- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Shockingly Low Inventory Creates Market Stand-Off | Coconut Grove Q1 & Q2 2023 Market Report

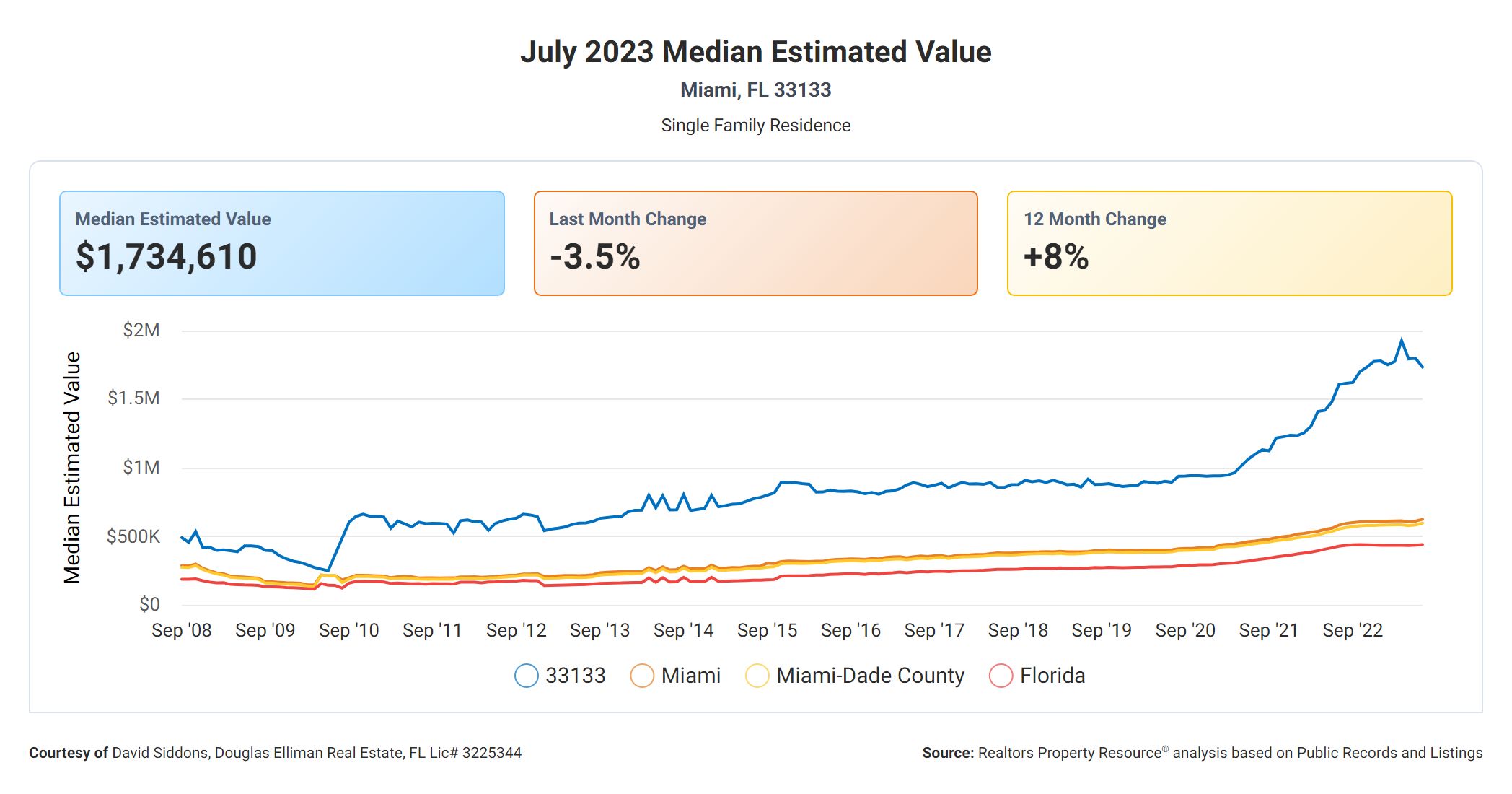

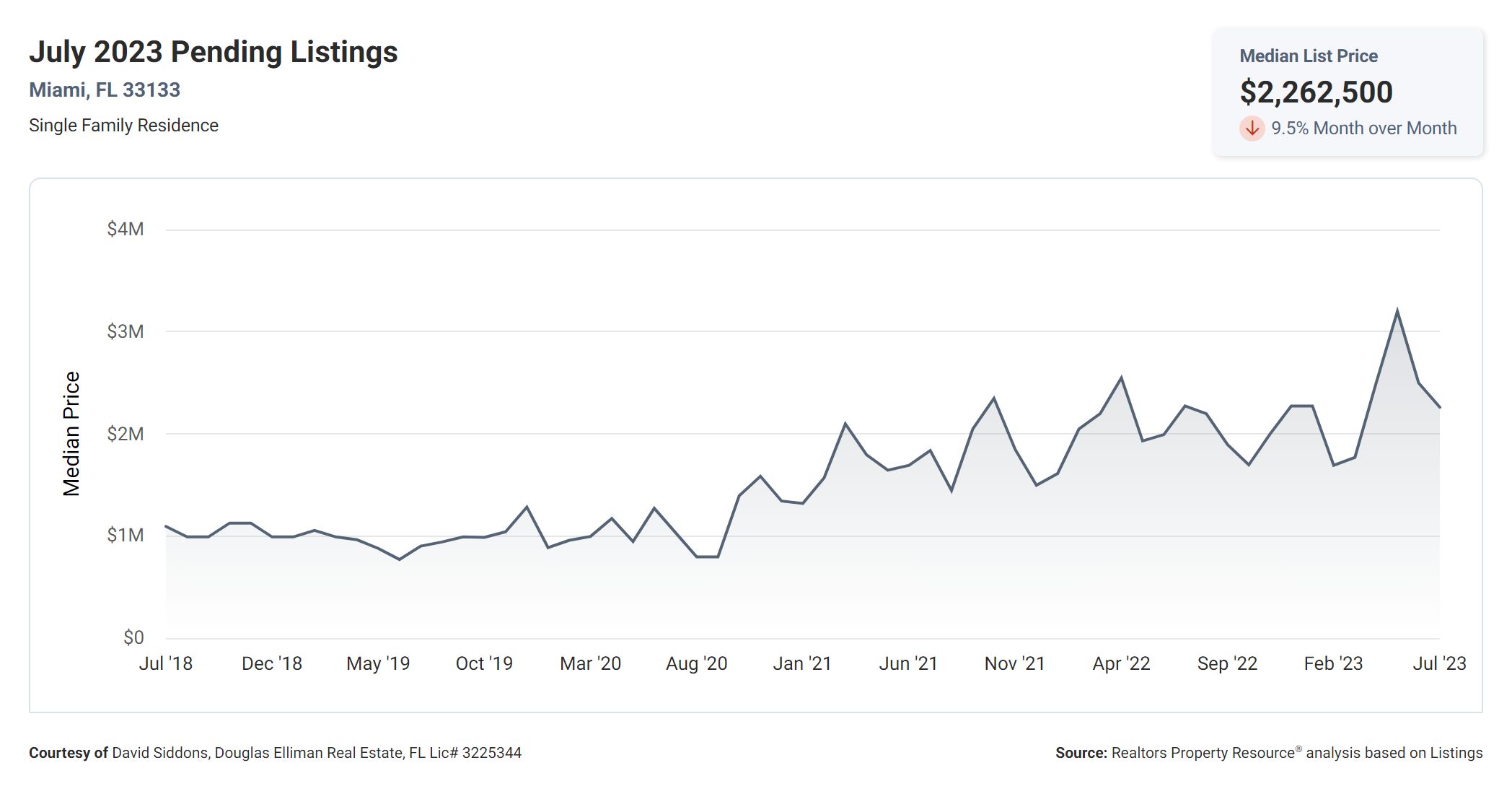

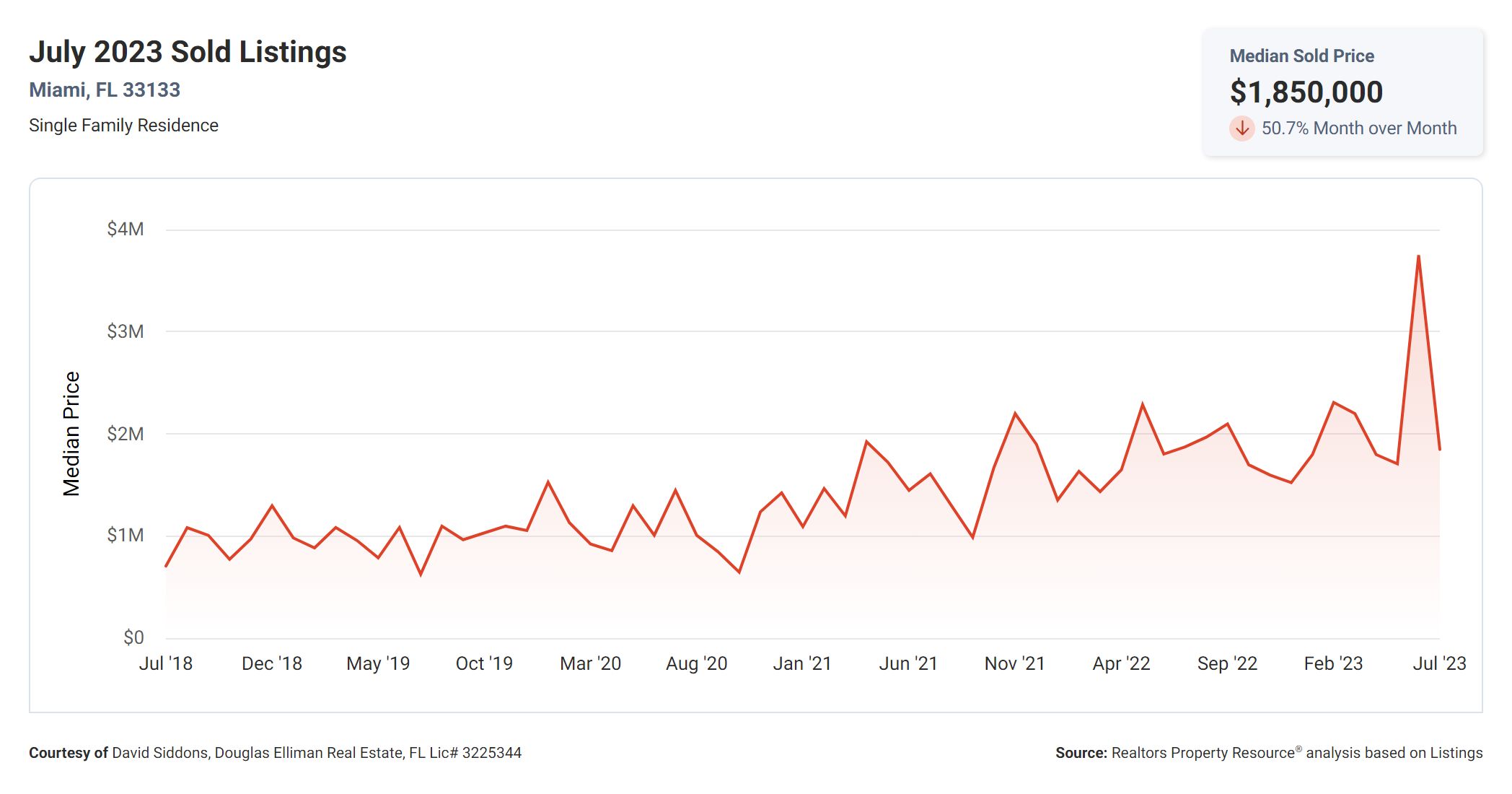

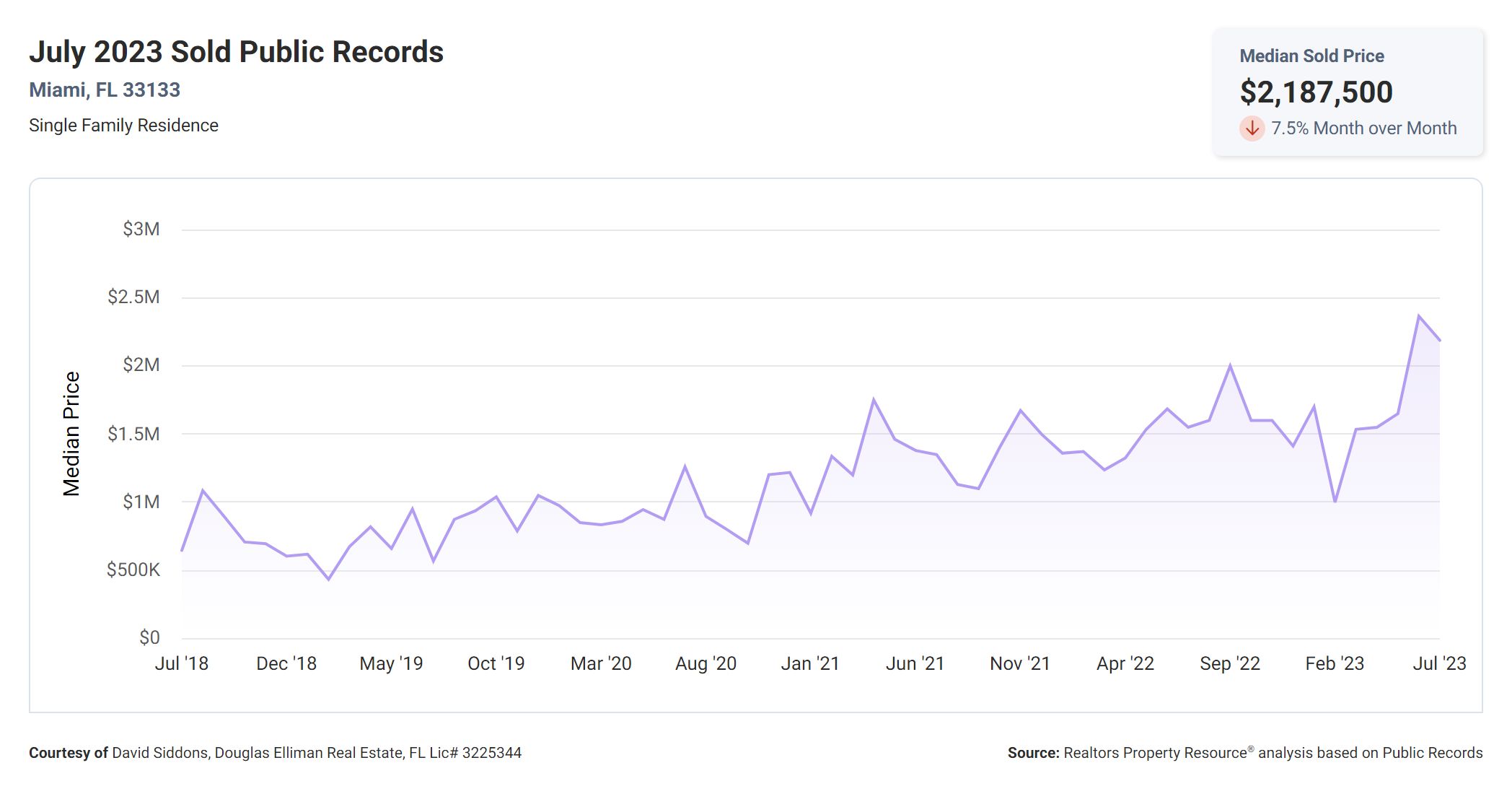

2023 Coconut Grove Q1 & Q2 Market Report Summary. It feels like shockingly low inventory is creating a market stand-off in Coconut Grove. In juxtaposition to low inventory, prices are not dropping and we are still seeing some record-breaking prices in some specific areas of Coconut Grove.

According to our market statistics software, for the 2023 Coconut Grove Market Report end of Q2, Inventory sits at an average of just under five months. Although this does not seem much lower than last year what does feel lower is the availability of highly desirable inventory like new construction.

Let’s first explore why this is happening: due to the Grove’s primary nature an understandable ‘stand-off’, is felt on the street between buyers and sellers. Why? For many Coconut Grove homeowners who bought in the last three years who might want to ‘size’ up or ‘size down’ but want to stay local, the prospect of selling is less motivating than ever. The prospect of losing their lower interest rates on their next purchase coupled with losing their ‘grandfathered’ low property taxes, which were obtained when they bought initially at much lower prices, and then still having to buy high in a limited inventory market makes it a ‘check mate’ game in many clients psychological game of real estate chess.

Certainly slower sales in 2023, but as we pass the halfway point in the year we are really feeling the lack of inventory. Just 110 homes were sold this year between Jan-August, less than half of that sold in 2021 for the same period. not wanting to trade up due to high-interest rates and their ‘grandfathered’ low property taxes.

Specifically digging into the new or newer home market we have just 5% of the homes sold were new properties. There is very little inventory of +$10m homes, this may be because few people want to sell at this level and those in the market are often priced at a ‘make me move level’. The top of the market was $1400 per sqft for a new dry-lot home.

Currently, only ten newer homes (built between 2020-2024) are available for sale in the Grove. Five of those are well over the current highest $ per sqft (asking between $1400 per sqft – $2000 per sqft), suggesting either a new level of product (which I doubt) or simply ‘overreaching’. I believe they are working with the psychology of fishing the market for a ‘motivated, less value-sensitive buyer who needs to shop but is faced with unnaturally shallow levels of inventory.

Advice for Buyers

If we find the ‘right house’, recognize that there will be stiff competition. Notably for new homes. Pay attention to our statistics page and check out the sales by price per sqft as it will effectively help guide you. Due to low inventory initiate our assistance in going off the market to open your options up. We have several excellent ‘off-market’ options in the Grove currently.

Advice for Sellers

Recognize that a significant amount of traffic will most likely come from ‘NYC and California still’. Our agent network has us calling and sharing your property with thousands of DE agents, and for luxury sellers, the top 250 from across the country are called. Help assess your value again with our statistics tool but also bear in mind the inventory levels once again. Buyers are cautious about ‘extremely overpriced’ products right now, so fishing the market is not wise unless you legitimately have a ‘unicorn’ product. Lower-end products (Sub $2m) still have incredible velocity.

The rental market is still incredibly strong so in some cases, we recommend clients to not sell but to turn their primary homes into investments and rent.

Read our other neighborhood and luxury reports

If you would like to get perspective on other specific neighborhoods or luxury reports. Please click here to go to our main database of reports. We update these every 6 months.

Schedule a meeting / time with David

FAQS

These are the most commonly asked Google Real Estate Related questions

I see the market is balanced going towards a buyers market, what does that mean?

A balanced market is a market in which neither buyers nor sellers have an advantage. A buyers market is a market in which buyers have an advantage over sellers as there is more supply than demand. In today’s market however the supply we are seeing is not always quality product. We see that well finished homes still trade fast as long as they are asking market prices.

Do you think we should wait for interest rates to go down before buying a home?

Many buyers are waiting for rates to come down. If the rates will come down, many buyers will become active again or current owners might look for alternatives. This will create market activity again, which has been slow in the last few months.

For people that are waiting for interest rates to come down, we have some advice. By the time rates go down, prices will go up again. If you want to buy a home anywhere in the next year, buy it now and refinance later. If interest rates don’t come down it’s because inflation is still high and that’s mostly a consequence of a hot housing market so this also means housing prices will continue to go up. So in almost all scenarios, you are losing by waiting for interest rates to go down.

Do you think home prices will come down any time soon?

The nation, and Miami, is experiencing a severe housing shortage we need to address, especially when it comes to single-family houses. We see many new condos being construction, but most of Miami’s new condos are in the $2,000 per SF + range, so this caters only to a small group of buyers.

We are still in the expansion phase and given we are not building sufficient housing units to cover the 4 million in shortage, we do not expect to enter the hyper-supply phase any time soon.

In addition, everyone is waiting for the crash. There is so much money waiting for when the market goes down that almost by definition the market will not crash. If prices will come down by 10% many people will start buying. There is a lot of money waiting to get into this market, in combination with a shortage of properties. As a result, a strong correction is highly unlikely.

For more information please listen to our latest podcast in which we discuss the likelihood of the market to crash with a FIU professor of Real Estate: https://luxlifemiamiblog.com/is-a-miami-real-estate-crash-coming-the-economic-truth-with-fiu-professor-eli-beracha/

What price range is this study taken over

This is done for homes between $1M and $10M. If you would like a more specific result for homes in a specific price range please contact me.

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS