This Brickell Condo Market Report reveals what’s really happening at each price point, which segments are thriving, where challenges lie, and how new developments are reshaping the market. Our insights combine hard data with on-the-ground experience, helping buyers, sellers, and investors move forward with clarity and precision.

- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

2025 Midyear Brickell Condo Market Report | The Truth Behind the Numbers

Summary

At first glance, it may seem like the Brickell condo market has hit a pause, but a deeper look tells a more layered story. Beneath the headlines and assumptions about slowdowns or price fatigue, our mid-year review reveals a market that’s recalibrating rather than retreating.

KEY TAKEAWAYS

1. A High Amount of Expired Listings. Across almost all price ranges, just as many listings expired as successfully sold in the past six months. This is a sign that the market is still seeing a lot of inventory that is not absorbed by the market. Most likely caused by overpricing.

2. Discounts Are Becoming More Generous. Sellers are becoming (and must continue to be) more realistic in their pricing with many already offering hefty discounts.

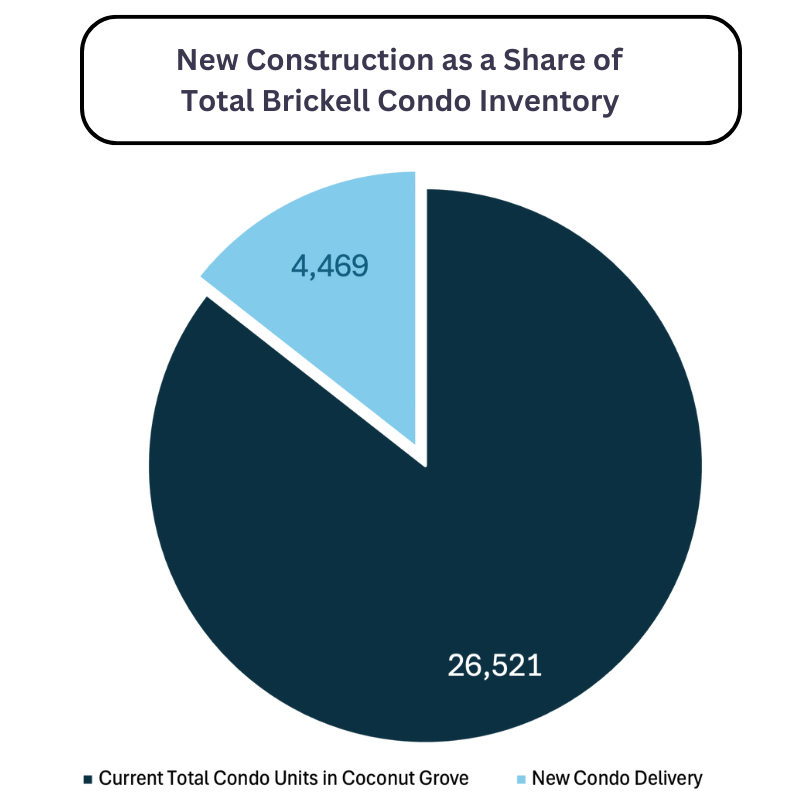

3. Condo inventory is projected to jump 17% in the coming year as a wave of new developments hit the market. Current 4,500 new units are under construction.

4. The Market Is Recalibrating, Not Retreating

Inventory is up, partly due to new condo deliveries, but demand from end-users remains steady. Sellers are adjusting pricing strategies, and buyers are more selective, making differentiation critical.

5. $3M–$6M Segment Is the Standout Story

Sales nearly doubled, prices rose to ~$1,290/SF, and days on market dropped from 142 to 86. However, most homes sell at about 86% of the original asking price, signaling overpricing at launch.

6. $1M–$3M Remains the Core Market

Despite fewer sales, prices have held or increased slightly, and properties are selling faster (99 → 65 days). Well-positioned, renovated units still move quickly, even with higher inventory.

7. $6M–$10M Is High-Priced but Slowing

This tier saw the biggest price jump (+44% to $1,642/SF) but also the biggest slowdown in absorption (15 → 103 days on market) as newly delivered inventory competes with resale.

8. Quality Still Commands Attention

Top-tier buildings like Four Seasons, Santa Maria, and Bristol Tower outperform thanks to design, management, and location — while dated or poorly positioned condos face deeper discounts, longer listing times, and a higher chance of expiring.

The Brickell Pre-Construction Condo Market

The Pipeline of new construction condos

| Condo | # of Units | % Sold | Available Inventory | Average Price per SqFt | Price Range | Delivery Date |

| St Regis Residences | 152 | 75% | 38 | $2,968 | $6,800,000 to $47,000,000 | Q4 2027 |

| The Residences at Mandarin Oriental | 228 | 60% | 91 | $2,987 | $6,850,000 to $49,900,000 | Q1 2030 |

| 1428 Brickell | 189 | 60% | 76 | $1,993 | $4,142,900 to $16,973,900 | Q1 2028 |

| Cipriani Residences | 397 | 73% | 107 | $1,817 | $1,753,900 to $7,605,900 | Q1 2028 |

| 2200 Brickell | 105 | 80% | 21 | $1,374 | $1,296,000 to $3,049,000 | Q3 2026 |

| UNA Residences | 135 | 97% | 3 | $2,165 | $6,800,000 to $9.800,000 | Q4 2025 |

| Baccarat Residences | 360 | 97% | 11 | $1,800 | $4,100,000 to $31,000,000 | Q4 2028 |

| Viceroy Residences | 498 | 50% | 249 | $1,200 | $600,000 to $2,500,000 | Q1 2026 |

| Mercedes Benz Places | 821 | 65% | 287 | $1,550 | $750,000 to $4,000,000 | Q1 2028 |

| The Standard Residences | 422 | 20% | 338 | $1,362 | $621,000 to $2,150,000 | Q4 2027 |

| Parkside Brickell | 185 | 35% | 120 | $1,100 | $500,000 to $900,000 | Q4 2027 |

| Season One Brickell | 80 | 100% | - | $1,400 | $551,000 to $1,500,000 | Q4 2028 |

| Millux Place | 99 | 50% | 49 | $1,200 | $450,000 to $1,100,000 | Q4 2028 |

| 888 Brickell by Dolce & Gabbana | 259 | 32% | 176 | $1,950 | $2,200,000 to $88,000,000 | Q1 2029 |

| ORA By Casa Tua | 540 | 75% | 135 | $2,200 | $993,900 and $4,500,000 | Q1 2029 |

| TOTAL | 4469 | 1701 |

Brickell currently has approximately 26,500 condo units across its main buildings. With an additional 4,500 units expected to be delivered over the next years from new developments. This represents a 17% increase in total inventory.

The $1M to $3M Market: Volume-Heavy and Value-Driven

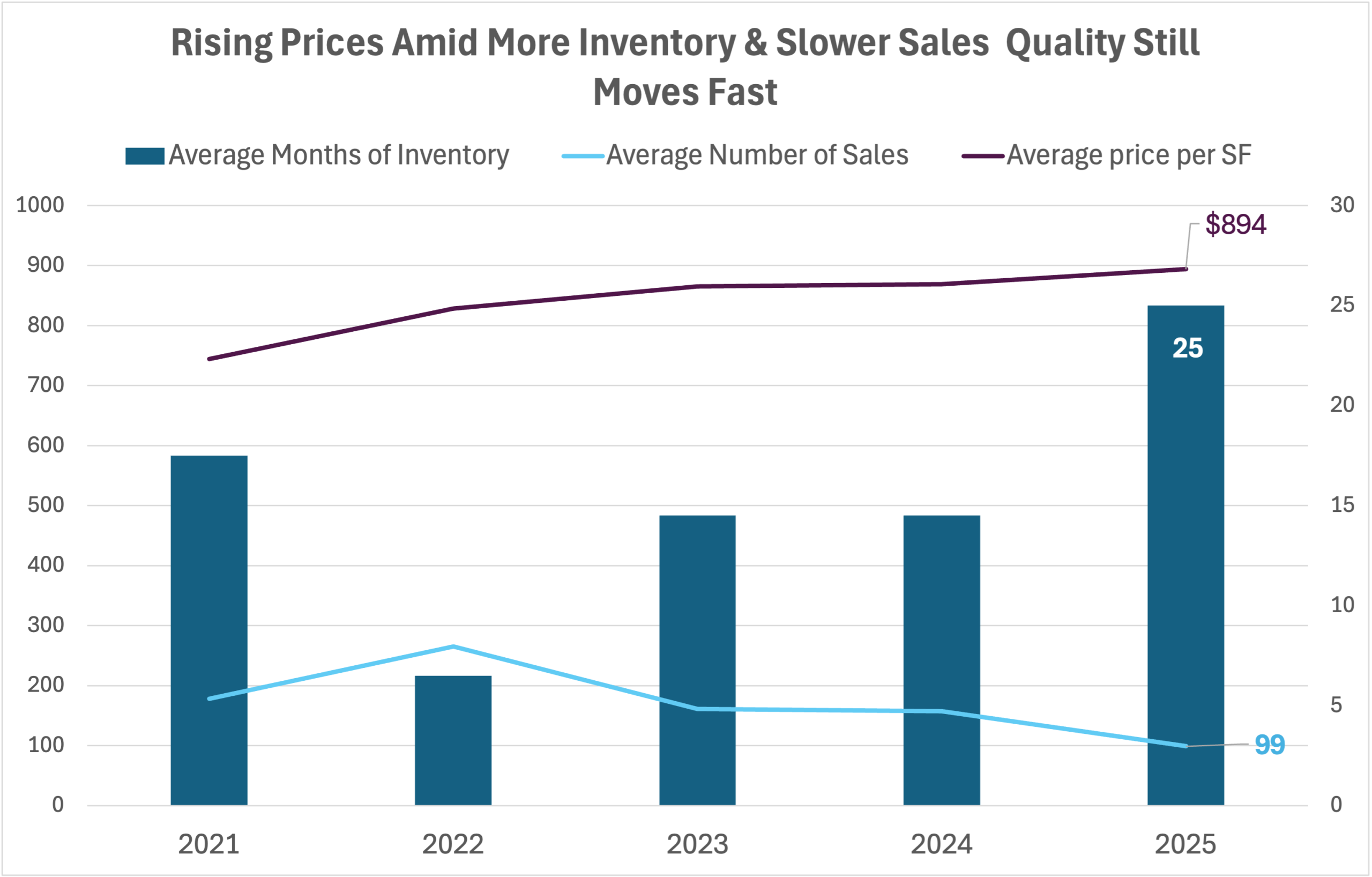

This remains the most active segment in Brickell. Sales volume dipped from 157 sales in the first half of 2024 to 99 in the same period of 2025. Despite the slowdown in deals, the average price per square foot rose from $869 to $894, suggesting that values are holding steady or even gaining traction, particularly for well-positioned properties.

The $1M to $3M range, which accounts for the largest share of inventory and transactions in Brickell, has the lowest months of inventory at 25. While still elevated, it reflects more balance compared to upper tiers. Interestingly, prices have continued to appreciate despite high supply, pointing to a more nuanced environment in 2025 likely driven by end-user demand and long-term positioning. Properties in this bracket are also moving faster, with median days on market dropping from 99 to 65.

For sellers, it’s important to understand how recent shifts in buyer behavior and inventory levels have changed the landscape. In this environment, differentiation is essential. Renovated units can still attract strong interest, but only when priced thoughtfully and aligned with current market conditions. Properties with dated finishes, awkward layouts, or in buildings facing high resale competition are at greater risk of prolonged market time. In a landscape where inventory is abundant, standout features matter more than ever. Success now depends on clear positioning, strategic pricing, and a compelling value proposition that resonates with today’s more selective buyer.

For buyers in this segment, there is an abundance of choice. With ample inventory available, you are able to remain active yet highly selective, knowing that time may work in your favor while you pursue the right opportunity. Value continues to be defined by thoughtful floor plans, strong building reputation, and long-term upside potential. While options are plentiful, the most compelling properties that offer a blend of design, functionality, and investment appeal still attract swift interest. Buyers who recognize quality and act with intention are best positioned to capitalize on today’s conditions.

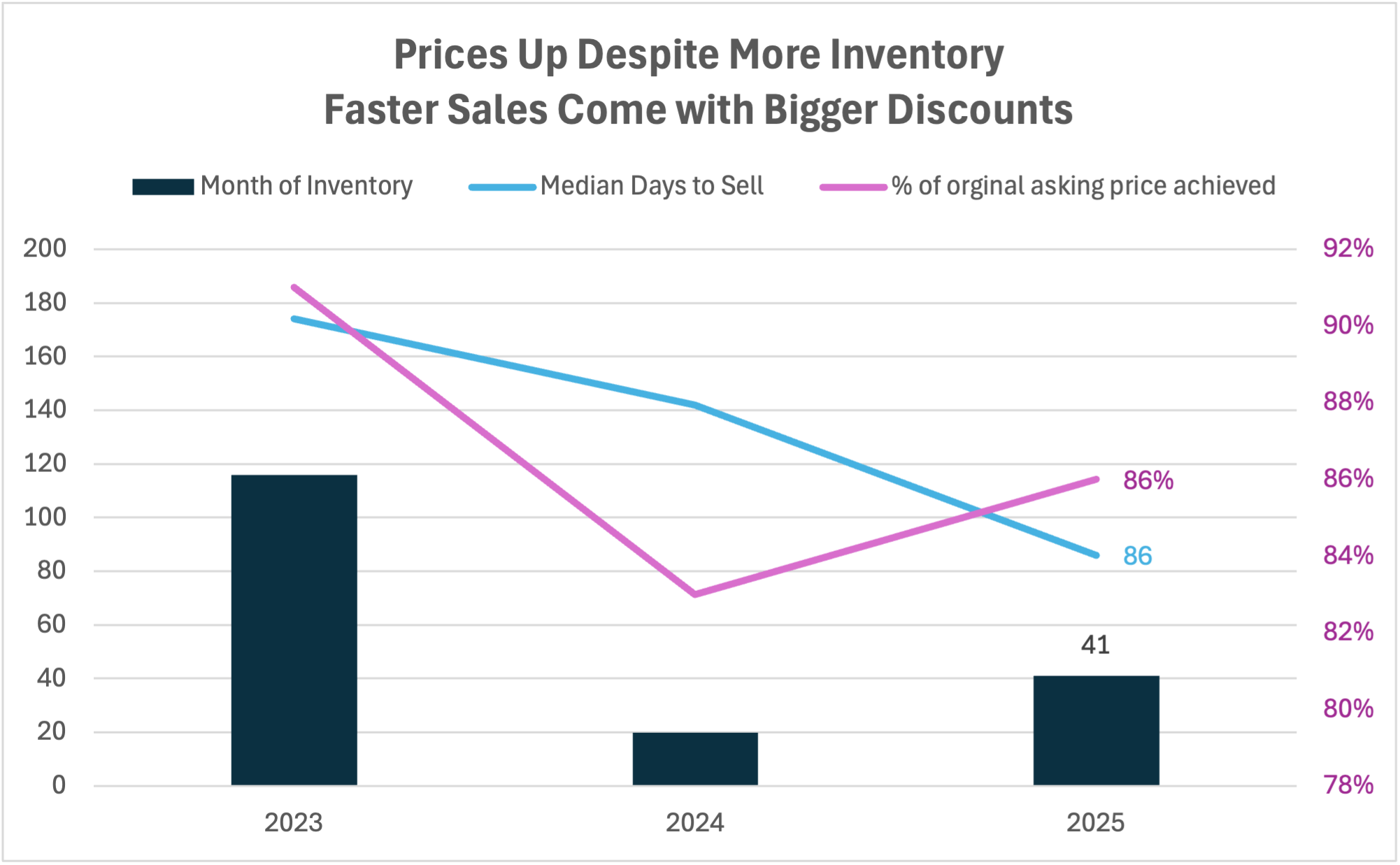

The $3M to $6M Market: Gaining Momentum and Speed

This segment has become one of the most compelling stories of 2025. Sales in the $3M to $6M range nearly doubled, and the average price per square foot climbed from just over $1,100 to nearly $1,290. At the same time, inventory has also increased, fueled partly by the offering of new construction condos giving buyers more options. Most notably, median days on market dropped sharply from 142 to just 86, signaling a shift from a period of limited activity to heightened momentum. Although properties sell fast, on average only 86% of the original listing price is achieved. Meaning that most sellers are listing at prices that are not in line with the market.

This uptick is likely driven by a combination of new, thoughtfully designed inventory and end-users who had been waiting for the right moment to act. Buyers in this tier tend to be strategic, prioritizing long-term livability, architectural quality, and overall value.

For sellers, there is clearly renewed interest, but competition remains, particularly from new developments. Properties that offer a compelling mix of location, layout, and well-managed amenities continue to command the most attention.

For buyers, current conditions offer room to negotiate, with higher inventory and broader economic uncertainty creating meaningful leverage. That said, when price and quality are in alignment, waiting too long can mean missing the opportunity altogether.

The $6M to $10M Market: Price Growth Meets Slower Absorption

The $6M to $10M segment posted the most significant price appreciation of any bracket, with average price per square foot increasing by more than 44%, rising from $1,136 to $1,642. Yet, during the same period, median days on market jumped from just 15 to 103. While this may seem at odds, it reflects the impact of increased supply rather than a decline in demand. Much of this can be attributed to newly delivered inventory entering the resale market, where units originally priced at pre-construction levels are now going through a period of price discovery as the market reassesses their value.

For sellers, this puts them in a more delicate and competitive environment that demands precision. With elevated inventory and continued competition from developers, sellers must lead with product quality, strategic positioning, and thoughtful pricing. Even well-located or well-finished units may struggle if not aligned with current buyer expectations. In this segment, differentiation is no longer optional; it is essential.

For buyers, this tier presents one of the most strategic windows in the market today. Motivated sellers and elevated carrying costs have created conditions for negotiation, especially in buildings with a track record of holding or growing in value over time. While certain properties may still command premiums, others offer meaningful upside through private dialogue or off-market access. Those who combine patience with a clear understanding of quality will be best positioned to capitalize in the months ahead.

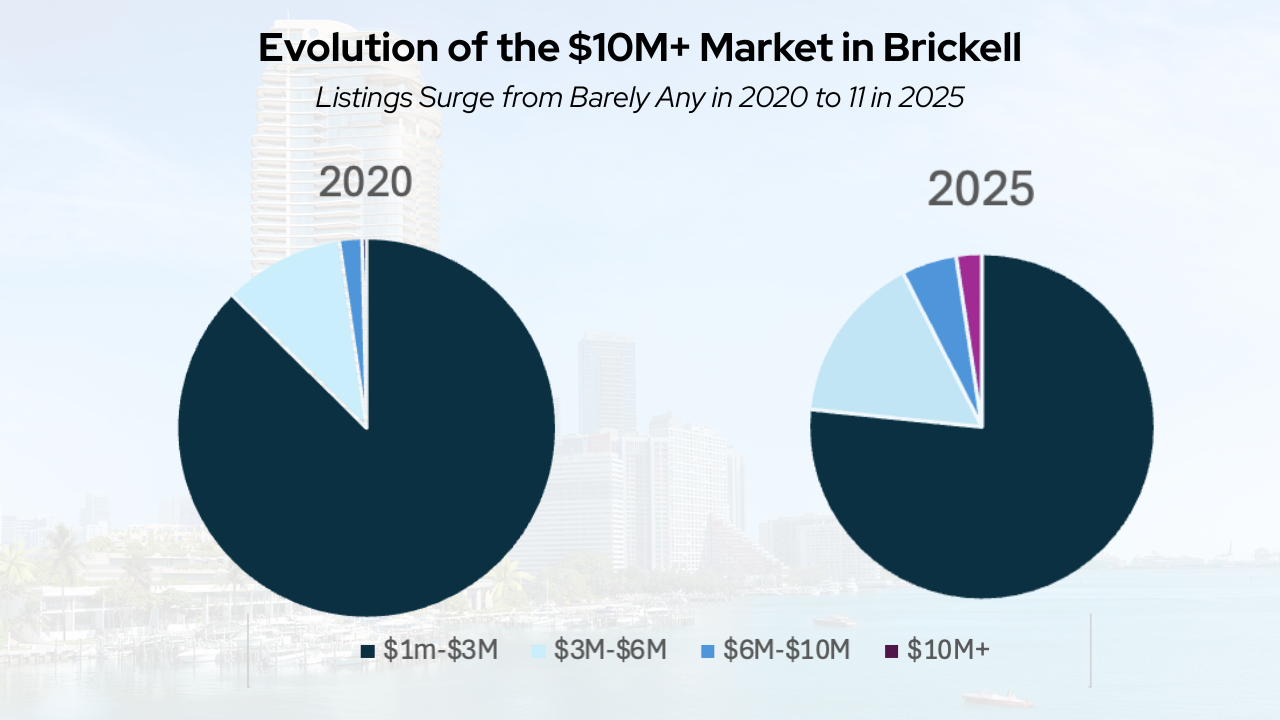

The $10M+ Market: A New Era of Ultra-Luxury Living Is Taking Shape

There were no recorded sales in the $10M+ segment during the first half of 2025 or the same period in 2024. However, this does not reflect inactivity. The landscape is shifting, with a new generation of ultra-luxury developments poised to reset expectations at the top of the market. Projects like the St. Regis Residences and Mandarin Oriental are redefining what qualifies as true luxury in Miami, combining architectural distinction, refined design, thoughtfully planned floor plates, and elevated services.

For sellers, this shift highlights the need to understand how your property compares within this evolving landscape. Many resale units fall short of emerging standards in design, brand prestige, or exclusivity. Legacy buildings may require significant updates or must offer truly unique attributes to remain competitive. Price alone is no longer enough. Presentation, positioning, and product quality are critical.

For buyers, the focus is increasingly on next-generation towers that are setting new benchmarks for luxury and long-term value. Today’s buyers are highly selective, globally attuned, and looking for residences that align with both lifestyle and investment potential. As the ultra-luxury segment evolves, timing and discernment will be key to securing the right opportunity.

In Summary: The Market Is Recalibrating, Not Retreating

The Brickell and Downtown condo market in 2025 is not in decline but in transition. Elevated inventory and a more selective buyer pool are challenging outdated pricing strategies, prompting sellers and developers to adjust. Still, demand remains steady, especially among end-users who value thoughtful design, quality construction, and long-term potential. Certain buildings are outperforming the broader market due to exceptional management, prime location, and architectural appeal. On the other hand, buildings with aging infrastructure, history of poor performance, or frequent assessments are seeing longer days on market, deeper discounts, and a rise in expired listings.

For sellers, success now depends on presentation, pricing, and product differentiation. Simply being “luxury” on paper is no longer enough. In today’s market, thoughtful updates, floor plan functionality, and a building’s track record matter more than ever.

For buyers, especially in the upper tiers, increased inventory presents new leverage. But well-positioned residences, those with enduring fundamentals and lifestyle appeal, remain competitive. The release of new luxury inventory, particularly from pre-construction towers priced over $3 million, is reshaping the landscape. These projects introduce compelling new options, but they also raise the bar for resale properties, contributing to higher inventory and slower absorption in some pockets.

Final Thoughts: What This Means for You

- Sellers should price thoughtfully, present their property with intention, and understand how it measures up against new development inventory.

- Buyers have more negotiating power, especially above $3 million, but well-priced, turnkey homes are still seeing strong demand.

- Market activity is shifting. Days on market have decreased in many segments, and pricing remains stable, even with elevated inventory levels.

- Top-tier buildings such as Four Seasons, Santa Maria, and Bristol Tower continue to lead due to strong management, design quality, and long-term value.

- Opportunities still exist for both buyers and sellers, but success in this environment depends on thoughtful strategy, timing, and product differentiation.

Let’s connect. Whether you’re considering a sale or exploring a purchase, we’re here to guide you through today’s market with clarity, strategy, and perspective as you navigate the market and make informed decisions.

Connect with the David Siddons Group

If you have questions about this Brickell Condo Market Report please contact the David Siddons Group at 305.508.0899 or schedule a call via the below app.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Close

Edit Search

Close

Share this property

Recomend this to a friend, just enter their email below.

Close

Your email was sent successfully

Close

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS