- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

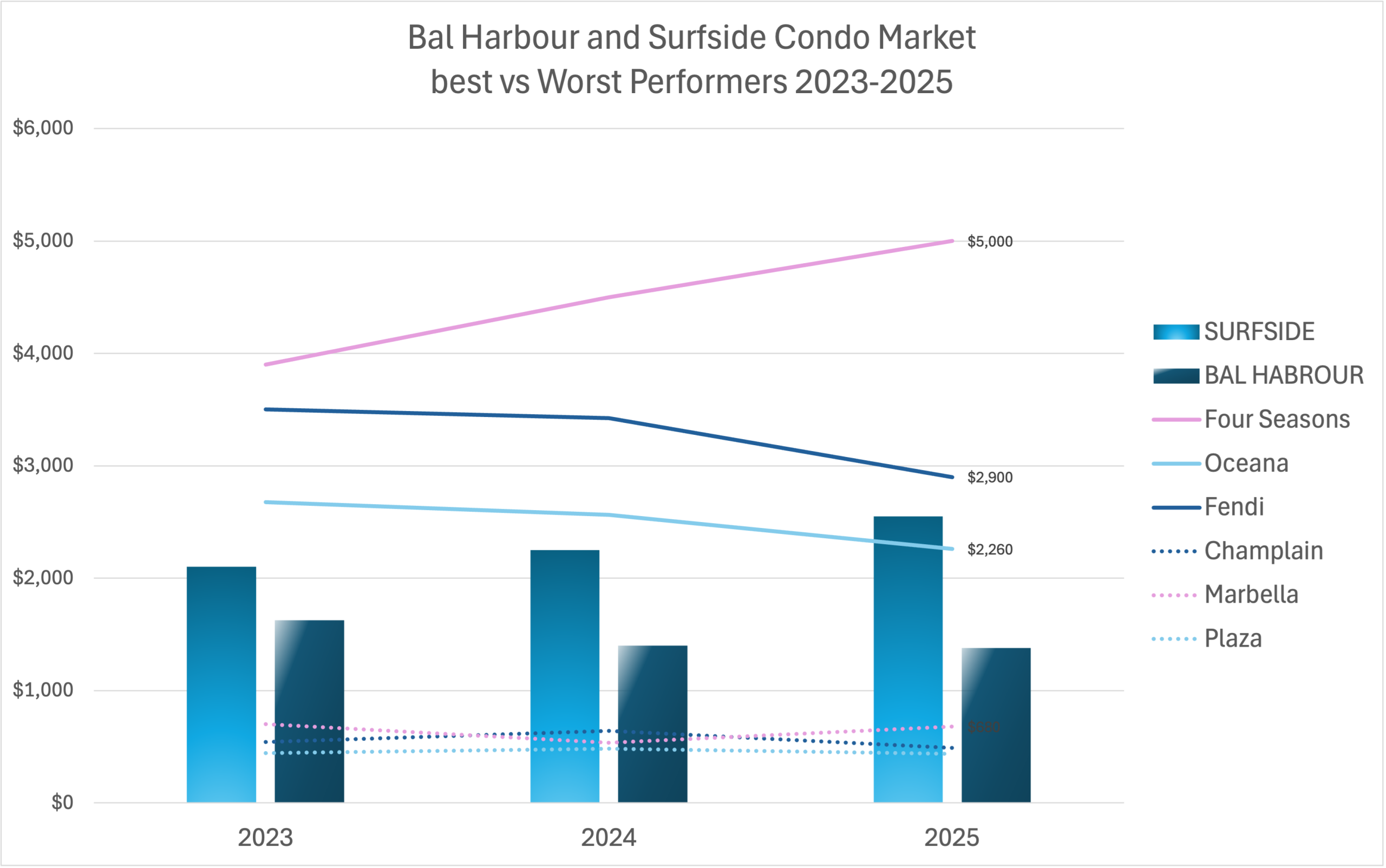

Best and Worst Performing Condos in Surfside and Bal Harbour in 2025

Not all condos in Surfside or Bal Harbour are created equal. In 2025, some towers are breaking price records while others are quietly struggling to sell. To separate perception from reality, we reviewed every major building in the neighborhood, analyzing price per square foot, resale velocity, HOA fees, and owner-to-renter ratios. The result? A clear look at Surfside’s true winners and losers, and the shocking gaps that define Miami’s most exclusive stretch of sand.

Objectives

The objective of this report is to analyze all 38 condos across Bal Harbour and Surfside in 2025 and identify the true winners and losers. Buyers and sellers alike should know that if you’re going to partner with an agent in this market, you want to be with the most learned and tuned-in group possible. No one markets like us, has the reach like us, or researches like us.

-

For Buyers: We help you understand what to buy and what to avoid. Out-of-town buyers are often overwhelmed by the sheer optionality across Miami. By bolting this report into our larger “network of reports” covering every major neighborhood, we provide clarity and focus. Buyers typically visit multiple areas before deciding where they feel most at home (and what they can afford). These reports help narrow that search.

-

For Sellers: We help you understand the current state of your market—what’s popular, what’s not, and where your property stands. This candid view is critical for pricing, timing, and strategy.

-

For Everyone: This is a starting point in your research, not the finish line. We’ve scraped the surface here; the real value comes when we get granular with your specific needs. That’s why I’ve made it easy to connect—scroll down to the bottom of this report to use my Calendly link and schedule a call. Whether you’re buying or selling, we can help you make better decisions.

Top 3 Best Performing Condos in 2025

- Surf Club Four Seasons Surfside → The Surf Club Four Seasons is Miami’s ultimate fortress asset. It spans eight acres of unmatched scale with full five-star hotel integration. With zero assessments and virtually no turnover, it continues to outperform even in a cooling market.

- Fendi Surfside → Fendi Château stands out as Surfside’s clear #2. It combines villa-like intimacy, $2.8/SF HOAs, and virtually no rentals. The result is long-term stability and value.

- Oceana Bal Harbour→ Oceana Bal Harbour delivers resort-style living on 5.5 acres with $2.10/SF HOAs, strong end-user demand, and steady resale performance

3 Worst Performing Condos in 2025

- Champlain Surfside→ Champlain Towers remains Surfside’s weakest buy. Values have flatlined around $490/SF. Sales drag nearly a year and close at 20%+ discounts. HOAs at just $1.10/SF all but guarantee future risk.

- The Plaza Bal Harbour → The Plaza is a classic decline story, frozen at ~$440/SF. With more than 50 months of inventory, 18% discounts, and looming $120K–$180K assessments, it has become a high-risk money pit for buyers.

- Marbella Surfside → Marbella has plunged 22% to $680/SF. Sales drag on for 190 days and close with discounts up to 23%. With $70K assessments looming on top of dangerously low $1.10/SF HOAs, this aging tower is in clear decline.

The 3 Best Performing Condos in Surfside and Bal Harbour

1. Surf Club Four Seasons Residences in Surfside

The Surf Club Four Seasons Private Residences sets the bar for Miami living with a rare combination of scale, design, and service. Set on eight acres of oceanfront gardens, its expansive footprint allows for sweeping separation between towers, lush landscaping, and unobstructed sightlines, offering a sense of space and privacy almost unheard of in today’s market. Inside, flow-through floor plans with wide frontages maximize natural light and deliver both ocean and city views—vibrant by day, sparkling by night. What truly distinguishes the Surf Club is the integration of a full Four Seasons Hotel on site, elevating the experience beyond standard condo amenities with five-star hospitality that includes private restaurants, a spa, pools, beach butlers, concierge, and the iconic Thomas Keller Surf Club Restaurant. HOA fees of $3.78 per square foot may be high, but they are justified by this suite of amenities, and the building remains well-capitalized with strong reserves and no special assessments—an increasingly rare feature post-Surfside. Rentals are almost non-existent, with only three to five units a year coming to market, underscoring that this is an end-user community rather than an investor playground. For buyers who value stability, exclusivity, cultural significance, and lifestyle in equal measure, the Surf Club offers something unmatched: a low-turnover, high-demand residence that is both a piece of history and a global trophy asset, consistently setting the benchmark for what “the best” truly means in Miami. Although Surfside’s condo market has softened over the past two years, this property has continued to outperform. Click here for key data

2.Fendi Chateau Residences Surfside

The real debate is between Arte and Fendi Château Residences, two buildings that sit firmly in the ultra-luxury bracket. Arte has recently posted sales around $3,900 per square foot, which is remarkable for a boutique tower. But when I weigh the numbers and the lifestyle, Fendi wins out. It is slightly less expensive yet equally impressive, and in some ways more practical for long-term owners. It also has better ‘peripheral’ views in my opinion as neighboring condos don’t sit so close. Completed in 2016 with just 58 residences, Fendi Château feels like a private villa on the sand. Arquitectonica’s design and Fendi Casa interiors deliver rare brand integration and craftsmanship.

The top recorded trades show $3,100 per square foot in 2025, compared to $3,700 in 2024 and $4,000 in 2023. Although values have been consistent, prices came down from $3,400–$3,500 in 2023 and 2024 to $2,900 in 2025. This trajectory demonstrates both resilience and the reality of small-sample volatility. The 2025 price “dip” also needs context. Unlike the prior two years, no 01/06 corner residences sold. These units usually command a premium. Combined with the overall market slowdown, this has weighed on the numbers. Still, for buyers, it signals value compared with Arte or the Four Seasons.

The fundamentals are excellent. HOA fees are $2.8/SF, significantly lower than Arte’s $3.75. Amenities are just as strong, with multiple pools, a restaurant, spa, concierge, and beachfront services. At this intimate scale, they feel personalized. Inventory is tight, with only 4 of 58 units currently for sale (7%). Rentals are practically nonexistent, with just two or three per year. Current rental prices range from $35,000 to $85,000 per month. This underscores the owner-occupier profile that helps values stay strong. Equally important, the building is backed by healthy reserves, avoiding the pitfalls that older condos in Miami are now facing under stricter regulations. Click here for Key Data

3. Oceana Bal Harbour

When ranking the best condos in Surfside and Bal Harbour, Oceana Bal Harbour comfortably takes the number three spot, offering a mix of scale, luxury, and healthy market performance that keeps it consistently attractive to both end-users and second home owners. Completed in 2017 Oceana spans 5.5 acres with 240 residences spread across two sleek glass towers. Designed by Piero Lissoni, the property feels more like a private resort than a condo building, with expansive grounds, multiple pools, lush landscaping, tennis courts, a world-class spa, and even museum-quality Jeff Koons sculptures anchoring the public spaces. It’s a lifestyle product in every sense, but one that also has the numbers to back up its prestige. Prices have eased a bit, which reflects a slower overall market rather than any decline in the building’s popularity; demand for prime lines remains strong and many owners aren’t willing to sell. HOA fees are well managed at $2.10 per sqft which is very reasonable considering the amenities options. This is not surprising though as the scale of the project is significant. There are currently 17 active listings out of 240 units (7%) and roughly 20 rentals per year (about 8% of the building), underscoring its primarily end-user profile. It remains one of the few true luxury condos in Bal Harbour; The St. Regis is often the runner-up but now feels dated, while top luxury newcomer Rivage is still several years from completion. Click here for key data

The 3 Worst Performing Condos in Surfside and Bal Harbour

1. Champlain Towers, Surfside

Champlain Tower has struggled more than any other Surfside condo, weighed down by its tragic history and weak market performance. Sales numbers have remained nearly unchanged for years: $464 per SF in 2022 versus $490 in 2025. Ceiling prices have flatlined around $650 per SF, with only a brief uptick in 2024. This year has been particularly rough: every sale took close to a year to close, and all at heavy discounts;22%, 18%, and 9%, the latter is more consistent with the price cuts required in prior years.

Of the 14 active listings, half have already sat on the market for more than six months, highlighting illiquidity. Rentals look healthier at about seven per year, with six currently listed, but that doesn’t mask the underlying concerns. The HOA fee of just $1.10 per SF may seem appealing, but for an older oceanfront building in today’s climate, it’s dangerously low and likely signals deferred maintenance, future assessments, and compliance risks with current building codes. Renovating a unit won’t change those fundamentals. When we inquired with the building association however, we were told there are no assessments coming up as they have the 40 years certificate completed. On top of this, the brand-new Delmore is rising next door, bringing years of construction noise and traffic issues. Together, these factors make Champlain Tower the weakest buy in Surfside, a condo where risks far outweigh rewards. Click here for key data

2. The Plaza Bal Harbour

The Plaza shows all the signs of a condo stuck in decline. Prices per SF have been frozen since 2022 at around $440, and peak values have actually fallen, from $600–$700 in prior years to just $443 in 2025. Sales are sluggish: units take 4–5 months to sell, typically at 10–11% discounts, and this year discounts have deepened to 18%. Worse, only three units have sold so far in 2025, while 17 remain active. At this pace, it would take over 50 months to clear inventory: an extreme buyer’s market, especially for a building positioned as a more affordable option. Liquidity is further hampered by the fact that 14 of the 17 active listings have already sat on the market for more than six months, and seven for over a year. Rentals are more active at about 27 per year, with 23 units currently available, but this doesn’t offset the ownership challenges.

HOA fees of $1.30–$1.40 per SF seem low, yet for a 1965 oceanfront building they are dangerously out of step with today’s rising insurance costs and inevitable repair needs. Unsurprisingly, the Plaza is already facing multiple assessments tied to major renovations, including a 50-year structural renovation along with lobby and hallway improvements. Work will cover CMU walls, doors and walls, patio decks, railings, the parking garage, and exterior elevations. The total estimated cost ranges from approximately $120,000 to $180,000 per unit.

Altogether, it’s a property with stagnant values, painfully slow sales, heavy discounts, and mounting financial risks. A clear warning sign for buyers. Click here for Key Data

3. Marbella Surfside

Marbella has seen its values tumble. In 2022, units averaged $873 per SF, but by 2025 that figure dropped to $680; a 22% decline. While one unit this year managed a peak price of $1,200 per SF, the rest traded between just $450–$610. Needless to say, this pulled the averages down sharply. Sales take a long time to materialize, averaging 190 days on market, and discounts are steep. The 2025 closings show price cuts of 15% on average, with half of sales seeing 18–23% reductions. This is a stark contrast to the 7% discounts typical in prior years.

Inventory, however looks more balanced compared to others: 4 active listings against a normal pace of 3–5 sales per year. This equates to roughly 12 months of supply, a buyers’ market but not extreme. That said, two of those active units have lingered for nearly a year and three for six months, showing real liquidity challenges. Rentals remain healthy, with 8 annually on average and 2 currently active. My deeper concerns are structural: built in 1989, Marbella charges just $1.10 per SF in HOA fees, an unusually low figure for an aging oceanfront building, suggesting deferred maintenance. The building is about to undergo a series of renovations, including balcony updates and the removal of shutters. Once completed, owners will be required to install new hurricane-proof doors and windows. The total current assessment amounts to approximately $70,000 per unit. Altogether, Marbella combines falling values, long sales timelines, heavy discounts, and questionable upkeep, leaving little reason for confidence. Click here for Key data

The Red Line Between Winners & Losers

Winners (Surf Club, Fendi, Oceana)

- End-user Dominance → These buildings have almost no rental activity (just a handful per year), which keeps them stable and insulated from investor sell-offs.

- Strong Financials → Healthy reserves, no looming assessments, and HOA fees that, while high, actually match the cost of five-star amenities and proper maintenance.

- Scarcity + Prestige → Low resale velocity (3–7% inventory at any time), branded architecture/design, cultural cachet (Four Seasons, Fendi Casa, Jeff Koons art).

- Market Resilience → Even in a slower market, values hold or bounce quickly because the buyer pool is UHNW end-users who prize security and lifestyle over timing the market.

Losers (Champlain, Plaza, Marbella)

- Low HOAs That Signal Risk → $1.10–$1.40/SF sounds “cheap,” but it points to deferred maintenance, underfunded reserves, and inevitable special assessments.

- Assessment Burdens → $70K–$180K per unit for structural/lobby/renovation work; buyers see future costs as a red flag.

- Investor-Heavy + Liquidity Issues → High rental ratios, units sitting 6–12+ months, and heavy discounting (15–23%) erode buyer confidence.

- Aging Infrastructure → Built in the 1960s–1980s, these condos face tougher code compliance, rising insurance, and construction competition next door.

Condos that outperform are “end-user fortresses” with strong reserves, scarcity, and premium positioning; while those that underperform are older, underfunded, investor-heavy towers weighed down by assessments and weak demand.

One Conversation could Save you Six Figures.

Thinking of buying or selling in Surfside or Bal Harbour? I’ve analyzed every major building in this market and can give you a private strategy session on how to position yourself on the winning side. Don’t gamble with a million-dollar decision, I’ll help you separate true value from hidden risk. Whether you’re buying or selling, timing and building choice are everything, and with years of guiding buyers and sellers through Miami’s luxury condo market, I’ll make sure you protect and grow your investment. Before you commit to a building, commit to a call, and get the inside edge you need to make the right move.

Call me directly at +1 (305) 508-089 or schedule a meeting via the application below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS