- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

What Miami Real Estate NOT to buy!

Which Real Estate in Miami you better not buy!

What Condos to Avoid?

Miami real estate is among the most desired in the world, and buyers from across the globe come looking for their slice of paradise. Most real estate content, including on our own site , focuses on what and where to buy. But just as important, and often overlooked, is what to avoid. This is the conversation I have with clients when they’re eyeing a property that looks tempting but carries red flags that could cost them dearly down the road.

Overpriced Condo Units

Many Miami condos remain overpriced despite a market correction and increased inventory. Sellers often list units as if it’s still a red-hot seller’s market, keeping prices inflated far above true market value. These units typically sit unsold until reality forces a price cut. Before buying, consult accurate market data for that neighborhood or building, or call me directly, to avoid overpaying.

Generic or Overhyped Buildings

Some condos are simply replaceable. In markets like Brickell, newer towers can look and feel nearly identical, with little to set them apart in quality or value. In a buyer’s market, generic units compete with thousands of similar options, making them hard to sell. Branded residences can be equally risky — while some, like the Porsche Design Tower, deliver on their promise, others charge a premium for a name without offering lasting quality or resale appeal.

Ignoring the Owner-to-Renter Ratio

One of the most overlooked but critical metrics is the owner-to-renter ratio. Rental-heavy buildings are more volatile, especially during market downturns, and tend to see slower appreciation compared to owner-occupied buildings. As I detail in the “How to Lose $1M” blog, communities like Park Grove in Coconut Grove, with a high percentage of end-users — have appreciated up to 250% over the past decade, while rental-heavy Brickell buildings have often stagnated.

These are some of Miami’s Worst Performing Condos

- ONE THOUSAND MUSEUM | Premium Offering in a Non-Premium Area

- PARAMOUNT WORLD CENTER | Questionable Location, Compromised Quality, and Built for EB-5 Investors Not End Users

- MUSE SUNNY ISLES | Secondary markets, including Sunny Isles, have experienced the steepest declines.

- PORSCHE DESIGN TOWER | A typical example of branding gone wrong

- AR MANI CASA| Several floor plans in this building are not particularly well-designed

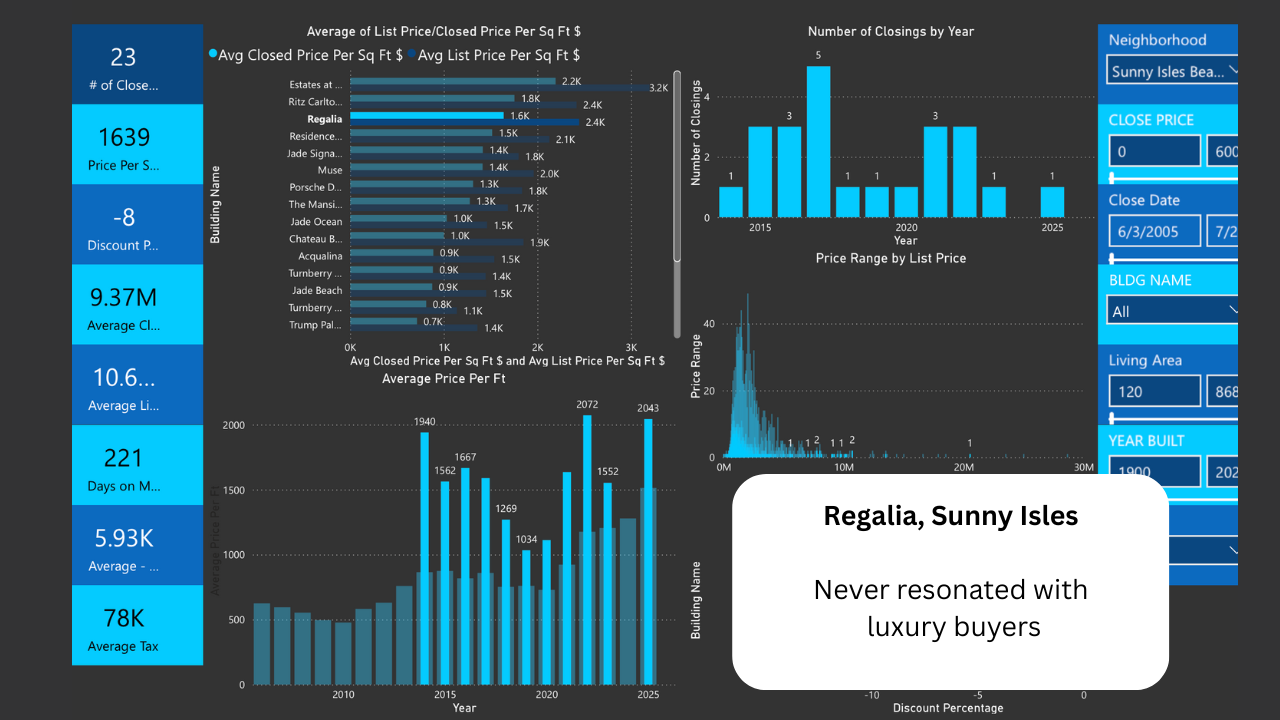

- REGALIA, Sunny Isles | Never resonated with luxury buyers

- FAENA HOUSE | A development in which property values have slipped, likely influenced by exceptionally high HOA fees and not all equally qualitative floor plans

- ARTE SURFSIDE | Launched during the Pandemic, but unable to keep its value in the resale market

- ICON BRICKELL | Poorly built condo, that now needs major repairs

- KENILWORTHMiami Beach | Aging Beachfront Condos are Facing Price Pressure 1970s-era buildings are seeing values slide as the market shifts

- NINE AT MARY BRICKELL | Generic condo with many short term rentals.

- RISE Brickell City Center | Luxury that was not luxury, but rather generic

- 321 OCEAN, South Beach | 321 Ocean has one of the highest HOA fees on the beach

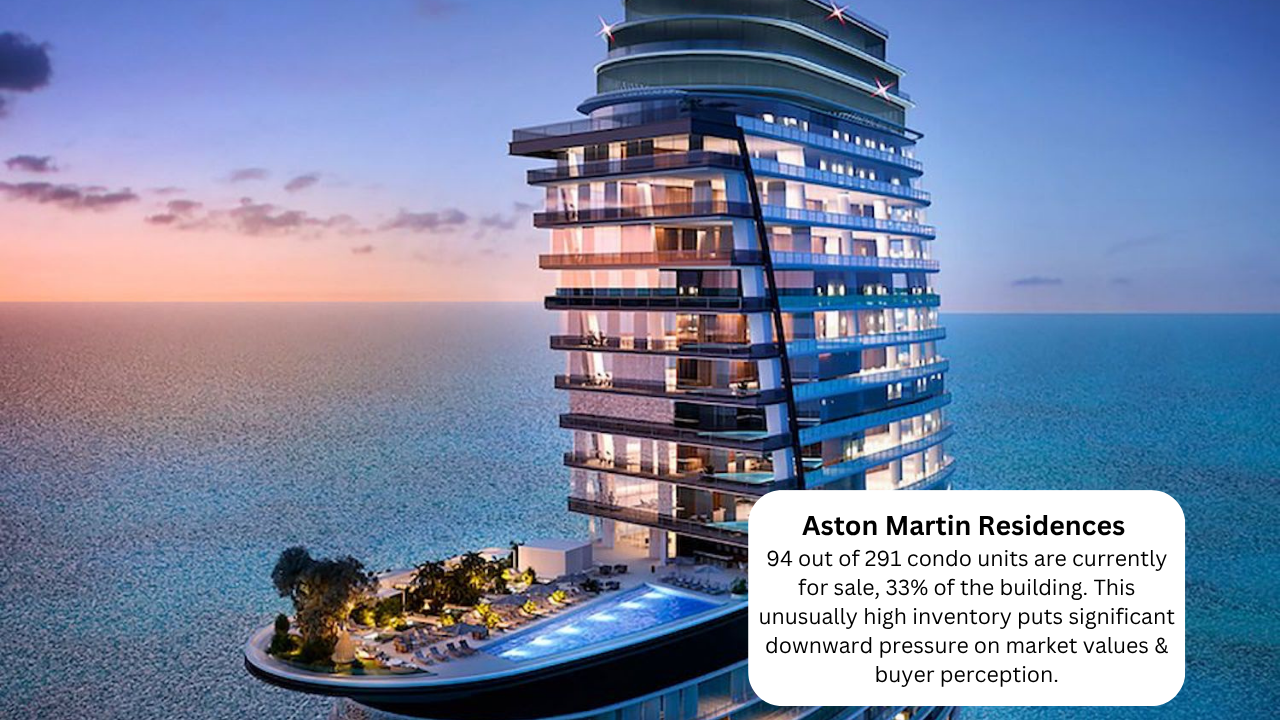

- ASTON MARTIN RESIDENCES | 94 out of 291 condo units are currently for sale, 33% of the building. This unusually high inventory puts significant downward pressure on market values & buyer perception.

Buying the Wrong Line

In a condo, location within the building is as important as the building itself. “Bargain” prices often point to units with bad layouts, wasted space, or views at risk of being blocked by future construction. Once a view is lost, value rarely recovers. Always choose lines with protected, desirable views.

Overlooking Unique Features

Choose a unit with features that modern buyers value, high ceilings, corner layouts, large balconies, unobstructed water or skyline views. Avoid small, awkward floor plans and tiny balconies that compromise livability. These units face tougher resale competition and diminished appeal.

Future-Proofing Your Investment

Before buying, assess the building’s financial health and upcoming maintenance or special assessments. Also, research surrounding lots, an empty lot next door could soon be a tower blocking your million-dollar view.

Bottom Line

The difference between a condo that appreciates and one that drains your equity comes down to doing the right research, asking the right questions, and avoiding emotional decisions. The Miami market rewards buyers who focus on location quality, building composition, unique features, and resale potential, and penalizes those who don’t.

What to Avoid when Buying a Miami Single Family Home

Perform a Comparative Market Analysis

When it comes to single-family homes, it is also important to stick with the market price in the area and to have a realtor perform a comparative market analysis. You do not want to pay a higher price per SF than similar homes, not even in a seller’s market. This still happens a lot with buyers using a realtor who does not perform a market analysis. They pay too much for a property and when they try to sell the property they notice they overpaid and cannot cope with the competition.

Consult the Miami real estate market updates on my site or even better call me for an up-to-dated overview of the market to avoid paying over market prices.

An Eye for Detail

The Miami Market offers many finished spec homes these days. It is sometimes hard to make a comparative analysis for these homes, which makes buyers blind for the price. As the home is very new and features the latest in finishes, buyers often fall in love with its design without critically looking at the different details. The David Siddons Group worked with many spec homes and knows a generic product from a luxury product. Moreover, as the husband of a renown Miami interior architect and designer, David recognizes high-quality finishes from low quality finishes, which helps in the process of establishing the correct price.

Natural Disasters

Miami knows certain areas with flood hazard. It is advised to stay away from these zones for obvious reasons. As Miami experiences hurricanes one should also look for well-build homes, which are equipped to protect themselves from hurricanes.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS