Miami Beach Homes

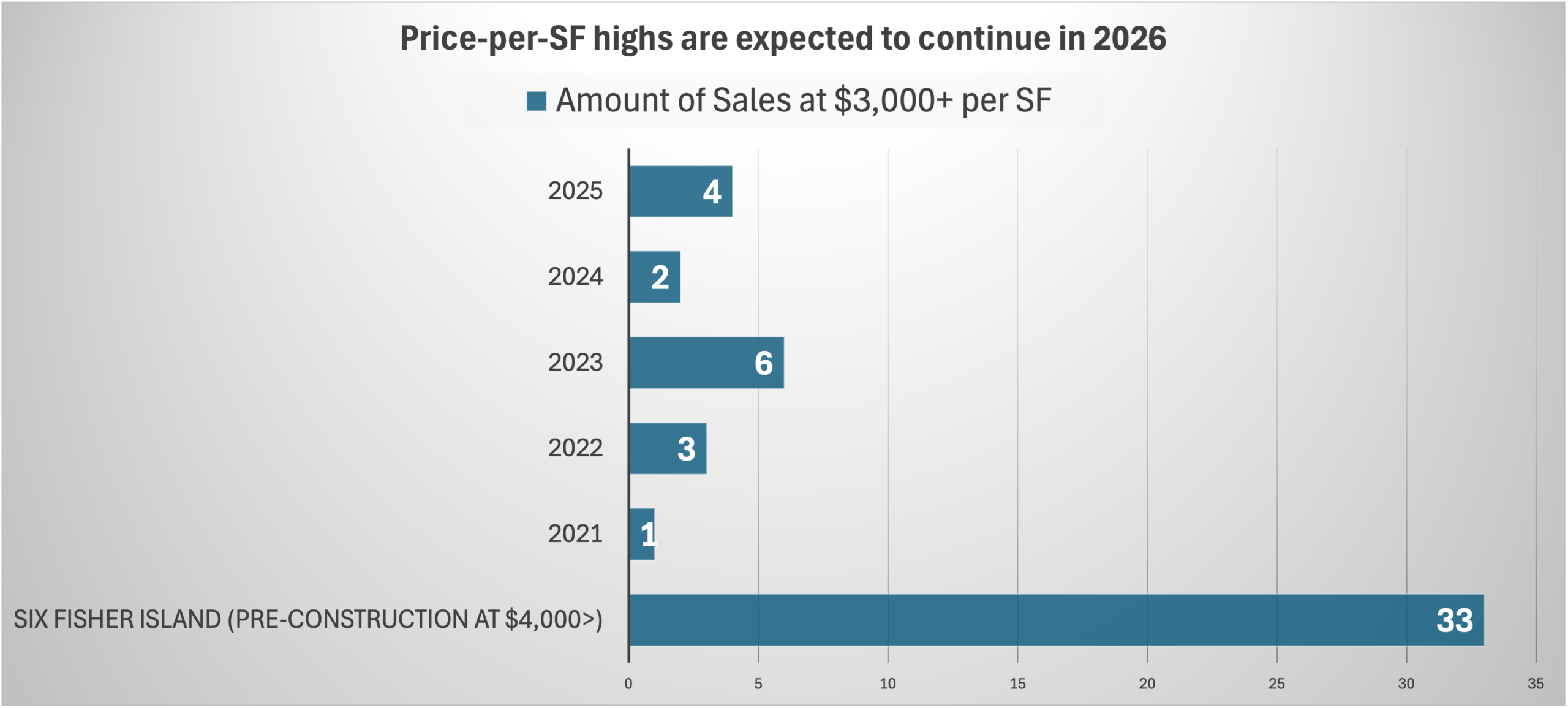

Homes in the trophy enclaves (Venetian Islands, North Bay Road, Palm/Star/Hibiscus, La Gorce, Sunset Islands) continue to set the pace, with 8 sales at $4,000/SF+ and 20 at $3,000/SF+ this year, proving that prime, turnkey, view-protected waterfront homes still clear at premium prices. Demand is anchored by cash-heavy end-users and structural scarcity. $1M–$3M runs near ~10 months of inventory (balanced), while most other brackets hover around ~20 months (buyer-leaning) with 10–14% average discounts and ~130 days on market. Yet the $10M+ tier moves faster (~3.5 months), proving A-plus, view-protected, turnkey waterfront homes still clear quickly even when headlines hesitate. Limited new supply preserves scarcity, and the same macro tailwinds (lower rates, NYC/CA inflows) support depth at the top. Therefore Miami Beach is in the Top 5 Miami neighborhoods to Buy in 2026

What to Buy: Buy turnkey bayfront homes on exceptional lots; avoid compromised orientation or inferior lots that won’t hold the line on resale.

What to Avoid: Older Homes on the water unless the price justifies to tear them down and rebuilt them (look at market caps for the market)