- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Midyear 2025 Miami Beach Condo Market Report | Boom, Bust or Bubble?

Summary

As we reach the halfway point of 2025, the Miami Beach condo market shows a multifaceted performance across price segments. The first six months offer a clear lens into buyer behavior, pricing trends, and the evolving role of new development — with a growing divergence between resale and pre-construction product, particularly at the high end. In this Miami Beach condo market report we provide you with a breakdown by price bracket, along with top value picks across the market:

Key Takeaways – Mid 2025 Trends

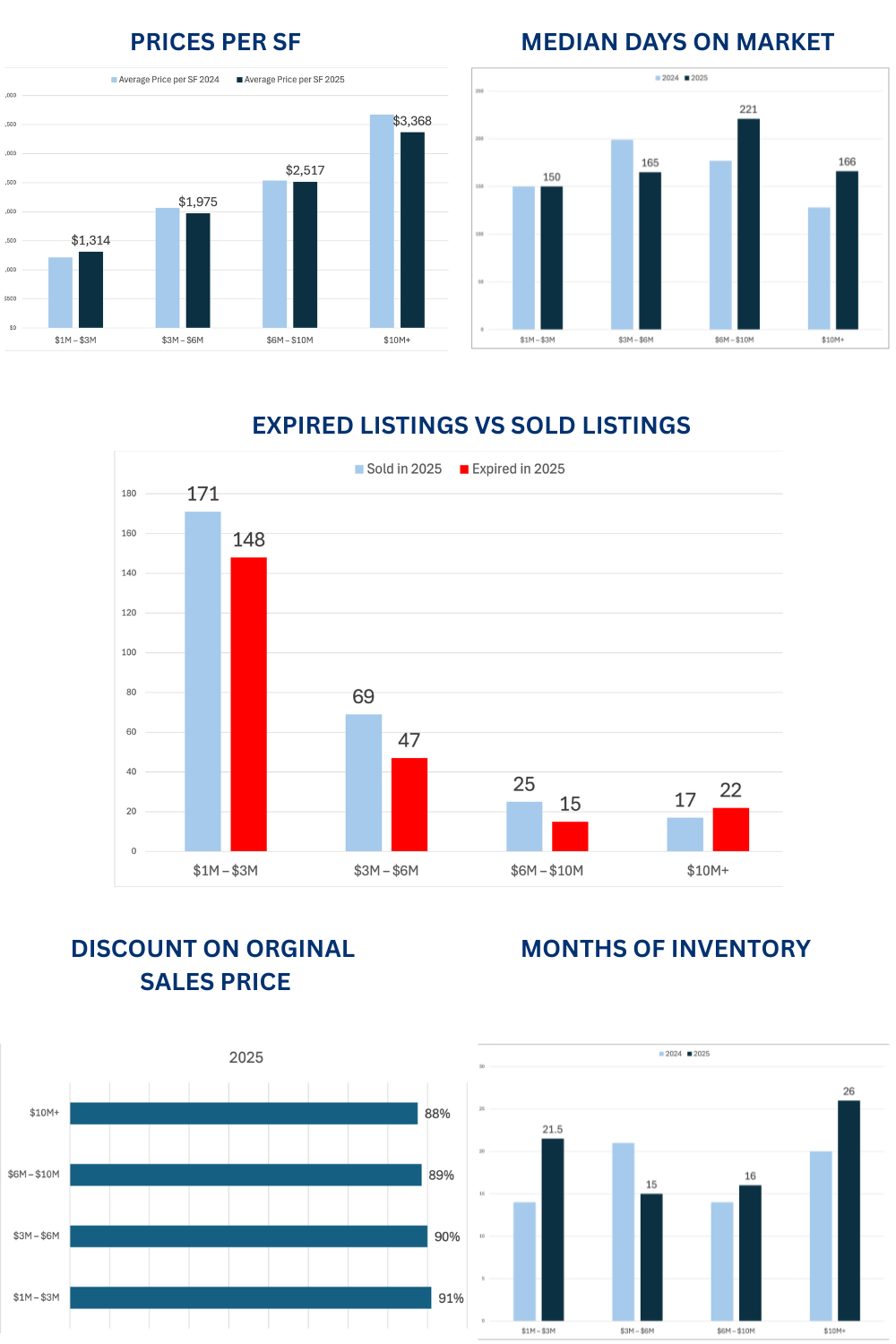

- A High Amount of Expired Listings. Across almost all price ranges, just as many listings expired as successfully sold in the past six months. This is a sign that the market is still seeing a lot of inventory that is not absorbed by the market. Most likely caused by overpricing.

- Discounts Are Becoming More Generous. Sellers are becoming (and must continue to be) more realistic in their pricing with many already offering hefty discounts.

- $1M-$3M: Supply ballooned with more than 50%, but values climbed due to selective demand. Top-quality condos move fast, the rest linger.

- $3M–$6M: Demand Surges, Prices Soften. Sales up 22% year-over-year, while inventory dropped 28%. Yet, price per SF slipped 4%, showing that sellers had to adjust pricing to get deals done.

- $6M–$10M is experiencing a stalled momentum. Sales fell 14%, inventory rose 14%, and days on market jumped 25%. Buyers are becoming much more selective, only paying for fully upgraded, prime-location units or turn to new construction.

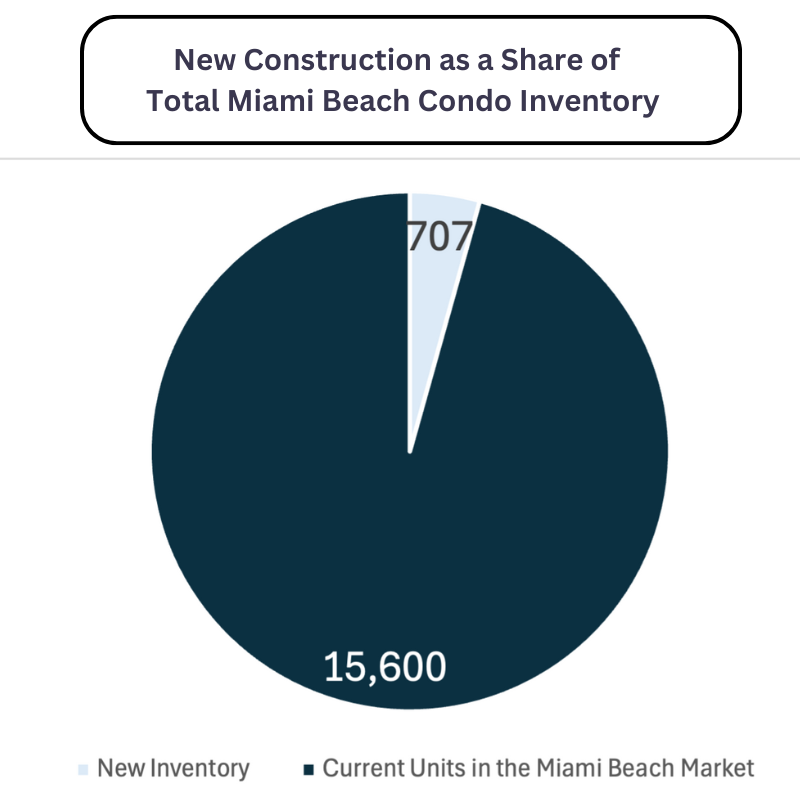

- 10M+ Ultra-Luxury: The Big Divide. Inventory spiked 30% (20 → 26 months) while price fell. 60% of pending sales are in pre-construction, exposing how older resales are losing out to new branded luxury towers. Ultra-luxury resales are struggling while new construction dominates

- Pre-Construction Dominance in Ultra-Luxury: New builds are absorbing demand while older resales accumulate inventory. Luxury inventory is set to surge, with nearly twice as many $6M+ condos entering the marke (411)t compared to those sold since 2020, signaling a major shift in supply-demand dynamics.

The Miami Beach Pre-Construction Condo Market

The Pipeline of new construction condos

| Condo | Location | # of Units | % Sold | Available Inventory | Average Price per SqFt | Price Range | Delivery Date |

| The Perigon | Miami Beach | 83 | 82% | 13 | $3,250 | $4M-$25M+ | Q2 2027 |

| Villa Sofia | Miami Beach | 27 | Not Disclosed | Not Disclosed | $650K-$2M | Q2 2026 | |

| Ocean House | Surfside | 25 | 50% | 12 | $3,300 | $5M-$16M+ | Q3 2027 |

| Ritz Carlton Residences South Beach | Miami Beach | 30 | 25% | 18 | $2,750 | $3M-$25M+ | Q2 2027 |

| Ocean Terrace | Miami Beach | 52 | Not Disclosed | Not Disclosed | Don’t know | $9,500,000 - $25M+ | 2029 |

| The Shore Club | Miami Beach | 49 | Not Disclosed | Not Disclosed | $5,500 | $6M-$50M+ | 2027 |

| 72 Park | Miami Beach | 270 | 95% | 15 | $1,700 | $750K-$2.5M | Q2 2025 |

| Rivage | Bal Harbour | 60 | 50% | 30 | $3,600 | $7M-$50M+ | Q1 2026 |

| Delmore | Surfside | 37 | Not Disclosed | Not Disclosed | $4,700 | $15M-$50M+ | 2028 |

| Surf Row Residences | Surfside | 24 | 40% | 14 | $1,450 | $1.3M-$3.5M | 2027 |

| Ocean House | Surfside | 25 | 50% | 12 | $3,300 | $5M-$16M+ | Q3 2027 |

| Six Fisher Island | Fisher Island | 50 | 65% | 17 | $4,000 | $16M+ | 2027 |

| Total | 707 |

Miami Beach currently has approximately 15,500 condo units across its main buildings. With an additional 707 units expected to be delivered over the next years from new developments. This represents a 4.5% increase in total inventory. It is however important to remark, that most of this inventory sits in the $5M or even $10M+ market.

$1M–$3M: Steady but Inventory-Heavy

Between 2024 and 2025, the $1M–$3M condo segment remained steady in terms of closed sales, with no year-over-year change in volume. However, inventory rose sharply from 14 to 21.5 months, a 53.6% increase, giving buyers more leverage, especially in older or less updated buildings. The average price per square foot increased by 8.2%, from $1,214 to $1,314. Despite the higher inventory, buyer interest remains strong for well-renovated and well-located units, which continue to command premium pricing. The close-to-list ratio also improved from 89.2% to 91.2%, signaling slightly stronger seller positioning. Meanwhile, days on market remained flat at 150, reflecting consistent market pacing despite the added supply.

For Buyers: This segment is inventory-heavy, giving you leverage to negotiate, especially in older buildings that may need updates. Focus on well-located, renovated units to get the best value. Take your time and look for properties where sellers might be more flexible on price.

For Sellers: With inventory rising, it’s crucial to price competitively and highlight any upgrades or prime location features. Consider freshening up your property to stand out and respond quickly to buyer interest to avoid longer days on market.

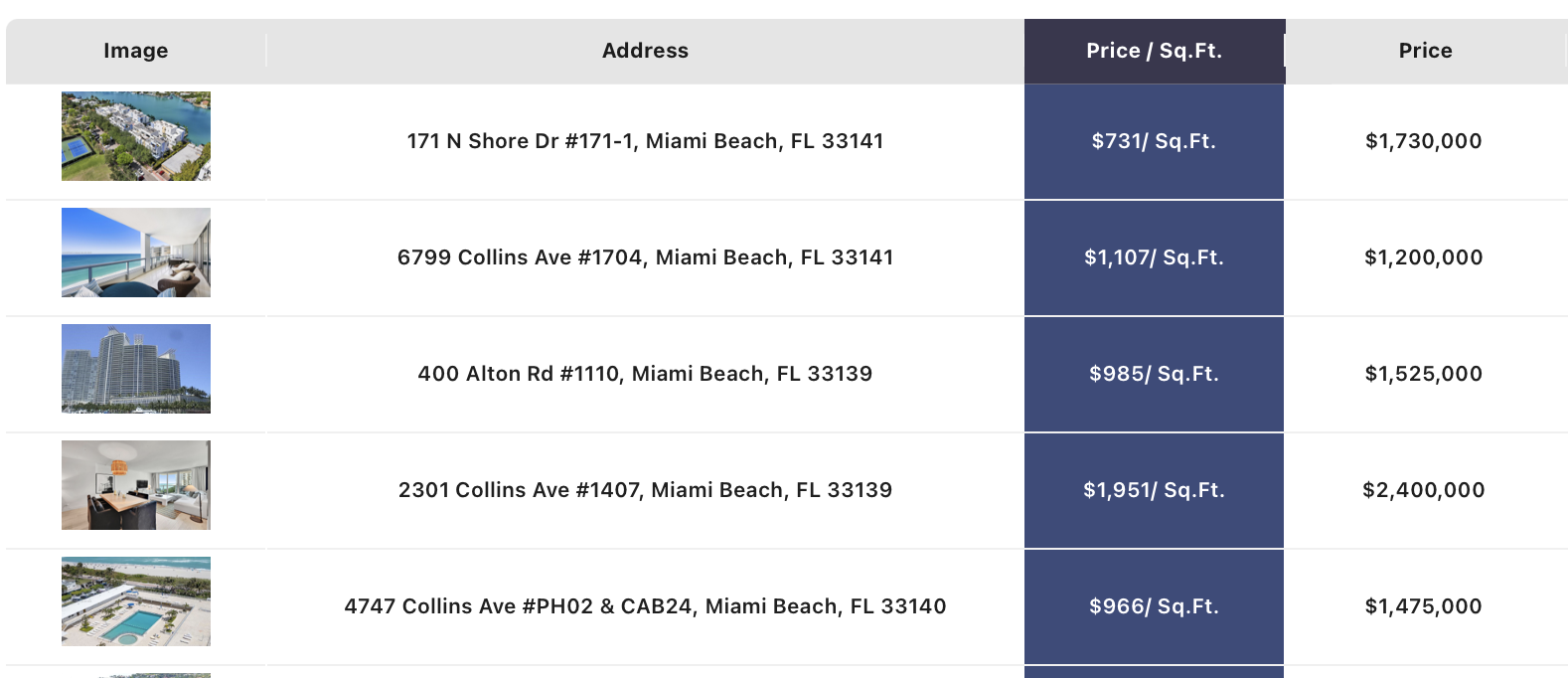

Top Picks:

- Mei Condo (Mid-Beach, Oceanfront): Boutique, modern, great value under $3M

- Costa Brava & The Grand Venetian (Belle Isles): Waterfront charm, strong neighborhood feel

$3M–$6M: High-Interest, Lower Prices

The $3M–$6M condo market saw a 22% increase in closed sales year-over-year, rising from 50 to 61 transactions. This surge in activity was paired with a 28% drop in inventory, falling from 21 to 15 months—a sign that motivated sellers and price adjustments are successfully moving product. Despite the increased demand, the average price per square foot remained equal (just a 4% decrease). The average days on market improved as well, decreasing 17% from 199 to 165 days, showing that well-priced listings are being absorbed more quickly. While the close-to-list ratio remained relatively stable, inching up from 89.7% to 90.2%, it reflects a market where buyers are still negotiating, but sellers are increasingly meeting the market to close deals.

For Buyers: Prices have softened slightly here, and inventory is tightening, so this is a great window to find good value. Act decisively on well-priced, upgraded listings since demand is strong and inventory is lower. Watch for motivated sellers who may be open to negotiations.

For Sellers: This market favors sellers more than lower tiers due to higher demand and reduced inventory. Price your home smartly but competitively, and be prepared to move quickly when good offers come in. Highlight any upgrades and strong value propositions to attract buyers.

Top Picks:

- Portofino Tower (South of Fifth): Renovated 3BR or 2+Den units around $1,500/SF

- Bath Club (Mid-Beach): Elegant, private, full-service — a hidden gem

- Pre-construction alert: The Perigon in Mid-Beach is drawing luxury buyers early

$6M–$10M: Slight Cooling, Solid Value

Luxury inventory is set to surge, with nearly twice as many $6M+ condos entering the marke (411)t compared to those sold since 2020, signaling a major shift in supply-demand dynamics.

The $6M–$10M market is showing signs of a slight cooling with closed sales declining 14% year-over-year, dropping from 22 to 19 transactions. Inventory increased 14%, rising from 14 to 16 months, indicating more options for buyers but also a slower pace. Average price per square foot remained relatively stable, dipping just 0.7% from $2,536 to $2,517, reflecting steady pricing in this segment. The close-to-list ratio decreased slightly from 90.3% to 88.5%, suggesting sellers may be making more concessions to close deals. Meanwhile, days on market rose 25%, from 177 to 221 days, showing buyers are taking more time and being more selective, focusing on fully upgraded units in prime locations. Overall, the segment reflects a healthy pause with solid value for discerning buyers.

For Buyers: The market is cooling a bit, so take advantage of the longer days on market to negotiate better deals. Focus on fully upgraded homes in prime locations as buyers are becoming more selective. Don’t rush—there’s room to be discerning.

For Sellers: Expect longer selling times and some price sensitivity. Maintain realistic pricing, especially if your home isn’t fully upgraded or in a top location. Investing in renovations can help your property stand out and shorten market time.

Top Picks:

- Continuum on South Beach

- Murano at Portofino (South of Fifth): Both offering premier amenities, privacy, and ocean access

$10M+ Ultra-Luxury: A Market of Contrasts

Closed sales in this segment remained flat at 12 year-over-year, but pending sales have increased to 9, indicating growing market velocity. Months of inventory rose significantly by 30%, from 20 to 26 months, signaling an oversupplied resale market, particularly in older buildings priced unrealistically. Average price per square foot declined 8.3%, dropping from $3,673 to $3,368, reflecting this pricing pressure. The close-to-list ratio slipped slightly from 87.3% to 86.3%, and days on market increased by 30%, from 128 to 166 days, showing that listings are taking longer to sell. Meanwhile, pre-construction and new developments, which make up 60% of pending contracts, are driving much of the recent activity, highlighting a growing divide between resale and new construction values as the defining trend in this segment.

For Buyers: This segment shows a clear divide between resale and new construction pricing. Focus on pre-construction or new developments, which dominate pending sales and often offer better value. Be patient with resale properties and carefully evaluate pricing, especially in older buildings.

For Sellers: With growing inventory and longer days on market, especially in resale, price your home carefully and consider offering incentives or upgrades to compete with new construction. Stay informed on new development activity and adjust your strategy accordingly.

Top Picks:

- Continuum on South Beach: Larger remodeled units at $3,500/SF

- Eighty Seven Park (North Beach): Renzo Piano design, south-facing units above $4,000/SF

- New Development Momentum: Buyers are prioritizing architecture, amenities, and long-term value

Final Thoughts of the Miami Beach Condo Market Report

The Miami Beach condo market continues to reflect the changing tastes and sophistication of today’s buyers. Across every price point, those buildings and units that offer location, design, privacy, and amenities are outperforming the rest. Sellers of older product need to adjust to today’s pricing reality, especially at the top end where competition from new development is fierce.

Looking Ahead

As we move into the second half of 2025, all eyes will be on inventory absorption and how interest in new construction product continues to shape the market. Miami Beach remains a global destination, and with strong fundamentals and continued demand, we anticipate a dynamic and opportunity-rich second half of the year.

Connect with the David Siddons Group

If you have questions about this Miami Beach Condo Market Report please contact the David Siddons Group at 305.508.0899 or schedule a call via the below app.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS