- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Investing in Rental Properties: Income Generating Homes in Miami

Introduction to Rental Property Investments in Miami

This article is about investing in rental properties in Miami and specially, single family homes. For Miami condo investments please click on the link. In this article, we cover which neighborhoods or types of homes are currently providing the highest returns as rental properties Investment. We cover working examples of investments and provide rules of what to avoid and what to buy. Additionally, we take a broader perspective by examining the micro and macro variables influencing the Miami investment landscape. To cap it off, we present compelling reasons why the overall Miami housing market merits serious consideration for inclusion in your investment portfolio.

For personalized investment guidance tailored to your specific budget, timeline, and expectations, please don’t hesitate to reach out to me directly. Your individual needs are at the forefront of our approach, and we’re here to provide one-on-one assistance.

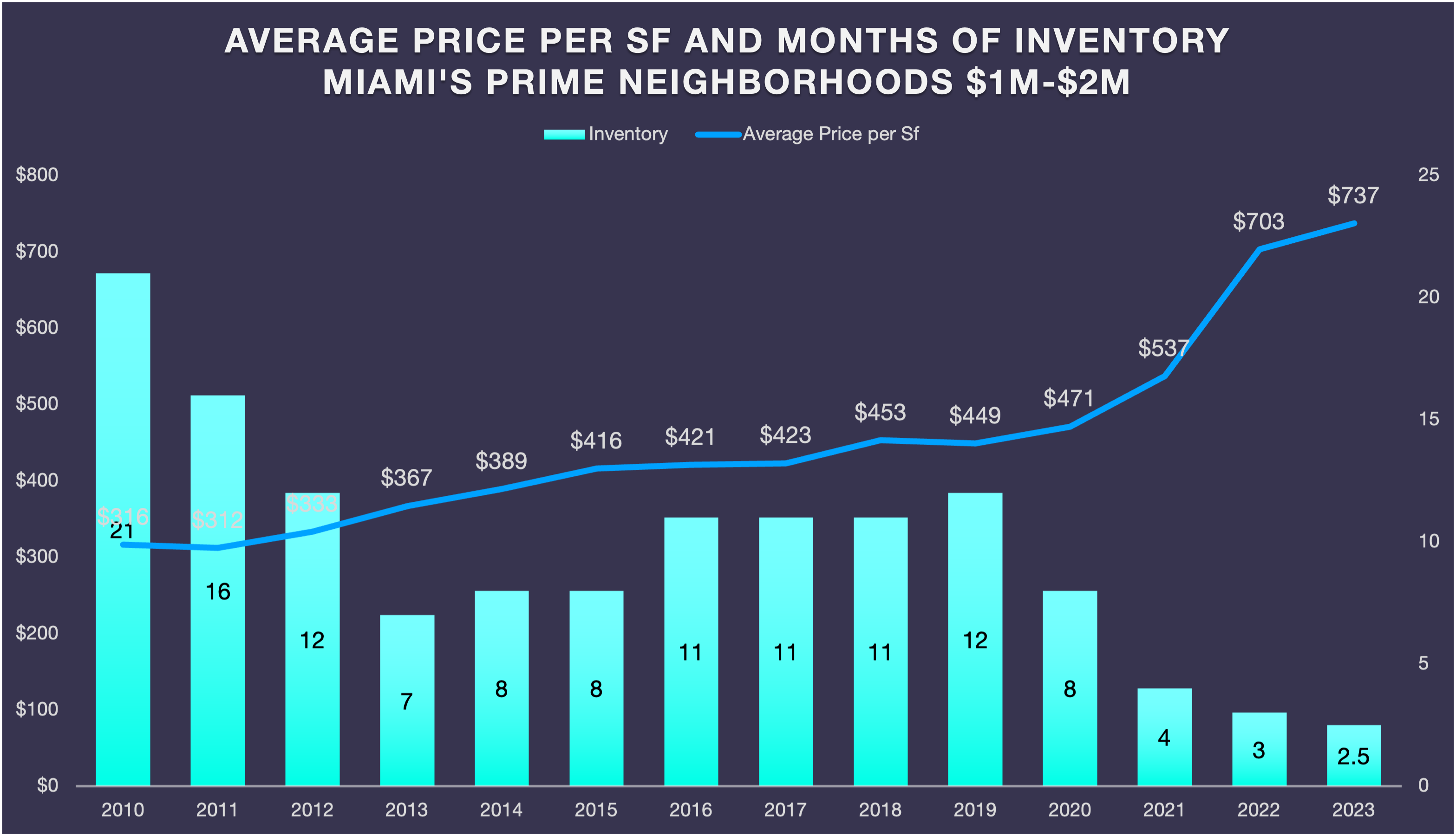

Historical performance of the Miami Housing investment market

Most people look at the condo market when investing in the Miami real estate market. The housing market however tends to provide a higher ROI. Houses are scarcer than condos, especially in the rental market. Given the high demand and low supply, landlords have a better negotiation position.

Historically seen, the single family market has been more stable than the condo market. While the condo market saw waves of mass investment, followed by lows because of oversupply, the single-family home markets in Miami have always shown a healthy performance with year over year increase in value.

With more and more families moving into Miami, who often want to test the market before they buy a property, the housing rental market has boomed in recent years. Especially the housing markets around Miami best private schools. These areas are therefore best to focus on when you are investing in rental properties.

Why work with us when buying a Miami Investment?

The Miami housing market is a good market to invest in if you follow a few basic ground rules. In short, this is how we effectively analyze the best Miami investments.

- We run our own data analysis.

- We have our own software and also look at additional data sources to follow the market.

- Soon we will have our brand new Home Geeks tools that can trace the market 15 years back

- We consider not just ROI but resale values.

- We study the human behavior.

- We look at the close relationship between supply and demand.

- After 15 years in the market dealing with sellers and buyers, we know what homes will appreciate and which ones won’t

The Neighborhoods that Yield the Highest Rental Returns per SF

| Neighborhoods | Average Rental Price per SF | Average Rental Price | Search for Properties |

| Coral Gables (West) | $3.58 | $7,950 | Coral Gables Homes for Sale |

| Coral Gables (East) | $4.31 | $12,000 | Coral Gables Homes for Sale |

| Coconut Grove | $3.86 | $9,000 | Coconut Grove Homes for Sale |

| Pinecrest | $3.35 | $9,631 | Pinecrest Homes for Sale |

| Ponce Davis | $3.77 | $11,700 | Ponce Davis Homes for Sale |

| High Pines | $4.34 | $10,500 | High Pines Homes for Sale |

| South Miami | $3.91 | $9,592 | South Miami Homes for Sale |

| Key Biscayne | $5.16 | $13,000 | Key Biscayne Homes for Sale |

| Miami Beach | $4.54 | $11,314 | Miami Beach Homes for Sale |

| Miami Beach Islands | $6.63 | $17,825 | Miami Beach Homes for Sale |

The different rental prices per SF in Miami’s most desired markets. Average taken over all rental prices in last 365 days (since Oct 2023) that rented between $5K and $25K.

What to Avoid when Investing in Rental Properties in Miami

- Avoid older homes when possible. Most tenants are focused on newer homes and these tend to rent faster and for higher amounts. Furthermore, they tend to be in better shape, so the tenant will not be calling you or complaining on a weekly basis. Newer homes are also more more economical when it comes to insurance rates and will have less structural issues eg termite, roofing etc. In addition, newer homes have a higher appreciation rate than older homes.

- Homes in the floodzone. These tend to be of lower value, but appreciate less over the years and insurance costs are expected to rise sharply in the years to come

- Don’t buy close to main arterial or on main arterial streets.Most renters are families and prefer more quiet or safe streets It may be a great neighborhood, but if you’re selling to families being on a busy street is a big negative. In addition, homes on these busier streets have a limited ceiling for appreciation.

What To Focus for your rental property investment in Miami

- The most desired areas to rent a property are those around Miami’s best public and private schools. These areas are Pinecrest, Coral Gables, Coconut Grove, South Miami, High Pines and Ponce Davis. Key Biscayne also offers some excellent opportunities.

- Focus on areas that have parks or walkable areas nearby and that cater to families.

- Quiet cul-de-sac and dead-end streets will be best for families looking to rent a property. When we look at homes around busy streets they most certainly have a ceiling limit to their values and it’s unsurprising to see homes se ll for 30% less on these busy streets. It may be a great neighborhood, but if you’re selling to families being on a busy street is a big negative.

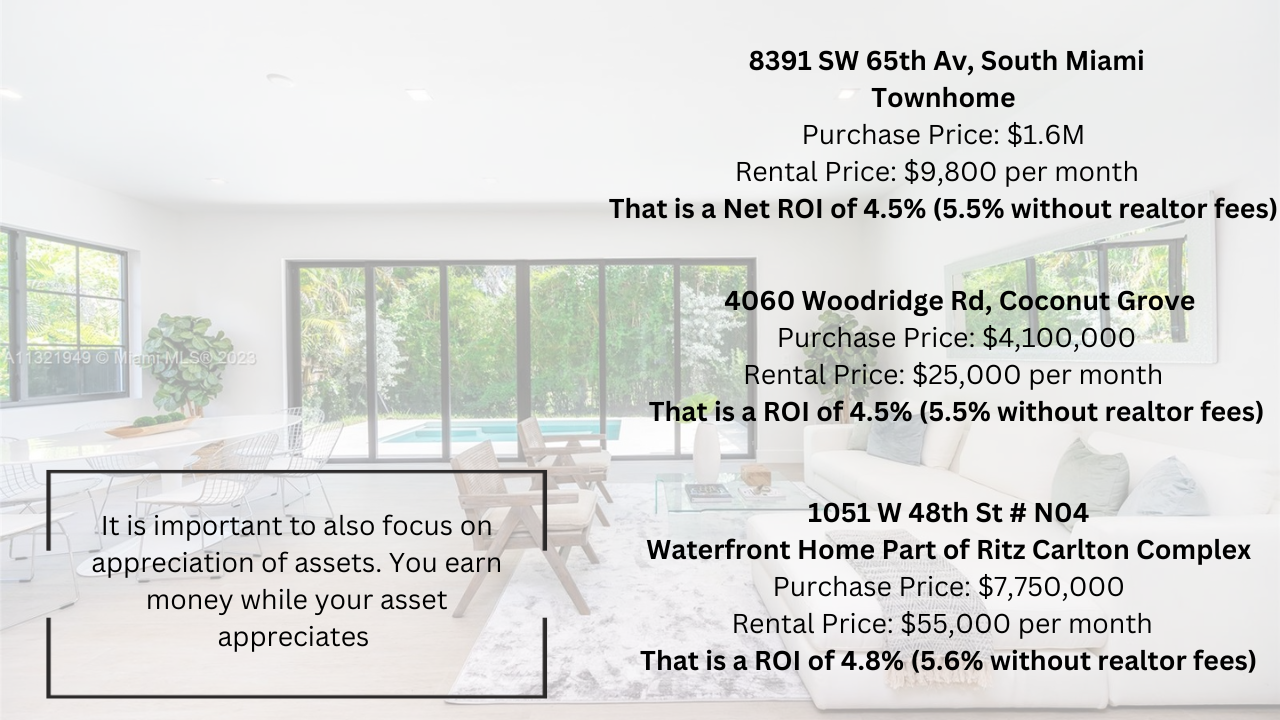

3 Investing in Rental Properties | Working Examples of Income Generating Properties. Investing in Rental Properties

Please find below three examples of income generating properties. Cap rates are important but please also keep the appreciation in mind. The townhome in question was bought for $1.6M and is now (less than a year later) worth around$1.85M. We had an investor who bought a brand new home with us in 2016 for $2.5M. They have been renting it ever since around $30k /$35K per month. It is currently rented for $38K. That is a 14% net ROI. The property is currently worth around $4,2M. Hence it appreciated $270K year over year.

Tax Benefits of Investing in Rental Properties

One of the tax advantages of owning a rental property might be the real estate depreciation. Depreciating a property for tax advantages involves utilizing the depreciation expense as a deduction to reduce taxable income, thereby lowering the tax liability.

Contact me if you would like more information on investment properties or to discuss your personal situation and investment opportunities.

Is this Rental Market sustainable?

Recent reports in the media have highlighted a decrease in Miami’s rental prices. Yes, the turbulence of 2021/2022 has subsided, leading to a modest correction in rental rates. Professor Beracha from FIU underscores the importance of considering the price’s historical context. It would be unjust to claim that prices dropped from $10,000 per month to $7,500 per month without acknowledging their pre-pandemic level of $6,000. During the pandemic, individuals were willing to pay premiums merely to secure housing, but today, such overpayments are no longer commonplace. While the market remains robust, prices have stabilized, signaling the end of panic-driven surges. This adjustment does not imply that the market was in a bubble and is now collapsing; rather, it signifies the dissipation of the urgency to acquire a property.

The demand for rental units remains high, and we are aware that the housing market is currently experiencing a shortage of available properties. The demand for properties is extremely high and in an area like Miami that is landlocked between the Everglades and the Ocean, it is harder to built new homes. The number of ongoing migration and new businesses do not lie, while inventory keeps decreasing.

What are the best Place to Buy in Miami?

The best places to live are those areas around the urban core that also offer the best schools. The demand for properties is largest here and prices have increased year over year. These markets are Coral Gables, Coconut Grove, Pinecrest, High Pines and South Miami. South Miami is quickly becoming a new luxury market, where old properties are being replaced for new luxury homes. When you are looking to invest in Rental Properties these are solid choices.

Are Miami Homes Profitable for Rental Property Investing? Conclusions by the Author

In conclusion, Miami is a magnet for relocating families and businesses, often accompanied by their workforce. Notably, the city is witnessing a significant increase in the arrival of young individuals, which is a key factor driving its ongoing economic transformation. This contributes to a growing demand in a market where the supply of available properties is limited. It essentially boils down to the classic issue of supply versus demand.

There are several very desired areas in Miami that concentrate around the Financial district as well as the best private schools. I have given some very solid points on what to look out for and what to avoid. With over 15 years of experience as a real estate agent, I possess extensive knowledge of what kind of properties are likely to appreciate and which ones do not. In addition, I can offer valuable insights into the current market trends. Please do not hesitate to get in touch with me, and together, we can navigate the Miami real estate landscape to help you achieve your investment goals.

The different mechanisms to invest in Miami Real Estate

- Income-generating properties – Condos In this article, we discuss which Miami condos offer the best returns, share real-life examples of condo investments, provide guidelines on what to invest in and what to steer clear of, and examine the local and global factors influencing the Miami real estate market.

- Building a new home. In Miami, a notable trend is the high demand for new luxury homes. Custom, finely crafted properties command premium prices. We’ll cover how to locate suitable land, determine the construction cost, and manage the project timeline.

Schedule time with me (In Person or Via Zoom)

If you are considering investing in Rental Properties in Miami or want to invest in any other type of Miami property, please contact me today!

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS