- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Surprising Trends and Remarkable Shifts | Brickell Q1 & Q2 2023 Market Summary

Brickell Q1 & Q2 2023 Market Summary. As the Brickell and Brickell Key condo market continues to undergo remarkable shifts, a question emerges: Who holds more leverage, buyers or sellers?

As the market continues to overcome the challenging macroeconomic landscape, this success story is not uniform across all Brickell and Brickell Key, as certain pockets struggle with a surge in inventory levels, leading to prolonged periods for properties to secure buyers. The evolving market conditions have prompted discernible shifts in the behaviors of both buyers and sellers. As you read this report, you will be able to gain a clearer perspective on where you stand within the market—whether you’re a prospective buyer or seller.

The Brickell and Brickell Key condo market has a relatively balanced inventory level, averaging around 5.4 months of supply. The price points experiencing the highest saturation of inventory are the properties priced between $1M and $3M, which currently hold an average of 10.2 months of supply. Properties priced at $3M and $5M are also experiencing a surge in supply, with an average of 15.3 months.

The behavior of today’s buyers is more conservative with their approach and generally based on comparable sales, with the exception of truly unique properties. This means that if sellers are still trying to sell average units at a premium price without justification (i.e., the unit remains in its original condition or needs work), it will only extend the selling period and likely lead to multiple price reductions.

Buyers may not have the same sense of urgency as they did in 2021 or perhaps the earlier portion of 2022, but they do not want to consider significantly overpriced units. For this reason, when we strategize with our sellers, we emphasize the importance of properly pricing units so that you can have optimal results. Overall, with extended periods to sell, higher inventory levels, and lower transaction volume, the market conditions will continue to shift from a balanced market to a buyer’s market.

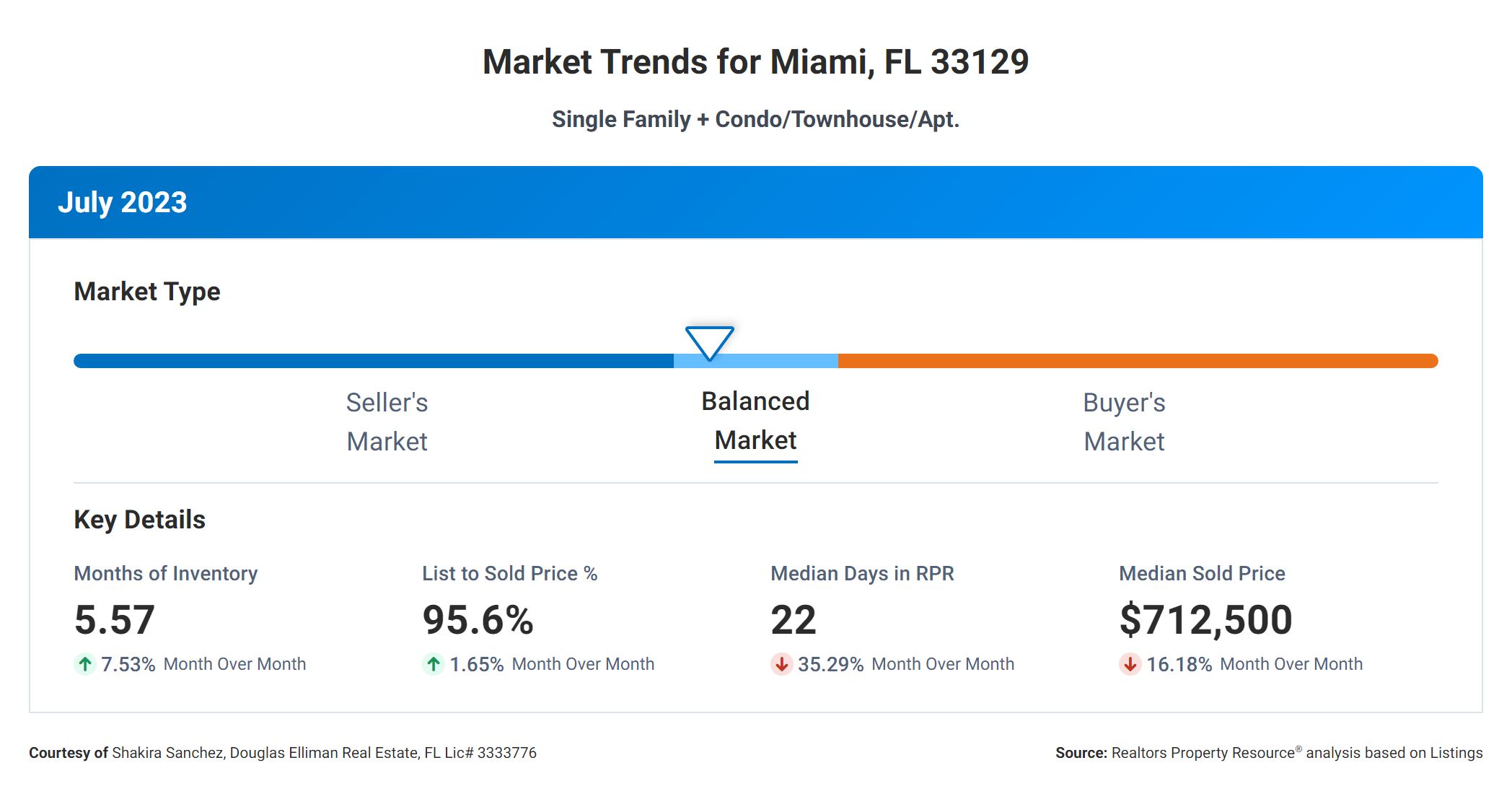

Brickell Q1 & Q2 2023 Market Summary: 33129: SOUTH BRICKELL

Buildings: Santa Maria, Bristol Tower, The Palace, Skyline, and Brickell Place

As we delve further into the details, it becomes evident that South Brickell experienced the highest surge in supply, increasing by over 82% since the previous year. Remarkably, this area also experienced the highest price appreciation within the neighborhood, with a substantial rise of over 21% in value.

Despite a notable increase in supply, South Brickell maintains a relatively balanced market with a 5.6-month inventory. Regarding the future landscape for the neighborhood, buyers are proceeding cautiously regarding older buildings. Although older buildings may offer better views, floor plans, or service, buyers want to avoid dealing with special assessments or the work that entails in these buildings.

As we continue to see the new condo legislation unfold, this will directly impact the older coastal buildings that predominantly comprise the South Brickell neighborhood. Ongoing work on the exterior and interior of buildings is anticipated to continue next year, which could hinder seller leverage in the near future.

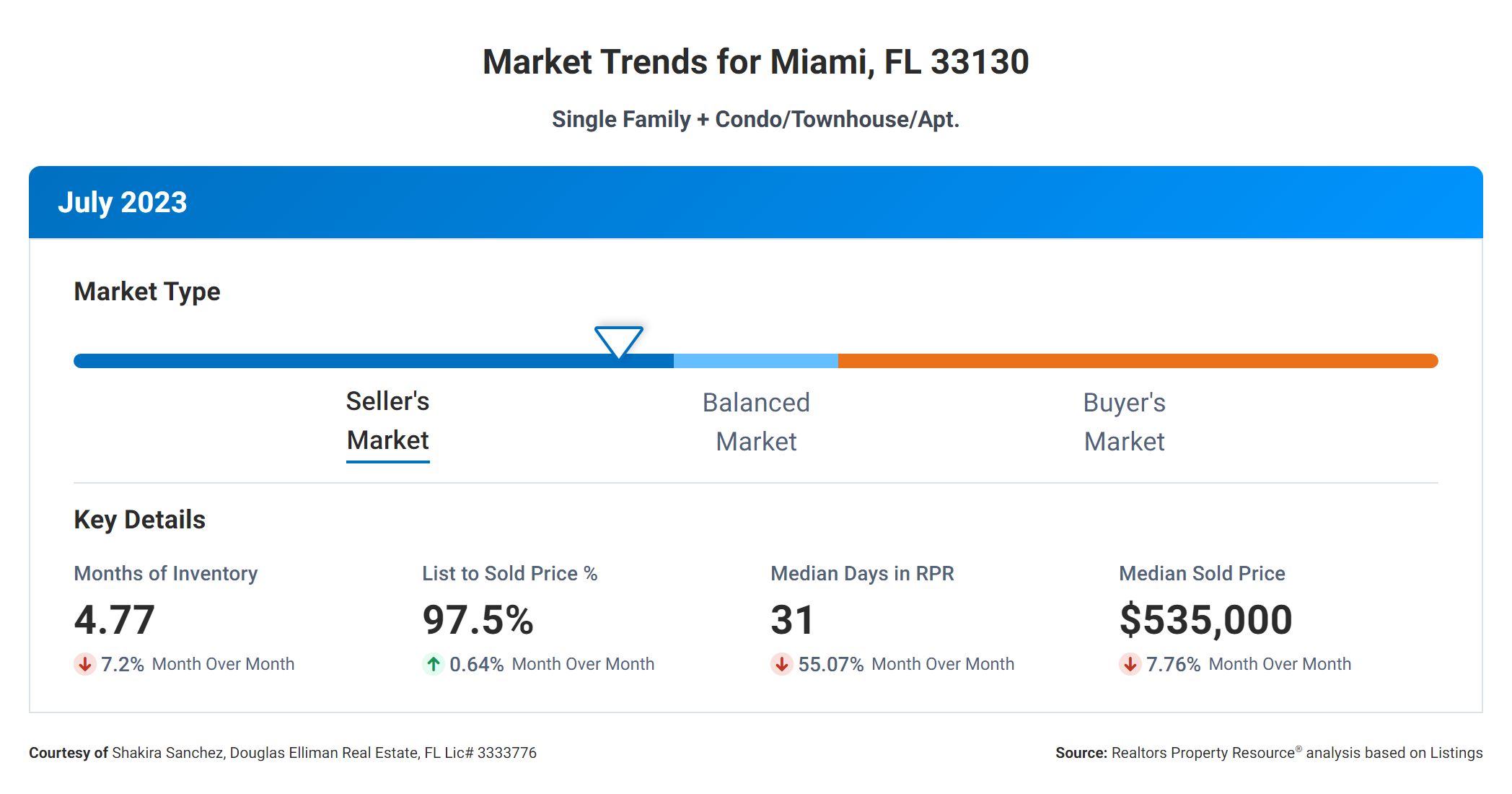

Brickell Q1 & Q2 2023 Market Summary: 33130 New Brickell/NW Brickell

Buildings: Rise at Brickell City Centre, SLS, and Brickell Heights

Out of all the areas in Brickell and Brickell Key, this one has the lowest supply level, which currently holds 4.8 months of inventory, making it quite favorable for sellers. However, it’s worth noting that this area had the smallest appreciation growth, recording only a 5% increase from the previous year.

Although this area is experiencing the lowest supply level, the future trajectory for sellers could change as the days on the market for active listings continue to pile up at an average of 94 days. Without a healthy absorption rate, this could change the landscape from favoring sellers to favoring buyers.

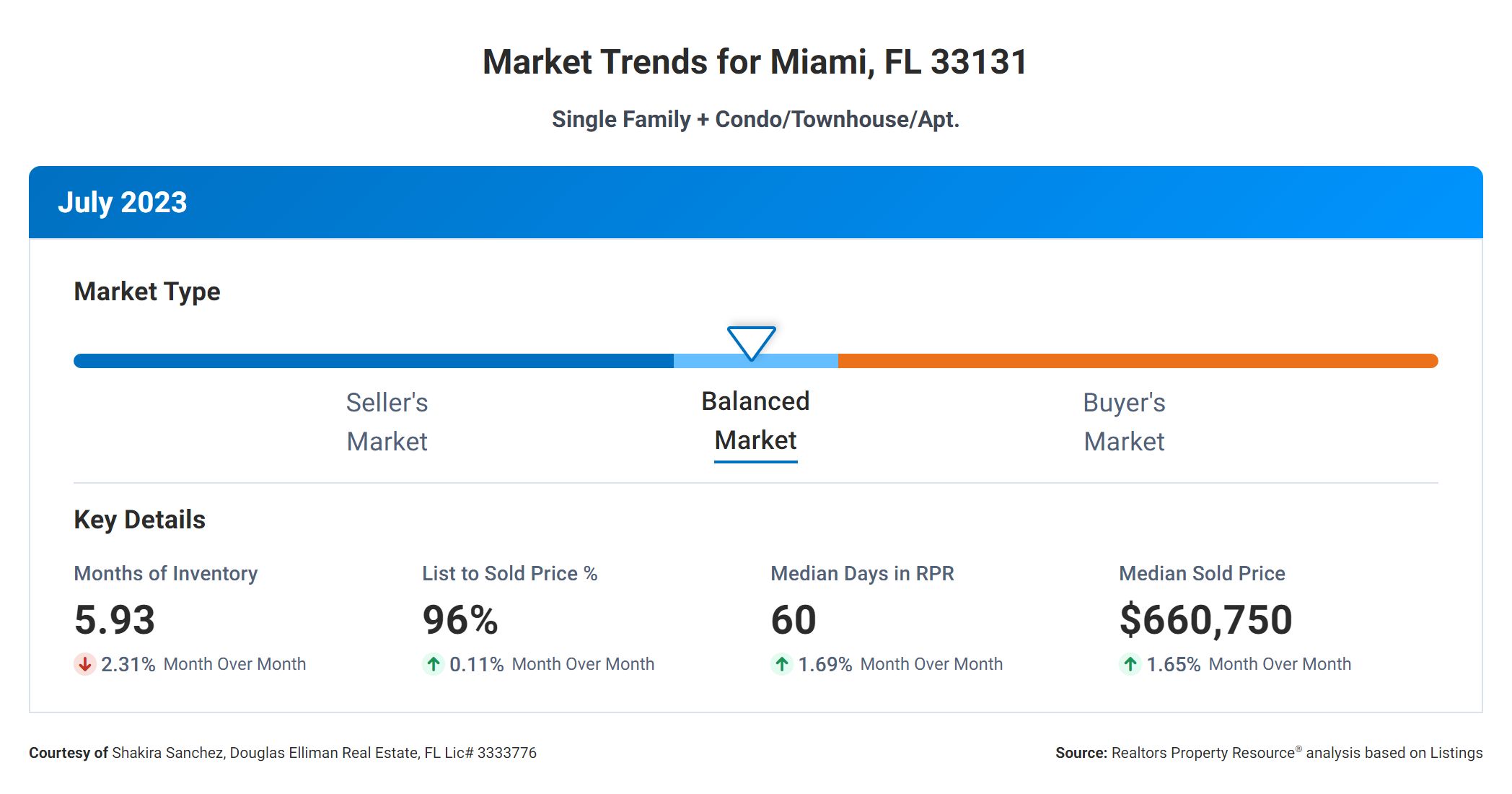

Brickell Q1 & Q2 2023 Market Summary: 33131: New Brickell/NE Brickell/Brickell Key

Buildings: Flatiron, Jade, Four Seasons, Brickell House, Echo, Reach, Carbonell, and Asia

In this area, there is a wide range of building categories, from highly desirable and top-performing condos to ones generally owned by a more significant portion of investors. This area in the neighborhood traditionally has a higher transaction volume given that there is a larger pool of investor owners, who usually have shorter holding periods when compared to primary homeowners. However, the tides have shifted this year, witnessing a notable drop of over 41% in volume compared to the prior year’s activity.

As transaction volumes recede, a robust absorption rate becomes imperative to counterbalance the trend. However, the challenge emerges here: supply levels have increased by over 48%, and the average period to sell has increased by 140%, now with an average of 60 days to secure a buyer.

ADVICE FOR SELLERS

With the evolution of new condo legislation, the prospect of continued renovations to building exteriors and interiors looms. This development can significantly impact seller advantage in the near future. Given that the neighborhood is still experiencing appreciation in value with moderate levels of supply, the window to sell will quickly diminish as time passes and inventory rises.

ADVICE FOR BUYERS

Embark on your condo search well in advance to gain a strategic edge. Our clients recognize that our strategy encompasses hyper-local market research, enabling us to assess a unit’s value accurately. We’ve been diligently reevaluating residences that have stayed on the market for extended periods and have undergone repeated price adjustments. By familiarizing yourself with the neighborhood, various buildings, and diverse floor plans, we will serve as a resource to your family to ensure that you make the best decision.

Read our other neighborhood and luxury reports

If you would like to get perspective on other specific neighborhoods or luxury reports. Please click here to go to our main database of reports. We update these every 6 months.

Schedule Time with David Siddons and Shakira Sanchez

What is a Sellers, a Buyers or a Balanced Market?

A buyers market is a market in which there is more supply than demand. Therefore buyers have an advantage. A balanced market is a market in which neither buyers nor sellers have an advantage.

A sellers market is a market in which there is more demand than supply. Therefore Sellers have an advantage. A balanced market is a market in which neither buyers nor sellers have an advantage.

In a balanced market, supply and demand is balanced and nor buyers nor sellers have an advantage.

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS