- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

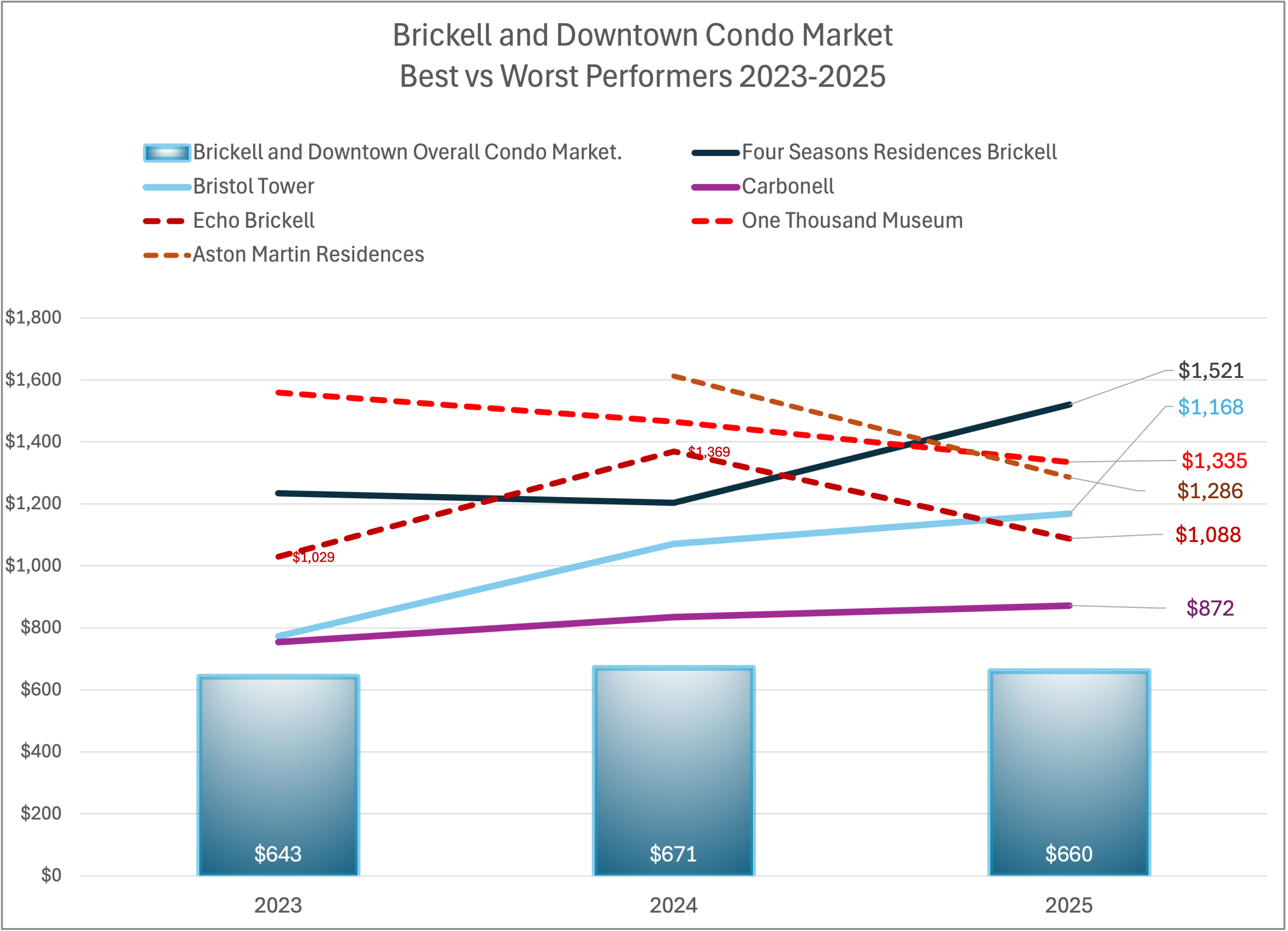

The Best and Worst Condos in Brickell and Downtown (2025)

The 2025 Brickell and Downtown condo landscape tells two stories: one of stability and growth, and another of adjustment and recalibration. To separate perception from reality, we analyzed a range of core buildings across Brickell and Downtown, looking at price per square foot, resale velocity, months of inventory, HOA fees, owner-to-renter ratios, and upcoming supply. The goal is to provide a clear view of which buildings are truly sustaining value and which are still finding their footing.

Purpose of the Report

The intent of this analysis is to highlight which buildings have shown strength and which are under pressure in 2025. For buyers, it helps focus attention on the properties that balance quality, livability, and long-term stability. For sellers, it provides a realistic view of pricing, timing, and competition within each segment of the market. And for anyone following the evolution of Brickell and Downtown, it offers perspective on where value is holding firm and where it is beginning to soften.

Top 3 Best Performing Condos Brickell and Downtown in 2025

- Four Seasons Residences Brickell → A consistent benchmark for quality and end-user stability. Strong price growth, limited turnover, and service standards that continue to support premium values.

- Bristol Tower → A boutique building with enduring appeal. Solid five-year appreciation, responsible management, and a community of long-term residents.

- Carbonell (Brickell Key) → Steady performance supported by generous layouts, refreshed amenities, and a largely owner-occupied profile that protects values over time.

3 Lowest Performing Condos in Brickell and Downtown 2025

- Echo Brickell → Double-digit declines in price per square foot, elevated HOA costs, and long marketing times. Investor concentration has slowed absorption.

- One Thousand Museum → Gradual price softening from its 2022 peak, higher carrying costs, and slower transaction velocity at the ultra-luxury level.

- Aston Martin Residences → Still finding equilibrium post-delivery, with prices down roughly 14% year over year and a large resale pipeline weighing on timelines.

The 3 Best Performing Condos in Brickell

1 Four Seasons Residences Brickell

Four Seasons remains Brickell’s reference point for quality and consistency. In 2025, average prices reached $1,521/SF, up 26% year over year, and nearly double the $744/SF level seen in 2020. Average marketing time is 88 days, with sales closing at a 7% discount to list. HOAs of $1.53/SF are proportionate to the hospitality and service provided. Out of roughly 263 units, only 3% were rented in 2025, clear evidence of an end-user base that values long-term ownership. For buyers, it represents a rare combination of long-term stability, proven reputation, and quality that endures through market cycles. For sellers, consistent end-user demand and the building’s proven track record continue to support strong pricing.

2 Bristol Tower

Bristol Tower is a well-established South Brickell building that continues to perform steadily. 2025 saw average pricing of $1,168/SF, up modestly from $1,131/SF in 2024. Average days on market are 46, and typical discounts remain around 5%. HOAs of $1.63/SF reflect a well-managed building with sound reserves. With minimal rental activity and a loyal ownership base, Bristol stands out for its sense of stability and privacy.

Its performance reflects the fundamentals of good design, sound governance, and a resident- driven community rather than branding or trends.

3 Carbonell (Brickell Key)

Carbonell continues to perform as one of Brickell Key’s most balanced and resilient buildings. Average prices reached $872/SF in 2025, up 5.8% year over year, with low discounting and moderate inventory.HOAs of $1.11/SF and roughly 7% rental activity keep it competitive within the island market. Its combination of larger floor plans, quiet surroundings, and proximity to Brickell’s core continues to attract steady demand.

The 3 Weakest Performers in Brickell and Downtown

1 Echo Brickell

Echo has seen notable price adjustments, averaging $1,088/SF in 2025, down 10.5% from 2024. Marketing times are long (132 days) and HOA fees are high ($2.47/SF). With roughly 12% of units rented, investor exposure remains elevated. As new branded developments such as St. Regis Residences, 1428 Brickell, and Mandarin Oriental introduce larger layouts, family-oriented designs, and a higher standard of design and amenities, Echo faces growing competition from buildings that offer a more complete luxury living experience. This shift continues to pressure pricing and underscores the importance of thoughtful repositioning to remain competitive.

2 One Thousand Museum

After peaking near $1,617/SF in 2022, One Thousand Museum pricing has adjusted to $1,335/SF in 2025 (–8.9% year over year). Limited transaction volume and extended marketing periods have weighed on momentum. The building remains an architectural landmark, but Downtown’s surrounding infrastructure and streetscape are still maturing. Rising carrying costs have further weighed on values, and until the area’s infrastructure and retail presence fully mature, absorption is likely to remain gradual.

3 Aston Martin Residences

Following completion, Aston Martin is undergoing the usual post-delivery period of price discovery and market stabilization. Early resident feedback suggests that the living experience has not fully met expectations for this ultra-luxury segment, with certain finishes and details lacking the level of refinement seen in comparable projects. The building’s location, while visually striking, also presents practical challenges for day-to-day convenience given traffic patterns and overall density in the area, which can detract from the seamless lifestyle many buyers in this tier expect.

Average pricing is $1,286/SF, down 14% year over year, with longer marketing times (117 days) and wider discounts (approximately 13%). A larger resale pipeline and roughly 16% rental rate suggest more time will be needed for supply to balance. Over the next few years, performance will hinge on differentiation within a crowded luxury market.

What Separates the Winners from the Rest

Top Performers (Four Seasons, Bristol, Carbonell)

These buildings have sustained value through end-user ownership, measured management, and a focus on genuine luxury built on quality and longevity, where reputation stems from substance rather than marketing. Their strength lies in consistent governance, resident commitment, and enduring design quality.

Why they outperform:

- End-user ownership: Limited rental activity supports pricing stability and steady demand.

- Governance and maintenance: Well-capitalized associations and proactive boards reinforce financial health and long-term confidence.

- Design and livability: Larger layouts, functional floor plans, and thoughtful amenities attract residents seeking comfort and long-term usability.

- Reputation and trust: Proven service standards and community continuity sustain buyer interest through cycles.

Together, these elements create lasting momentum. Values hold firm, turnover remains low, and resale markets operate efficiently even as broader conditions fluctuate.

Underperformers (Echo, One Thousand Museum, Aston Martin)

While these buildings maintain strong brand recognition, each faces specific market and structural headwinds that have tempered performance in 2025.

Why they underperform:

- Investor concentration: Higher rental ratios have introduced more pricing variability and slower resale absorption compared to primarily end-user buildings.

- Rising carrying costs: HOA fees ranging from $1.70/SF to $2.50/SF have become a larger consideration for buyers, especially in a higher rate environment.

- Product market mismatch: Smaller floor plans, finishes that fall short of newer luxury standards, and evolving neighborhood infrastructure have limited appeal to residents prioritizing everyday livability.

- Competitive pressure: The arrival of new branded developments such as St. Regis Residences, 1428 Brickell, and Mandarin Oriental offering larger layouts and expanded amenity programs has shifted demand toward more comprehensive luxury offerings.

Overall, these dynamics have created a more nuanced performance gap in 2025. Price movements are less a reflection of brand strength and more a function of ownership composition, cost structure, and how each building aligns with today’s definition of livable luxury.

Closing Thoughts

Brickell and Downtown remain among Miami’s most active and dynamic markets. In 2025, the differences between investor-driven and end-user-driven buildings have become clearer than ever. For buyers, the key is to focus on buildings that pair quality with stability. For sellers, success comes from aligning timing and pricing with real demand, not perception. This analysis is meant to bring clarity to both sides, helping you make better decisions, protect value, and move with confidence in a changing market.

Connect with The David Siddons Group about The Best and Worst Condos in Brickell

Thinking of buying or selling in Brickell or Downtown? I’ve analyzed every major condo in these markets and can guide you through a private strategy session to ensure you’re on the winning side. Don’t gamble with a million-dollar decision, I’ll help you distinguish true value from hidden risk.

With years of experience helping Miami’s luxury buyers and sellers, I’ll make sure your next move protects and grows your investment. Before you commit to a building, commit to a call and get the inside edge you need. 📞 Call me at +1 (305) 508-0899 or schedule a meeting below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS