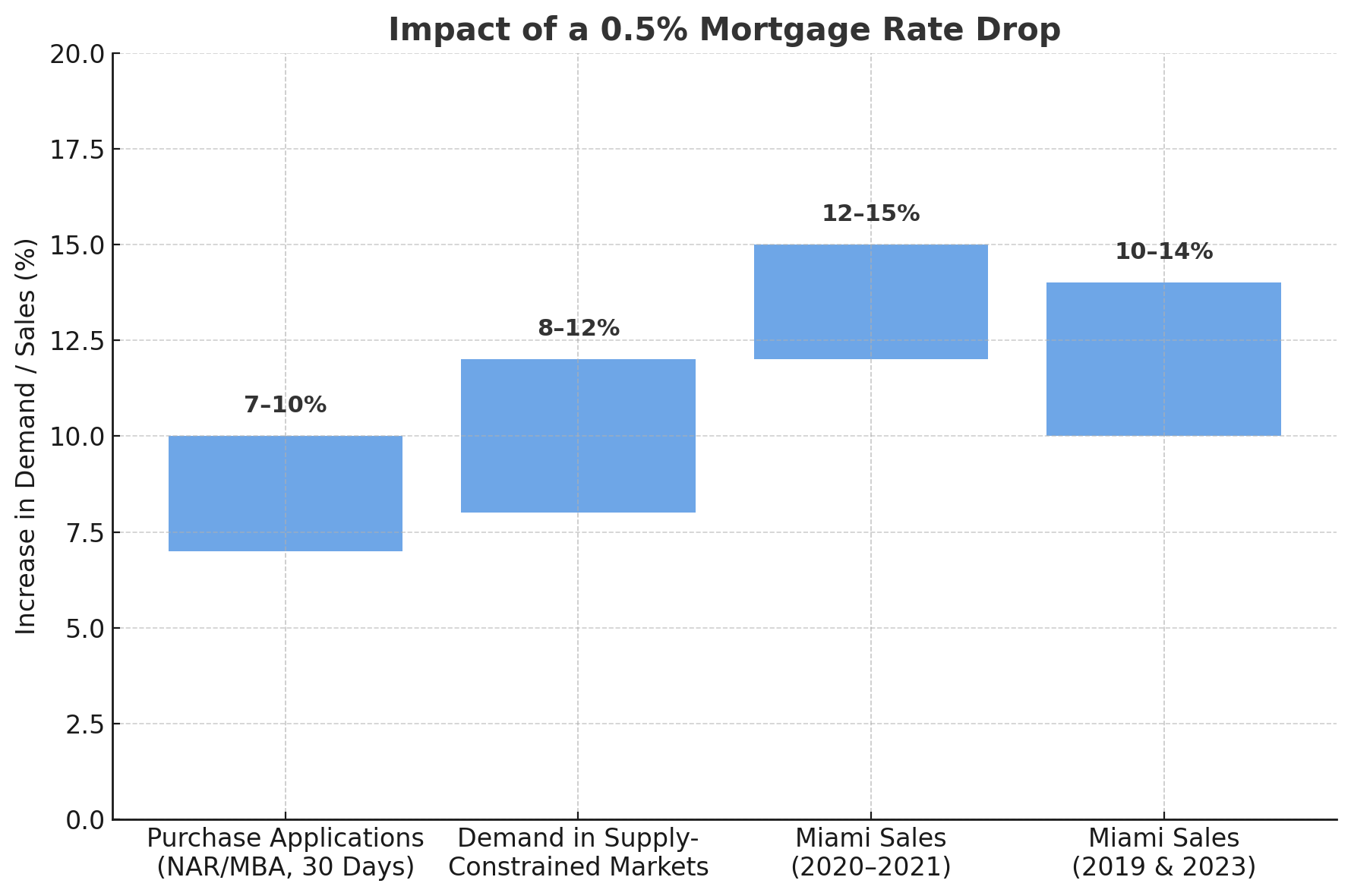

How a 0.5% Rate Drop Can Supercharge Miami Real Estate Demand

National Association of Realtors and Mortgage Bankers Association data show that such a shift can boost buyer demand by 8–12% in the following months, especially in supply-constrained markets. NAR (National Association of Realtors) and MBA (Mortgage Bankers Association) studies show that for every 0.5% decrease in mortgage rates, purchase applications rise ~7–10% within 30 days. which aligns with Miami’s MLS data. In 2020–2021, mortgage rates fell from ~3.5% to ~3.0% (a 0.5% drop). Miami-Dade condo sales jumped ~12–15% the following quarter (particularly in the $500K–$2M range). Same pattern appeared in late 2019 and early 2023, when small rate drops coincided with a visible surge in pending sales.

Will Lower Rates Push Miami Home Prices Higher?

When demand rises, available supply is absorbed more quickly. The impact is strongest in highly desirable, low-inventory markets, where prices respond faster. In higher-inventory markets the effect is softer, but even there, stronger demand reduces the room for price negotiations.

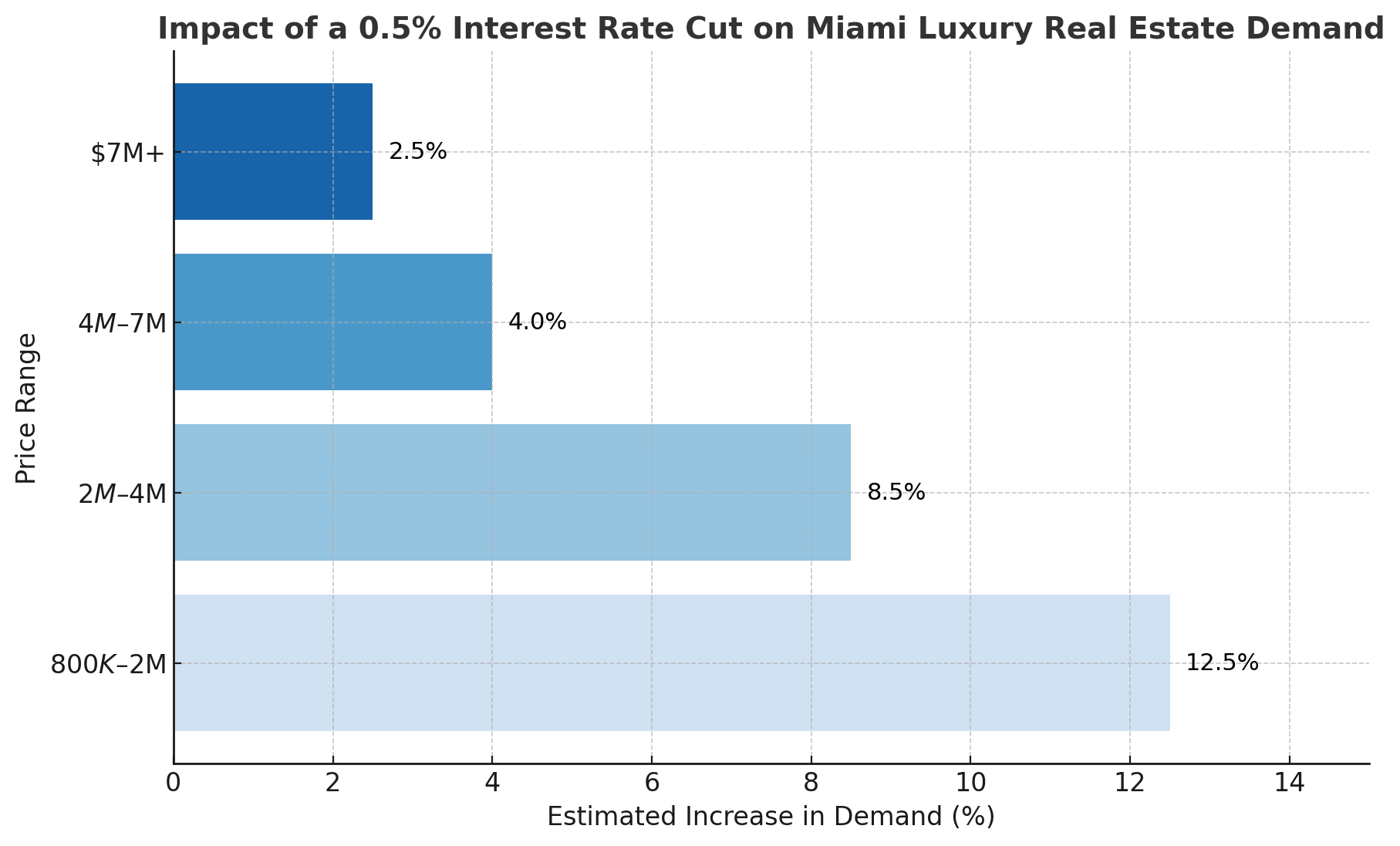

Which Miami Price Points gain the most when rates drop?

Why Demand Rises More Than the Math Predicts

While the $1M–$3M segment feels the most direct lift from a 0.5% rate cut because buyers there are more financing-dependent, the effect doesn’t stop at entry and mid-luxury. At the higher end of the market, where many buyers pay cash or structure deals through private banking, the impact is more psychological than mathematical. Lower rates signal stability, expand the future pool of financed buyers, and give wealthy buyers greater confidence in liquidity and resale values. In practice, this often accelerates decision-making on $5M–$10M+ properties, not because affordability changes, but because sentiment shifts, creating urgency at the top just as much as accessibility at the bottom.

Miami Real Estate and Interest Rates: Buy Now or Wait for the Drop?

In Miami, the “buy now and refinance later” strategy makes the most sense in low-supply, high-demand submarkets. In Coconut Grove and Coral Gables ($2M–$5M), inventory is tight and demand from relocating families is steady, meaning waiting often costs more than you save. In South of Fifth, Continuum, Apogee, and Fisher Island ($5M+), trophy condos and ultra-luxury homes are scarce, here, securing the property matters more than waiting for a 0.5% rate cut. The same is true for Venetian Islands, North Bay Road, and Gables Estates, where true scarcity means uniqueness drives value, not rates. By contrast, Brickell, Edgewater, and Downtown ($800K–$2M condos) are highly rate-sensitive and investor-driven, so waiting for lower rates could give buyers more leverage and better appreciation potential.

Do lower rates benefit cash buyers too?

Even if you’re paying cash, lower interest rates still work in your favor. They expand the pool of financed buyers, which strengthens resale value and liquidity when you decide to sell. Rate cuts also boost overall market confidence, often pushing prices higher, so cash buyers who act early gain an edge before demand spikes. On top of that, cheaper borrowing gives you the option to finance later and redeploy capital into other investments, while your ability to close quickly keeps you competitive when inventory is scarce.

Are Mortgage Rates likely to drop?

The majority of surveyed experts predict a decline (Bankrate experts (69%), Fannie Mae, Realtor.com, Morgan Stanley, NAHB), albeit modest, toward the end of 2025 or into 2026. Meanwhile, a cautious minority (NAR, Forbes, broader market sentiment) suggests that rates may remain elevated—for now—due to persistent inflation and underlying economic trends.

Connect with David Siddons

If you’d like a personalized strategy—whether it’s deciding if now is the right time to buy or waiting for rates to adjust, or a deeper dive into specific Miami neighborhoods—schedule a call below or reach me directly at 305.508.0899.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS