In Gables, Grove, and South Miami, buyers should map out noise and traffic, since major roads like US-1, Le Jeune, Bird, 37th and 57th Avenue, and the busier sections of Old Cutler are clear red flags; instead, aim for homes at least two turns off main roads and prioritize proximity to parks such as Merrie Christmas, Salvadore, and Dante Fascell, which consistently drive stronger resale demand.

- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Why Miami Homebuyers Are Getting Burned – The Million-Dollar Home Buying Mistakes

What are the million-dollar mistakes buyers make in the housing market? I’m David Siddons, and this is the second video in my “How to Lose $1 Million” series. Last time we looked at condos, today we’re looking at homes. You’d think houses are safer, but after 20 years in real estate I’ve seen just how easy it is to miss out, or worse, lose big. In this video, I’ll share the key lessons that can help you avoid those home buying mistakes and maximize your upside. Also read: How to Lose $1M in the Miami condo market

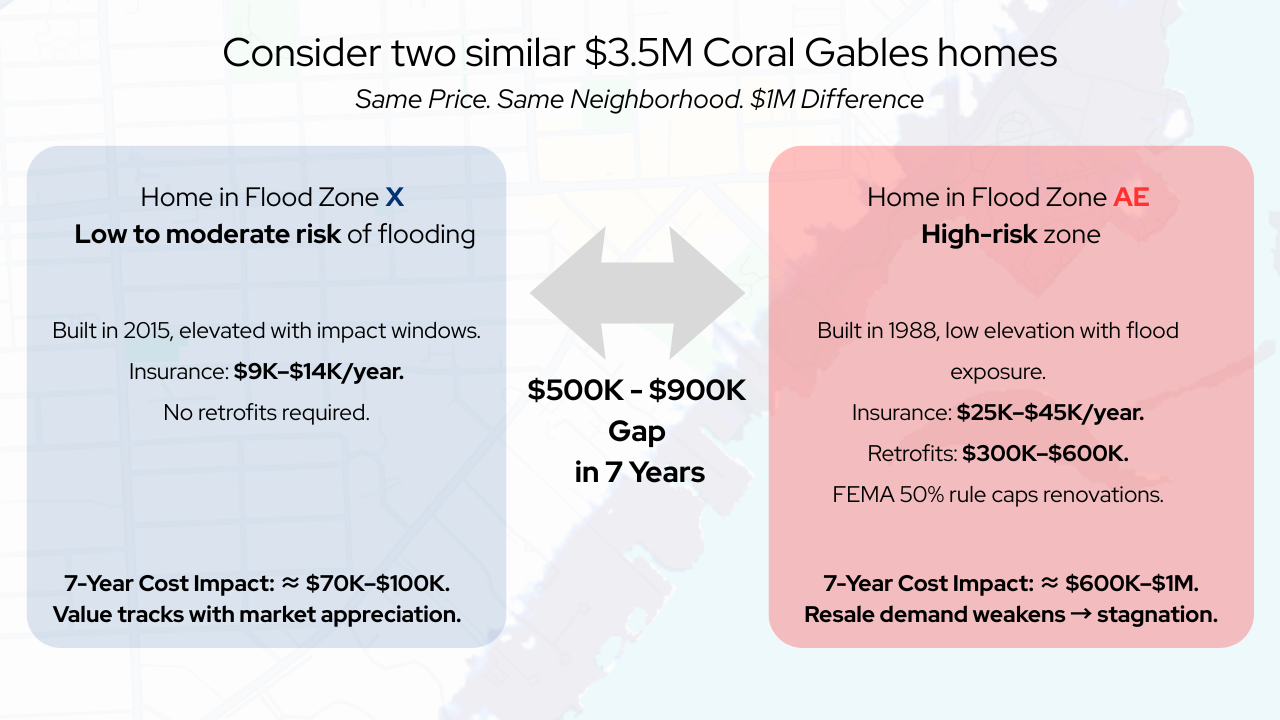

Mistake #1 | Ignoring Flood Zones and Insurance Risk

One of the biggest ways to lose money in Miami’s housing market is underestimating the impact of flood zones and rising insurance costs. Many buyers assume this is only a condo problem—but it’s not. If you’re buying a waterfront home, you know you’re in a flood zone, and you accept the elevated structure requirements and higher premiums. But the real danger lies with older, non-waterfront homes that still sit in flood zones. Here’s what happens: homeowners renovate these properties beautifully, then list them for resale—only to find buyers walking away. Why? Because the insurance premiums are sky-high compared to similar homes just outside the flood zone. Over time, those “safe” homes appreciate far faster—sometimes 60% more, while flood-zone homes stagnate. The biggest risk? Eventually, many of these older, low-elevation homes become essentially land trades. No matter how much you’ve invested in renovations, if insurance becomes unaffordable or unavailable, buyers disappear, and your property value collapses to land-only pricing.

Action Steps to Avoid this Mistake:

Always factor in elevation, flood-zone classification, and long-term insurability before buying.Favor X-zone or high-elevation AE homes (target FFE ≥ BFE + 2–3 ft). A seemingly small premium difference today could be the million-dollar mistake that destroys your upside tomorrow. Look for 2002+ Florida Building Code builds or fully permitted post-2018 gut renovations. Finally, you should price in the FEMA 50% rule before you bid, get a contractor estimate and an elevation certificate early.

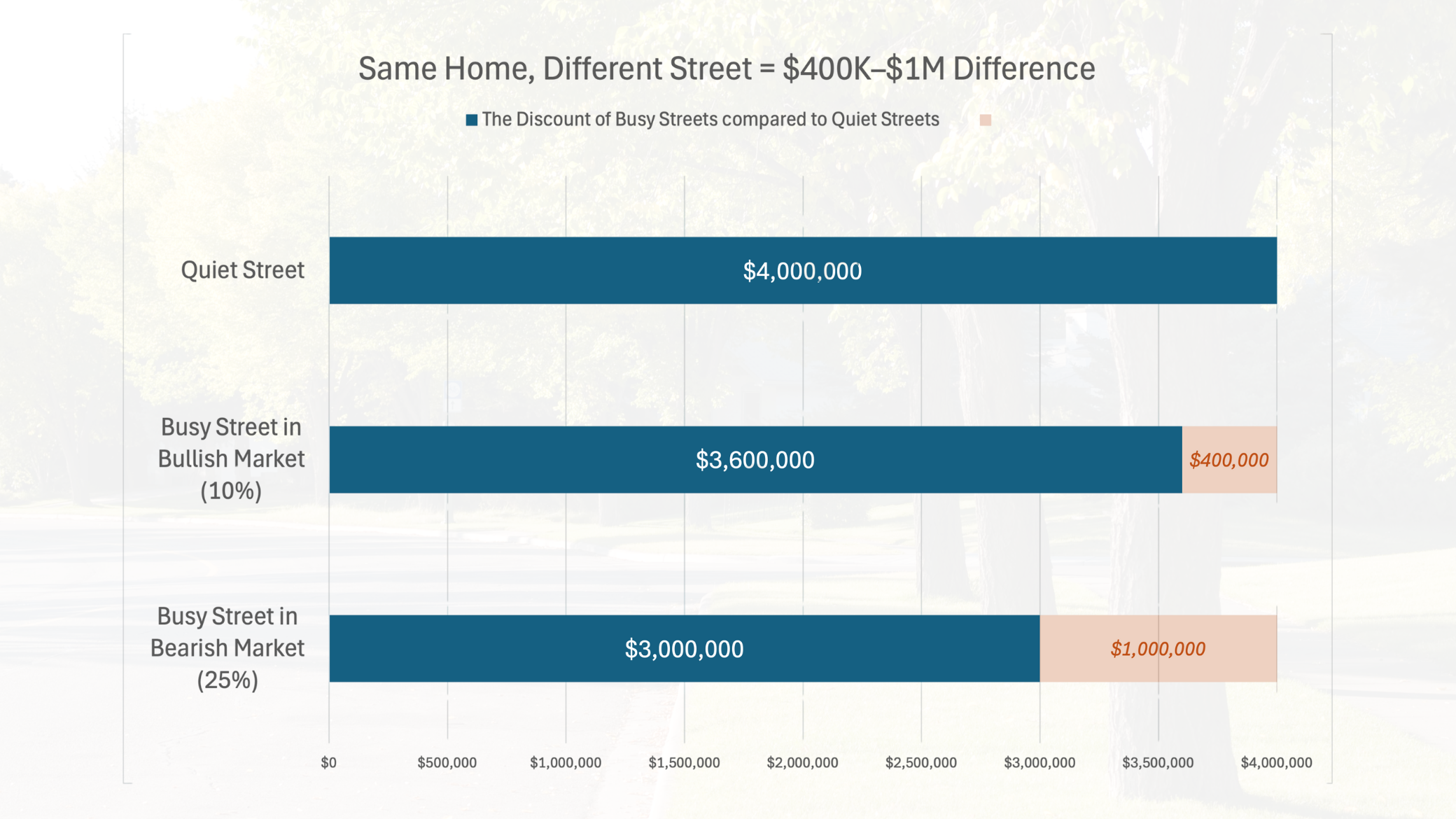

Mistake #2: Buying on the Wrong Street

It sounds obvious, but location really is everything. In Miami’s family-oriented neighborhoods, a home on a busy street is a deal-killer for most buyers. Families don’t want the noise, the traffic, or the safety concerns of kids riding bikes on a busy road. As a result, homes on high-traffic streets often sell at a 20% discount compared to similar homes on quiet streets. More importantly, they carry a built-in ceiling on appreciation, your value stalls while comparable homes on quieter blocks keep climbing. Over time, that gap compounds, and it’s one of the fastest ways to lose big money in the housing market.

In soft markets, discount grows to -25% and adds 30–60+ days to sale.

To see the impact, take two nearly identical $4M homes, one on an interior, family-friendly street and the other on a busy arterial. In a normal market, the busy-street home sells at an 8–12% discount, but in softer markets the gap widens to 15–25% and time-to-sell stretches by 30–60+ days. That translates into $320K–$1M of lost value plus extra carrying costs—purely based on street location.

Action Steps to Avoid This Mistake:

Mistake #3: Overlooking Zoning and Lot Size

Land is the one thing they’re not making more of, and zoning dictates its long-term value. Buyers who settle for smaller 6,500–7,000 sq. ft. lots often hit a ceiling on appreciation, while homes on 15,000–20,000 sq. ft. lots have consistently outperformed over the past 20 years. A house may be stunning on a small lot, but it’s capped by the land beneath it. And while some owners think they can add value by going vertical, adding a second story often destroys existing value rather than creating it. In many cases, the smarter move isn’t to renovate, but to sell and trade up to a better-located, better-zoned property.

For context, look at Pinecrest: buyers consistently pay 20–35% more per square foot for wide, deep 20–30K SF parcels compared to 10–15K SF lots, because larger land offers expansion, pools, and privacy. In Coral Gables, 5–6K SF interior lots do appreciate, but they lag behind 10–15K SF parcels by 10–20% in hot cycles. Shallow depth, narrow frontage, or odd-shaped parcels only shrink your buyer pool further and cap resale upside. Over time, that translates into hundreds of thousands—sometimes millions—of dollars in lost appreciation.

Action Steps to Avoid This Mistake:

Mistake #4: Ignoring Price-Per-Square-Foot Ceilings

Every neighborhood has a price-per-square-foot ceiling, and once you hit it, appreciation slows dramatically. Geography, school districts, and traffic patterns often create natural cut-off points that cap values. But ceilings work in both directions: in some neighborhoods, the ceiling is low and you’ll stagnate quickly, while in others, the ceiling is very high, creating far greater long-term upside. That’s why the old saying still holds true, don’t buy the nicest house in a weaker area; buy the worst house in the best neighborhood. It may feel uncomfortable at the time to settle for a smaller or less updated home, but history shows that these properties almost always outperform. The worse home in a stronger area consistently beats the nicer home in a weaker one. You can see this clearly in neighborhoods like Gables Estates versus the general Coral Gables market east of US-1. Both areas have appreciated, but the gated enclave has surged far higher, and its price ceiling continues to push upward while surrounding homes stall. The same story plays out in Old Cutler and other elite quadrants across Miami. The reason is simple: you can’t build another Gables Estates, another Old Cutler, or another Cocoplum. These micro-markets are finite, and over the next 20 years, the spread between top-tier neighborhoods and everything else will only widen as ceilings shift higher in the most desirable enclaves.

Action Step to Avoid Home Buying Mistakes

Before buying, study neighborhood sales to identify true price ceilings. If a home is already trading at or above the local cap, walk away. Instead, target the lowest-priced property in the best neighborhood you can afford—over time, that upside will far outpace a “nicer” home in a weaker area.

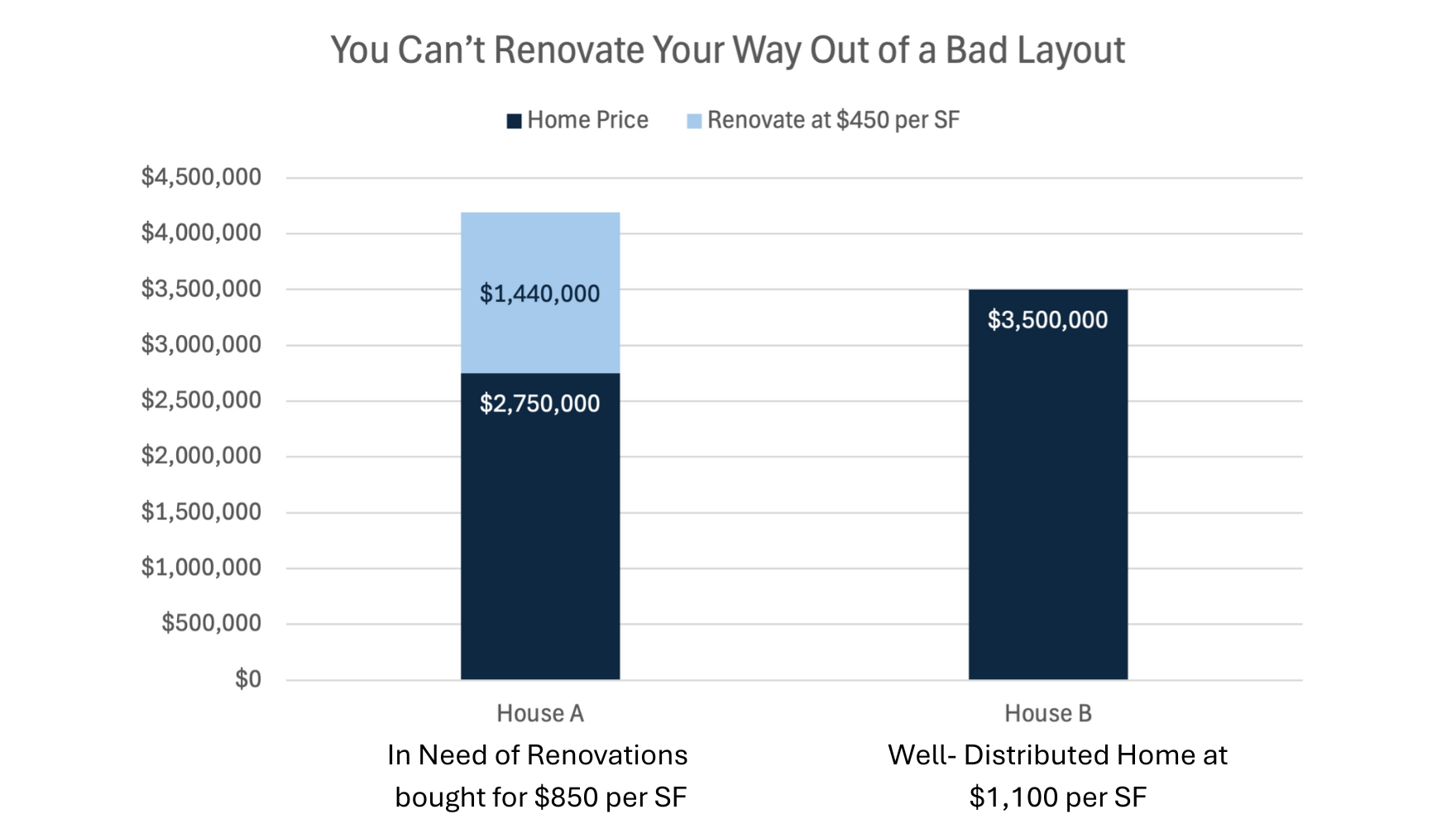

Mistake #5: Ignoring Architecture and Floor Plans

One of the costliest home buying mistakes is buying a home with poor architecture and trying to “make it work” through renovations. Expanding a 3,000 sq. ft. house to 5,000 sq. ft. without rethinking the kitchen, master, or living flow only creates a Frankenstein home; bigger, but functionally worse. Buyers often say, “We’ll make it work, we just need an office or more bedrooms for the kids.” The truth is, it may work for you but not for the market. At some point, it’s smarter to stop renovating and trade up to a home with the right bones.Distribution matters just as much as flow. Layouts with three bedrooms up and three down rarely hold value; long-term buyers want 4–5 bedrooms together on one floor, with maybe a guest suite downstairs. Builders make this mistake too, locking in permanent resale discounts no matter how nice the finishes. Low ceilings, chopped layouts, and poor light are silent killers. You can spend a fortune on marble counters, but buyers will always prefer a smaller home that flows over a larger one that doesn’t.

For example, re-planning a 3,200 sq. ft. home with a chopped layout often runs $300–$450 per square foot all-in ($960K to $1.44M) plus 12 months of carrying costs. And if ceiling heights, lot constraints, or setbacks prevent you from creating today’s standard program (open kitchen/great room, seamless indoor-outdoor flow), you’ve essentially bought a permanent discount. No matter how much you spend on finishes, that home will never trade like the comps with good bones.

You can’t fix bad bones. A poor floor plan, low ceilings, or chopped architecture will always cap a home’s value, no matter how much you spend on finishes. Renovating around those flaws only creates a “Frankenstein” house and a permanent resale discount. The smarter move is to buy a home with good bones—or know when to walk away and trade up.

Action Steps to Avoid This Mistake:

When evaluating a home, focus on four key elements: the kitchen’s location, the balance between bedrooms and bathrooms, the circulation width, and the sightline to the yard or pool. If two or more of these require major structural changes, it’s better to walk away or negotiate a steep discount. Above all, prioritize ceiling height, natural light, and overall flow rather than cosmetic finishes, since these are what truly drive long-term resale value. And if the architecture is simply too compromised, recognize when it’s time to stop renovating and trade up to a home with better bones.

Mistake #6: Cutting Corners on Finishes

In today’s market, buyers won’t overlook cheap materials. A home with a great floor plan but low-quality millwork, doors, or finishes will struggle to sell and command less at resale. It’s worth investing in the right millwork, the right doors, and the right finishes—details that make a home stand out. When it comes time to sell, today’s buyers are demanding a higher level of quality than Miami has seen before. Don’t be the seller who falls short at the finish line by cutting corners at the last moment; it will cost you dearly.

Action Step to Avoid Home Buying Mistakes

If you’re building or renovating with resale in mind, budget an extra 5–10% for top-tier finishes. That final stretch is where million-dollar gains (or losses) are made.

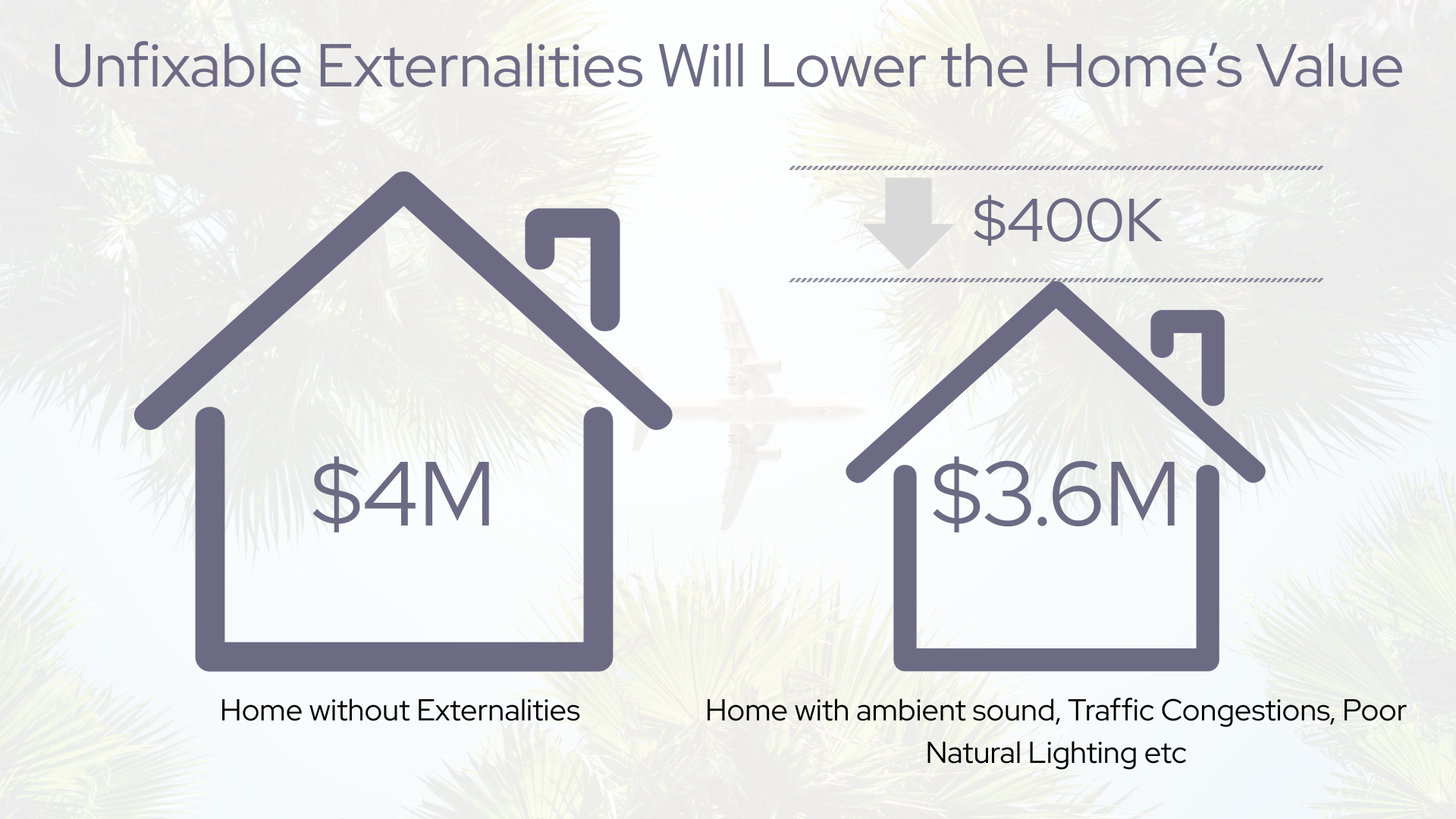

Mistake #7: Ignoring Externalities You Can’t Renovate Away

Some problems no renovation can fix; high-tension power lines, flight paths, commercial neighbors, or constant traffic noise. These externalities permanently cap a home’s appeal and resale value. I’ve even had sellers ask me not to show their property during school pick-up hours or in the late afternoon when airport flight paths roar overhead. Buyers notice, and once you own it, you’re stuck. Always visit a property morning, noon, and evening. A house that feels perfect at 11 a.m. may be unbearable at 4 p.m. Light and aspect matter just as much as noise, which is why good architects design homes to maximize natural light. In balanced markets, homes with these flaws typically sell at a 5–12% discount; in softer markets, the gap widens to 10–20%. On a multimillion-dollar property, that’s hundreds of thousands lost.

Action Steps to Avoid These home buying mistakes

When evaluating a property, always visit at different times of day and use noise apps to measure ambient sound. Go beyond first impressions by pulling flood history reports and noting canal setbacks, as water exposure often carries hidden risks. Just as importantly, check the sun and wind orientation—west-facing pools, for example, often overheat and create glare that can make outdoor spaces less enjoyable and harder to sell.

Mistake #8: Ignoring Boundaries, Schools, and Zoning Rules

Every neighborhood has a ceiling price, often dictated by boundaries you can’t change. In Coral Gables, for example, homes east of US-1 trade far higher than those to the west—largely because school commutes are cut in half. Even if schools don’t matter to you, they will to the next buyer, so always test the drive times at morning drop-off. Beyond boundaries, zoning and FEMA rules can turn a dream project into a nightmare. Buyers often think they can “just add 1,000 square feet” or buy a $12M waterfront home and renovate it to compete with $20–25M neighbors. But if the land is worth $8–10M and the house only $2M, FEMA’s 50% rule caps you at $1M in renovations—hardly enough for luxury standards. Many who thought they had a six-month flip discover they’re in a three-year teardown with millions in carrying costs. Trees, setbacks, and lot coverage bring their own risks.Finally, be aware of what’s happening around you. Buyers often complain about new construction nearby, but in reality, redevelopment usually pushes values up—even if it’s inconvenient short-term. The bottom line: respect boundaries, schools, and zoning laws before you buy, or risk being trapped in a property that never reaches its potential.

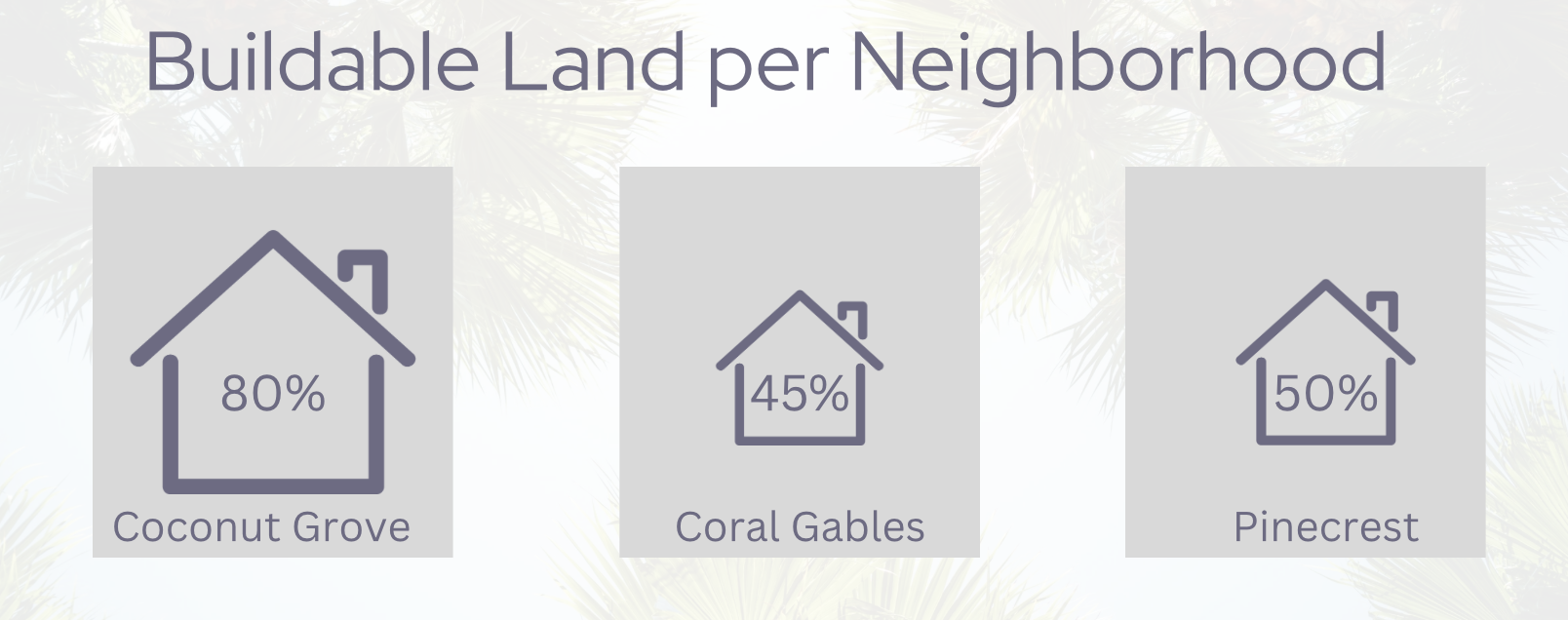

Coconut Grove restricts buildable area to about 80% of the lot, Coral Gables to ~45%, and Pinecrest to ~50%. Remove a protected tree without approval and you can be fined, shut down, or delayed for six months.

Action Steps to Avoid This Mistake:

Before inspections, make sure to pull a zoning letter, review FAR and lot coverage limits, and obtain a tree survey. For any property in AE or VE flood zones, secure an elevation certificate, and if the home is in a flood zone, have a general contractor price out improvements in advance to confirm whether the work will stay under the 50% rule or trigger full FEMA compliance.

Mistake #9: Overlooking Hidden Utility Costs

In Miami, most homes still run on septic rather than sewer, and that creates hidden costs many buyers miss. Septic tanks and drain fields take up lot space you can’t build on—so the spot you imagined for a pool or pergola may be off-limits. Worse, the number of plumbing lines in a house dictates the size of the septic system required, and I’ve seen owners forced to dig up existing pools mid-renovation just to expand a drain field. These surprises usually surface during renovations, when fixes are most expensive. Add in power line easements, plumbing constraints, and potential $20K–$60K sewer conversion costs, and the “perfect lot” can quickly turn into a money pit. The solution is simple: research utilities early or hire an expert before you buy.

Action Steps to Avoid This Mistake:

Before inspections, confirm whether the property is on septic or sewer, since this alone can have a major impact on usability and cost. Be sure to ask about any active or upcoming municipal conversion requirements, liens, or assessments that could add unexpected expenses. If a conversion may be needed, budget $20K–$60K or more and adjust your offer price accordingly so you’re not blindsided later.

Conclussions

Not All Miami Neighborhoods Perform the Same

In Miami, two homes just a mile apart can have completely different appreciation curves. North and East Coconut Grove—with their elevation, canopy, and walkability—have consistently outpaced the broader market, while South Grove and cut-through streets lag. In Coral Gables, pockets like the Golden Triangle, Country Club Prado, and north of Sunset lead, while homes west of 57th or on busier corridors trail behind. In Pinecrest, Ponce-Davis, and High Pines, large, regular sewer-connected lots with newer builds hold up best. Smaller or irregular parcels underperform in up-cycles and fall harder in corrections. Even in Palmetto Bay, east-of-Old Cutler with larger lots and park adjacency absorbs steadily, while interior tracts on busier roads always trade at a discount.

The 10 Rules That Protect Your Upside

If you want your home to hold value—and avoid the silent $1M Home Buying Mistakes—follow a simple playbook. Prioritize lot and elevation first: at least 10K SF in Gables/South Miami, 20K+ in Pinecrest, with widths of 80 ft on interiors and 100 ft on waterfronts, and finished floor elevations at least 2–3 ft above BFE. Stick to homes built under the 2002 Florida Building Code or fully renovated post-2018. Favor quiet interior streets near parks or schools over arterials. Look for straightforward layouts with indoor-outdoor flow and ceiling heights of 9–10 ft or more. Sewer connection is preferable—if not, budget realistically for conversion. Avoid unfixable externalities like power lines, substations, flight paths, or noisy venues. Pay attention to orientation—harsh west-facing yards without shading are resale killers. And always check zoning, trees, and school zones before assuming expansion is possible.

Bottom Line: Avoid $1M Home Buying Mistakes, Capture Real Appreciation

In Miami, you’re not just buying a house—you’re buying its land, elevation, street, and future buyer pool. Choose wrong, and you quietly lose $1M over a normal ownership cycle. Choose right, and you ride the neighborhood’s true growth curve and enjoy a far smoother exit when it’s time to sell.

Closing Thoughts

At the David Siddons Group, our 15 territory managers live and breathe their neighborhoods. They know the zoning laws, FEMA rules, and $/SF dynamics that shape values today, and where they’re headed tomorrow. Backed by decades of historical data and predictive modeling tools, we can show you which neighborhoods are nearing a ceiling and which still have room to run. This video may not be as “juicy” as our condo market review, where you can really lose your shirt, but the lesson is just as important: in housing, there are real dangers and even bigger opportunities. If you don’t choose wisely, you risk not only losing $1M—but also missing out on making it. Consult with us. Let me connect you with the right neighborhood expert so you can make the best decision for your future. Thanks for watching, and stay tuned for our next video covering Miami, Broward, and Palm Beach.

Before you make a move, work with an agent who knows how to spot the $1M home buying mistakes. We check flood zones, zoning rules, lot potential, and resale risks upfront—so you don’t get burned later.

Call David Siddons at 305.508.0899 or schedule a meeting via the app below!

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Close

Edit Search

Close

Share this property

Recomend this to a friend, just enter their email below.

Close

Your email was sent successfully

Close

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS