- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

Buy Now or Wait? The Real Math Behind Waiting for Lower Rates in Palmetto Bay

Many Palmetto Bay buyers wonder: Should I wait for rates to drop before buying a home? It’s a valid question, but the reality is that acting before rates fall often puts you in the best position, not after.

Why Waiting Rarely Pays

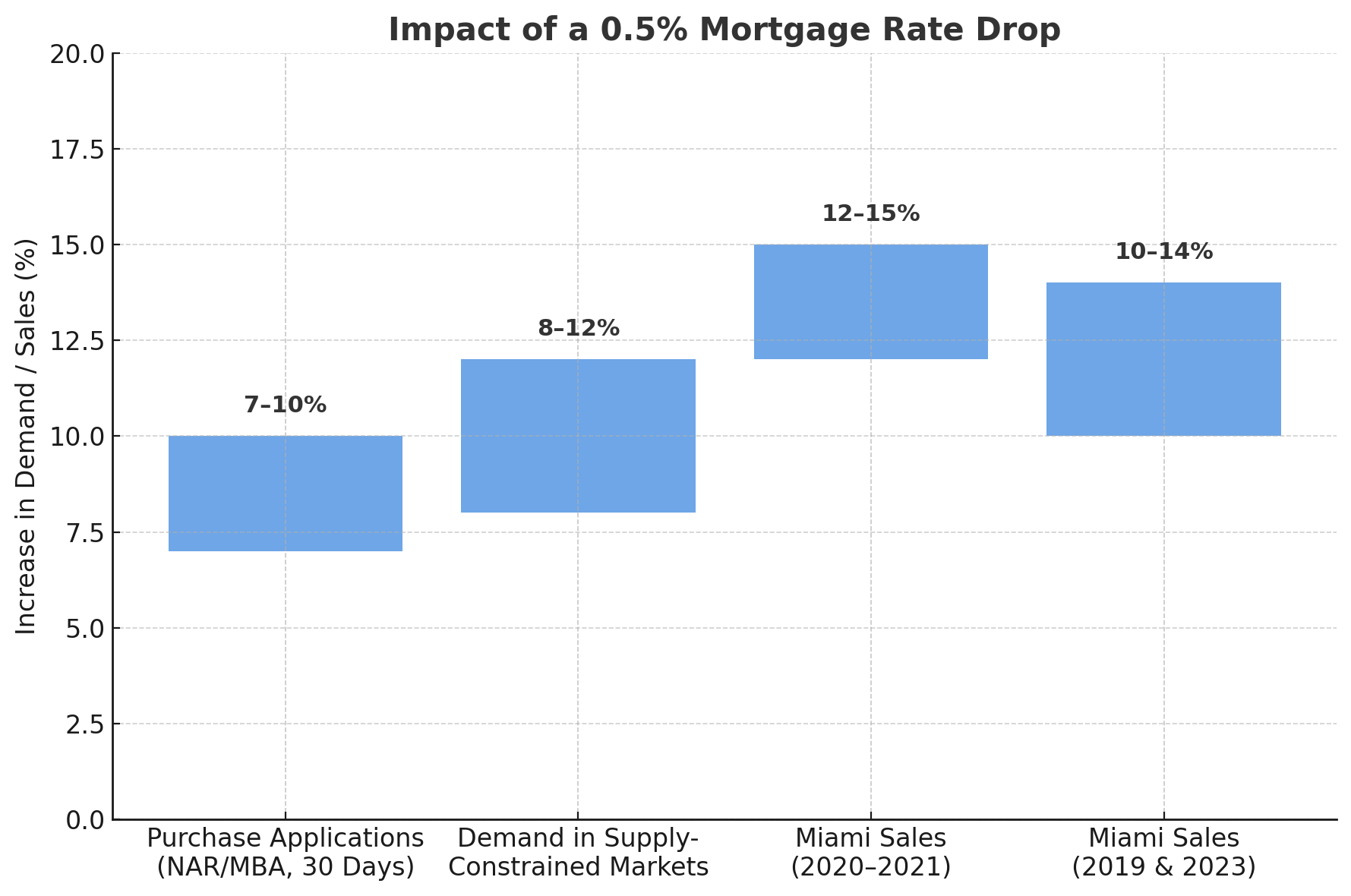

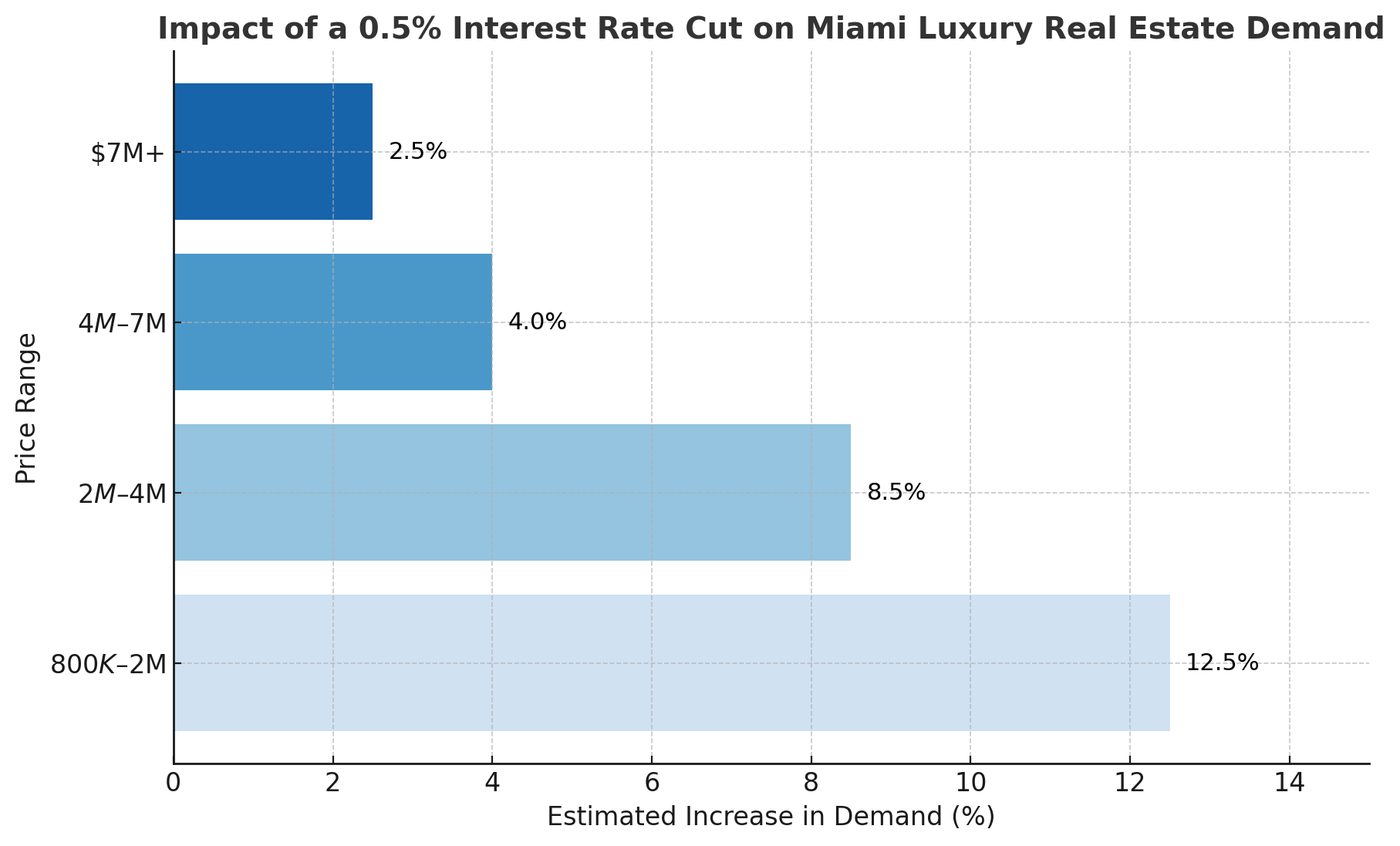

Waiting on the sidelines feels safe. Many buyers think they will save money if they just wait until rates go down. BUT here’s what really happens when rates drop: Demand surges and more buyers re-enter the market. Inventory tightens, homes may even go into a multiple offers scenario overnight. Prices increase, competition pushes values higher, often faster than the rate savings. Instead of trying to get a deal, you’re stuck paying more for the same house, or worse, losing it to a cash buyer who didn’t wait.

Why Waiting for Lower Rates Could Cost You More in Palmetto Bay

Please find below an example** of what might happen with a $2.2M Home in Palmetto Bay

| SCENARIO* | HOME PRICE | LOAN | ESTIMATED MONTLY P&I | NET EFFECT |

| Buy Today @ 6.5% | $2,200,000 | $1,760,000 | ≈ $11,100 | Baseline |

| Wait 6 Months – Rates 6.0% (+3% Price) But Buy Before the Buyer Rush | $2,266,000 | $1,812,800 | ≈ $10,900 | -$200/mo, but +$66,000 upfront |

| Wait 6 Months – Rates 6.0% (+5% Price) But you reacted later than the rest of the market | $2,310,000 | 1,848,000 | ≈ $11,100 | Same monthly, +$110,000 upfront |

| * Example assumes: 80% financing on a $2,200,000 purchase at a 6.5% 30-year fixed rate (≈$11,100/month). Waiting scenario assumes 80% financing at 6.0% 30-year fixed rate, but with higher purchase price due to increased demand. Payments shown are principal and interest only and are estimates for illustration purposes. Actual payments will vary. | ||||

| Even in the “best case,” your monthly savings is just $200 — but you’ve paid $66,000 more for the same home. | ||||

In the second scenario, you saved $200/month at first glance. But you paid $66,000 more upfront to own the same house. That extra $66K could have gone toward your kids’ school tuition, a boat slip at Deering Bay, or a full backyard renovation. Instead, it disappears into a higher purchase price for the same house. In the 3rd scenario, your payment is right back where it started, but you’ve paid $110,000 more for the same home.

The Bottom Line

Waiting for rates to drop is always a gamble. Even a modest 2–3% increase in prices can erase the savings of a 0.5% rate cut, while a 5% jump, which often happens quickly in low-inventory markets when demand surges, can leave you paying more overall than if you bought today. On top of that, you risk losing the home you really want in a wave of multiple offers. The smarter play is to secure the right property now, lock in ownership, and take advantage of refinancing later when rates ease. History shows that opportunities to refinance come around far more often than chances to purchase the perfect home at today’s price.

The Bigger Picture: Why Palmetto Bay Doesn’t Wait

Palmetto Bay isn’t just about the math — it’s about lifestyle. And when the right home hits the market here, it rarely lasts.

- Space & Privacy – Expansive lots, lush canopies, and gated enclaves give families room to breathe.

- Waterfront & Parks – Direct bayfront access, marinas, and miles of trails keep boating and outdoor life at the center.

- Top Schools – Some of Miami’s most respected public and private schools drive long-term demand.

- Steady Appreciation – A history of consistent value growth makes waiting an even bigger gamble.

When the right home hits the market, it doesn’t wait around for rates.

Key Takeaway

If you’re waiting for rates to drop before buying a Palmetto Bay home, you may find yourself paying more for the same home when everyone else jumps back in. The smart play? Secure the home you want now, with today’s terms, and refinance later if rates improve. I don’t just work here, I live in Palmetto Bay. Over the years, I’ve helped both sellers and buyers successfully navigate this neighborhood and close on the right opportunities. I know the neighborhoods, the schools, and the trends that make Palmetto Bay one of Miami’s most desirable communities.

Connect with the David Siddons Group

If you’re considering selling or buying a Palmetto Bay home, don’t wait on the sidelines. Call me today to discuss your goals. I’ll guide you through the numbers, uncover the opportunities, and create a strategy to help you move forward with confidence.

Sarah Alayon | Territory Manager of Palmetto Bay Realtor at the David Siddons Group & PB Resident

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS