- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The 2025 Midyear Miami Beach Real Estate Market Report | What’s Hot, What’s Not, and What to Watch

The Miami Beach luxury market is evolving — and fast. From entry-level luxury homes to record-shattering trophy properties, performance varies sharply by price point. Some segments are holding steady or even accelerating, while others are oversupplied and struggling to keep pace with shifting buyer expectations. In this report, we break down the key trends across four distinct price brackets — showing you where demand is heating up, where it’s cooling off, and what today’s buyers are truly looking for. Whether you’re thinking of buying, selling, or simply staying informed, this analysis will help you see the Miami Beach real estate market with clarity.

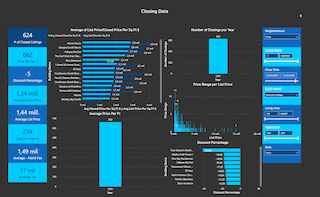

| $1M-$3M | Change | $3M-$6M | Change | $6M-$10M | Change | $10M+ | Change | |

| Sales Volumes | 24-> 21 | -12.5% | 17->18 | +5.9% | 13->9 | -31.3% | 17->20 | +20% |

| Price per SF | $1,039 -> $950 | -8.6% | $1,424-> $1,363 | -4.3% | $1,835->$1,553 | -15.35% | $3,169->$4,136 | +30.5% |

| Median Days on Market | 74->81 | +9.5% | 86->84 | –1.6% | 123->85 | –30.9% | 92->80 | –13.0% |

| Ratio Sales Price to Original List Price | 93.3%->89% | -3.9% | 94.3%->89.4% | -4.8% | 88.4%->91.6% | +3.2% | 86.3%->88% | +2% |

| Months of Inventory | 7.1 -> 9 | +25% | 8.5-> 10.3 | +20% | 15 -> 28 | +86% | 26 -> 15 | -42% |

$1M–$3M | Entry-Level Luxury

Status: Stable, but Sensitive to Product Quality. This segment remains the most accessible tier in the luxury market — and it continues to see activity, though with greater scrutiny from buyers.

- Sales Volume: Down 12.5% (24 → 21 sales)

- Price Trend: Down 8.6% ($1,039 → $950/SF)

- Inventory: 9 months — manageable, but slowly creeping up

- Buyer Behavior:

- Renovated, well-located homes sell steadily

- Outdated, poorly laid out, or over-ambitiously priced homes sit longer

- Expired Listings: A growing concern for underwhelming listings

Key Insight: The $1M–$3M segment remains active but increasingly price- and quality-sensitive. Sales volume is down slightly year-over-year (-9%), and prices are essentially flat, indicating that while demand persists, buyers are approaching with caution. Inventory is gradually rising, now at 9 months, signaling a market that is shifting toward balance but could tilt into oversupply if trends continue. Buyers in this tier are laser-focused on value: well-located, turnkey homes continue to sell, but anything outdated, oddly laid out, or priced too aggressively is likely to linger or expire. Presentation and move-in readiness are critical — modern finishes and smart layouts can make or break a sale. Sellers should be aware that even in what is still one of the more active segments, the margin for error is shrinking. A misstep in pricing or quality could result in months of sitting on the market, particularly as buyer expectations continue to rise.

$3M–$6M | Mid-Luxury Core

Status: Balanced but Losing Momentum. A pivotal tier that defines the core of Miami’s mid-luxury market. This segment still commands solid pricing — but only for properties that deliver on quality and design.

- Sales Volume: Up 5.9% (17 vs. 18 sales)

- Price Trend: Down 4.3% ($1,424 → $1,364/SF)

- Inventory: 10.3 months — slightly elevated

- Buyer Behavior:

- Demand remains strong for turnkey homes

- Homes over $1,500/SF: 7 in both 2024 and 2025 — stable high-end buyer pool

- Buyers negotiating harder and walking away from homes that feel overpriced or under-finished

Key Insight: The $3M–$6M mid-luxury tier is still the heart of the Miami Beach real estate market but momentum is shifting. Sales are up slightly year-over-year, pricing is down 4.3% and buyers are looking for value. The market rewards quality—especially homes with designer finishes, functional layouts and prime locations—but anything lacking polish or priced too high is meeting resistance. With inventory at 10.3 months this tier is slowing down. Sellers in this segment should know that while buyer interest is there, the bar is higher than ever. Presentation, condition and a strong pricing strategy are non-negotiable to attract serious offers and avoid extended time on market.

6M–$10M | Upper Mid-Luxury

Status: Oversupplied and Struggling. This tier is experiencing the sharpest disconnect between supply and demand. Despite overlapping with some of the most desirable neighborhoods, inventory growth far outpaces buyer appetite.

- Sales Volume: Down 31.3% (13 → 9 sales)

- Price Trend: Down 15.3% ($1,835 → $1,553/SF)

- Inventory: Surged to 28.2 months — highest of any tier

- High-end activity: Fewer homes broke the $2,000/SF threshold (down from 7 to 4 homes)

- Buyer Behavior:

- Only truly standout homes — architecturally distinct or newly built — are selling

- 35% of listings have sat for over 5 months

- Partial updates or generic finishes are a hard pass for today’s buyer

Key Insight:

The $6M–$10M segment is currently the weakest link in Miami’s luxury market, marked by a growing gap between what’s available and what buyers actually want. Sales volume plunged 31.3% (13 → 9 sales), while inventory surged 86%, pushing months of supply to 28.2 — the highest of any price tier, signaling a serious oversupply issue. Average price per square foot has slipped 2.1%, and fewer homes are breaking the $2,000/SF threshold, down from seven to just four. The core issue here isn’t just pricing — it’s a fundamental product-market mismatch. Buyers in this range are showing up for exceptional properties: newly built, architecturally distinctive, and perfectly located homes. But the bulk of the inventory is falling short, offering partial renovations, dated finishes, or uninspired design. As a result, 35% of listings have been sitting for over five months, and many are facing price reductions or going stale. Sellers in this tier must come to terms with today’s elevated buyer expectations: if the home doesn’t deliver that “wow” factor, it’s likely to be passed over. This market demands standout quality — anything less will struggle to compete.

$10M+ | Ultra-Luxury & Trophy Properties

Status: The Star Performer. The ultra-luxury segment is not just holding — it’s surging. These buyers are less rate-sensitive, more cash-based, and highly driven by prestige, location, and uniqueness.

- Sales Volume: Up 20% (17 → 20 sales)

- Price Trend: Up 30.5% ($3,169 → $4,136/SF)

- Record Pricing:

- 2025 saw 3 sales over $5,000/SF (vs. just 1 in 2024)

- Top recorded sale hit $7,600/SF — a new Miami high

- Inventory: Down 41% YoY; now at 15.1 months (vs. 25.8 months in 2024)

- Buyer Behavior:

- Cash buyers from NY, CA, and Chicago dominate

- Demand concentrated onnew construction, waterfront, and architect-designed homes

- Generic ultra-luxury homes without strong identity or execution are still being passed over

Key Insight: The $10M+ ultra-luxury segment is the undisputed star of the Miami Beach real estate market in 2025, showing strength on nearly every front. A 20% increase in sales volume, a 12 day drop in median days on market, and record-breaking price per square foot Up 30.5% ($3,169 → $4,136) — with three properties even surpassing the $5,000/SF mark, including a record-setting $7,600/SF sale. Inventory has dropped sharply, down 41% to 15.1 months, a sign that supply is tightening as demand intensifies. Unlike other tiers, this buyer pool is largely unaffected by interest rates — many are all-cash buyers coming from New York, California, and Chicago, driven by lifestyle, location, and architectural excellence. They are targeting new construction, waterfront estates, and truly one-of-a-kind properties. But even at this level, quality is king: homes that are merely expensive without standout design or flawless execution are being overlooked. This segment rewards uniqueness, precision, and prestige. Sellers who bring those elements to the table are not just selling — they’re setting new records.

Miami Beach Real Estate Market | Market-Wide Trends Influencing All Segments

Inventory Pressure & Days on Market

- Median days on market up from 96 → 105 days overall

- Even in active tiers, buyers are slower to act unless homes are priced well and require no renovation risk

Close-to-List Ratio

- Dropped from 93% → 90% — buyers are negotiating more aggressively across all brackets

Expired Listings

- Steady but concerning: ~35/month in 2025 vs. ~33/month in 2024

- Homes that fail to price for condition or meet lifestyle expectations are increasingly going unsold

Rental Market as a Pressure Valve

With sales hesitating in some tiers, many owners — especially those with low locked-in mortgage rates — are choosing to lease instead.

- $5K–$10K: Tight and stable (inventory down 52% YoY)

- $15K–$30K: Softer, price-sensitive (rents dipped from $6–$8/SF → $6–$7/SF)

- $30K+: Expanding fast. Now averaging 44 listings/month (up from 35). These are often homes owners won’t sell until the market improves.

Insight: Renters want the same as buyers — turnkey, luxury, lifestyle-ready homes in great locations.

Buyer Psychology 2025

Buyers are still engaged, but they’re moving with caution. High interest rates and election-year uncertainty are cooling urgency—though not demand. In the ultra-luxury tier, cash buyers continue to dominate, keeping momentum strong and insulating this segment from rate pressure. Across all tiers, one thing is clear: renovation risk is a dealbreaker. With rising construction costs and new tariffs on materials, homes that aren’t move-in ready are increasingly passed over.

Final Takeaways of this 2025 Miami Beach Real Estate Market

Miami Beach’s luxury market is increasingly segmented — and success depends on how well you align with buyer expectations. For sellers, it’s all about alignment. Buyers are more picky than ever and overpricing a home that’s not turnkey is one of the biggest mistakes we’re seeing—especially in the $6M–$10M range where inventory is up 86% and sales have slowed to a crawl. Homes without design, location or cohesive renovations are being passed over. But if you have a truly exceptional property—especially in the $10M+ tier—you’re in a position to get premium offers especially when the home delivers on design, quality and lifestyle.

For buyers this is an opportunity, not chaos. Inventory is growing and negotiation power is shifting across multiple segments. This is especially true in the mid-to-upper tiers where pricing has softened and sellers are getting more flexible. Cash buyers who are ready to move fast can get long term value especially on well located move-in-ready homes. The right properties are still selling—and in some cases making history.

Whether you’re entering at $1M–$3M or going for a trophy property above $10M one rule remains the same: quality, presentation and pricing matter more than ever.

Connecting with The David Siddons Group

If you have questions about this 2025 Miami Beach Real Estate Market or the Miami Beach market in general, reach out to the David Siddons Group (Laura Barrera or David Siddons) at 305.508.0899 or schedule a meeting via the application below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS