- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The Quarterly Downtown Miami Condo Market Update

The 90-day Downtown Miami Condo Market Update

Downtown Miami Condo Market Update for September 2022. Welcome to our 90-Day Downtown Condo Market Update. We will update this information every quarter so you can follow the market and discover trends.

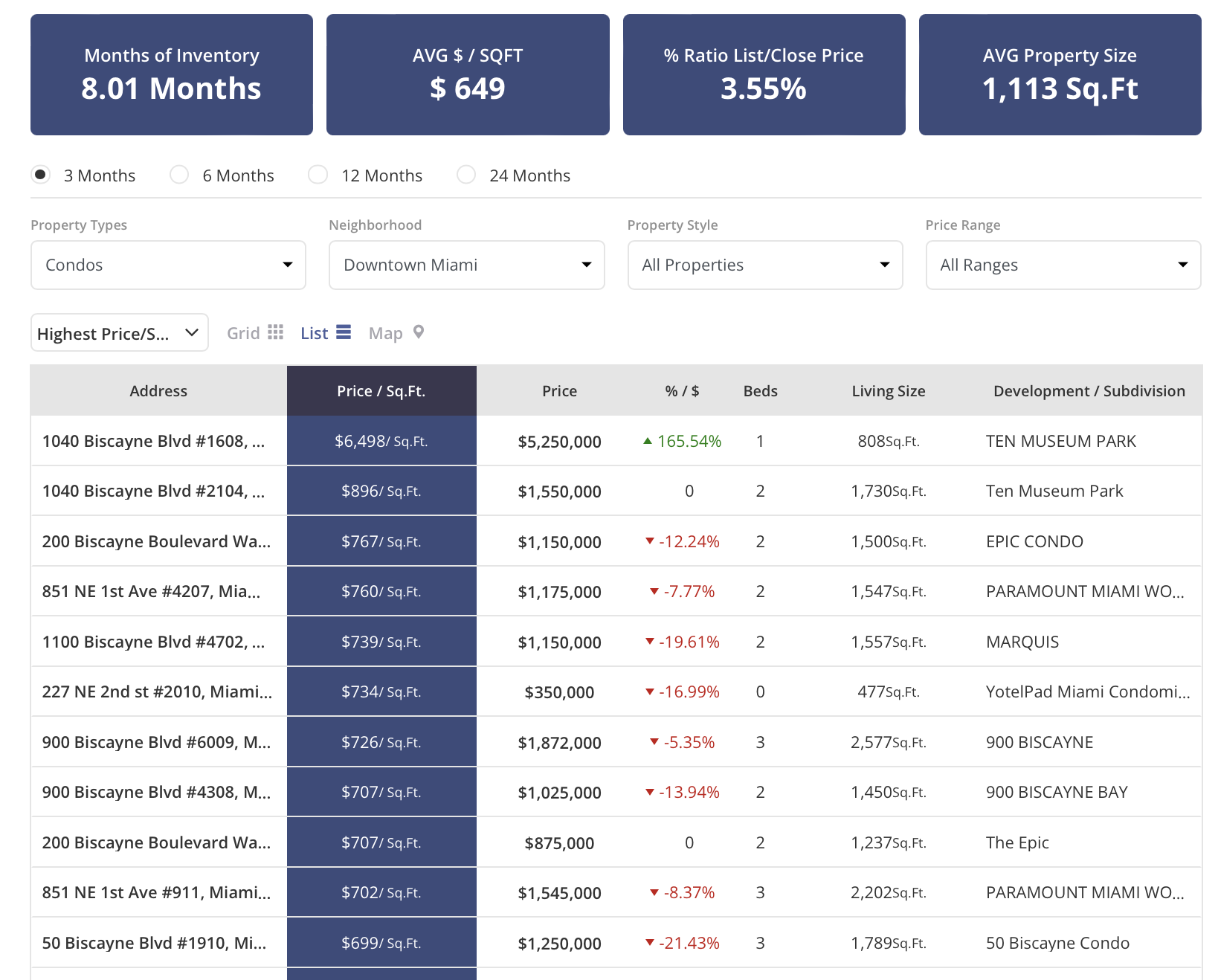

Miami Downtown Statistics and Specific Sales

Looking at the statistics page for Downtown Miami will reveal the specific sales from the last 90 days. As a registered user on the site, you can go back further than 90 days. Browse the specific sales and observe what is transacting at the highest price per sqft and why. For a granular analysis of a property you are interested in selling (or buying), please call me and we can plug your subject property into the stack to see how it compares. This is an advanced one step further feature, that is not part of the website’s front-end capability, but a highly advantageous tool to assess real-time property values.

A Buyer’s Market

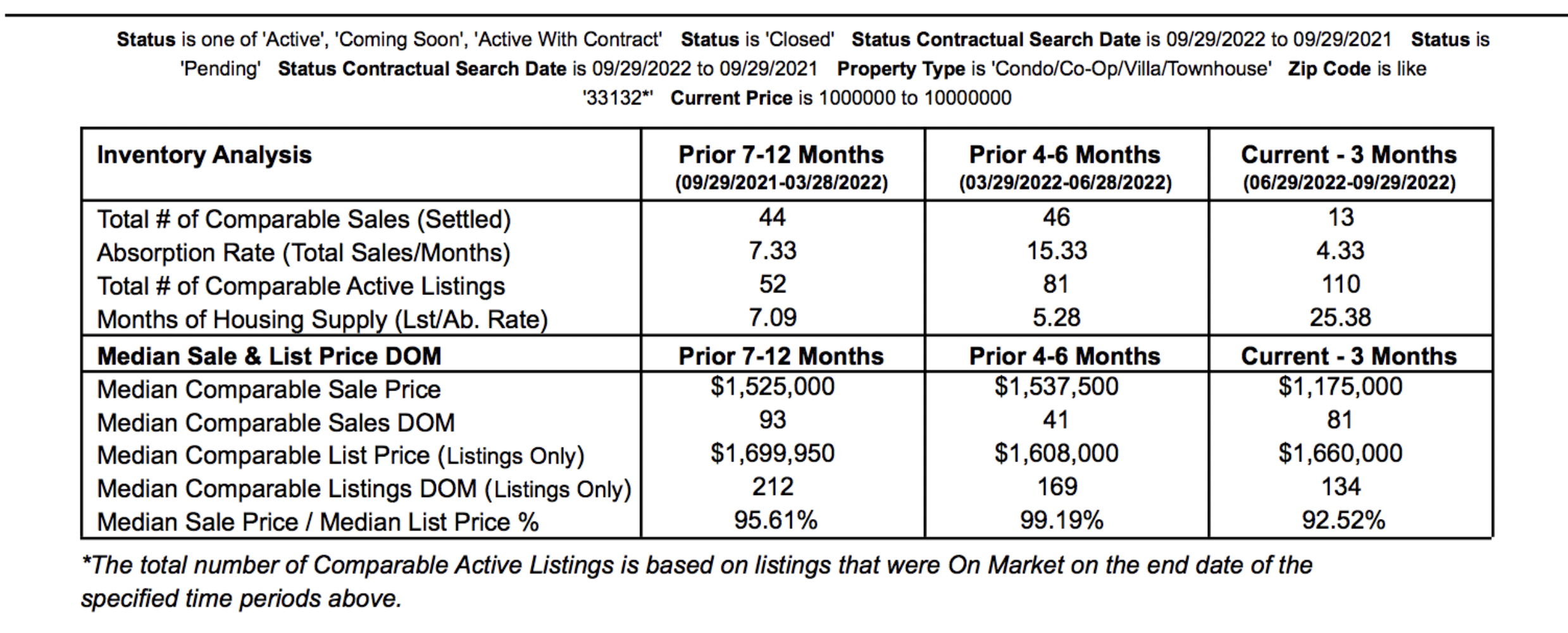

Throughout the entire Urban Core, Downtown Miami is the neighborhood that has the highest saturation of inventory. In the last three months, this sub-market stacked up over twenty-five months of inventory, which is a 258% increase compared to where the market was a year ago. Typically, we refer to this inventory level as a Buyer’s Market. Anything below six months is a Seller’s Market, and if it’s more than nine months, it is a Buyer’s Market.

The Different Price Brackets

Condos priced between $1M to $3M were most affected. This price bracket currently holds about twenty months of inventory, a 246% increase from where it was a year ago. The total sales fell by 66%, while the number of new listings has increased by 131% since last year. If the number of new listings continues to increase as the absorption rate decreases, this will saturate the market and diminish the leverage condo owners previously held.

Condos priced below $1M experienced a 174% increase in inventory levels yet had a healthy absorption rate. Downtown condos priced below 1M only have 6.3 months of supply. This example shows that if inventory increases and the absorption rate increases, we have a balanced market. A balanced market has six to nine months of supply.

What does this mean for Sellers?

Other neighborhoods in the Urban Core, such as Edgewater and Midtown, also had a healthy absorption rate for condos priced below $1M. This market trend means that if you have a condo valued below 1M, you can still price it relatively aggressively, as we experienced in previous months. If you have a condo valued around $1M to $3M, you will want to price accordingly and strategically so that it does not sit on the market.

Downtown has more than 7,000+ condo and apartment units in the new-construction pipeline. If the absorption rate does not keep up with the increase in supply, it will continue to saturate the market and affect prices.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS