- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Miami Neighborhood Economic Health Meter | An Exclusive New Tool to Measure Your Area’s Economic Health

What is the Neighborhood Economic Health Meter?

The David Siddons Group developed this tool as an index to measure a neighborhood’s economic health. Using the human body as the perfect metaphor, you can measure a person’s health, but you cannot guarantee someone will always stay healthy. This neighborhood health score indicates the current economic health of an area and its likelihood to fall ill or to be susceptible to illnesses. So this score does not predict the future, it merely provides the current status of a market and provides you with an indication of the market’s defense mechanism aka: its strength to process future hits. It is not about bear or bull markets. It’s about the market’s elasticity; about robustness and resilience of the market against economic change. A low score can present a world of opportunities at the right offer.

We used the below real estate indicators to measure the Neighborhood’s Economic Health Score:

Real Estate Indicators Explained

Below we explain for each indicator why that indicator /category is important for the health score and how me measure the category

Months of Inventory

The months of inventory is a very important indicator in real estate. It shows the relationship between supply and demand and therewith it indicates how fast a market can digest or absorb product. This is basically the market’s metabolism. If a market cannot absorb new listings for sale, this would be equal to a slow metabolism in the human body. The more bloated we get, the less we can burn, which adds to one’s decreasing metabolism.

Months of Inventory are calculated by dividing the current amount of listings by the average amount of sales per month (Based on the last 12 months). The final amount of months of inventory was then given a score on a metric scale between 0 and 100

Changes in Sales Prices per SF

Prices can go up and down, just like your hear beat. Small price changes, just like changes in your heart rate, will not impact a market. If other market conditions are optimal, these changes will correct itself. If the rest of the market is not in equilibrium, the prices are less likely to correct themselves easily. An increased heart beat can be handled easily by your body, but if your heartbeat goes up a lot and you are obese (High inventory levels in a market), then this might lead you to collapse or get a heart attack. There is a optimum range for everything and extreme high or low price levels, supported by other healthy variables, will be able to correct themselves. Miami is known for its dynamic cycles, with booms and bursts. Some markets go hard, reach the top and they explode.

Moral of this story: It is ok to have an extreme high heart rate or price increases as long as you have a fast metabolism (low inventory levels). Increasing prices and no demand or high supply are a deadly combination.

This category is measured by looking at the price changes between 2018 and 2017. The percentage of change is then given a score to be included to the health score

On another note: Exploding markets also provide us with the opportunity to step in low!

Ratio of Owners to Renters

The ratio of owners to renters is important as this is like your body’s immune system. Neighborhoods occupied mostly by home owners (primary markets) tend to be healthier than markets occupied by renters. Imagine an economic crisis, would you sell your primary property, where you live with your family? Or would you first sell your investment property? Investment-based markets tend to suffer most from economic turmoil and therefore it is important to know the owner to renter ratio in order to establish a health score. Primary markets have a better immune system than investors-based markets.

This number is calculated by dividing the amount of active sales by the amount of active rentals.

Months of Inventory for Rentals

The months of inventory is a very important indicator in real estate. It shows the relationship between supply and demand and therewith it indicates how fast a market can digest or absorb product. It is important for the sales market but also for the rental market. This is basically the market’s metabolism. If a market cannot absorb new listings for rent, this would be equal to a slow metabolism in the human body. The more bloated we get, the less we can burn, which adds to one’s decreasing metabolism.

Months of Inventory are calculated by dividing the current amount of listings by the average amount of rentals per month (Based on the last 12 months). The final amount of months of inventory was then given a score on a metric scale between 0 and 100

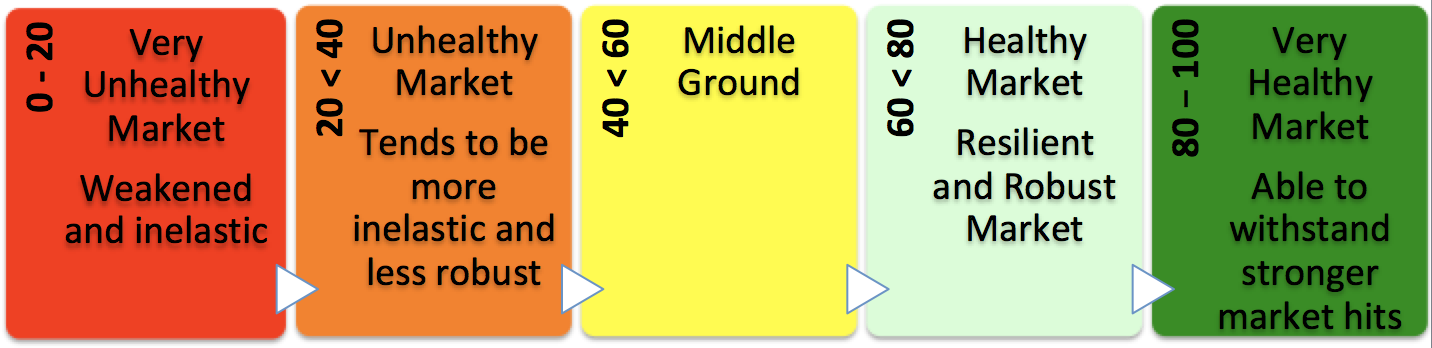

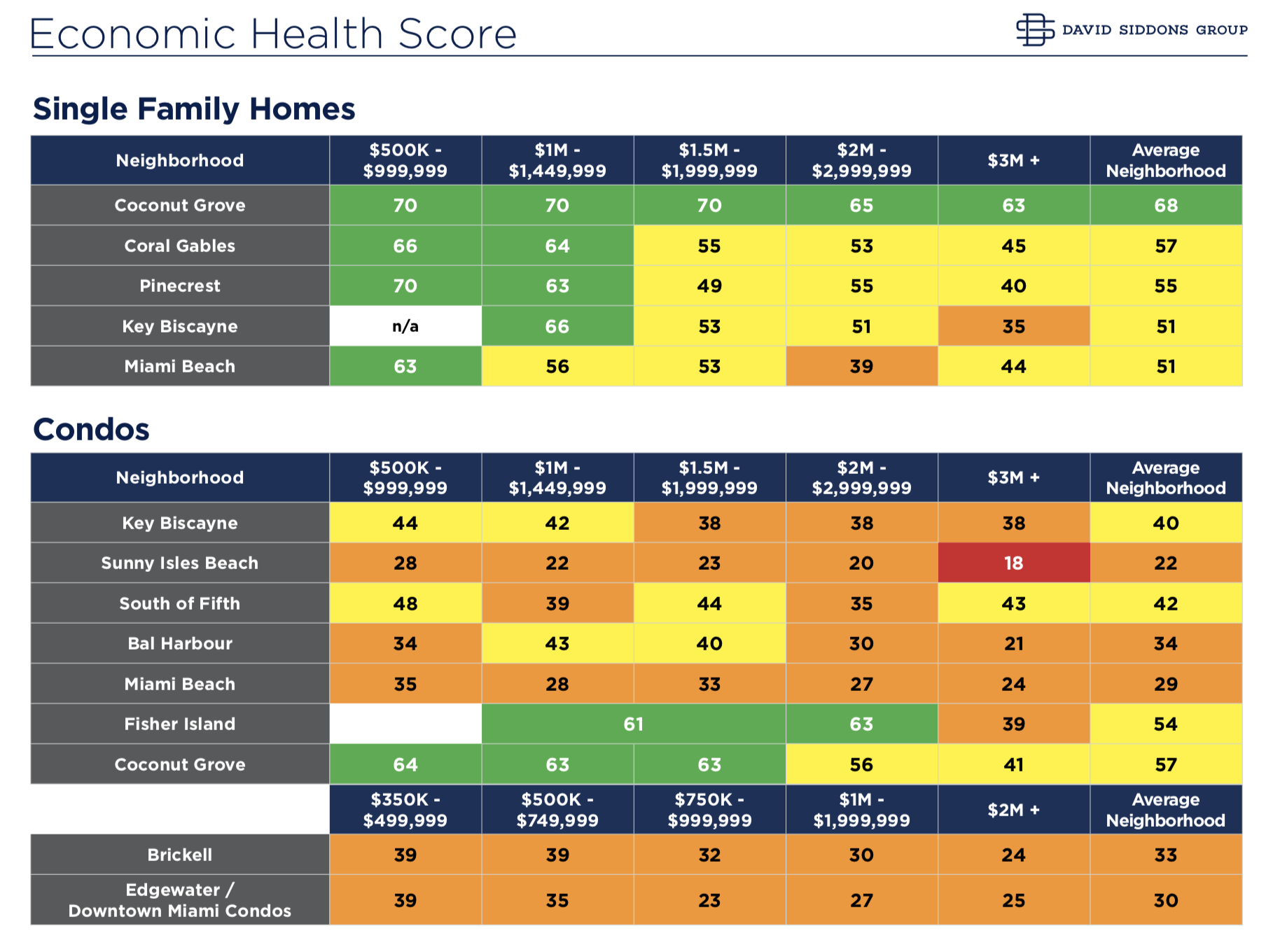

The Final Score; The Neighborhood’s Economic Health

The score card goes from 1 till 100. 100 Will be an impossible number, this will never happen and the market is too good. A market with score 75 is a really good market worth buying into. In less healthy markets we still have healthy product and it all depends on the price. For many investors, these markets offer excellent opportunities to get top product for a discounted price.

The score provided here is an average of all the different scores within a neighborhood. We gave each of the 5 price ranges per neighborhood a score and took the average from these 5 scores. The different price ranges might vary significantly in score. Furthermore, each score comes with an explanation to put things into perspective. Please sign up for our 2019 Miami Real Estate Forecast to receive all the details on these different health scores.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS