- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Why the Miami Real Estate market cannot Correct. The Economic Truth with FIU Professor Eli Beracha

Is a Miami Real Estate Crash on the horizon? In this podcast, we sit down with Prof Eli Beracha and answer the questions that are on everyone’s mind. Prof. Eli Beracha is a professor of Real Estate and Finance at FIU, which is now ranked number 1 in the world for real estate research.

We’ll discuss the current state of the Miami real estate market and the factors that are driving it, including the recent economic crisis.

Prof. Eli Beracha holds a Ph.D. in Finance with a concentration in Real Estate Investment and has published dozens of academic papers in leading journals featured in the popular press including the WSJ, The Economist, CNBC, Bloomberg, The NY Times, and Forbes, among many others. In a recently published report by the Journal of Real Estate Literature, Dr. Beracha was ranked 3rd in the world for his real estate research productivity.

What’s going on in the Miami real estate market?

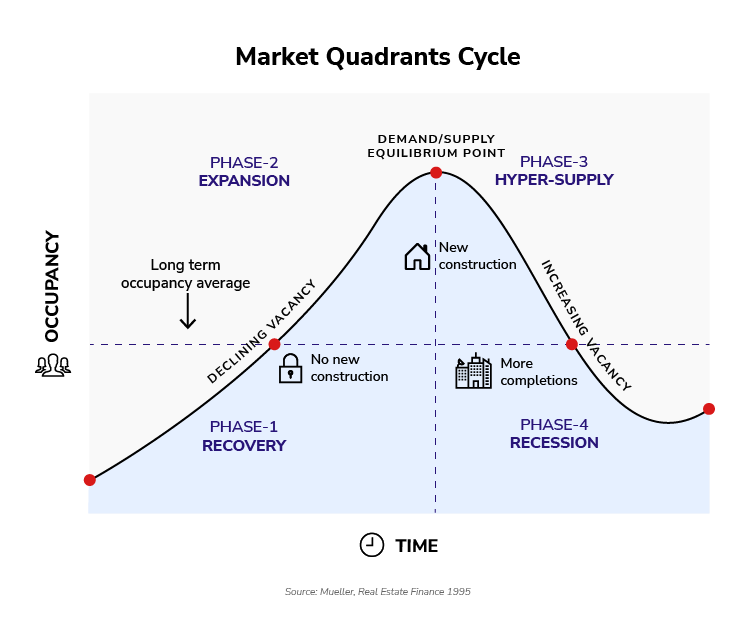

Where we are in the cycle and how to notice the transition?

Understanding the big picture is very key in order to understand the current real estate market. For this reason, it is important to look at where we are in the real estate cycle. There are four parts in a real estate cycle and we are currently in the expansion part. We are actually experiencing a super cycle as the entire cycle we are experiencing is prolonged. While the expansion period would normally take up to 5 or 6 years we are currently in an expansion period that has lasted 13 years so far.

This cycle has been expanding since 2010 coming from a very low point after the last Miami real estate crash. In addition, the last recession was the first of its kind that was actually caused by the real estate market which created a lack of trust. As many people had lost their trust in the real estate market or were left with little assets, the cycle moved forward extremely slowly.

The current US Housing market is about 4 million housing units short. To take you back a little, we started this expansion period in 2007 with 3 million housing units in oversupply. After the crash, people stopped building. Florida, because of its unique nature, was the poster child of the recession as our market got hit harder than many others. The Miami market used to be more volatile cause much of the capital came from foreign, more unstable economies. In addition most of the investments at that time were speculative, using the property purchase as a way to get money out of their home countries. Nobody looked too much at the true value of the underlying asset or potential returns, they just wanted to get money out of the country.

Are we close to Hyper-supply?

Thus, from 2007 onwards we stopped building and we have been underbuilding ever since. Around 2012 we broke even and we are currently looking at a 4 million shortage of housing units across the US. In Florida we have many land constraints so condos are the easiest to build. We often speak about too many condos being built, but we need to put this condo market in perspective. The condo market only takes up 18% of the total US housing market (130 million units). So yes the condo market is seeing a large amount of new units enter the market, but this market is oversupplied because the rest of the market is undersupplied. Does it mean we have an overall housing oversupply? Not anytime soon. We address the demand with something we can quickly build. Condos are the easiest and fastest to build, especially in Florida where land constraints are real. We would need to overbuild 4 million units to get there. The nation, and Miami, is experiencing a severe housing shortage we need to address, especially when it comes to single-family houses. In addition, most of Miami’s new condos are in the $2,000 per SF + range, so this caters only to a small group of buyers.

We are still in the expansion phase and given we are not building sufficient housing units to cover the 4 million in shortage, we do not expect to enter the hyper-supply phase any time soon. Besides the residential markets, the most undersupplied market is the industrial real estate market.

Is a Miami Real Estate Crash Imminent?

If you google Miami real estate it auto populates with crash or bubble. Many studies say a new real estate crash is inevitable. In Florida, we are now also experiencing that properties are 10 times (or more) worth what a family earns in a year. This is unsustainable. A small change in a family’s income or expenses will have far-reaching consequences. South Florida never had this problem before the pandemic, but affordability is becoming more and more of an issue.

While most reports tend to point out the affordability crisis, Prof Eli Beracha points out that income numbers are tricky, especially in South Florida. As many investors or buyers come from out of state or abroad they may not have official income in Florida, while they do come with enough wealth. More importantly, Eli looks at other more important factors to determine whether a crash is coming. The main question he asks is: “Are prices supported by fundamentals”?

Today we see sales prices go up at the same rate as rental prices. This provides fundamentals as it means people can actually afford these prices. While we often hear “Prices are too high”, the truth is that prices go only as high as people can afford. There are no mortgages or speculations so the rental prices indicate how much someone is able to pay. So this means that although Miami is expensive, it is not in a bubble. The prices are what people are willing and able to pay. Maybe today the rush to find a new place is not as high as it was during the pandemic and therefore we see less record prices or decreasing rental prices, but the market is not bursting.

Everyone is Waiting for a Miami Real Estate Crash

In addition, everyone is waiting for the crash. There is so much money waiting for when the market goes down that almost by definition the market will not crash. If prices will come down by 10% many people will start buying. There is a lot of money waiting to get into this market, in combination with a shortage of properties. As a result, a strong correction is highly unlikely.

Finally, interest rates went from 3% to 7% and the market did not break. Entrance prices are still going up so this market is super resilient. It is also important to mention that many people buy with cash in the $1M+ market. They might get a mortgage afterward, to not use their own liquidity, but they can afford the property in cash which makes this a very stable market.

Migration Flows

Migration rates have slowed down but we still see interest in our city. Besides Miami becoming more expensive and offering less good quality inventory than before, home prices in feeder cities such as San Francisco or LA have also started to come down in some instances. It was to be expected that the rate of migration we experienced during the pandemic would not last forever. People will still be moving to Miami but at a slower rate. As long as people want to keep moving and companies will still come and bring employees, our city will see positive flows of migrations.

Out-of-town investors who are using their units just a few weeks out of the year are also seeing the costs of opportunity. Before the pandemic they wouldn’t rent their unit, now it’s worth it. These days the costs of opportunity are too high to sell the units. Many investors see the upside of renting their units while they are not in town. Most people who own a second or third home in Miami do not need to offload their property. In addition, many of these units are now bought with cash or with a large sum paid down. The owners have enough equity to not be forced to sell. Price corrections tend to be created by people being forced to sell.

The rental market and its prices

We have seen rental prices decrease slightly over the last few months. According to Professor Beracha you need to consider where the prices are coming from. It is not fair to say prices decreased from $10K per month to $7.5K per month, cause they were coming from $6K before the pandemic. We need to understand that during the pandemic people overpaid just to get a unit. These days people are no longer overpaying. The market is still hot but prices are no longer panic prices. This does not mean the market was in a bubble and is now bursting. It purely means the panic to find a property is gone.

Renting Vs Buying

Renting makes a lot of sense in many cases, but in a hot city like Miami what is the risk of buying? Many consumers are afraid prices go down and they overpay for a property. Although they are very likely not going down, people are afraid of this. What many people do not consider is the risk of property prices going up. What if you are renting and prices go up significantly? You will price yourself out of the market. If prices go up, rental prices go up. Your current rent will increase and the price of your future home will increase. This is the real risk people do not see. Even if prices do drop, it will be short-termed cause with current migration flows we will keep growing and prices will come back up. There is always the right time for something. As long as you do not grossly overpay or invest in a bad-quality property, investing in a hot city like Miami is a good idea.

Interest Rates

The Feds started increasing interest rates to slow down the market and it is actually working. The effect of the higher interest rates is that many owners who have locked in a good rate, are now not willing to sell. They would love to sell and get a premium but with a lack of available product, they are not willing to trade their current property for an equal property and pay higher tax and interest rates. If the rates will come down, many buyers will become active again or current owners might look for alternatives. This will create market activity again, which has been slow in the last few months.

Waiting for rates to go down

For people that are waiting for interest rates to come down, we have some advice. By the time rates go down, prices will go up again. If you want to buy a home anywhere in the next year, buy it now and refinance later. If interest rates don’t come down it’s because inflation is still high and that’s mostly a consequence of a hot housing market so this also means housing prices will continue to go up. So in almost all scenarios, you are losing by waiting for interest rates to go down.

Other metrics to look at

First of all, it is important to know that there is a lot of information out there to test how healthy a real estate market is. Not every single person however knows how to analyze these data and draw conclusions. Many news outlets also use dramatic clickbait titles or only tell half of the story. The David Siddons Group combines the latest data, with on-the-ground experience and third-party experts such as Prof Eli Beracha, to come to conclusions. It is important to look at all factors. Months of inventory can be important and determine the health of a market but they normally assume that all other things remain equal. However, all other things never ever remain equal, they always change. It is important to look at real estate data in combination with buyer/seller behavior and the wider economy. Only when all factors are included one can make a better prediction or estimation of where the market is and where we are heading.

Schedule Time with David

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS