- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Miami Condo Market: Saturated but not Busting

Has the Miami Condo market peaked? Yes (In some neighborhoods)

Do we expect another Bust? No

Whoever follows the Wall Street Journal will have read their recent article about a looming next Miami condo bust. The WSJ used sensational headlines like: “Developers, seeing sharp drop in sales, inventory surge, take steps to avoid a ‘bloodbath’“, which served the writer’s purpose for creating a stir in combination with numerous shares, comments and likes. In this blog we try to explain to you what the condo market in Miami is really experiencing. Although some elements in the before-mentioned WSJ article are true, we are not expecting another bubble.

Read our article in the Miami Herald about the Brickell condo market and its shift in supply and demand

Based on our Brickell Real Estate Report 2015

The Miami condo market knows a different climate these days

Despite the slower Miami condo sales, we are not likely to see another condo bubble like the one we experienced in 2007 and 2008.

- First of all, very little has been bought on credit (most Miami condos are bought in cash), so we’re not going to see our hand being forced where we have to sell at half the price. This means most people are not in debt and can actually afford their investment.

- Many developers require buyers to pay a 50% deposit (unlike the 20% required in the last cycle) on the total cost of their units by the time the project breaks ground. Developers don’t break ground until the project is 80% sold, which means the deposits are enough to cover a significant portion of the construction costs.

- Miami has developed as a world city with business, services and retail to rival any other major metropolitan hub around the globe. The gap we had for quality retail, banking and services has been filled. What is interesting is the entrepreneurial spirit, open attitudes, and influx of wealth coming into the city. Services that add to the real quality of life in Miami are its arts, shopping, diverse culinary hotspots, and entertainment. Miami is becoming more and more a preferred residential place for young professionals from all over the world.

-

A slowdown in new projects will prevent the massive oversupply that Miami saw during the last cycle. The current inventory level is not as high as the inventory before the 2007 bubble.

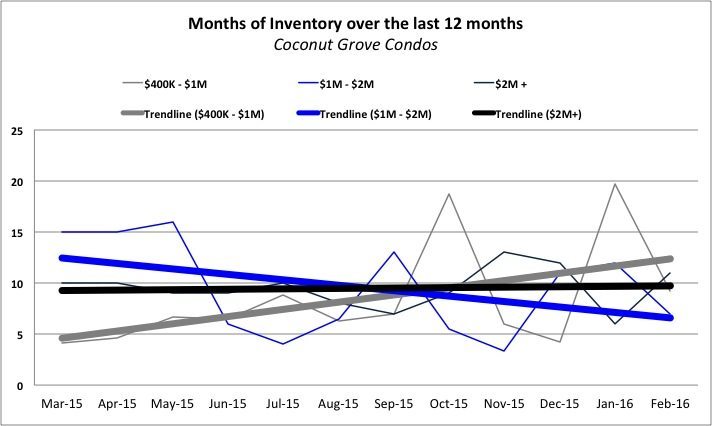

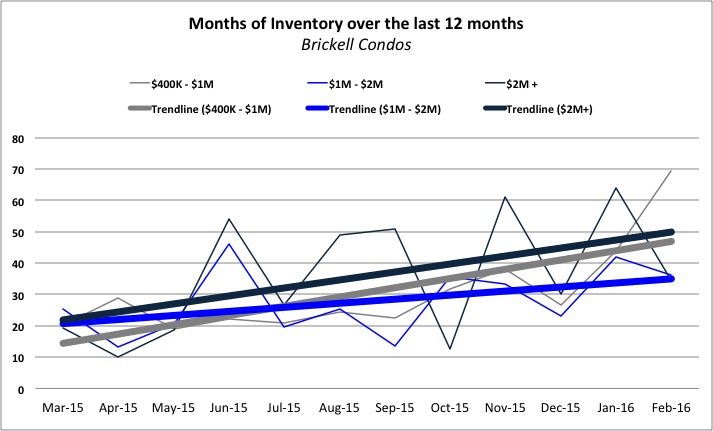

Pictured below: Condo Inventory Levels accros Miami (Provided for 3 different budgets)

Pictured below: Park Grove in Coconut Grove

David Siddons

[email protected] | +1 305 508 0899

Meet the team and see our unique insights into the Miami Real Estate Market.

No generalized opinions, we offer an analytic approach.

Preferred agents of First time buyers, Sellers, Investors and Wealth Managers

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS