- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Investing in Miami Luxury Real Estate

My 5 Golden rules for Investing in Miami Luxury Condo buyers in South Florida.

I recently sat down with a client in their condo — a unit they bought 10 years ago at the height of the market. It was a second home, used just 3 months a year. After reviewing their numbers, I realized they’d actually lost money over the decade. How could this be, when other clients I’ve advised with similar investments have tripled their money in the same timeframe? The reality: snowbirds and second-home owners often see weaker returns than full-time residents or investors who rent 100% of the time. But that doesn’t mean it has to be this way. With the right condo, you can enjoy a stunning place in the sun that pays for itself — and in many cases, ends up making you money.

That’s why I’ve put together my 5 golden rules for choosing the best luxury condo for second-home owners and snowbirds. Once I outline those, I’ll share the projects I believe stand out right now.

My 5 Golden Rules to Invest in Miami

1 Why Generic Condos Kill Returns

Luxury is about scarcity. Mass-produced towers with hundreds of cookie-cutter units will never appreciate the same way a rare, well-designed property will. Developers cram three beds into 1,300–1,500 SF layouts that look good on paper but feel cramped in reality. End-users (and future buyers) see through it ,and values suffer.

2 Glossy Isn’t Luxury: How to Spot the Real Thing

Don’t confuse glossy renderings for real luxury. High-density towers, tiny lots, and too many units per floor are red flags.. In Miami we have seen so much construction and although much of it promotes a glossier, sexier lifestyle, it does not always deliver. Buildings with high density (lots of units), sometimes a huge condo on a tiny lot and buildings in which you have 12 units per floor and 3 bedrooms cramped into 1,300 SF. This is not luxury and should not be accepted as such, no matter how it is portrayed in renderings. I won’t name names in my blog, but if you call me I will tell you my opinion and give examples of condos to avoid. This brings me to the branded-condos conversation: a Versace pillow or celebrity name doesn’t make a project luxury if the fundamentals are flawed. Pay for substance, not just marketing.

3 Data Over Hype: Reading Miami’s Market the Right Way

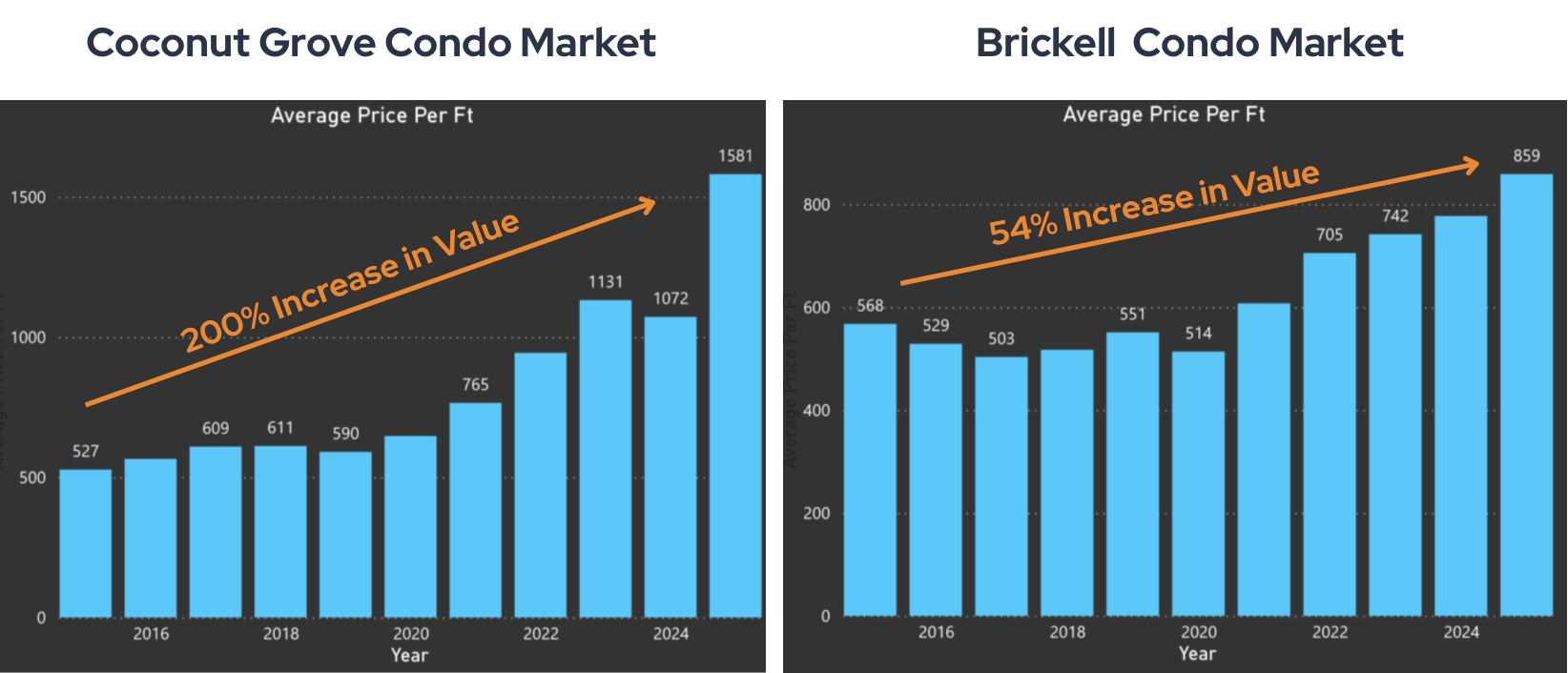

Data beats hype. Look at months of inventory, price per SF, absorption rates, and how each sub-market is performing. Not all Miami neighborhoods move in sync. Our Miami Market reports help identify which markets are going up and which are going down. By using measurement indicators like: ‘Months of inventory’, ‘Price per SF averages’ and ‘% increases’, I can start to guide you on where to focus. I say start, because this is the first step and there are more variables to take into consideration moving forward such as South Florida real estate trends and Miami real estate forecasts. But this is an essential step when investing in Miami.

Thinking of Investing in Miami?

There are Miami’s Worst-Performing Condos — And the Lessons They Teach Investors

- ONE THOUSAND MUSEUM | Four-bedroom residences here typically trade between $6M and $7M, in a market that recorded only 16 other sales above $4M over the past year, most of them within the Aston Martin Residences.

- PARAMOUNT WORLD CENTER | There are a staggering 75 units for sale at this project of which 60% has been on the market for over half a year already. A sharp contrast to just 16 sales in the past year.

- MUSE SUNNY ISLES | Muse began selling at around $1,100 per SF in 2018. After a brief peak in 2022–2023 at approximately $1,600 per SF, prices have now settled back to about $1,380 per SF.

- PORSCHE DESIGN TOWER | Porsche’s resale drop is rare; from about $2,000 after launch to $1,200 per SF nowadays. Today, 25% of the tower (31 units) is for sale, with 60% listed for over six months.

- AR MANI CASA| 25% of the condo sold within two years of launch, a red flag. Even more unusual for this market, it hasn’t appreciated at all in the past four years.

- REGALIA, Sunny Isles | The Sunny isles Condo that sees the highest percentage of discounts from its asking price. On average 15% discount was given in the last 2 years.

- FAENA HOUSE | Over the past four years, values have fallen from $3,200 in 2022 to $2,750 in 2025, while HOA fees have surged 50–60% in the

- ICON BRICKELL | While HOA fees have risen 50%, rental prices are down 5% from 2024 and 10% from their 2022–2023 levels.

- KENILWORTH Bal Harbour | Current values at the condo are about $550 per SF, the same as in 2014–2015, showing no appreciation over the past decade.

- NINE AT MARY BRICKELL | Prices are now about $550 per SF — only 16% higher than the $462 per SF seen in 2015.

- RISE Brickell City Center | Current values sit at $785 per SF, down 10% from the 2023 peak, with no appreciation recorded since 2021.

- ASTON MARTIN RESIDENCES | 94 out of 391 condo units are currently for sale, 33% of the building. This unusually high inventory puts significant downward pressure on market values & buyer perception.

4 Miami Isn’t One Market — Here’s How to Drill Down”

It is often said that mainstream media have a lot to answer for. I have come to have a love / hate relationship with mainstream real estate news. Sometimes it’s really spot on, other times it’s so completely off track I cannot help but either laugh or want to scream. Ultimately, avoid generalized articles that talk about Miami as a whole. I have come to appreciate that within every neighborhood market of Miami, there are huge variations in consumer behavior, and within that price levels create huge differences. If you really want to get good solid advice you have to drill way down. From city to town to street to condo and sometimes even floor level.

5 Don’t follow the masses blindly

Sheep do not get rewarded they get slaughtered! There are a number of luxury condos that have overwhelmingly attracted investors. Promoted as ‘good investments’ and bought up on mass, these units end up being rented with a 80% tenancy ratio to home owners. This is a big mistake for long term investors as they are highly unstable; prone to price fluctuations and large scale ‘sell outs’. Investors buy on mass and often sell on mass.

Extra Rules for Protecting Your Investment

I gave you 5 rules but there is so much more. Representation, rental strategy, and timing are three areas where buyers often stumble. Walking into a sales center without an experienced agent is like going to court without a lawyer, you won’t save money, you’ll just miss the best opportunities. Chasing the Airbnb fantasy is another trap: while short-term rentals look profitable online, they come with heavy wear, high fees, and regulatory risks that cripple long-term resale value. Finally, even the best condo can turn into a liability if you wait too long to sell or overprice from the start; once a unit is seen as “stale,” it can take years to recover. I explored these themes in depth in a recent blog on new construction condos — lessons that are 100% transferable to resale units and give you a sharper framework for judging true long-term value.

Connect with the David Siddons Group

Contact David Siddons for more advice on investing in Miami.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS