- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Confidence Crisis: How Economic Uncertainty Is Quietly Reshaping Coral Gables Real Estate

The Impact of Tariffs and Economic Uncertainty on the Miami Real Estate

There hasn’t been much discussion about how broader economic uncertainty is affecting Miami real estate — but we’re seeing it play out in real time. Since early February, when new tariff actions were announced, the Coral Gables single-family home market has shown signs of shifting: more price reductions, longer deal timelines, and greater hesitancy from both buyers and sellers. But let’s be clear — it’s not just the tariffs. What we’re witnessing is a systematic decline in buyer confidence, driven by multiple indirect forces: concern over tariffs, a volatile stock market, and tightening liquidity. These factors may not impact real estate directly, but together, they’re reshaping market psychology — and that’s where the real story lies. This is one of the key dynamics we’ll explore in our upcoming Half-Year Market Report, where we break down what’s really happening beneath the surface — and what it means for your next real estate move.

Emerging Trends in Coral Gables: Price Adjustments and Listing Timelines

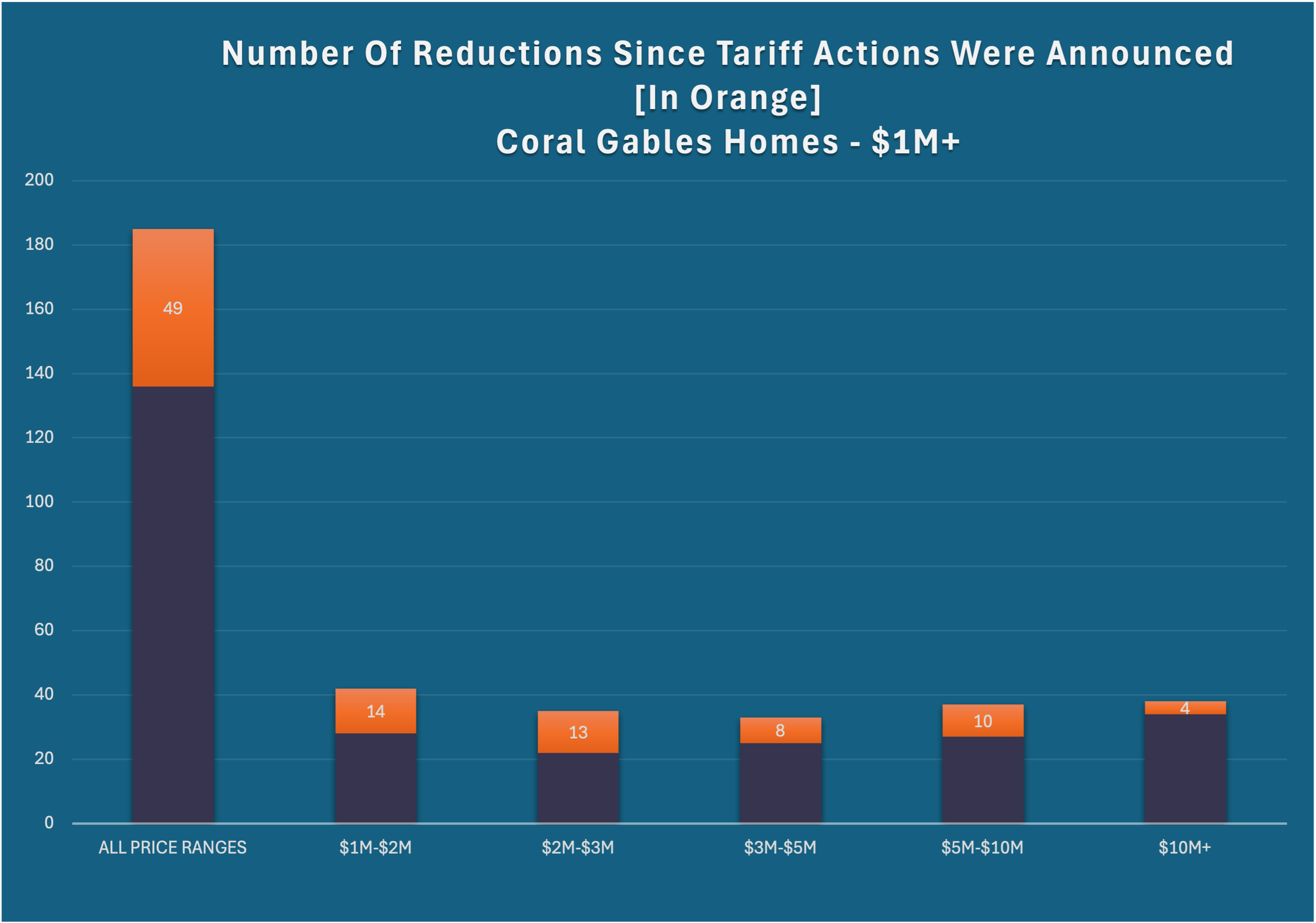

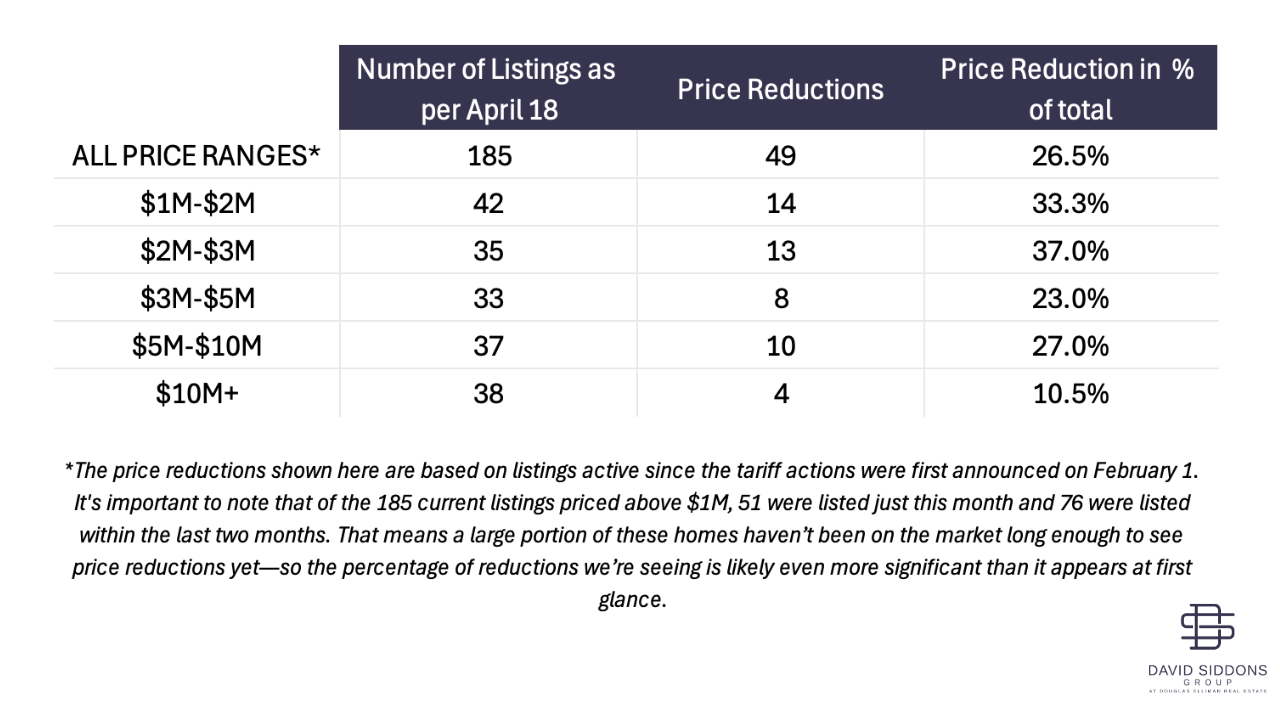

The two slides below reflect data from recent months. We used February 1, 2025 as our key reference point—the day when Trump signed an executive order to impose tariffs on imports from Mexico, Canada and China. We focused on all current Coral Gables Single-family listings over $1M and looked at which of these were reduced in price since February. Of the 185 listings currently on the market, 49 have been reduced—about one-quarter.

But here’s an important detail: 51 of those 185 listings were just added in April, meaning they likely haven’t been on the market long enough to reduce price. So if we focus only on the 134 listings that were active before April, that brings the reduction rate to about 36%.

What types of homes are seeing price cuts?

Analyzing these reduced listings revealed some strong trends.

- Most price reductions occurred in homes priced at $3M and under—about 35% of those listings were reduced.

- In contrast, the $10M+ ultra-luxury segment saw very few reductions—just 10%.

- 80% of the homes that were reduced were built 25 years ago or more, showing that newer homes are holding value better so far.

- 40 of the 49 reductions happened in March or April, with only a handful (9) in February—so the effects are still unfolding.

- Geographically, most reductions happened west of US-1, especially near golf course neighborhoods. In contrast, gated communities east of US-1, and neighborhoods like the French Village and Riviera, saw fewer reductions.

Finally, there’s the issue of market momentum:

- The median days on market for active listings is currently 84 days—and these homes still haven’t sold.

- Meanwhile, homes that successfully closed in the past four months had a median time on market of 85 days.

That tells us: unless all those active listings go under contract immediately, they’re trending slower than the recent solds.

Cautious Buyers and Construction Costs: The New Realities Sellers Face

1. More Cautious Buyers

Higher construction and goods costs can fuel inflation, which may prompt the Fed to raise interest rates. For buyers, that means higher mortgage payments—and for sellers, fewer qualified buyers. In some price points, especially mid to high-end, you might start to see longer days on market and more price sensitivity.

Over the past few months, we’ve listed well-finished properties go under contract at or near asking price—often within a week. These quick trades show that serious buyers are still out there and ready to move. At the same time, we’ve also listed homes that generated strong interest and praise from buyer but haven’t yet received offers. Oftentimes, buyers are clearly more cautious—hesitating due to uncertainty around the economy, the broader market, or even just the perception that something could shift. In fact, it’s often not the actual market change that slows buyer behavior, but the anticipation or fear of change. That alone can cause hesitation.

Despite concerns around the ompact of Tariffs on the Miami Real Estate Market, we’ve continued to see motivated buyers stepping up when the property and price align. Our listing on 907 Jeronimo Dr went under contract just one week after hitting the market, with a strong backup offer in place and a final price close to asking.

2. Pricing Pressure from New Construction

You may not feel the effects just yet — for now, it’s mainly a question of buyer confidence. But when it comes to homes, the impact of rising costs will become noticeable sooner. Developers will be holding back on discounts or pricing in higher construction expenses, which will ultimately push home prices upward. As construction costs rise, developers may increasingly focus on the luxury market, where higher profit margins can better absorb those added expenses. However, projects already underway may not have fully accounted for these cost increases, making them more expensive to complete. This could lead to either upward price adjustments or cost-cutting through value engineering—where the originally planned quality and finishes are downgraded to preserve margins.

On the other hand, sellers of resale or entry-level homes may find themselves in a stronger position. As rising costs make it harder for developers to profitably deliver new inventory in lower price segments, supply in that category could tighten—potentially boosting demand for existing homes.

Have Questions? Connect with Us!

If you’re thinking about selling and need insights tailored to today’s market, let’s connect. Understanding these trends could be the key to selling quickly and for top dollar. And if you’re looking for detailed information on a specific area, feel free to reach out.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS