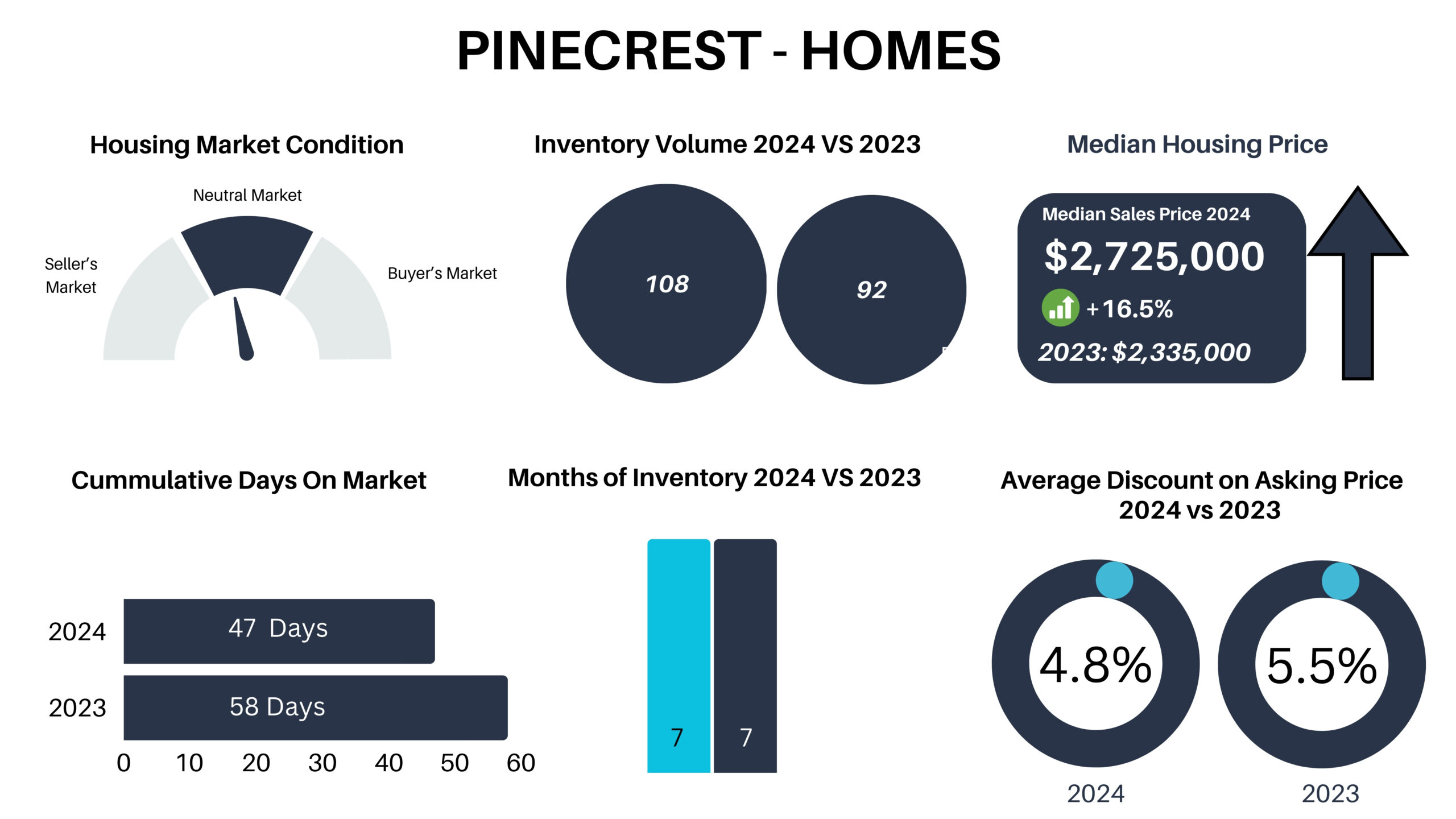

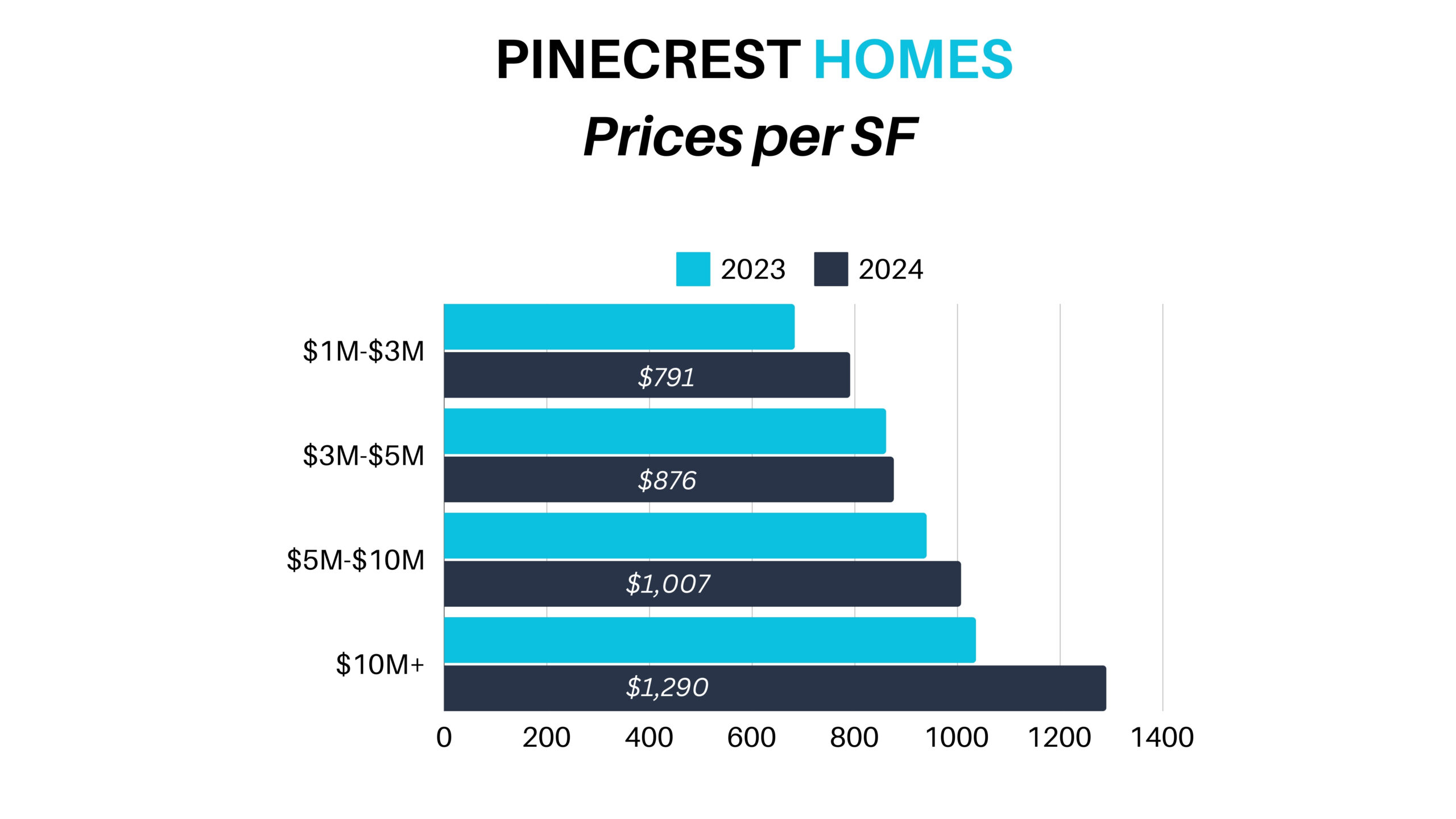

Highlights from 2024. Pinecrest has continued to attract relocating families in 2024, particularly those looking for larger 1-acre lots. In the entry-level market ($1-3M) inventory is down by as much as 50% from last year. Accountable because 1 acre of land is valued now at $3m+. Inventory of homes asking over $5m has risen considerably, especially when you get above $7.5m. Once again new home sales figures are up as these are always a first choice for buyers.

Overall, Pinecrest’s market has most certainly softened and become neutral. Older, less desirable homes are starting to ‘clog’ up the market’s inventory. As of September, 66% of Pinecrest’s inventory has been listed for 100 days or more! Finally, the number of homes that sold in 2024 so far matches the same number that sold last year.