- Best of All

- Best Miami Luxury Condos

- Most popular

- Relocating to Miami

- Private Schools

- Investments

- Gated communities

- Waterfront information

- Luxury homes

- Luxury Condos

- New Construction Condos in South Florida

- Independent Pre-Construction condo reviews for Miami

- Independent Pre-Construction condo reviews for Fort Lauderdale

The 2025 Fort Lauderdale Condo Market Report | Shifting Tides: Why Buyers Are Now in Control.

Summary

As we move through 2025, the Fort Lauderdale condo market is undergoing a clear transition. What was once a seller-driven, post-pandemic boom has cooled significantly. Inventory is rising, sales are slowing, and buyers, especially in the $3M+ luxury segments, are taking control. From value-conscious buyers in the $1M–$3M range to ultra-wealthy purchasers holding off in the $10M+ tier, the message is consistent: expectations are changing. Branded pre-construction developments with elevated design, service, and lifestyle appeal are capturing more attention, while legacy resale listings struggle to compete. This report breaks down what’s happening (and why) in each major pricing tier, and offers strategic insights for both buyers and sellers. Click here for the report on Fort Lauderdale Waterfront Homes

Key Takeaways

- Despite rising prices across all segments, buyers hold the advantage. Growing inventory and longer time on market mean only top-quality condos sell quickly at a premium, while overpriced listings stagnate.

- In nearly every price segment, more listings are expiring than selling. Clear proof the market is rejecting unrealistic pricing. Sellers who fail to align with market value risk sitting unsold while serious buyers focus on the well-priced, high-quality inventory.

- The market is set to see a 27% surge in inventory over the coming years, spanning properties from $500K to $10M. Buyer demand is shifting toward new construction and recently built projects, with branded developments like St. Regis, Ritz-Carlton, and Waldorf Astoria redefining what luxury living means.

- Ultra-luxury has stalled: Above $6M, activity is minimal, and seller flexibility will be key to unlocking deals. While last year 5 properties sold above $6M, this year we saw just 1 sales.

Discounts Are Becoming More Generous. Sellers are becoming (and must continue to be) more realistic in their pricing with many already offering hefty discounts. - Strategy matters: Whether you’re buying or selling, a data-driven, realistic approach is essential.

Fort Lauderdale New Construction Units

The Broward Pipeline

| Project | Location | # of Units | % Sold | Available Inventory | Average Price per SqFt | Price Range | Delivery Date |

| Rosewood Residences | Hillsboro Beach | 92 | 60% | 37 | $2,500 | $5.3m - $16m+ | 2026 |

| Casamar | Pompano Beach | 119 | 98% | 2 | $1,350 | $1.5m - $5.7m | 2025 |

| Armani Casa Residences | Pompano Beach | 28 | 0% | 28 | $1,600 | $5m - $9m | 2028 |

| Waldorf Astoria | Pompano Beach | 92 | 75% | 23 | $1,500 | $2.5m - $10M | 2027 |

| Ritz Carlton Residences | Pompano Beach | 225 | 94% | 14 | $1,400 | $1m - $10m | 2026 |

| Salato | Pompano Beach | 40 | 58% | 17 | $1,350 | $2.1m - $5.3m | 2026 |

| W Residences | Pompano Beach | 376 | 20% | 300 | $1,500 | $770k - $4.9m | 2029 |

| Selene | Fort Lauderdale | 194 | 87% | 25 | $1400 | $1.4m - $11.4m | 2025 |

| Sage IntraCoastal | Fort Lauderdale | 44 | 30% | 31 | $1,300 | $2.9m - $5m | 2028 |

| Andare | Fort Lauderdale | 163 | 60% | 65 | $1400 | $2m - $16m | 2027 |

| Pier Sixty-Six Residences | Fort Lauderdale | 92 | 65% | 32 | $2,100 | $3.5m - $15.5m | 2025 |

| St Regis Bahia Mar | Fort Lauderdale | 239 | 30% | 167 | $2,350 | Resort $3.088m - $6m Residences $5.2m - $12m | 2029 |

| Ombelle | Fort Lauderdale | 387 | 30% | 271 | $850 | $471k - $1.198m+ | 2028 |

| Viceroy | Fort Lauderdale | 370 | 370 | $1,250 | $525K – ~$2.5M | 2029 | |

| Sixth & Rio | Fort Lauderdale | 92 | 50% | 46 | $1,400 | $900,000- $2.5M | 2026 |

| Riva Residenze | Fort Lauderdale | 36 | 15% | 31 | $1,800 | $3.5m - $9m | 2028 |

| Bungalow East | Fort Lauderdale | 34 | 15% | 29 | $1,250 | $2m - $4.5m | 2027 |

| TOTAL | 2,623 | 1,460 |

Fort Lauderdale currently has approximately 10,000 condo units across its main buildings. With an additional 2,623 units expected to be delivered over the next years from new developments. This represents a 27% increase in total inventory.

$1M–$3M | Stability or Standoff?

This entry-level luxury tier remains the most stable in terms of pricing, but that doesn’t tell the full story. Buyers are moving cautiously, taking longer to make decisions, and using data to negotiate deeper discounts. Meanwhile, sellers are often slow to adjust to new market conditions.

Market Snapshot

- Sales down 15% | Inventory up 3%

- Average price per SF: $762 (–0.5% YoY)

- Average days on market: 104 | Avg. discount: 8%

- Months of inventory: 11

Market Dynamics: Buyers have returned to the driver’s seat. They’re scrutinizing listings, pushing for concessions, and holding out for well-presented homes with upgrades. Sellers clinging to 2021 pricing are seeing longer marketing times and steeper discounts. Competing with new construction—10% of this tier’s active inventory—is putting further pressure on resale properties that feel dated or overpriced.

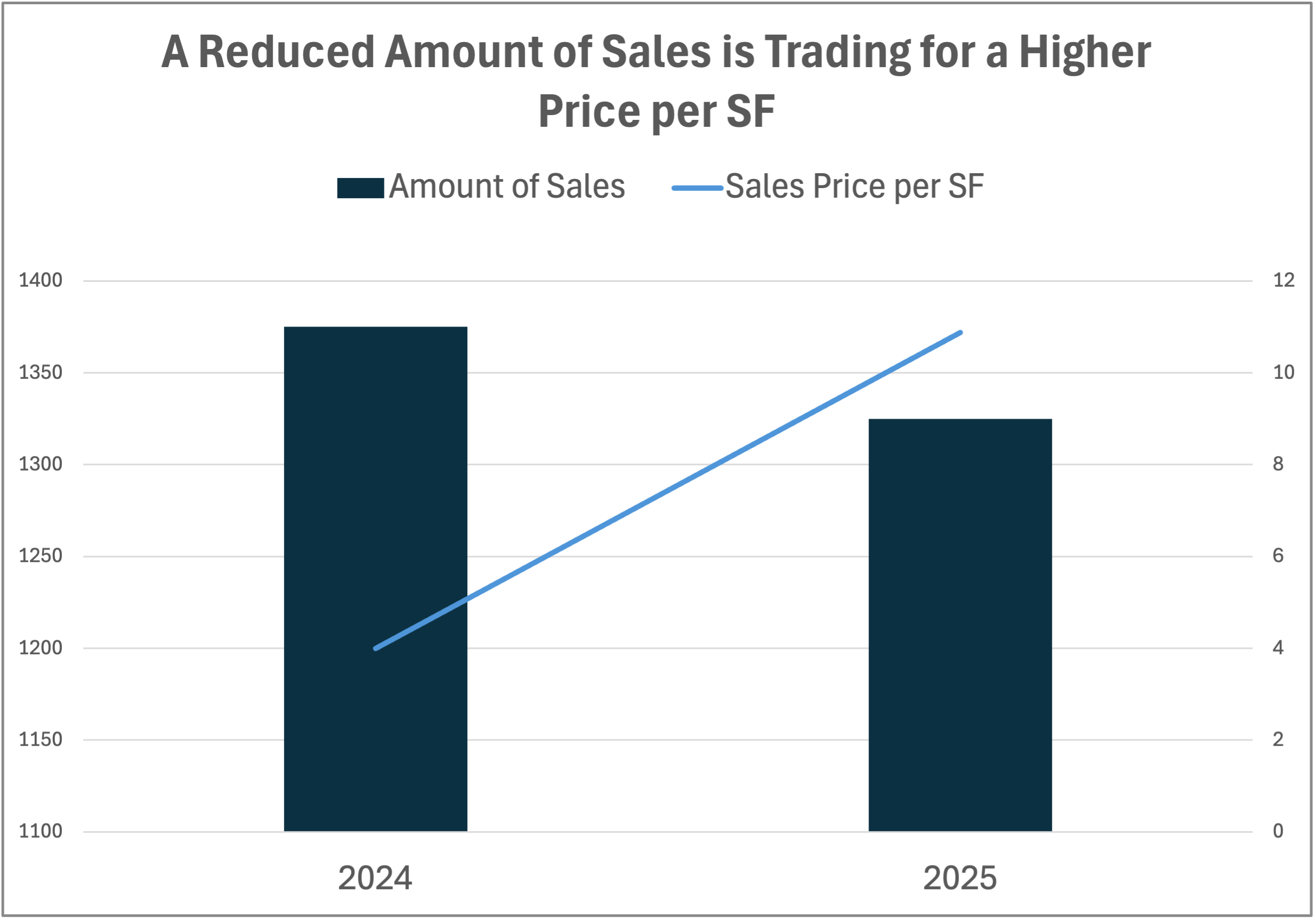

$3M–$6M | When Quality Sells and Inventory Swells

This mid-to-upper luxury tier is caught in a tug-of-war between rising prices and slowing activity. Sales volume has dropped, but the price per square foot is up—reflecting a buyer migration toward high-quality product. Still, a significant inventory overhang is weighing on performance.

Market Snapshot

- Sales down 18% | Inventory up 3%

- Average. price per SF: $1,372 (↑12.5%)

- Average. days on market: 91 (↓31%) | Avg. discount: 7%

- Months of inventory: 23

Market Dynamics Buyers are selectively paying more—but only for the best. Active listings are, on average, priced 33% above what buyers are actually paying, signaling unrealistic expectations. With one-third of all listings in this range being new construction, developers are pulling buyers away from aging resale units that can’t compete on finishes, amenities, or branding.

$6M–$10M | Luxury Paused, Inventory Surging

This tier is suffering from a severe slowdown. Just one sale closed in the first half of the year, and it required a 22% discount and six months on market. Meanwhile, inventory has exploded, and most of it is competing directly with branded new construction.

Market Snapshot

- 1 sale YTD | Inventory up 125%

- Average price per SF: $2,004 (↑19%)

- Average days on market: 182 (↑20%) | Avg. discount: 22%

- Months of inventory: 45

Market Dynamics This is no longer a functional market—it’s a waiting game. Buyers are cautious, patient, and exploring branded options that offer better service and stronger long-term value. Sellers must deeply discount or differentiate through unique attributes like design, privacy, or unobstructed views to remain competitive.

$10M+ | Ultra-Luxury, Ultra-Cautious

The ultra-luxury tier has essentially come to a standstill. No closed sales and no pending contracts were recorded in the first half of 2025, yet inventory continues to climb. At the same time, half of the active listings are branded pre-construction, raising the bar for what this buyer expects.

Market Snapshot

- 0 sales | Inventory up 33% | 8 active listings

- Average list price per SF: $2,485

- 50% of listings = branded new development

Market Dynamics This tier is defined by discretion, not desperation. Buyers are highly selective and often investing in pre-construction where they can customize, access exclusive amenities, and ride the appreciation curve. Sellers of existing resale inventory must be realistic—without a compelling lifestyle story or exceptional value, listings risk becoming stale.

Overall Market Summary

The data paints a clear picture: the Fort Lauderdale condo market has moved into a buyer-driven cycle. Sales have slowed in every tier, inventory is expanding—especially in the mid and ultra-luxury brackets—and the gap between what sellers want and what buyers are willing to pay is widening. Some pricing metrics show strength, but this is largely due to selective purchasing of high-end, modern product—not overall appreciation. In most cases, buyers are paying up for quality and negotiating hard on anything else. Branded pre-construction is shifting the landscape. Developments by St. Regis, Waldorf Astoria, and Ritz-Carlton are setting new standards for design, service, and lifestyle. Resale properties that can’t compete on those fronts must either reposition or be priced aggressively to sell. Today’s buyer is well-informed, data-driven, and deliberate. They’re in no rush—and they have options.

Strategic Advice

Sellers must adapt to the new market reality. Pricing should reflect recent closings—not inflated asking prices from last season. Properties need to be presented at their best, with thoughtful staging, strong photography, and marketing that tells a compelling lifestyle story. In markets saturated with branded new construction, differentiation is critical.

For buyers, this is a market of opportunity. High inventory and longer days on market create leverage. Resale properties that have lingered for 60+ days are often ripe for negotiation. Comparing pre-construction with existing inventory can also uncover long-term value—especially when factoring in lifestyle, service, and potential appreciation.

Connect with the David Siddons Group

Connect with Elaine Tatum (305) 793-0540 or David Siddons (305) 508-0899 to learn more about the 2025 Fort Lauderdale condo market. Give us a call or schedule a meeting via the application below.

FAQ

These are the most commonly asked Google Real Estate Related questions

1. What are the Current Best New Condos in Miami?

If you want to hear in more details our opinions on the best new Miami new construction condos. Please read this article:Best New Construction Condos 2022-2023.

2. What is the best New Construction Condo in Fort Lauderdale?

In our opinion, the Residences at Pier Sixty-six are certainly the most interesting and unique. Already well underway this 32 Acre project will be home to the first of its kind Marina where owners will be able to anchor up vessels up to a staggering 400 ft! For specifics of this project see our independent review of this project.

3. How can I compare the new luxury construction Condos to the best existing Luxury Condos in Miami?

Our Best Luxury Condos in Miami article will prove to be very useful to those looking to compare the existing to the new. You may also want to watch this video which shows the performance of the best Condos in Miami over the last 15 years!

Please fill in your details and David Siddons will contact you

- Get our Newsletter

- Subscribe

- No Thanks

Get the latest news from Miami Real Estate News

Edit Search

Recomend this to a friend, just enter their email below.

COMPARE WITH CONDOGEEKS

COMPARE WITH CONDOGEEKS