- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

11 Hard Truths About the 2025 Miami Luxury Real Estate Market (August 2025 Report).

11 Laser-focused truths about the 2025 Miami luxury real estate market and one Bonus point you won’t want to miss. So make sure to read to the end!

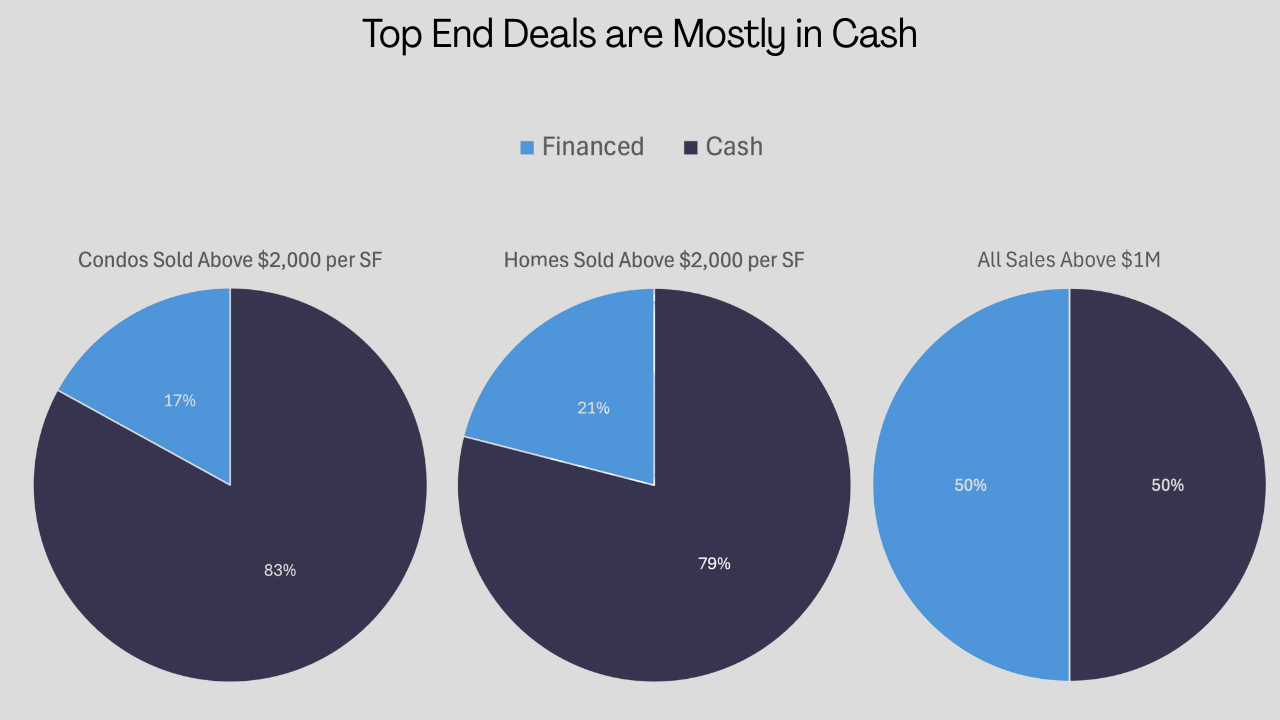

1. Cash is king at the top end for the top end.

Anything worth having is going to attract attention. There is no shortage of cash in our system, so if you want to be competitive you need to be offering cash or least a high level of certainty to a seller! Comment: If you’re shopping/selling above ~$2,000 per ft² or $10M+, expect cash on both sides.

Anything worth having attracts attention. At the $2,000/SF+level (condos and homes), only approx 17 to 22% of deals are financed, the rest present as cash. In practice, many UHNW buyers use portfolio/private lending (SBLOCs, relationship lines) behind the scenes: offers look cash to win, then get levered afterward. If rates drop soon, loan costs fall, volume lifts, and confidence returns, first in lower tiers and then pushing up, But remember the top end is less mortgage-dependent, so rate moves matter more for psychology/liquidity than eligibility. Bottom line: to compete, bring cash or deliver high-certainty terms.

Actions for Buyers: Bring proof of funds, have financing pre-approved as backup, and move fast with tight timelines to win.

Actions for Sellers: Prioritize cash offers over small price differences, and use quick-response deadlines when countering.

2. Luxury Resale Condos ($5M+) are a buyer’s market, especially in the Greater Downtown Area.

The oversupply of Miami luxury condos priced above $5M is giving buyers significant leverage. This dynamic is most pronounced in Greater Downtown, where the $5M+ condo segment is firmly buyer-skewed. Many of these residences are second or third residences, while most true investor product sits below $3M. Active listings are ~312; in the same period 179 expired vs. 141 closed, a clear sign of overpricing and subsequent price cuts. Resale condos are closing at roughly a 10% discount to original ask.

A wave of new, brand new condos product is being absorbed quickly, leaving the resale market at a clear disadvantage. New development is outcompeting resale on size and spec; think Perigon, The Shore Club, Mandarin Oriental, St. Regis—and in Coconut Grove we’re seeing about 3 new-development closings for every 1 resale. Older resale stock faces higher HOA/assessment drag and dated finishes, which slows absorption. Today’s buyers, from NY/CA/Boston/DC and Europe, are targeting larger, turnkey, primary-residence–grade units; the old ~1,000-sf investor model has largely fallen out of favor.

Key Stats:

- On average, resale condos are closing at about a 10% discount from their original asking prices.

- A telling sign of market imbalance: 179 listings expired compared to just 141 sales, meaning more properties came off the market unsold than were successfully closed.

Actions for Buyers: Press for credits (HOA, closing costs) and post-inspection repairs; target turnkey, prime-line stacks.

Actions for Sellers: Price to the last closed comp, not aspirational actives as your listing will just sit and expire.

3. Coconut Grove luxury condos are the relative “tightest” spot. Downtown condos are the very “loosest”.

Not all condo markets behave the same, and polarization is the word of the season. Some submarkets keeps outperforming on absorption. That said, performance is highly condo-specific. For example, buildings like Aston Martin have a high volume of listings competing in this segment, while in others, such as Park Grove, units continue to trade quickly. Learn more about the best vs the worst performing condos in Miami.

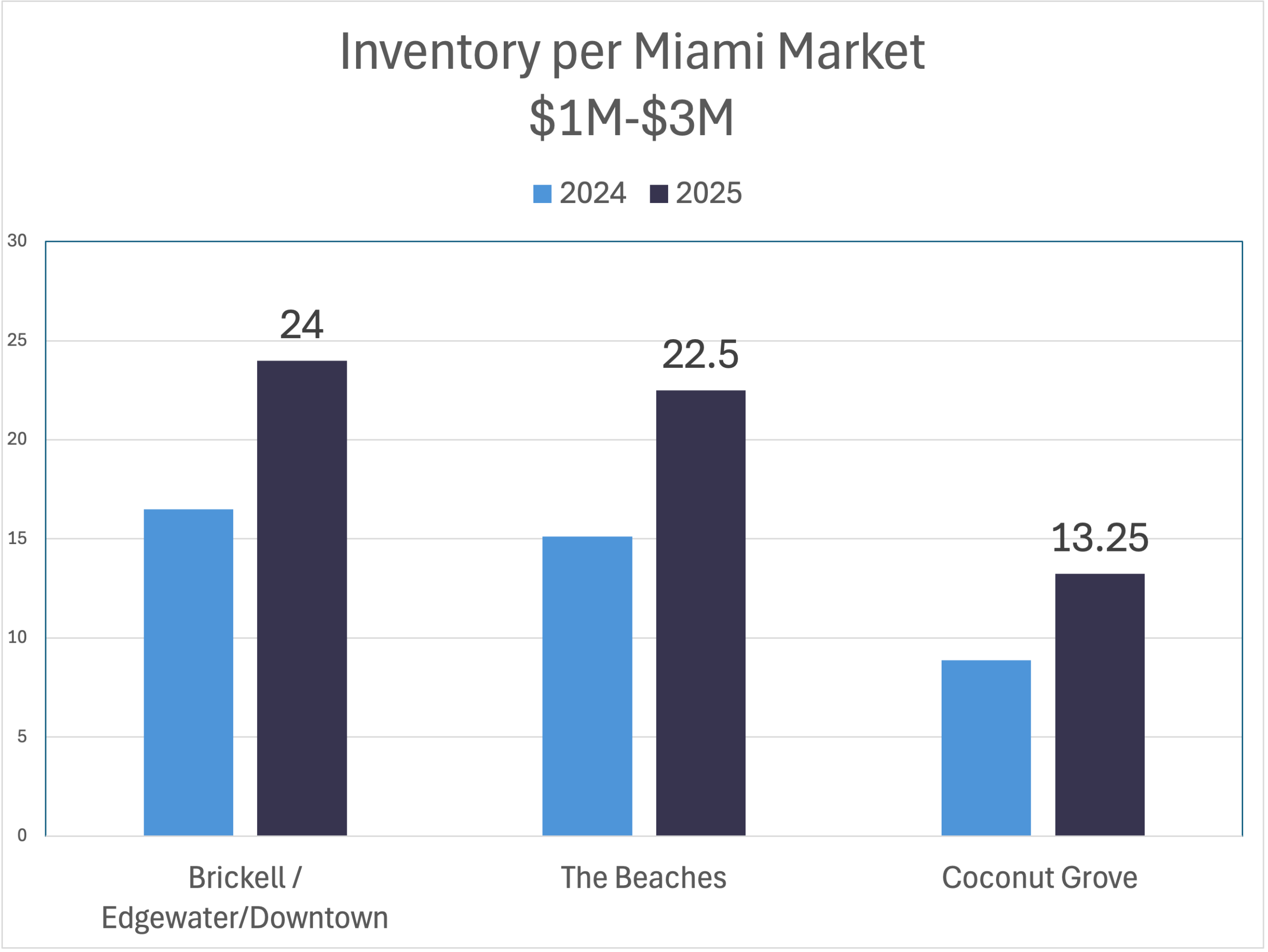

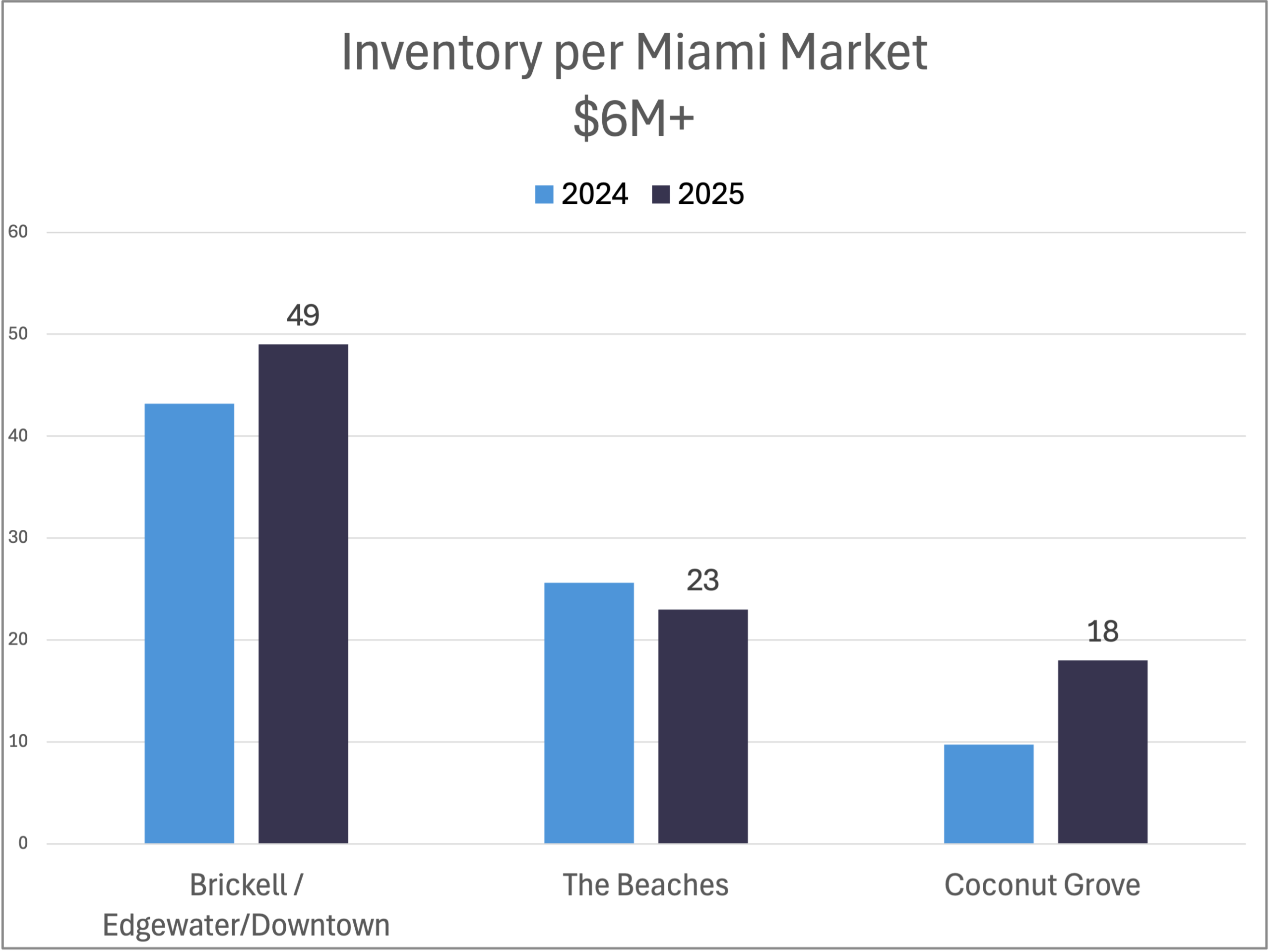

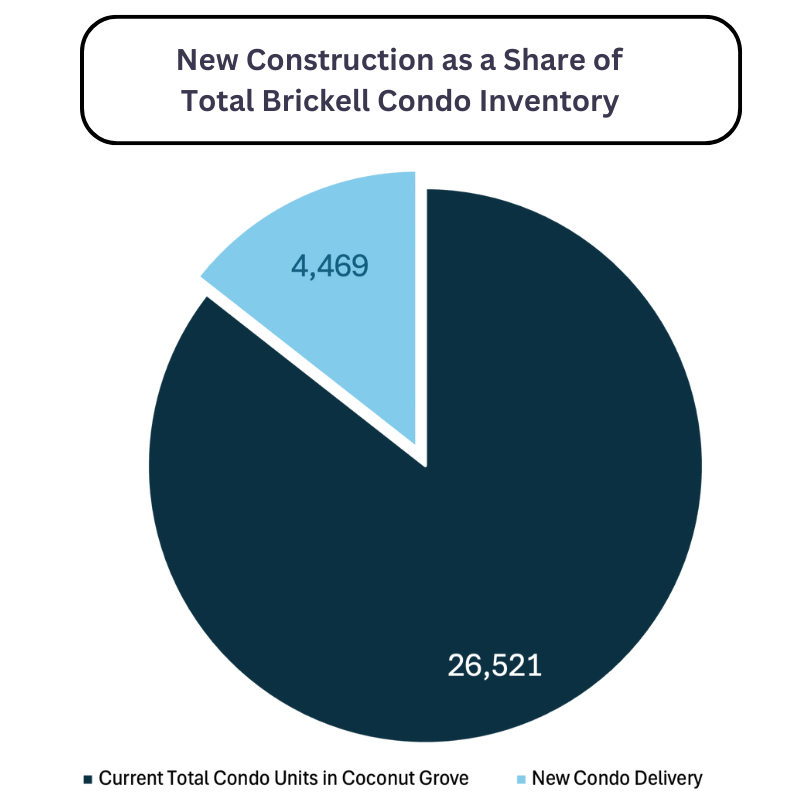

Key Stats: The Brickell & Downtown condo markets see a much higher inventory across all price ranges, while the Coconut Grove Condo Market performs the best.

Actions for Buyers: Move fast on A-grade buildings (low assessments, strong reserves).

Actions for Sellers: Highlight the property’s uniqueness by creating urgency. Use professional staging to maximize appeal and provide pre-inspection packets so buyers feel confident and can move quickly.

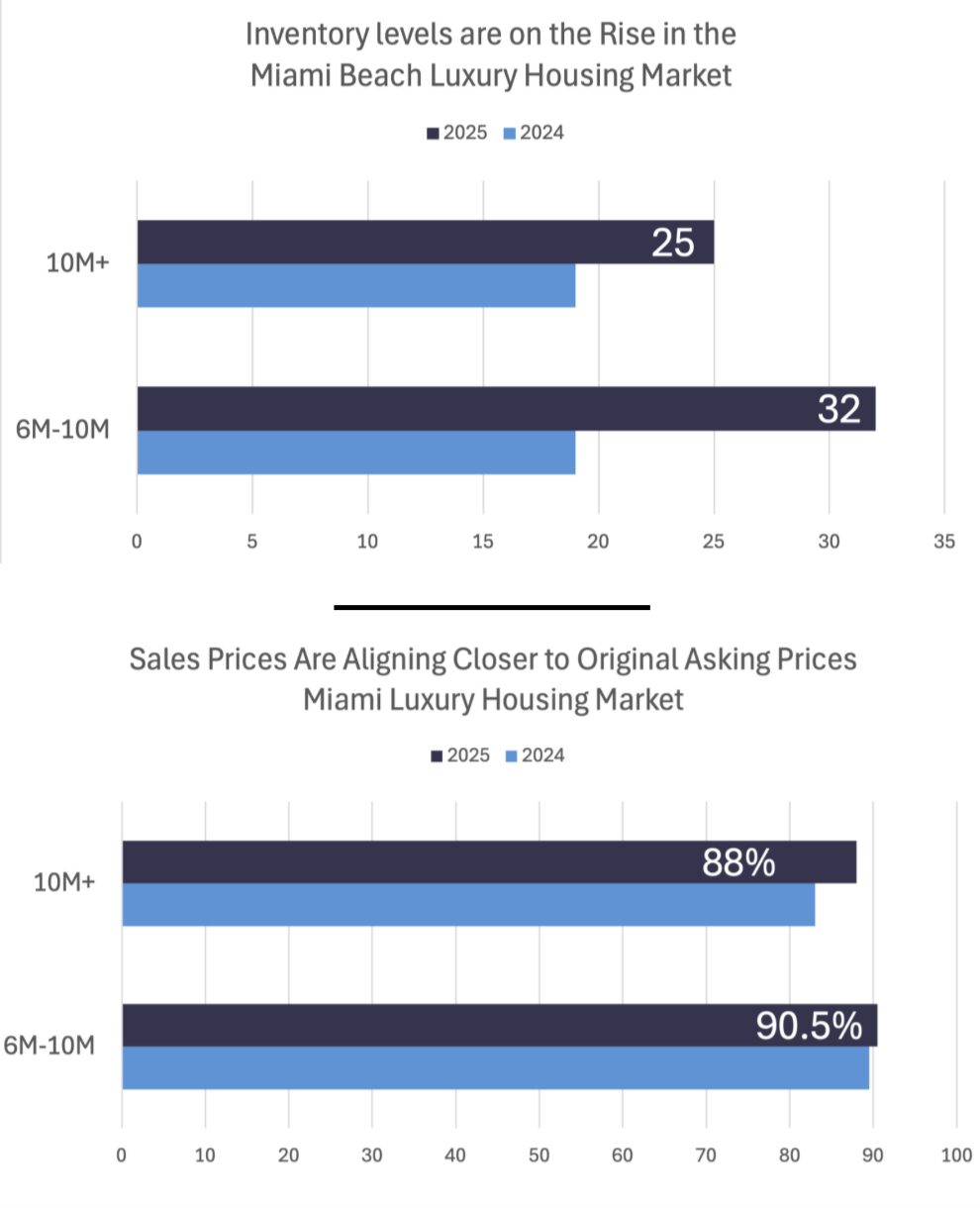

4. Miami Beach luxury single-family is softening | Opportunity window.

Miami Beach luxury single-family is softening—but that creates an opportunity window, especially in the $6M–$10M tier where inventory has jumped. Prices in this band are holding around $2,100/SF, while the $10M+ segment is actually up ~15% to roughly $3,250/SF. The ask-to-sale gap is narrowing: well-priced homes are getting absorbed quickly, and the very top end (waterfront on the Sunset and Venetian Islands) continues to print record sales closer to original ask. Unlike the condo market, we’re not seeing outsized discounts on A-plus Single-family homes; overpriced listings are the ones lingering as supply builds. If rates ease, expect confidence and volume to firm from the lower tiers upward.

Stats:

- In the $6M-$10M market the prices remained around $2,100 per SF , while in the $10M+ market prices are up by 15% now averaging $3,250 per SF.

- The Gap Between Asking and Selling Prices is Narrowing.

- Inventory however is growing.

Actions for Buyers: Work the 30–60 day Days on Market cohort for price cuts; structure appraisal-gap language only if pricing is truly sharp.

Actions for Sellers: Price surgically and refresh listings at day 30 with new media. Be aware that a drop of interest rates is going to bring about more buyers which could firm up negotiations and add strength to the market.

5. The influx of new developments boosts choice for buyers but heightens pressure on resellers.

On the condo side of the urban core, expect more luxury inventory, particularly in Brickell, where roughly 26,500 existing units are set to grow by about 4,500 more (~17%). By contrast, Coconut Grove’s pipeline is smaller in absolute terms but still a ~33% lift over the next 3–4 years, while Miami Beach adds only about ~5%. This new wave brings never-before-seen specs to Downtown and Brickell, which boosts buyer choice but raises pressure on resales—and creates room for concessions. Be mindful of brand arbitrage: headline branding isn’t always equal to intrinsic value line-by-line.

Stat: Brickell has approx. 26,500 existing condo units with approx.4,500 more coming (+~17%).The Grove will see a 33% increase in total inventory while on the Beaches this is just 5%.

Actions for Buyers: Look at VIP or early phases of new developments, that’s often where you’ll get perks like closing-cost credits or free upgrade packages.

Actions For Sellers (Resales): Be aware that in many neighborhoods, 3 out of 4 buyers are choosing brand-new condos over resales. To compete, you need a smart pricing and incentive strategy that pre-empts what the new developments are offering.

If you want to dive deeper into the new construction market, check out my piece on “The $1M Condo Mistakes” or watch any of our 55 independent new condo reviews.

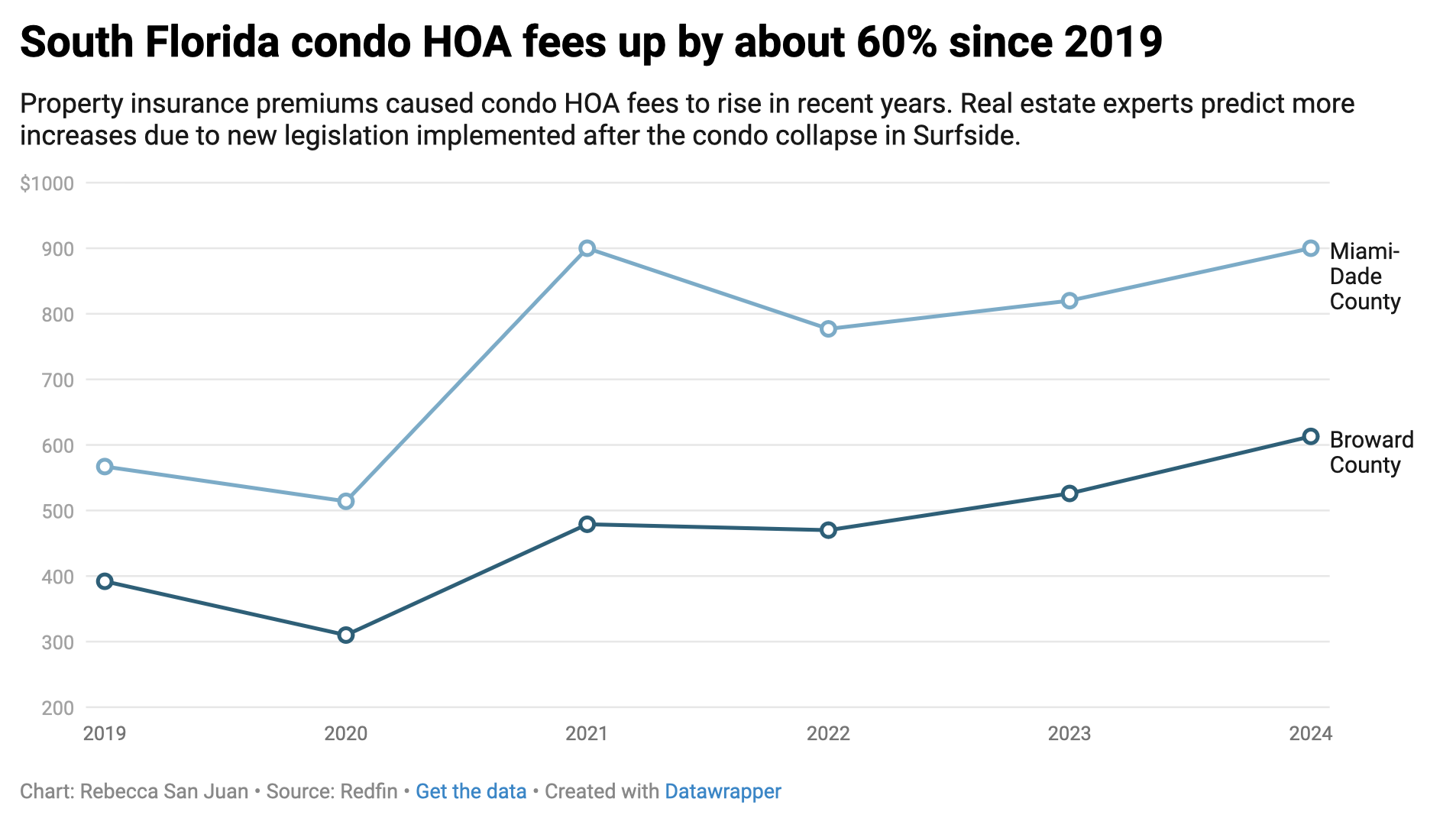

6. Costs Are Rising Across the Board, but Older Condos Struggle Most.

For older Miami condos, the strain is even greater. After the Surfside tragedy, Florida laws now require structural inspections and fully funded reserves once a building passes 30 years. That change alone has driven HOA fees sharply higher. Many of these buildings also need major repairs, roofing, waterproofing, structural work, that come with massive special assessments, sometimes exceeding $100,000 per unit. Decades of underfunded reserves have only made the problem worse, forcing today’s owners to absorb the full cost and pushing monthly fees to new highs.

Stat: Median HOA fees rose from approximately $567/month in 2019 to $900/month in 2024, an increase of approx. 59%/60%. More than 1,400 Florida condos are now on Fannie Mae’s “unavailable” list, making financing harder.

Actions for Buyers: Prioritizing post-2010 buildings or older condos that have already completed major structural and reserve requirements, and they expect full documentation (budgets, reserve studies, milestone reports). Luxury warning: All true luxury condos now carry HOA fees of $2+ per square foot. If someone quotes you less, it’s likely unrealistic.

Actions for Sellers: Gain an edge by disclosing these details upfront and offering assessment credits to attract a wider pool of buyers.

7. Time to contract is stretching, use it to your advantage.

Negotiations are taking longer, and patience is proving valuable. Time-to-contract is stretching across price tiers as inventory and optionality rise, buyers tour, circle back, and often choose the “do nothing” option unless the asset is truly exceptional (think point-lot in a gated island). Expect this to flip when rates ease: urgency returns and days on market compress, as we’ve seen in every prior cycle.

Stat: As of August 2025, Miami-Dade condos are taking around 100 days to sell with a 10% discount.

Actions For Buyers: Structure offers with smart expiration dates and keep an eye on listings that have been sitting 45–60 days, these often become more negotiable.

Actions For Sellers: Get ahead of the process by preparing lien searches, estoppels, and insurance quotes early. This upfront work can help cut down the timeline once a buyer is at the table.

8 Delistings are high — the real market is also off-market!

In the luxury market, many sellers prefer to take their property off the market rather than reduce the price. At the ultra-luxury level ($10M–$50M+), a meaningful share of the real market lives off-MLS. Owners of singular assets often prefer discretion; top agents quietly match these homes to a handful of vetted buyers, and if the property is truly exceptional, it will clear without broad exposure. At the same time, public listing counts are high and a large fraction expire—classic symptoms of aspirational pricing tied to one headline sale. Wealthy sellers can wait, but the market still enforces neighborhood ceilings: if a buyer can step up to the “next rung” (e.g., Pinecrest → Coral Gables, Miami Beach → Venetian Islands) at a similar price, they will. Real sellers either price to proof, or challenge the market modestly with evidence; otherwise the listing ages out (on- or off-market).

Stat: Around the same % of properties that sell will end up expiring, although in the $10M+ range more properties expire than sell and in the market below $3M more sells than expires.

- $1M-$3M | 1,834 Listings | 800 Sales | 695 Expires.

- $3M-$6M | 484 Listings | 192 Sales | 198 Expires.

- $6M-$10M | 177 Listings | 70 Sales | 69 Expires.

- 10M+ | 135 Listings |43 Sales | 66 Expires.

Action for Sellers: Tap into private channels: target expired or withdrawn listings, monitor upcoming terminations, and use buyer letters to approach key buildings directly. Ask me about our off-market inventory, we have a wide selection available.

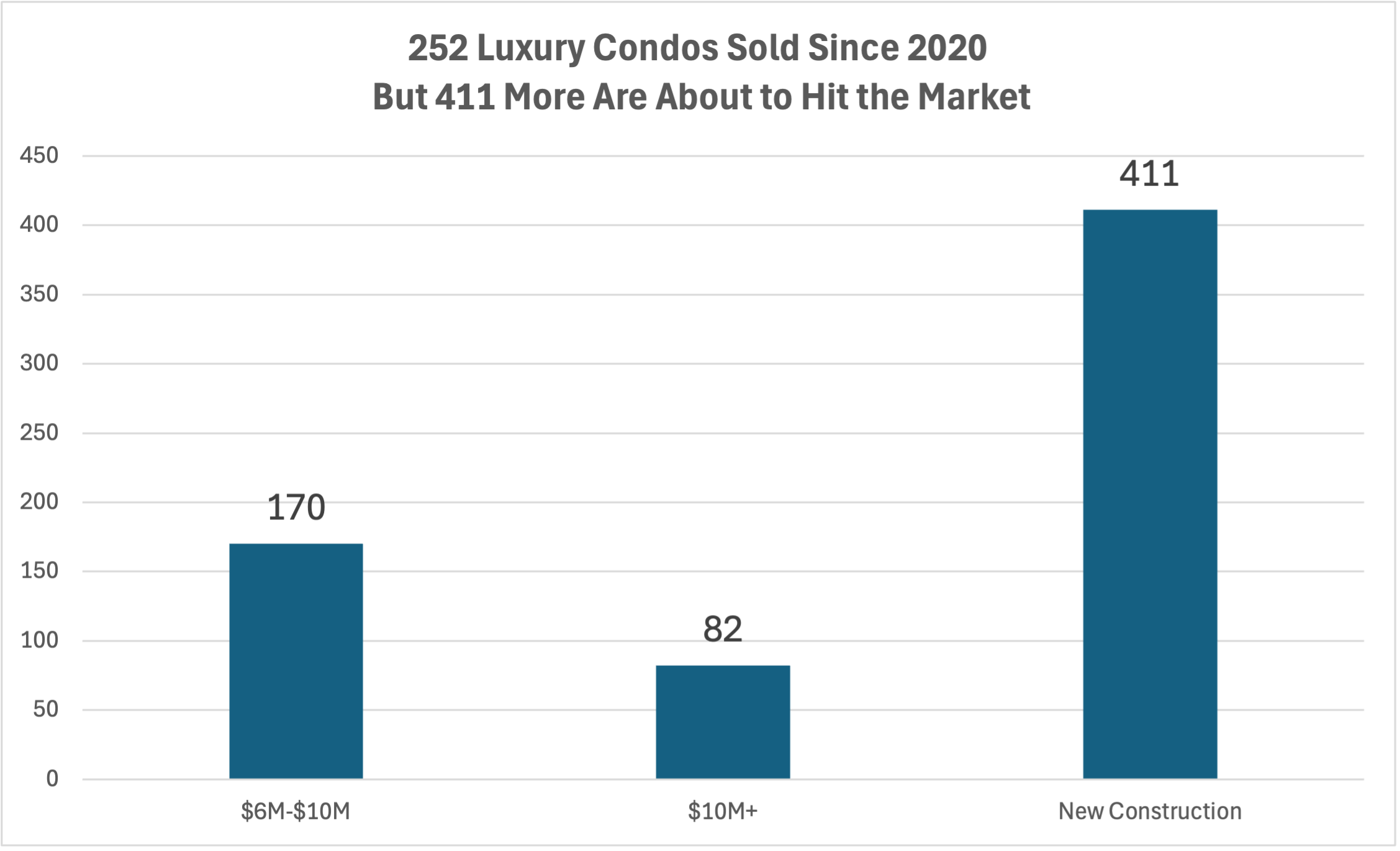

9.Segment Divide on the Beach: $6–$10M Condos Struggle.

$6M–$10M is experiencing stalled momentum. The condo market is in price discovery: sellers are granting deeper discounts and listings are sitting longer, yet months of inventory is trending down because motivated, realistically priced units still move.. This creates a polarized market where well-priced or high-quality condos (often new-build) sell, while overpriced older stock lingers. Remember, Miami is a mosaic of micro-markets: Coconut Grove condos remain strong, Sunny Isles faces more headwinds, and Beach Single family homes are softer than trophy pockets, so don’t lump neighborhoods together when reading the tape.

Stat:

- Days on market went up from 150 to 195 days, discounts from original listing prices went fro 9% to 11.5%. Inventory was down from 27 to 24, but do not forget that lots of inventory is hidden in the pre-construction market.

- Since 2020, 252 condo units have sold in the $6M+ range. In addition to today’s resale inventory, there are still 411 units in this price bracket being offered in the new development pipeline.

Actions for Buyers: Target well-located but dated condos or homes in this price range, they often trade at a discount and can be transformed with a full renovation.

Actions for Sellers: Consider investing in upgrades before hitting the market (kitchens, baths, lighting, smart tech) or price strategically below renovated comps.

For deeper insights, see our Mid-Year Beach Report.

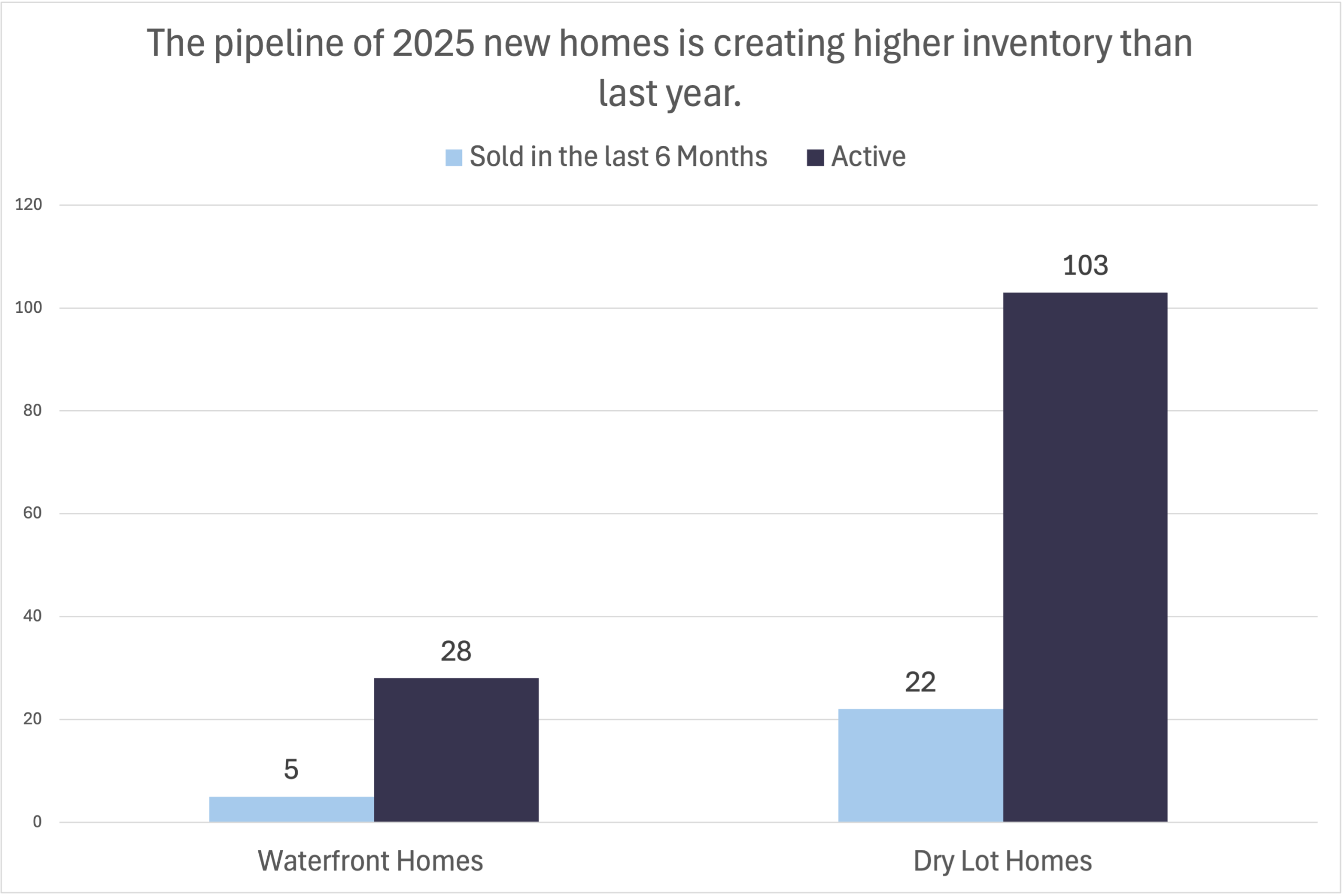

10. Overpriced New Builds are Failing to Sell.

New builds are moving slower than last year, with many overpriced listings expiring in the past six months. Values have softened and the share of unsold brand-new homes has grown; in some submarkets, as many as ~45% of new homes aren’t selling. A big reason is the spec vs. custom gap: inbound NY/LA buyers often find many specs expensive but underbuilt, while true custom product (exceptional lots, rare finishes) still commands premiums, think $5,000+/SF on standout sales. Too many specs skip the last 10% (landscaping, blackout treatments, millwork/paneling, advanced systems), so they’re not truly turnkey. Meanwhile, record prints keep appearing on the very best lots, which encourages some builders to hold out for top dollar even as the broader tape cools.

To compete, pricing must align with proof. Even on our record sales in Coconut Grove, Coral Gables, and Pinecrest, we brought $/SF to market to get them done—then the quality and lot did the rest. Bottom line: don’t buy it because it’s new; buy it because it’s better. For a deeper look at build quality and what “turnkey” really means at the top end, see our conversation with Dany Sebaaly on new construction.

• Stat: Miami’s luxury new homes are showing a median of about $1,120 per square foot this year, up slightly from $1,100 last year, but that number alone doesn’t capture the full picture. Overall luxury inventory is hovering around 18 months, while new construction is showing around 30 months of inventory. In top neighborhoods like Coconut Grove, Coral Gables, and Miami Beach, dry-lot new homes typically trade between $1,300 and $1,500 per square foot, while exceptional large-lot properties can reach $1,800 to $2,000. Prime waterfront new construction commands far higher prices, ranging from $3,000 to $5,000 per square foot, with the record this year hitting an extraordinary $5,300 per square foot.

Action for Buyers: Don’t be afraid to negotiate on new construction in certain markets. Builders are often tougher negotiators than individual sellers, they’re business-minded, unemotional about the deal, and usually have the experience and patience to wait for their price. Unlike an end-user who just wants to move on, a builder can sit tight until the right buyer comes along. My rule: if you can’t comp it, don’t buy it, unless the property is truly exceptional and cannot be replicated. Many builders still push for top dollar, yet cut corners on essentials like blinds, blackout shades, automation systems, or landscaping, features you’d often get in a top resale home. Too often, they assume the “new” label carries more value than it really should. (Also see my blog on 11 Lessons for Builders.)

11 Miami is currently holding TWO records for ‘most expensive neighborhoods’ in America.

With Fisher Island posted as most expensive zip code in US according to the ‘Robb report’ andGables Estates topping Beverley Hills as America’s priciest single-family neighborhood according to world red eye, business insider and several other sources.

Why this matters: Even though parts of the market softened in 2025 (more inventory, more over-ambitious asks), Miami’s ultra-prime enclaves prove demand is structural, anchored by tax advantages, global wealth migration, security, schools, and true waterfront scarcity. High-ticket sales here aren’t one-off anomalies; entire neighborhoods are resetting national benchmarks. Any corrections of slowness in our market is in smaller pockets and slower sales are a result of specific product that is not ‘hitting the mark’ for varied reasons mainly to do with pricing or finish.

Concrete moves you can make right now: Pick your lane and act decisively.

For Sellers in Top Enclaves (Gables Estates, Fisher Island, Indian Creek, prime Sunny Isles lines):

Price your property within 3–5% of the most recent, verified record sale for a truly comparable home or line (measured by $/SF, water or lot orientation, and exact line positioning). Then, highlight the difference between your asking price and that record with a simple one-page proof — include deed links, photos, and line maps. If showings stall by Day 21, follow through on a pre-planned price adjustment to protect momentum and avoid piling up days on market.

Buyer targeting these enclaves: Come fully prepared with underwritten financing and proof of funds, and lock in third-party timelines in advance. Prioritize quality factors — view corridors, dockage, lot size, and line position — over trying to time the market, because in these ultra-prime pockets, scarcity matters more than seasonality.

If you want to live in either of these two spots you better bring your check book and know that you are not the only one that sees the neighborhood as the best place to be! Also consider the close neighborhood alternatives which carry much of the similar characteristics: Indian Creek Islands or Sunset ‘Islands as an alternative to Fisher Island and Old Cutler Bay and Journeys End as the alternative to Gables Estates. What can we say about these two areas: One thing is for sure. Privacy never goes out of fashion and exclusivity is always synonymous with ultra Luxury!

Miami isn’t just competing with legacy markets, it’s increasingly the yardstick.

Connect with the David Siddons Group

Do you want to know more about the 2025 Miami Luxury Real Estate Market? Connect with me by calling 305.508.0899 or schedule a meeting via the link below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS