- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Miami Real Estate in 2025: 10 Defining Lessons Buyers, Sellers, and Investors Can’t Ignore

Lesson #1: Miami Didn’t Cool — It Fractured

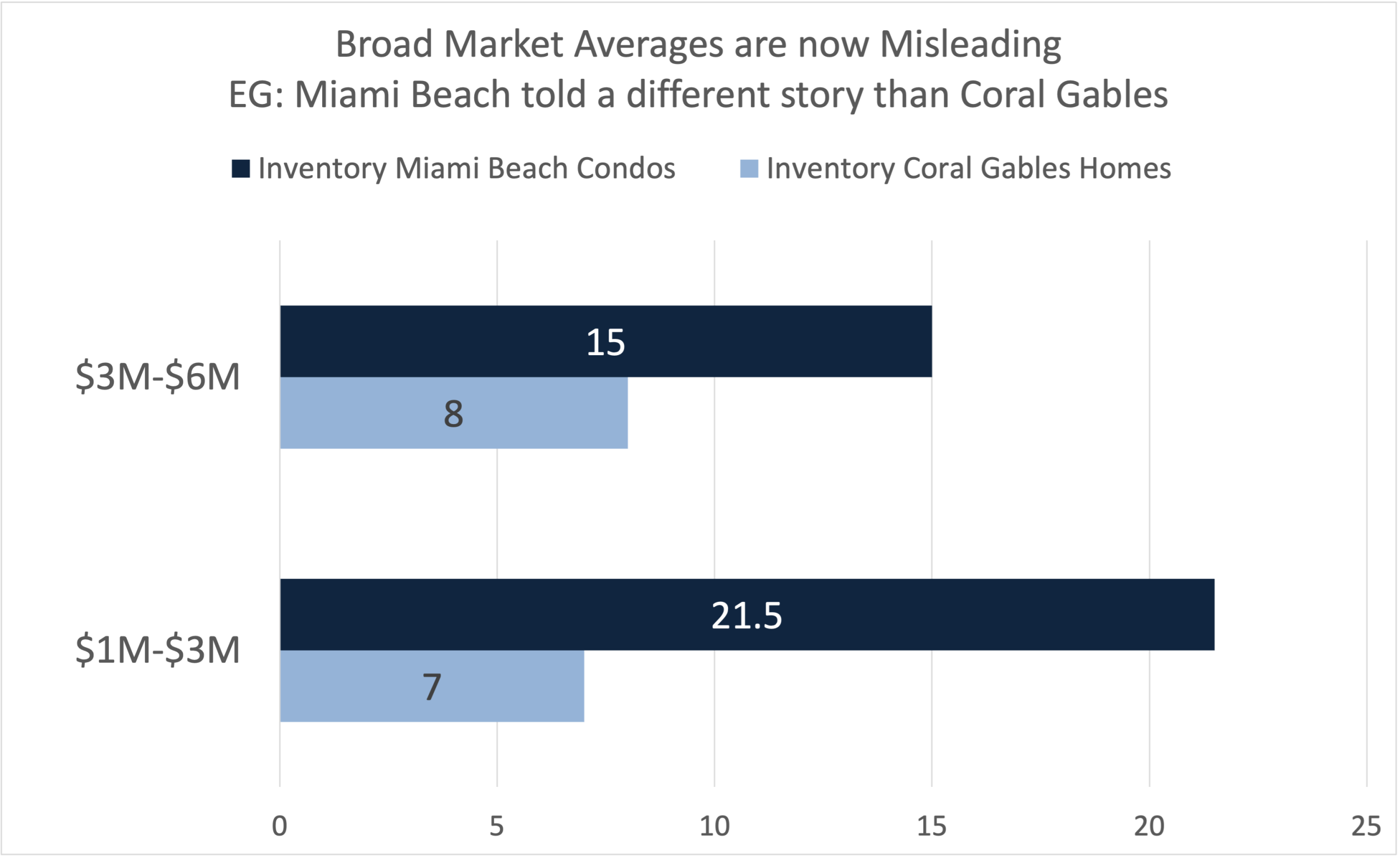

What many headlines labeled a “slowdown” in 2025 was not a market cooling at all, but a market breaking into distinct, often opposing realities. Miami is no longer one market, it is several running in parallel. Luxury resale condos in oversupplied areas quietly shifted into buyer’s markets, while ultra-prime single-family homes and trophy new construction continued to trade at or near record pricing. Coconut Grove behaved nothing like Brickell. Miami Beach told a different story than Coral Gables. Some sellers pulled listings rather than cut prices; others negotiated aggressively as inventory piled up. On paper, this looked like hesitation. In reality, it was fragmentation. Demand didn’t disappear, it became highly selective. Buyers rewarded scarcity, quality, and location, while punishing mediocrity and mispricing. The lesson from 2025 is simple but critical: broad market averages are now misleading. Success depends on understanding which Miami market you are in, because they are moving in different directions at the same time.

Lesson #2: The most dangerous listings in Miami weren’t overpriced — they were mispositioned

In 2025, the most vulnerable listings in Miami weren’t necessarily the ones asking too much, they were the ones telling the wrong story. Price alone didn’t kill deals; poor positioning did. Buyers became sharper, more informed, and far less forgiving of vague marketing, generic language, or features presented without context. A home could be “priced right” and still sit if the narrative failed to explain why it mattered in a crowded, fractured market. Meanwhile, well-positioned properties, even ambitious ones, continued to trade because they framed scarcity, lifestyle, and long-term value correctly. Sellers who relied on comps without understanding buyer psychology lost leverage quickly. Those who understood that real estate is not just a product but a message maintained control. The lesson from 2025 is clear: pricing opens the door, but positioning closes the deal. In Miami’s evolved market, narrative is not decoration, it is strategy.

Lesson #3: Liquidity Became the Ultimate Luxury Amenity

In 2025, Miami buyers began valuing something far less visible than ocean views or five-star amenities: liquidity. Buildings that could actually trade, with consistent closings, realistic sellers, and proven demand, became magnets for serious buyers. Those that couldn’t stalled, regardless of how new, beautiful, or well-located they appeared on paper. The market exposed a critical truth: luxury without liquidity is risk. Buyers grew wary of buildings with bloated inventory, few recent sales, or a history of delistings, recognizing that exit strategy matters as much as entry point. Meanwhile, residences in liquid buildings held pricing power because buyers trusted the market beneath them. The lesson from 2025 is unmistakable: in a fractured market, the ability to transact is itself a feature. Liquidity became the quiet separator between buildings that functioned as assets, and those that merely looked luxurious.

Lesson #4: Brand Names Didn’t Equal Performance

In 2025, Miami learned that a famous logo on the front of a building was no longer a guarantee of value preservation. Several brand-name condo towers underperformed quietly, not because demand vanished, but because recognition couldn’t compensate for fundamentals that buyers now scrutinize closely. High carrying costs, excessive inventory, weak resale liquidity, and inconsistent pricing behavior eroded confidence, even in buildings with global name recognition. Buyers stopped paying premiums for branding alone and instead focused on what actually protects value: scarcity, livability, financial health, and a track record of real transactions. Meanwhile, less flashy buildings with strong fundamentals outperformed expectations. The lesson was subtle but powerful: branding may open the conversation, but it does not close the deal. In a more mature Miami market, fundamentals, not fame, ultimately determined which properties held their ground and which quietly slipped.

Lesson #5: Days on market stopped meaning what people think it means.

In 2025, days on market (DOM) became one of the most misunderstood metrics in Miami real estate. Listings didn’t always linger because buyers disappeared, many lingered because sellers refused to adjust, quietly withdrew, or reset expectations off-market. As a result, DOM stopped signaling demand and started reflecting seller psychology instead. The real signals moved elsewhere: delistings versus closings, price discovery speed once a property was correctly positioned, and whether deals were happening publicly or behind the scenes. Some homes showed long market times yet traded quickly once narrative and terms aligned. Others appeared “fresh” after relaunches but carried hidden fatigue. The lesson is clear: surface-level metrics no longer tell the full story in a fractured market. Serious buyers and sellers must look beyond DOM and focus on absorption, liquidity, and behavioral trends, because in 2025, the truth of the market lived beneath the listing, not on it.

Lesson #6: Smart buyers in Miami weren’t chasing deals, they were avoiding mistakes.

In 2025, the strongest buyers in Miami weren’t hunting for bargains, they were hunting for certainty. Discounts existed across the market, but price reductions alone didn’t create value. Sophisticated buyers understood that overpaying for the wrong asset was far more damaging than missing a short-term deal. Their focus shifted to downside protection: liquidity, building health, future resale demand, and long-term positioning within a fractured market. Many passed on aggressively discounted listings because the risks were structural, not temporary. Meanwhile, well-chosen properties with fewer headline discounts but stronger fundamentals traded decisively. The lesson from 2025 is subtle but critical: the smartest buyers didn’t win by chasing price cuts, they won by avoiding irreversible mistakes. In Miami’s evolved luxury market, the best entry isn’t the cheapest one; it’s the one that still works when the market changes.

Lesson #7: Intent Replaced Wealth as the Real Driver

By 2025, Miami’s luxury market made one thing clear: capital alone no longer moves the market, motivation does. Wealth was everywhere, but intent was selective. The buyers who transacted weren’t the ones with the deepest pockets; they were the ones with a reason to act. Primary residents relocating, families securing long-term footholds, and buyers solving specific lifestyle or tax objectives drove real absorption. Meanwhile, discretionary and speculative buyers stayed patient, even opportunistic, but largely inactive. This shift reshaped negotiations, pricing power, and timelines. Sellers who understood buyer intent adjusted strategy and succeeded; those who marketed broadly to “any wealthy buyer” stalled. The lesson from 2025 is decisive: knowing why a buyer needs to purchase now matters far more than knowing how much they can afford. In Miami’s maturing luxury market, intent, not wealth, became the engine of movement.

Lesson #8: Popularity Increased Risk in Certain Neighborhoods — Not All Demand Is Equal

In 2025, rising attention didn’t uniformly translate into stronger markets, and our neighborhood-level reporting makes this clear. Across Miami’s core submarkets, inventory and absorption diverged dramatically by price tier and property type, creating environments where popularity outpaced exit certainty. In places like Miami Beach, mid-range segments surged while ultra-luxury faced oversupply, revealing that headline demand didn’t guarantee liquidity across the board. Our detailed neighborhood reports underscore that some areas with heavy buyer interest accumulated inventory faster than they absorbed it, widening the gap between listings and closings, especially when fundamentals like resale velocity and buyer profiles didn’t align with speculative expectations. The lesson from 2025 is nuanced: being popular draws eyes, but sustainable market performance depends on depth and tradability. Demand without dependable exit dynamics increases risk, especially in a market now defined by segmentation and selectivity.

Lesson #9: Rental Math Quietly Broke, and Caught Investors Off Guard

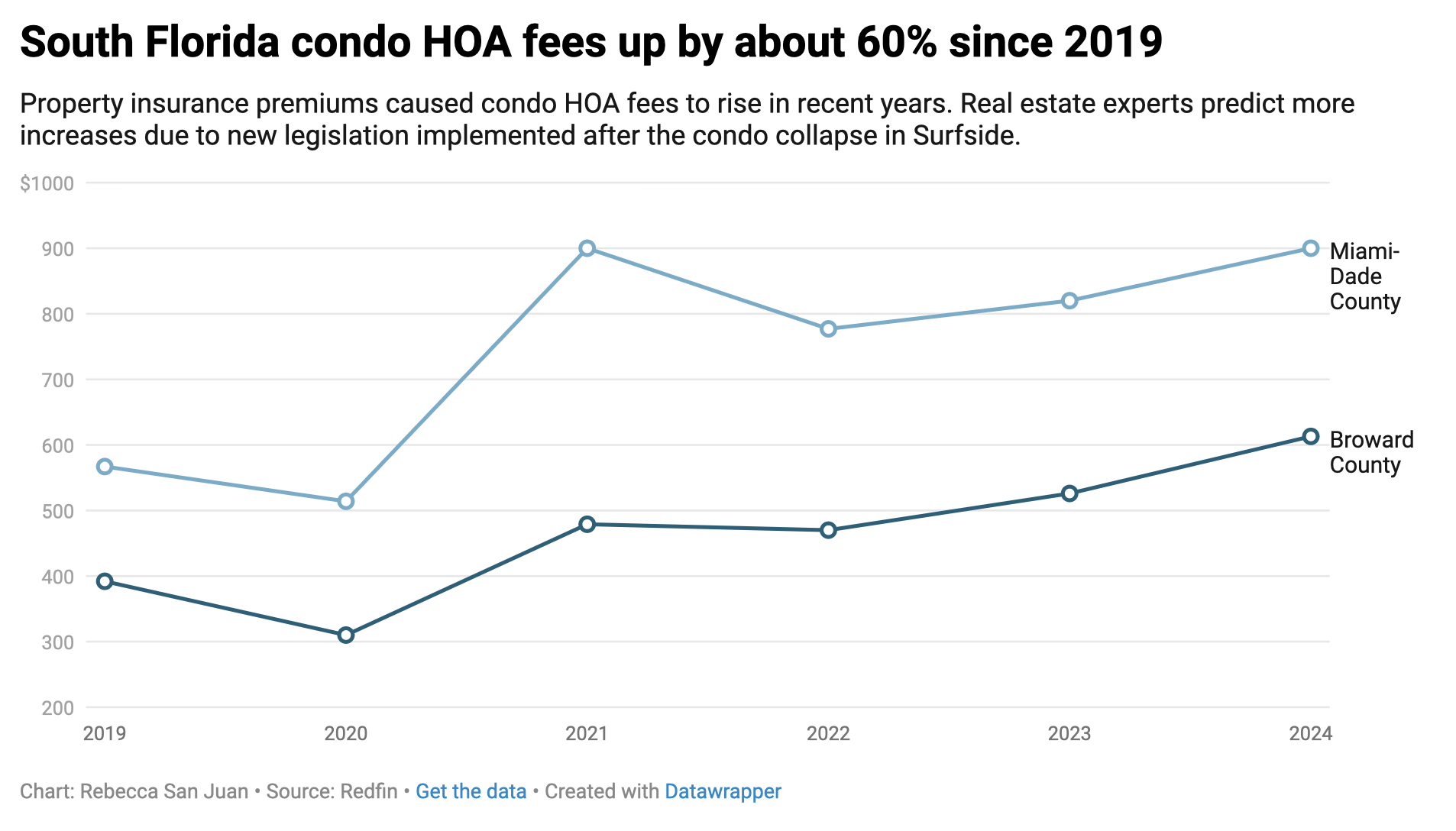

In 2025, one of the least discussed but most consequential shifts in Miami real estate was the breakdown of rental math across several submarkets, a trend repeatedly flagged in our commentary. Rising acquisition prices, sharply higher HOA fees, insurance costs, and property taxes collided with flattening rents, especially in condo-heavy, investor-dense areas. On paper, many deals still looked plausible; in reality, cash flow margins vanished. Our analysis has consistently warned that rent growth cannot outpace affordability forever, and 2025 proved that point. Investors who relied on outdated assumptions or peak-cycle rent projections found themselves subsidizing assets they expected to perform. Meanwhile, markets with strong end-user demand and limited investor saturation held up far better. The lesson from 2025 is subtle but costly: when fundamentals shift slowly, complacency is dangerous. By the time rental math “breaks,” the damage is already done, and exits become far more complicated.

Lesson #10: The biggest winners this year weren’t aggressive, they were precise.

In 2025, Miami’s biggest wins didn’t come from bold bets or aggressive timing, they came from discipline. The David Siddons Group consistently emphasized segmentation over speculation, and the results were clear. Buyers and sellers who understood exactly where they were in the market cycle, which submarket they were operating in, and who the real buyer was outperformed those who relied on optimism or momentum. Precision meant waiting when others rushed, acting decisively when alignment appeared, and walking away when fundamentals didn’t support the story. It meant choosing the right building, the right unit, and the right moment, not just getting a deal done. Aggressive strategies assumed the market would cooperate; precise strategies assumed it wouldn’t. The lesson from 2025 is defining: success favored those who respected timing, embraced selectivity, and exercised restraint. In a fractured market, accuracy, not enthusiasm, became the ultimate competitive advantage.

Connect with the David Siddons Group

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS